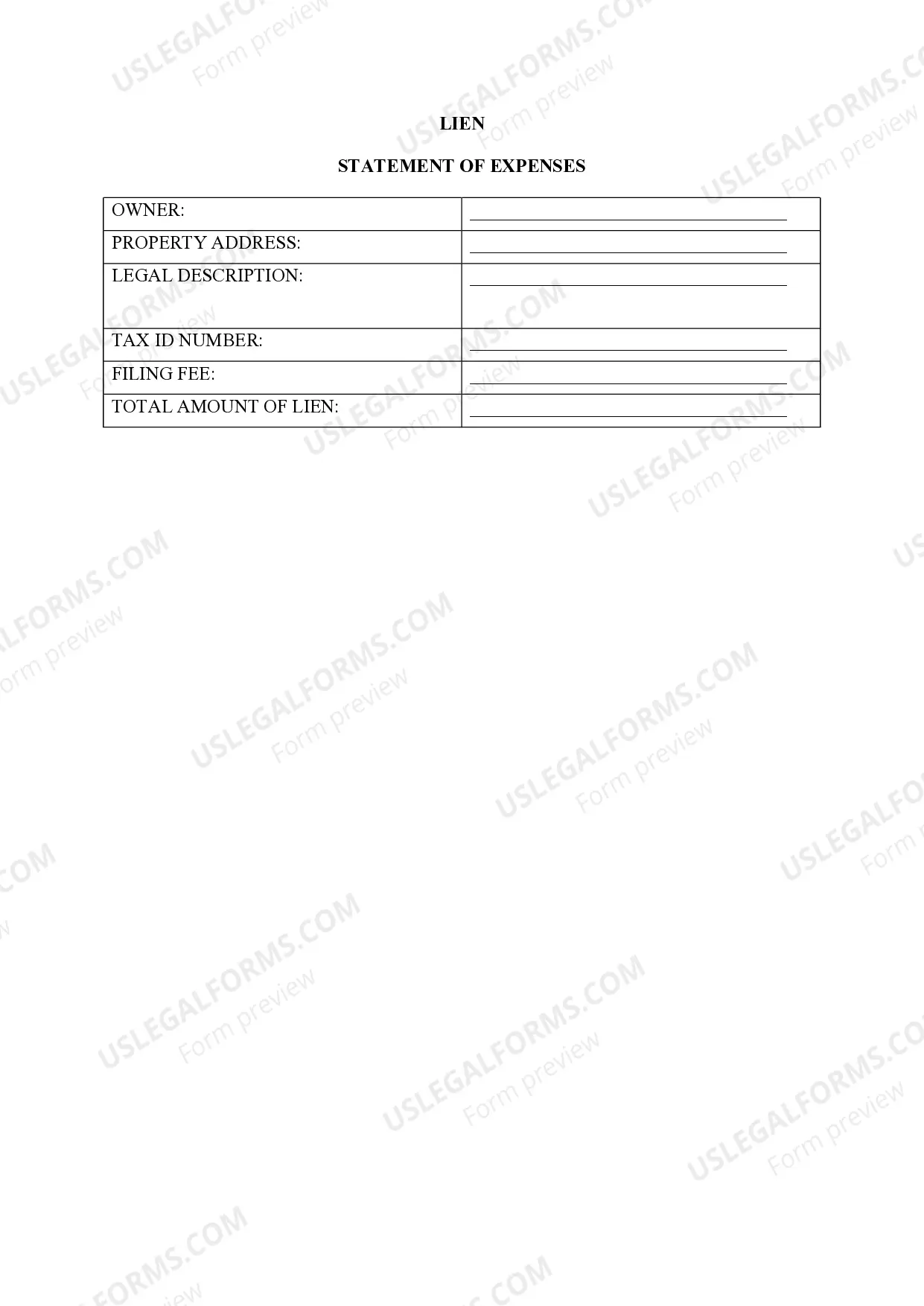

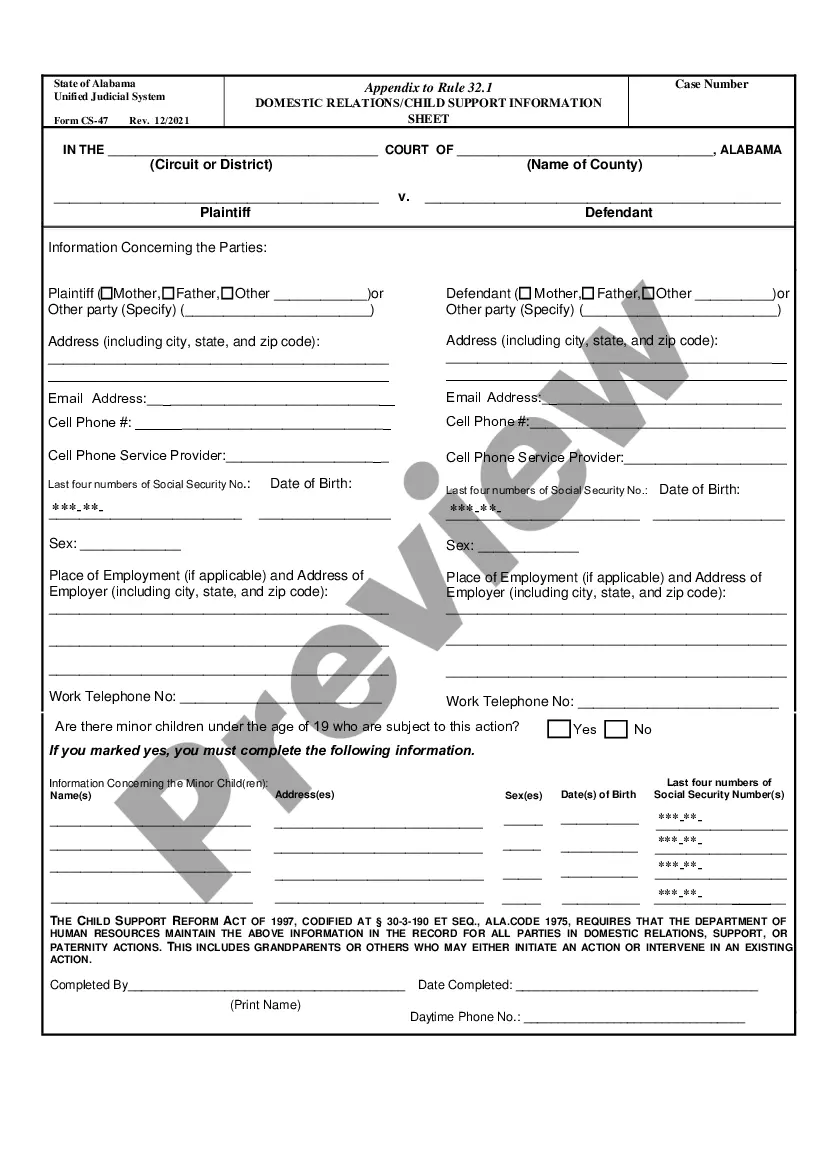

Wichita Falls Texas Lien-Property: A Comprehensive Guide Wichita Falls, located in the state of Texas, follows specific regulations and procedures regarding property liens, which are legal claims on real estate properties enforced to secure outstanding debts or obligations. Understanding the concept of a lien in Wichita Falls is essential for property owners, potential buyers, and lenders alike. Types of Wichita Falls Texas Lien-Property: 1. Mechanics Liens: Also known as construction liens, mechanics liens are filed by contractors, subcontractors, suppliers, or vendors who have not been paid for their work or provided materials on a construction project. These liens attach to the property and can affect its marketability and transferability until the debt is satisfied. 2. Tax Liens: Property owners who fail to pay their property taxes in Wichita Falls may be subject to tax liens. Such liens are imposed by the local or state government to secure the unpaid taxes. Tax liens grant the authorities the right to seize and sell the property if the owner fails to resolve the outstanding debt. 3. Judgment Liens: In the event of a lawsuit judgment against a property owner in Wichita Falls, a judgment lien may be filed by the winning party. This type of lien ensures the winner receives payment by attaching to the property's title. When the property is sold, the lien holder is entitled to claim the debt owed from the proceeds. 4. Child Support Liens: If a parent fails to pay court-ordered child support in Wichita Falls, the custodial parent or the state's child support enforcement agency can file a child support lien on the delinquent parent's property. This type of lien protects the child's financial interests and can result in the sale of the property to fulfill the unpaid support obligations. 