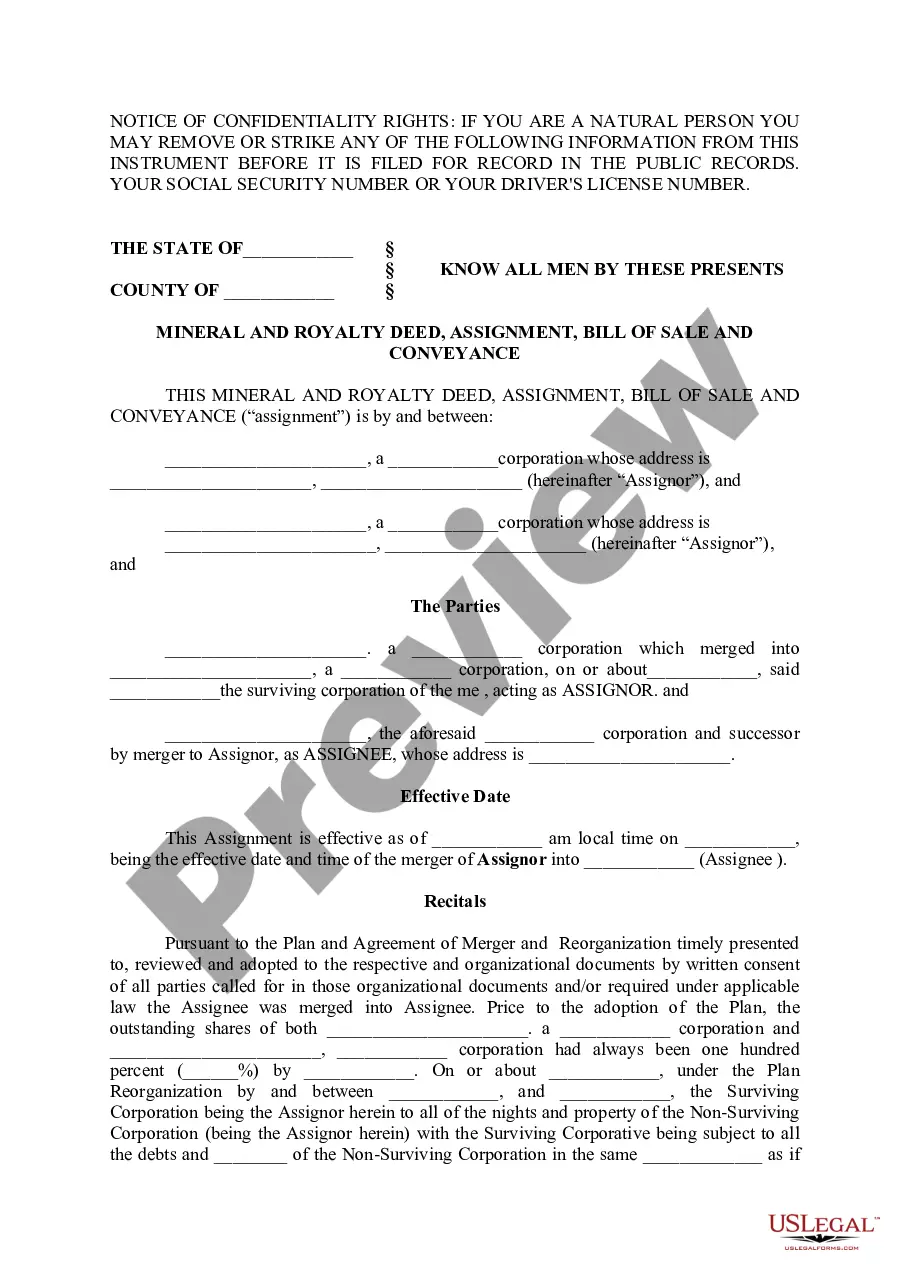

Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance

Description

How to fill out Texas Mineral And Royalty Deed, Assignment, Bill Of Sale And Conveyance?

We consistently strive to reduce or evade legal complications when engaging with intricate legal or financial situations.

To achieve this, we enroll in legal services that are typically very costly.

However, not every legal concern is equally convoluted; many can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and requests for dissolution.

Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure remains just as simple if you lack familiarity with the website! You can create your account within minutes. Ensure to verify whether the Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance adheres to the laws and regulations of your state and locality. Furthermore, it's essential to review the form's outline (if available), and should you find any inconsistencies with your initial requirements, look for an alternate template. Once you confirm that the Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance suits your situation, you can opt for the subscription plan and continue to payment. You can then download the document in any convenient format. For over 24 years in the industry, we’ve assisted millions by providing customizable and up-to-date legal documents. Optimize your experience with US Legal Forms today to conserve time and resources!

- Our library empowers you to manage your issues independently without needing to consult legal professionals.

- We provide access to legal document templates that aren’t always readily available to the public.

- Our templates are tailored to state and regional specifics, greatly simplifying the search process.

- Utilize US Legal Forms whenever you require the Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance or any other document in a straightforward and secure manner.

