Travis Texas Lien-Property is a legal process that allows a creditor to place a claim on a property in order to secure payment for a debt owed by the property owner. This lien serves as a legal right for the creditor to satisfy their debt before any other parties when the property is sold, refinanced, or transferred. There are different types of Travis Texas Lien-Property that can be applied depending on the circumstances and nature of the debt. Some common types include: 1. Tax Lien: This lien is placed on a property by the local government when the property owner fails to pay their property taxes. The government can then sell the property to recover the unpaid taxes. 2. Mechanic's Lien: A mechanic's lien is usually put on a property when a contractor, subcontractor, or supplier has provided labor, materials, or services for construction or improvement of the property but has not been compensated. This type of lien ensures that the party involved in the property's improvement receives payment. 3. Mortgage Lien: When a property is purchased with a mortgage loan, the lender places a mortgage lien on the property. This lien gives the lender the right to foreclose on the property and sell it to recover the unpaid mortgage balance if the borrower fails to meet their repayment obligations. 4. Judgment Lien: A judgment lien arises when a court awards a judgment against a debtor, and the creditor places a lien on the debtor's property to secure the payment. This type of lien ensures that the creditor receives the amount they were awarded by the court. 5. HOA Lien: Homeowners' Association (HOA) liens are placed on properties when homeowners fail to pay their HOA fees or dues. The HOA can then take legal action, including foreclosing on the property, to recover the unpaid dues. 6. Child Support Lien: When a parent fails to pay court-ordered child support, a child support lien may be placed on their property. This lien ensures that the unpaid child support amount is collected before any other debts are satisfied if the property is sold. It is important to note that each type of Travis Texas Lien-Property has its own specific laws and procedures governing its enforcement and release. Property owners should be aware of their rights and responsibilities regarding these liens to avoid potential legal complications.

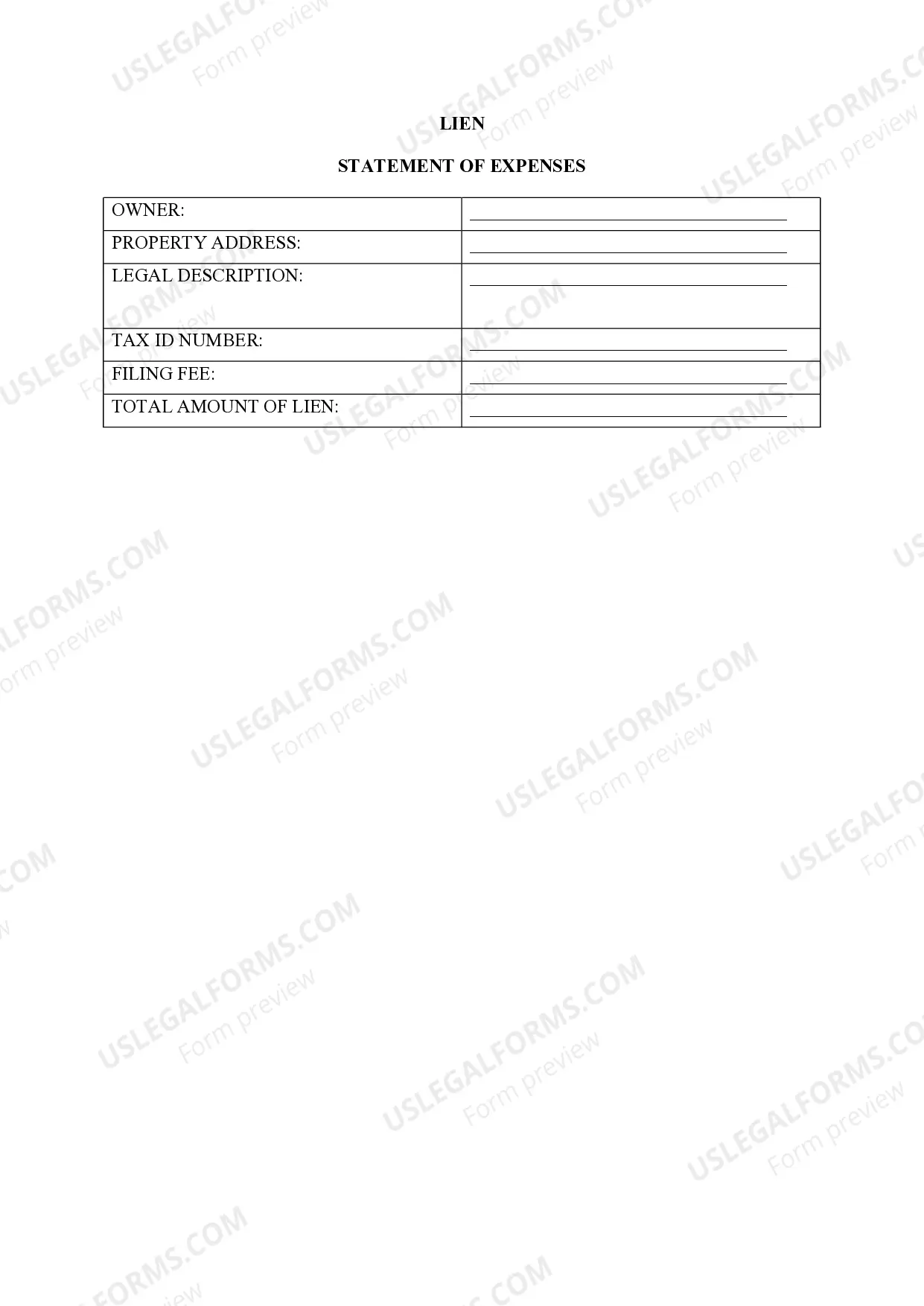

Travis Texas Lien -Property

Description

How to fill out Travis Texas Lien -Property?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law education to draft such paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Travis Texas Lien -Property or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Travis Texas Lien -Property in minutes employing our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Travis Texas Lien -Property:

- Be sure the template you have found is specific to your location since the regulations of one state or area do not work for another state or area.

- Review the form and read a short outline (if provided) of cases the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Pick the payment method and proceed to download the Travis Texas Lien -Property once the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. In case you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.