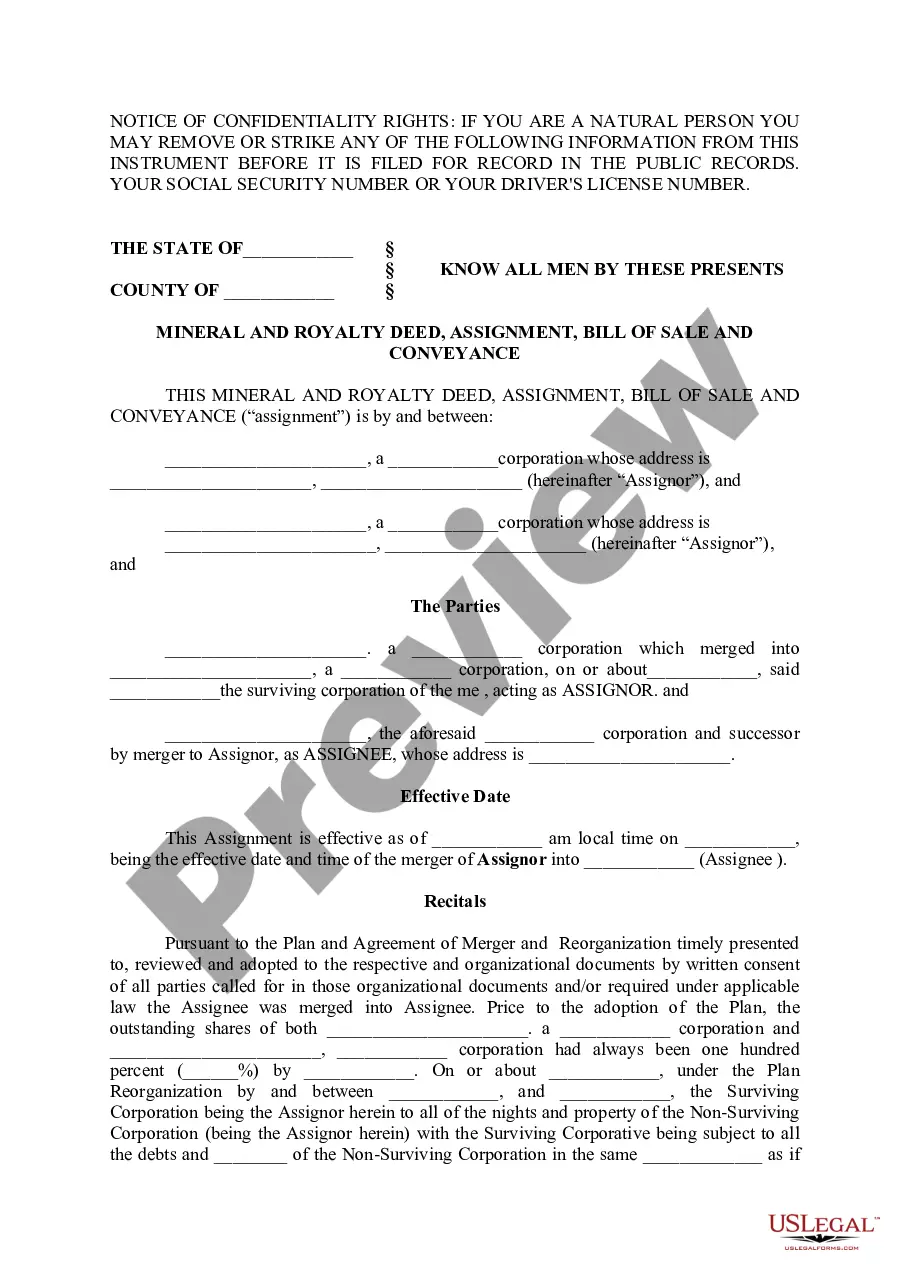

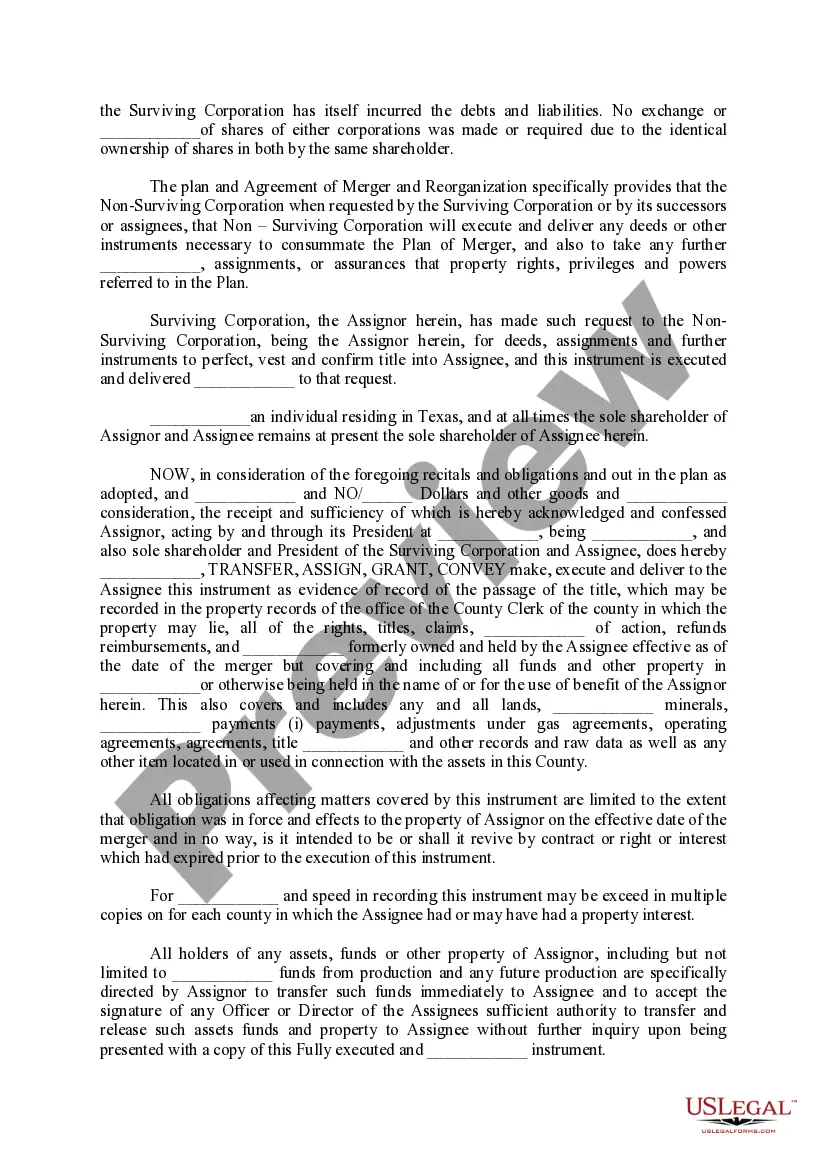

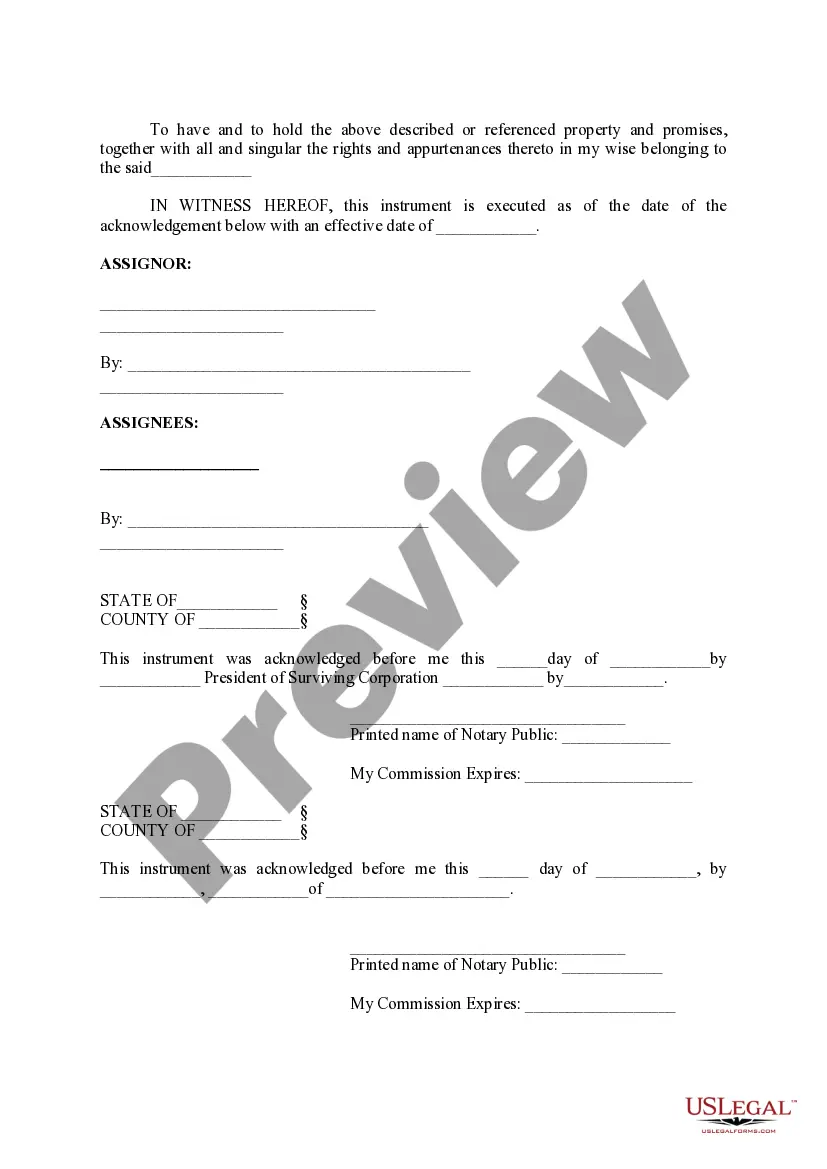

A Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance are legal documents used in the transfer of mineral and royalty interests in Tarrant County, Texas. These documents outline the terms and conditions of the transfer, ensuring that all parties involved understand their rights and obligations. Keywords: Tarrant Texas, Mineral, Royalty Deed, Assignment, Bill of Sale, Conveyance 1. Tarrant Texas Mineral Deed: A Tarrant Texas Mineral Deed is a legal document used to transfer ownership of mineral interests in Tarrant County, Texas. It conveys the rights to extract, exploit, and profit from the minerals located in a designated property from the granter (seller) to the grantee (buyer). This deed provides a clear title to the mineral estates, ensuring the buyer's rights are protected. 