Form popularity

FAQ

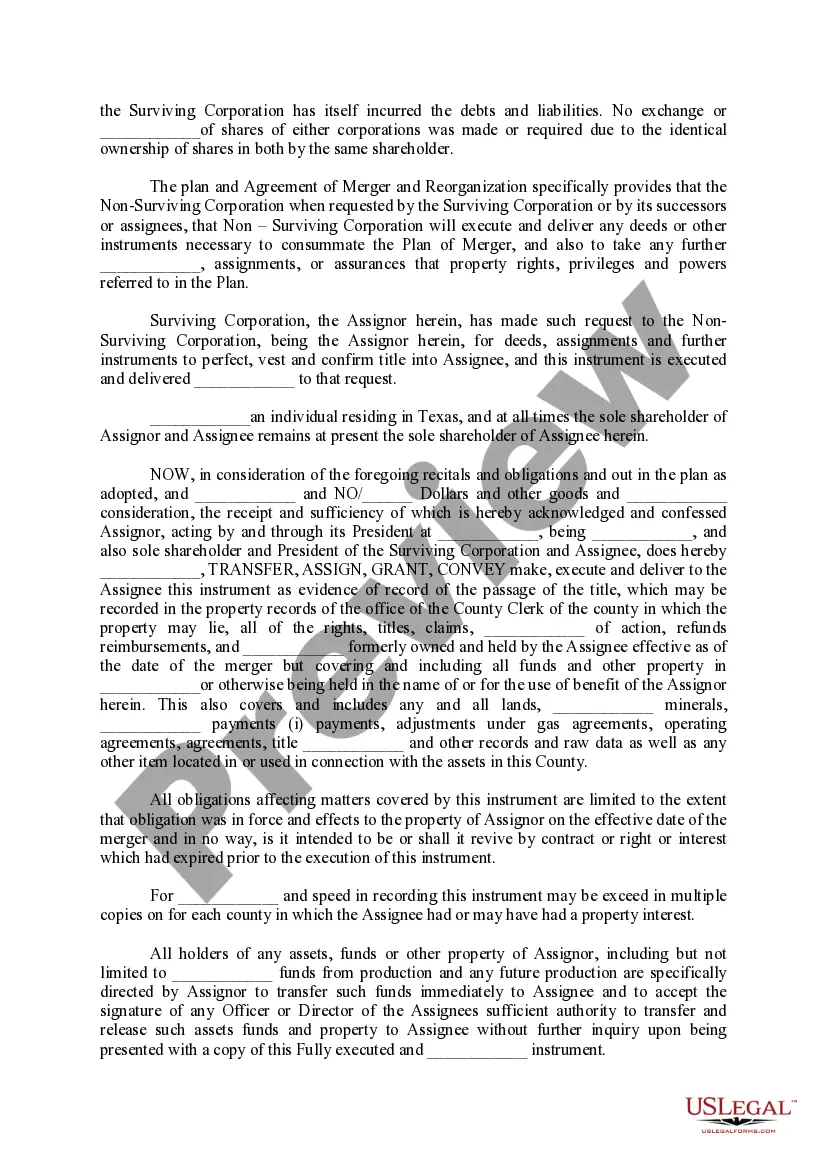

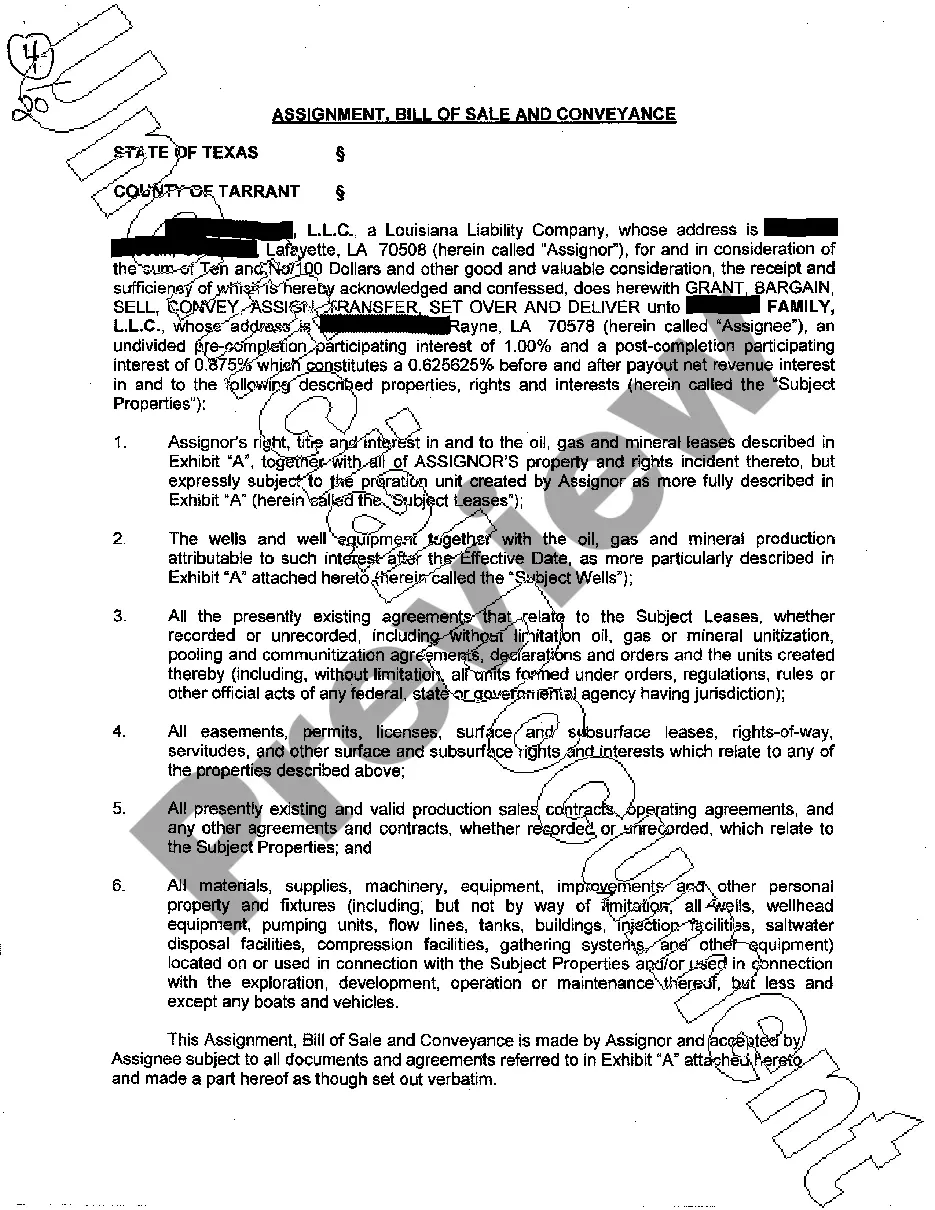

When mineral rights convey, it means the ownership of those rights has been transferred from one party to another. This is commonly documented through documents like the Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance. Conveying mineral rights can provide financial benefits to property owners, as they may receive royalties or payments in exchange for access to valuable minerals below the surface.

A mineral and royalty conveyance refers to the transfer of ownership rights for minerals beneath the surface of a property. This process often involves a Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance, ensuring clear documentation and legal compliance. Such a conveyance enables landowners to sell or lease their mineral rights, allowing them to capitalize on the value of their resource assets effectively.

To effectively transfer mineral rights in Texas, you would typically use a Pasadena Texas Mineral and Royalty Deed or a Bill of Sale. These documents clearly outline the rights being transferred and are essential for legal compliance. It's important to use the correct form to ensure clarity and legality in your transaction. USLegalForms offers straightforward templates tailored for your needs in mineral rights transfers, helping you navigate the process with confidence.

A deed of conveyance transfers ownership of property or rights from one party to another, often used in real estate transactions. In contrast, a deed of assignment refers specifically to transferring one party's rights or interests to another, such as selling mineral rights. Both documents serve important functions, but they are used in different contexts. For effective management of your transactions, consider utilizing USLegalForms to access templates for a Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance.

In Texas, the ownership of mineral rights often depends on past property transactions and the title deed associated with the land. Generally, the original property owner retains these rights unless they are sold or transferred through a Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale, or Conveyance. Checking your property records is the best way to determine ownership. Using our USLegalForms platform can help you find the necessary documents to clarify mineral rights associated with your property.