5. Homeowners Association (HOA) Liens: Homeowners who reside in a Wichita Falls community governed by a homeowners' association are required to pay dues, fees, and assessments. Failure to fulfill these obligations can result in the HOA filing a lien on the property. The lien enables the association to enforce collection by potentially foreclosing on the property. It is crucial to note that each type of lien has its own unique requirements, timelines, and procedures under Wichita Falls and Texas law. Property owners and interested parties should consult legal professionals to understand their rights and obligations when dealing with property liens in Wichita Falls, Texas. Avoiding or resolving these liens promptly is necessary to maintain a clear title and ensure the smooth transfer of real estate within the city.

Wichita Falls Texas Lien -Property

Description

How to fill out Wichita Falls Texas Lien -Property?

If you are searching for a valid form template, it’s extremely hard to find a better service than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can get thousands of document samples for organization and individual purposes by types and states, or keywords. With the advanced search feature, finding the most recent Wichita Falls Texas Lien -Property is as easy as 1-2-3. Furthermore, the relevance of every record is verified by a group of expert lawyers that on a regular basis check the templates on our platform and revise them based on the most recent state and county demands.

If you already know about our system and have an account, all you should do to get the Wichita Falls Texas Lien -Property is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you want. Check its description and use the Preview function (if available) to see its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to get the appropriate record.

- Confirm your selection. Select the Buy now option. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the file format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Wichita Falls Texas Lien -Property.

Every template you add to your profile does not have an expiry date and is yours forever. You always have the ability to access them via the My Forms menu, so if you need to get an extra version for modifying or printing, you can return and export it once again at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Wichita Falls Texas Lien -Property you were seeking and thousands of other professional and state-specific samples in a single place!