2. Tarrant Texas Royalty Deed: A Tarrant Texas Royalty Deed is a legal document used to transfer ownership of royalty interests in Tarrant County, Texas. Royalty interests entitle the owner to a portion of the revenue generated from the production and sale of minerals on a property. This deed specifies the percentage of royalty interests being conveyed and provides a clear title to the said interests. 3. Tarrant Texas Assignment: A Tarrant Texas Assignment is a legal document used to transfer ownership of a mineral or royalty interest from one party (assignor) to another (assignee). This assignment details the specific rights, interests, and obligations being transferred, ensuring a smooth transfer process without any ambiguity or disputes. 4. Tarrant Texas Bill of Sale: A Tarrant Texas Bill of Sale is a legal document used to transfer ownership of tangible assets related to mineral and royalty interests, such as equipment, machinery, or other assets used for exploration, extraction, or production purposes. It supports the transfer of these physical assets along with the mineral or royalty interests. 5. Tarrant Texas Conveyance: A Tarrant Texas Conveyance is a comprehensive legal document that combines elements of a mineral and royalty deed, assignment, and bill of sale, providing a complete transfer of ownership for both the mineral interests and any related tangible assets. This conveyance allows for a simultaneous transfer of various rights, interests, and assets in a unified manner. In summary, Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale, and Conveyance documents facilitate the proper transfer of mineral and royalty interests, ensuring clarity, legal protection, and smooth transactions for all involved parties in Tarrant County, Texas.

Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance

Description

How to fill out Tarrant Texas Mineral And Royalty Deed, Assignment, Bill Of Sale And Conveyance?

