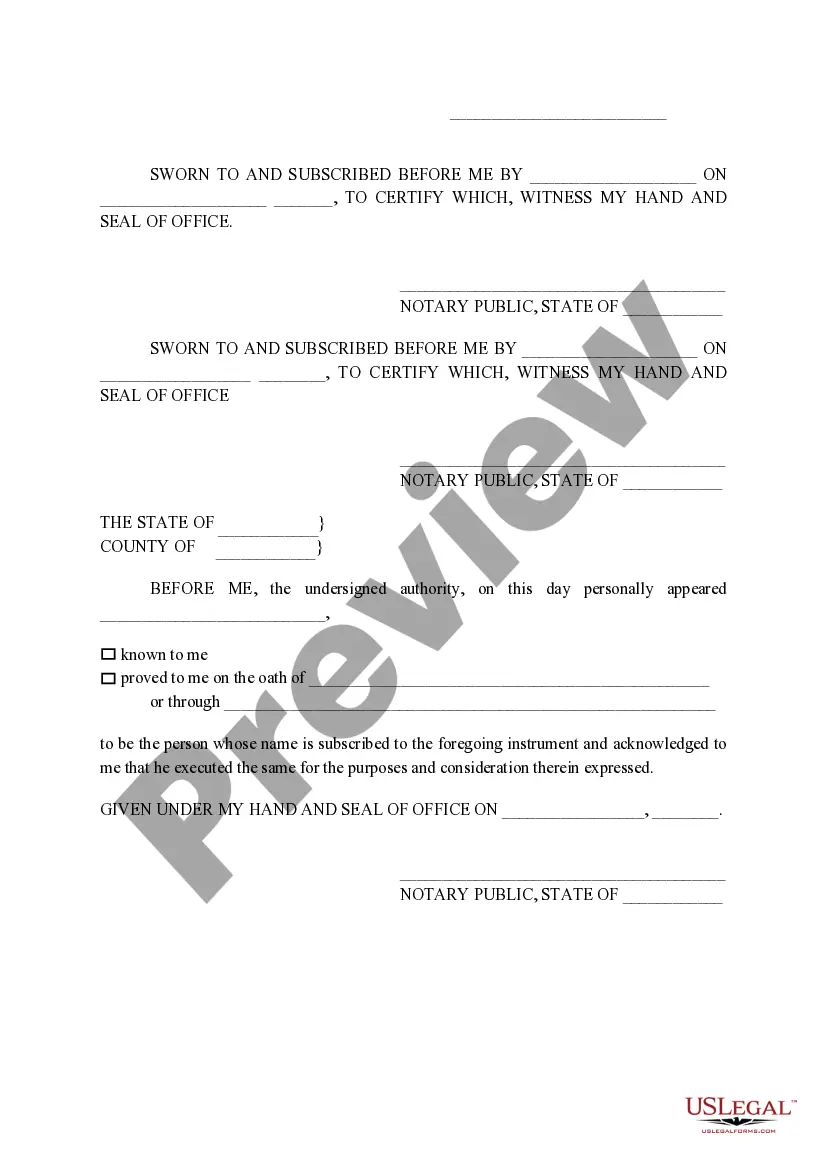

The College Stations Texas Non-Homestead Affidavit and Designation of Homestead are legal documents used to establish property ownership and determine the tax status of a residential property in the city of College Station, Texas. These forms serve to declare whether a property is used as a primary residence (homestead) or not (non-homestead). The Non-Homestead Affidavit is filed when the property is not the owner's primary residence. It is typically used for properties such as rental homes, vacation homes, or properties that are used for business purposes. By filing this affidavit, property owners are acknowledging that their property is not eligible for certain tax exemptions that are available to homestead properties. On the other hand, the Designation of Homestead is submitted when the property is the owner's primary residence. This form is crucial as it allows homeowners to claim various tax benefits and protections provided under Texas law for primary residences. These benefits may include a reduction in property taxes, protection from creditors, and exemption from certain liens. By completing and submitting either the Non-Homestead Affidavit or the Designation of Homestead, property owners in College Station can ensure that they comply with taxation regulations and accurately declare the usage of their property. It is essential to file the correct form based on the property's status to prevent any legal or financial implications. It's worth noting that there are no specific variations or alternate versions of the College Station Texas Non-Homestead Affidavit and Designation of Homestead. The distinction lies in whether the property is declared as a non-homestead or a homestead, and the appropriate form must be completed accordingly. In conclusion, the College Station Texas Non-Homestead Affidavit and Designation of Homestead are legally required documents that property owners in College Station, Texas, must file to declare the tax status of their residential properties. By accurately completing these forms, property owners can ensure compliance with tax regulations and take advantage of various benefits and protections associated with either non-homestead or homestead properties.

College Station Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out College Station Texas Non- Homestead Affidavit And Designation Of Homestead?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the College Station Texas Non- Homestead Affidavit and Designation of Homestead becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the College Station Texas Non- Homestead Affidavit and Designation of Homestead takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the College Station Texas Non- Homestead Affidavit and Designation of Homestead. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!