Title: Understanding Tarrant Texas Lien Property: Types and Detailed Description Introduction: In Tarrant County, Texas, a lien on a property acts as a legal claim or encumbrance against the property, typically made by a creditor who seeks to secure payment for a debt owed by the property owner. This article aims to provide a comprehensive understanding of Tarrant Texas Lien Property, including its definition, purpose, and various types that exist within the region. Definition and Purpose of Tarrant Texas Lien Property: Tarrant Texas Lien Property refers to the legal concept that grants a creditor the right to claim a portion of a property owner's assets as collateral for an outstanding debt. Lien properties are typically used as a mechanism to secure payment for unpaid taxes, mortgages, construction labor, and other financial obligations. These liens are registered with the county clerk's office and are considered public records. Types of Tarrant Texas Lien Property: 1. Tax Lien: This type of lien is placed on a property when the owner fails to pay property taxes. The county can enforce this lien by auctioning the property to recover the delinquent taxes. 2. Mortgage Lien: A mortgage lien is created when a property owner pledges their property as collateral for a loan taken for purchasing or refinancing the property. In the event of default, the lender can initiate foreclosure proceedings to sell the property and recover the outstanding debt. 3. Mechanics' Lien: A mechanics' lien is filed by contractors, subcontractors, or suppliers who haven't been paid for the labor and materials provided for property improvement projects. By filing a mechanics' lien, these parties can prioritize their claims above other creditors in the event of a property sale. 4. Homeowners Association (HOA) Lien: Property owners who are part of a homeowners' association can face an HOA lien if they fail to pay the required dues, assessments, or fines. In extreme cases, an HOA can foreclose the property to satisfy the debt. 5. Judgment Liens: Judgment liens arise when a court orders the property owner to pay a specific amount to a creditor as a result of a lawsuit. This type of lien can be placed on any property owned by the debtor within the county. Conclusion: Tarrant Texas Lien Property is a legal mechanism used to secure payment for various debts or obligations. Understanding its types helps property owners and potential buyers navigate the complexities of property transactions, ensuring clear titles and minimizing financial risks. It is essential to consult legal professionals or experts to fully comprehend the implications of different lien types when dealing with Tarrant Texas Lien Property.

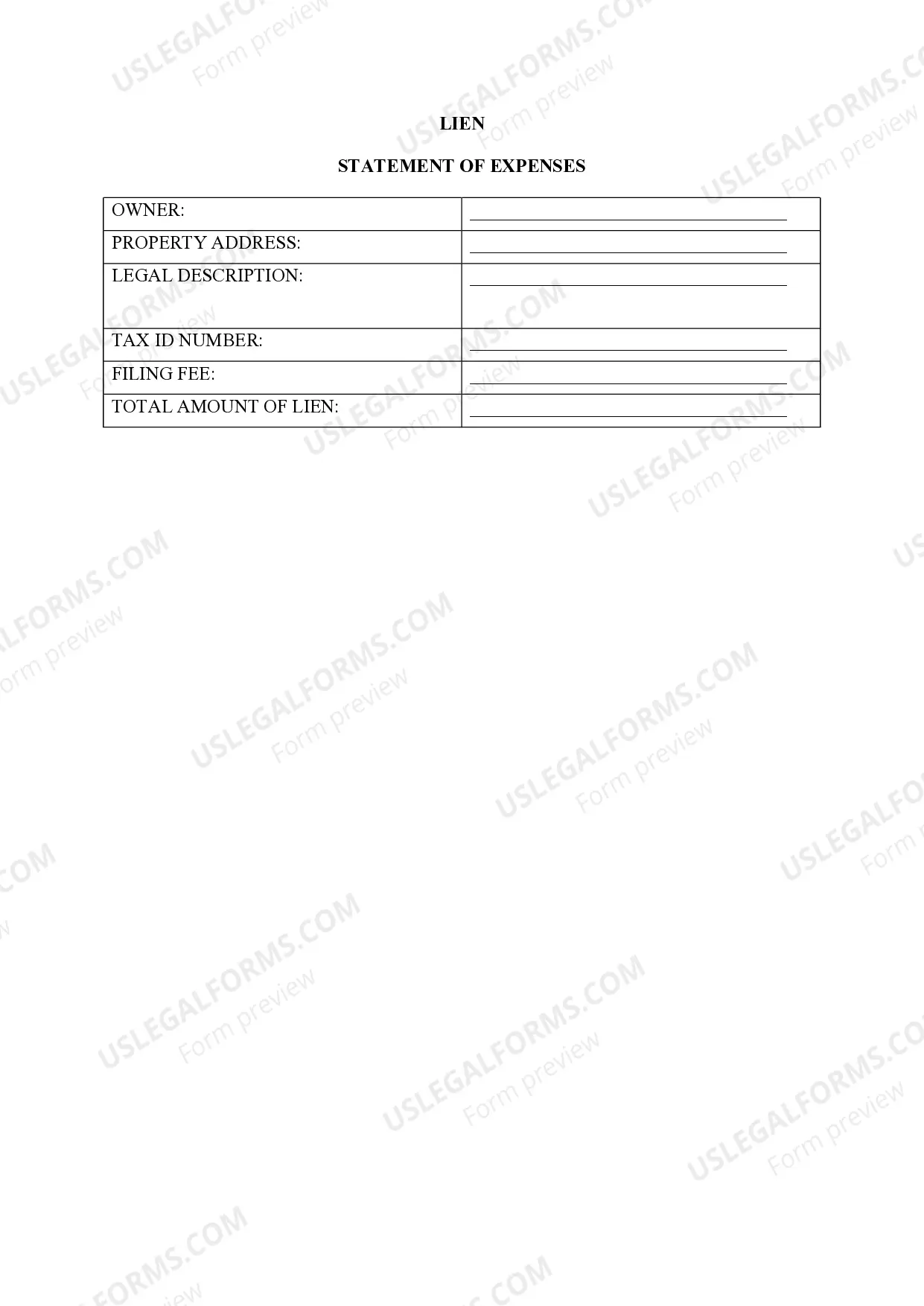

Tarrant Texas Lien -Property

Description

How to fill out Tarrant Texas Lien -Property?

Make use of the US Legal Forms and get immediate access to any form you want. Our useful platform with a huge number of templates makes it simple to find and get almost any document sample you will need. You can save, fill, and sign the Tarrant Texas Lien -Property in just a matter of minutes instead of browsing the web for hours attempting to find an appropriate template.

Using our catalog is an excellent strategy to improve the safety of your document filing. Our professional lawyers on a regular basis review all the records to make certain that the templates are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Tarrant Texas Lien -Property? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you view. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instruction below:

- Open the page with the form you require. Ensure that it is the form you were seeking: examine its headline and description, and take take advantage of the Preview feature if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Download the file. Choose the format to obtain the Tarrant Texas Lien -Property and change and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the web. We are always ready to assist you in any legal case, even if it is just downloading the Tarrant Texas Lien -Property.

Feel free to take advantage of our service and make your document experience as convenient as possible!