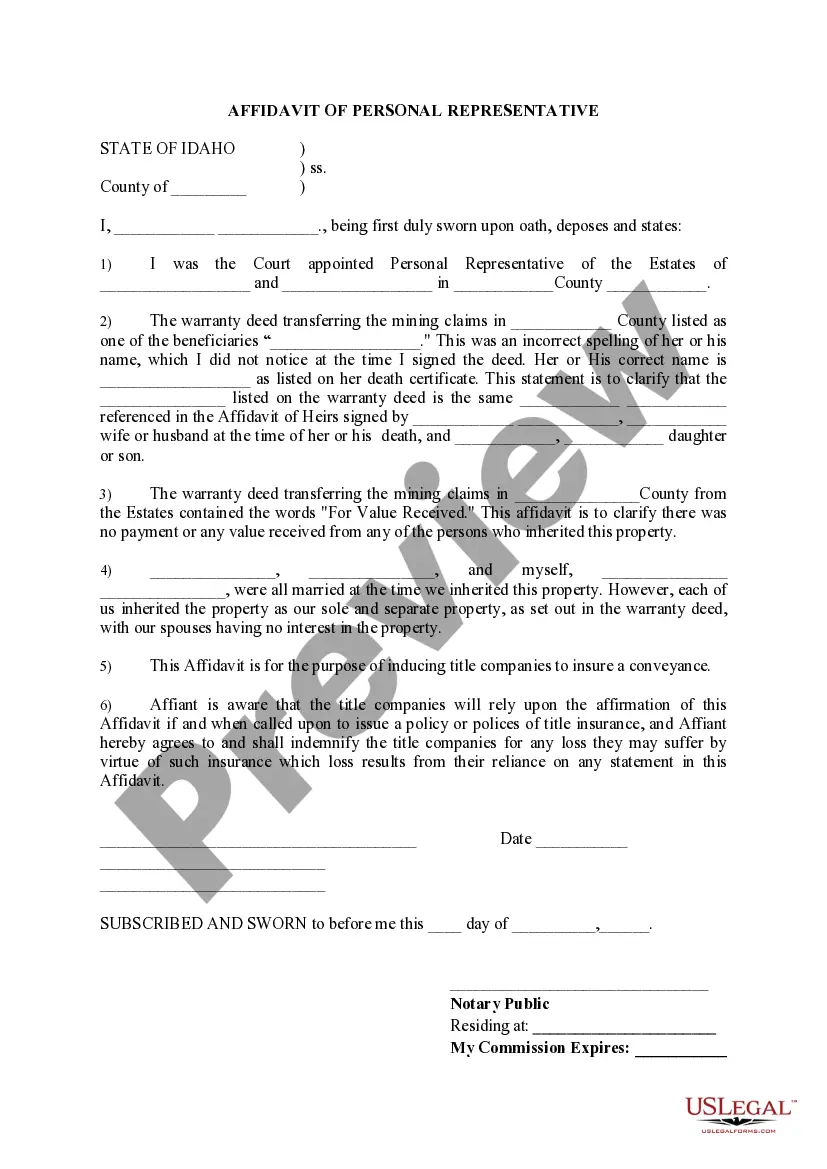

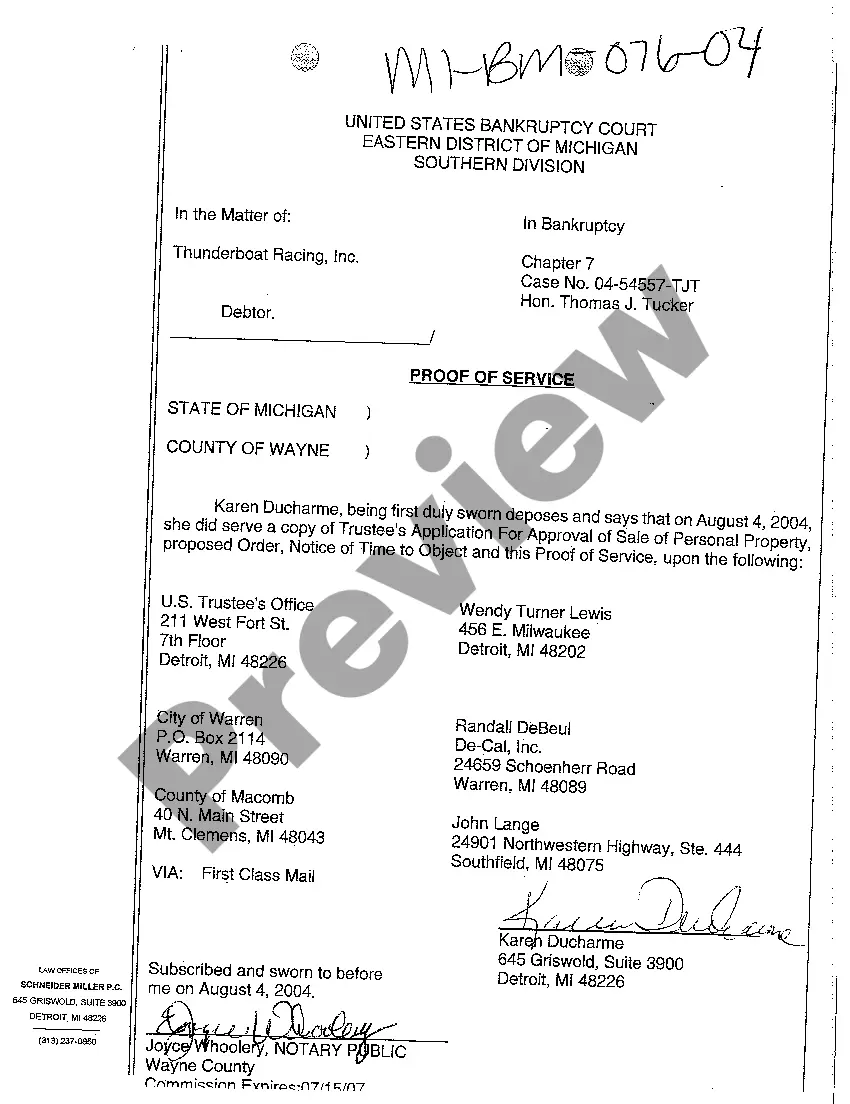

If you are searching for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get a huge number of form samples for business and individual purposes by types and states, or keywords. With our high-quality search feature, getting the latest Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance is as elementary as 1-2-3. In addition, the relevance of each file is proved by a team of skilled lawyers that on a regular basis check the templates on our platform and update them based on the latest state and county regulations.

If you already know about our platform and have an account, all you should do to get the Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the form you want. Check its information and utilize the Preview option to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to get the appropriate record.

- Confirm your selection. Select the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Choose the file format and download it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance.

Each form you save in your user profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to have an extra version for enhancing or creating a hard copy, feel free to come back and export it once again anytime.

Make use of the US Legal Forms professional catalogue to get access to the Tarrant Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance you were seeking and a huge number of other professional and state-specific samples on one website!

Form popularity

FAQ

Are inherited mineral rights taxable? The federal government does not consider inherited mineral rights taxable. Still, any income you accumulate from those rights does have to be reported on your tax return. This is another question you should ask when you accept your inheritance.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

The first step in claiming your inherited mineral rights is to find the deed or title to the property. This document will outline who owns the mineral rights and how you can transfer them. Once you have the deed or title, you must contact the appropriate state agency to make a claim.