A royalty deed conveys the right to receive royalties from mineral production without transferring ownership of the underlying mineral rights. In contrast, a mineral deed grants ownership of the mineral rights, allowing the holder to extract and sell the minerals. Understanding these distinctions is important when handling any Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance. For a clear and concise explanation of these terms, consider seeking assistance from a legal professional or using resources like uslegalforms.

To prove ownership of mineral rights in Texas, you’ll need to review your property records, which include deeds, county clerk filings, and title documents. Often, obtaining a Pasadena Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance can help clarify ownership. Additionally, you may consider consulting a title company to conduct a thorough search of your property's history. This will ensure that all aspects of your mineral rights are appropriately documented.

To claim your mineral rights, you should first verify ownership through property records and any relevant deeds. If you own the rights, consider utilizing a Pasadena Texas Assignment or Bill of Sale and Conveyance to assert your claim. Staying informed about your rights will empower you to take appropriate action.

Mineral rights are not automatically transferred with the sale of real property in Texas. For a transfer to occur, documents like the Pasadena Texas Mineral and Royalty Deed must explicitly state the terms. Clear documentation ensures that all parties know their rights and responsibilities.

If someone else owns your mineral rights, they have the ability to extract resources from the land without your permission. This can lead to disputes, especially if you did not intend to sell or convey those rights. Understanding your rights through resources such as the Pasadena Texas Mineral and Royalty Deed can help you navigate this situation.