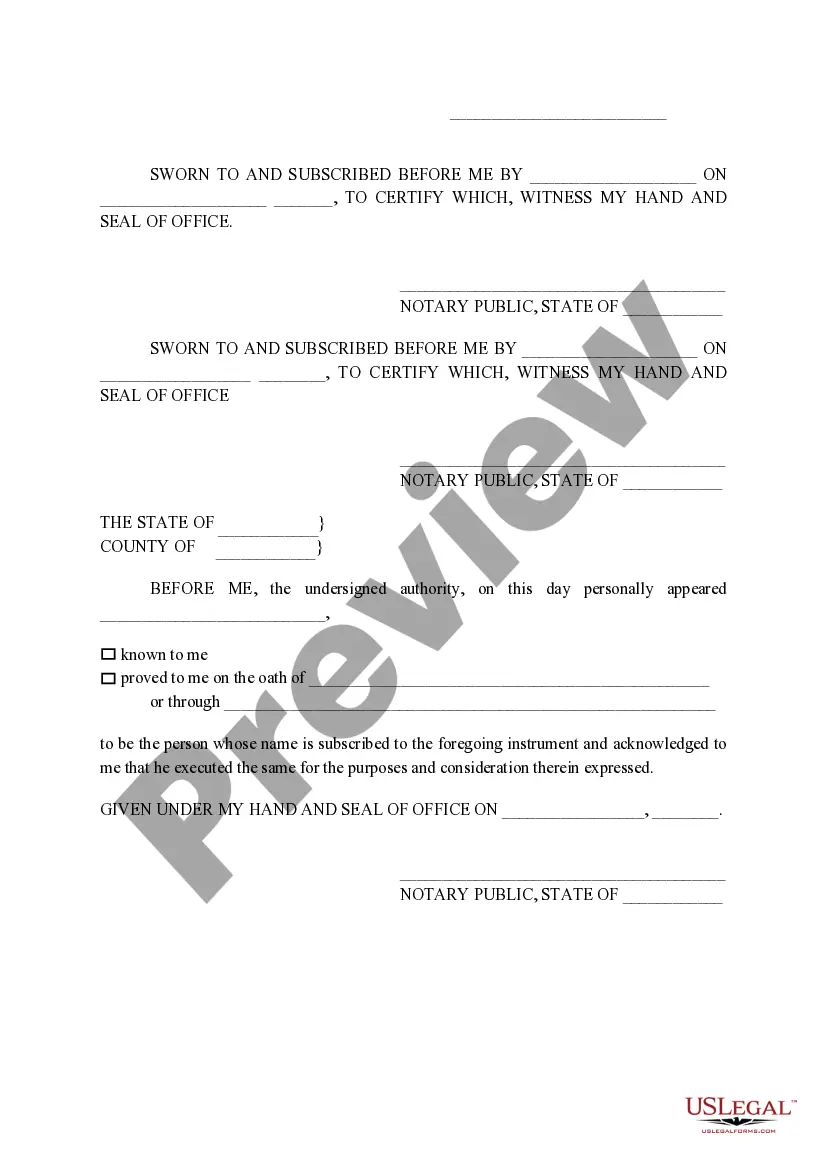

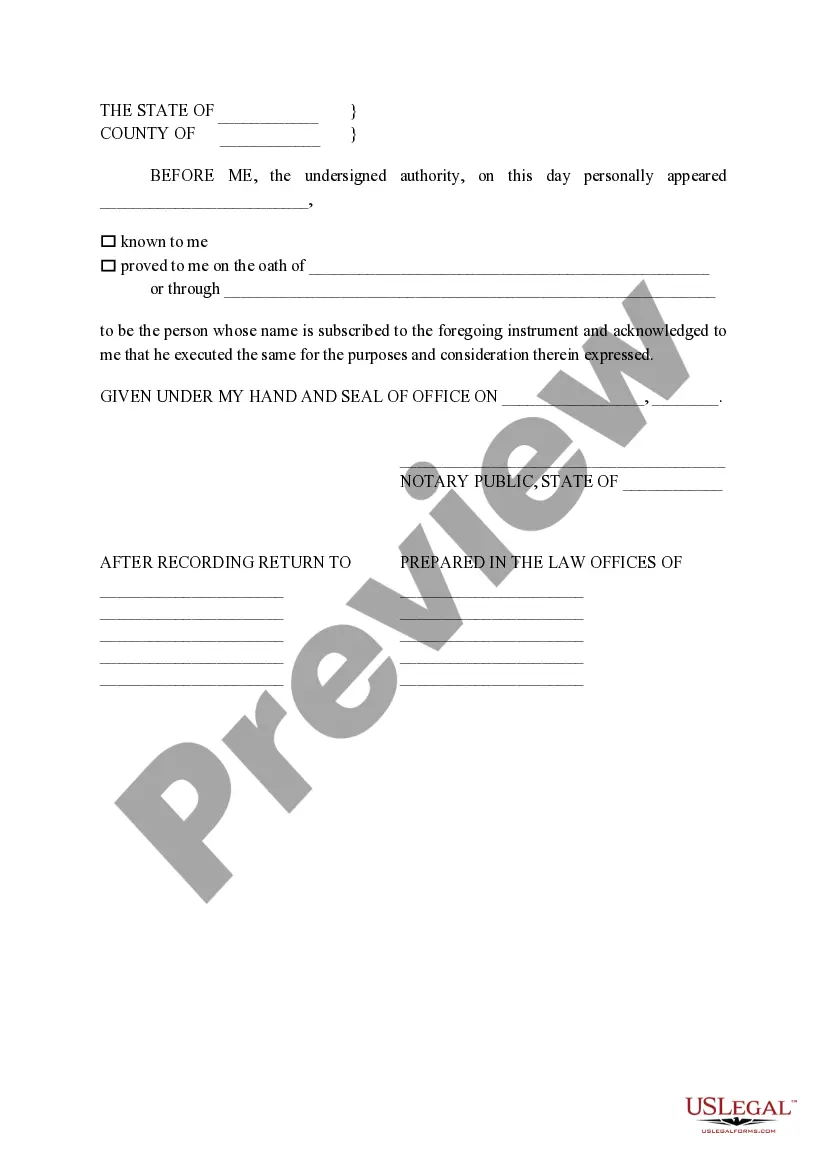

The Amarillo Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and the establishment of a homestead in the city of Amarillo, Texas. These documents hold significant importance when it comes to determining property taxes and protecting one's primary residence. The Non-Homestead Affidavit is a declaration filed by property owners who do not claim the property as their homestead. By filing this affidavit, owners affirm that the property is not their primary residence and therefore, does not qualify for certain homestead exemptions or tax benefits. This affidavit helps establish the correct property tax rate for the non-homestead property. On the other hand, the Designation of Homestead is an affidavit filed by property owners who claim the property as their primary residence or homestead. By designating the property as a homestead, owners become eligible for various homestead exemptions, which can significantly reduce their property tax liability. The Designation of Homestead lets the taxing authorities differentiate between properties and grant appropriate exemptions to qualified homeowners. In Amarillo, Texas, there are no variations or different types of Non-Homestead Affidavit and Designation of Homestead documents. However, depending on specific circumstances, additional supporting documents may be required along with these affidavits. These supporting documents could include proof of residency, such as a Texas driver's license or voter registration card, or other proofs required by the Texas Property Code. It is crucial for property owners in Amarillo, Texas, to understand the importance of accurately completing these affidavits. Filing the Non-Homestead Affidavit or Designation of Homestead incorrectly can result in incorrect property tax assessments or the loss of potential tax benefits. It is highly recommended that property owners consult with a qualified real estate attorney or tax professional to ensure the correct preparation and filing of these affidavits. In conclusion, the Amarillo Texas Non-Homestead Affidavit and Designation of Homestead are essential legal documents that property owners must utilize based on their residential status. The Non-Homestead Affidavit establishes properties that are not used as the owner's primary residence, while the Designation of Homestead allows owners to claim property as their homestead and benefit from various exemptions. Understanding and properly completing these affidavits are necessary to ensure accurate property tax assessments and avail tax benefits in Amarillo, Texas.

Amarillo Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Amarillo Texas Non- Homestead Affidavit And Designation Of Homestead?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Amarillo Texas Non- Homestead Affidavit and Designation of Homestead or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Amarillo Texas Non- Homestead Affidavit and Designation of Homestead quickly using our trusted platform. In case you are already a subscriber, you can proceed to log in to your account to download the needed form.

However, if you are unfamiliar with our library, make sure to follow these steps prior to obtaining the Amarillo Texas Non- Homestead Affidavit and Designation of Homestead:

- Be sure the form you have found is good for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief description (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment method and proceed to download the Amarillo Texas Non- Homestead Affidavit and Designation of Homestead as soon as the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. In case you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.