The mineral rights, or interests, after separation from the surface, can be retained or sold as the landowner wishes through a mineral deed or a royalty deed. A deed is also known as a conveyance or reservation.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Conveyancing is the transfer of the legal title of a house from one person to another. There are two key stages to this ? the first being the exchange of contracts, the point at which the terms of the deal are fixed, and the second being the completion, where the legal title passes.

Mineral rights are the rights to minerals and natural resources that are under the surface of a piece of property. Usually, the owner of the surface estate owns the mineral rights under the property. However, under Texas law, those rights can be sold or leased to another party.

While both surface and mineral rights are generally conveyed when the landowner acquires the land, it is far more common for the seller to retain mineral rights than surface rights (or for prior sellers in the chain of title of the property to have retained the mineral rights).

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property.

But, if after 10 years the mineral rights are not being exploited (there is no oil and gas exploration or production), then the mineral rights revert to the new surface owner.

More info

This is not a simple form to fill in. It could take two hours to complete it. We recommend that you get an expert help from a professional. In addition, it is crucial to determine whether the person receiving the deed is the proper owner. If the appropriate paperwork has not been completed, you must file with the appropriate court and pay court costs and penalties, if applicable. For more information, click here or contact the office at. 43rd Annual Ernest E. Smith Oil, Gas and Mineral Law Institute. Each form is designed using an MS Word “Fill in the Blank” format. This is not a simple form to fill in. It could take two hours to complete it. We recommend that you get an expert help from a professional. In addition, it is crucial to determine whether the person receiving the deed is the proper owner. If the appropriate paperwork has not been completed, you must file with the appropriate court and pay court costs and penalties, if applicable.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.