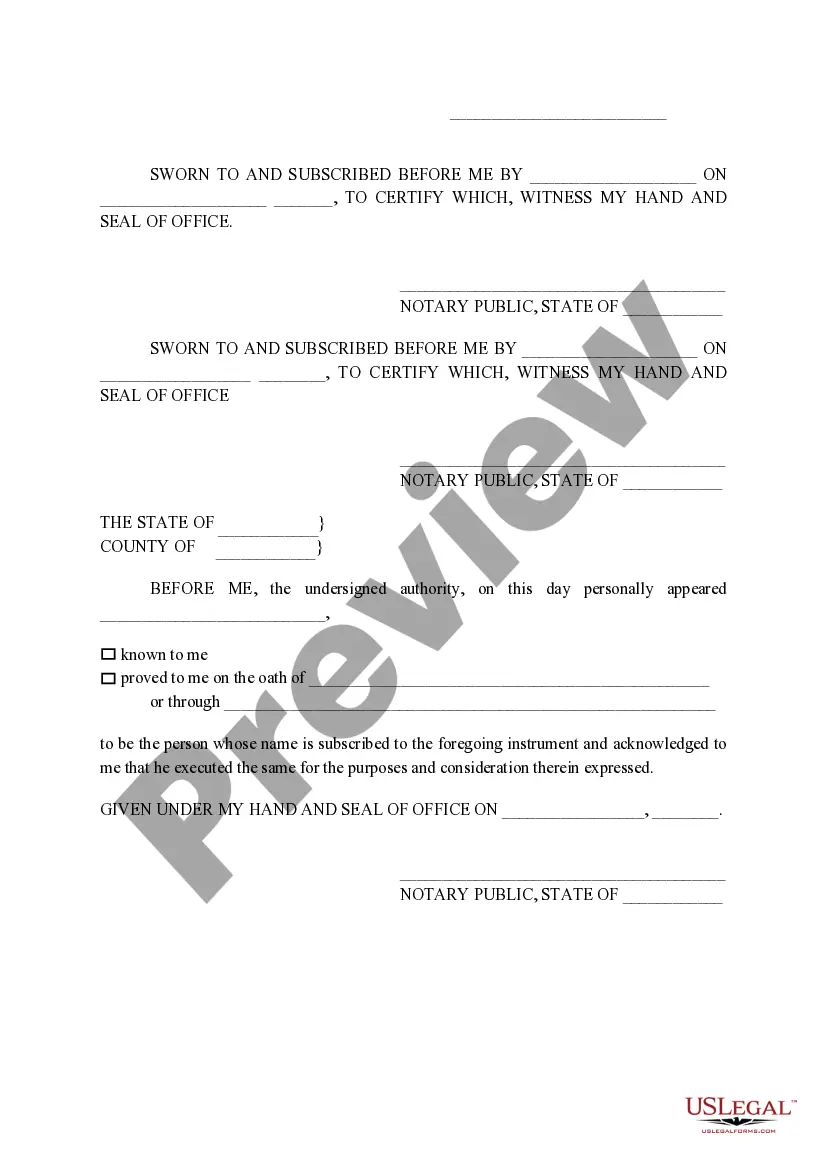

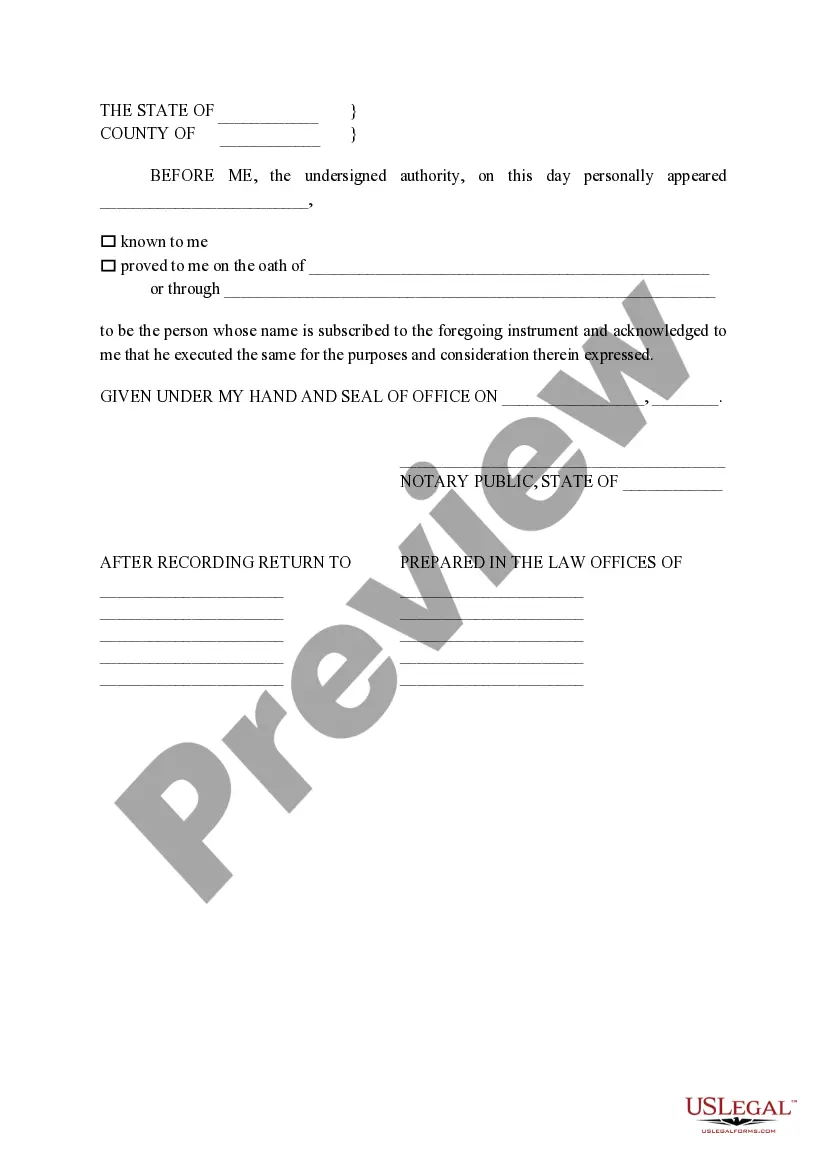

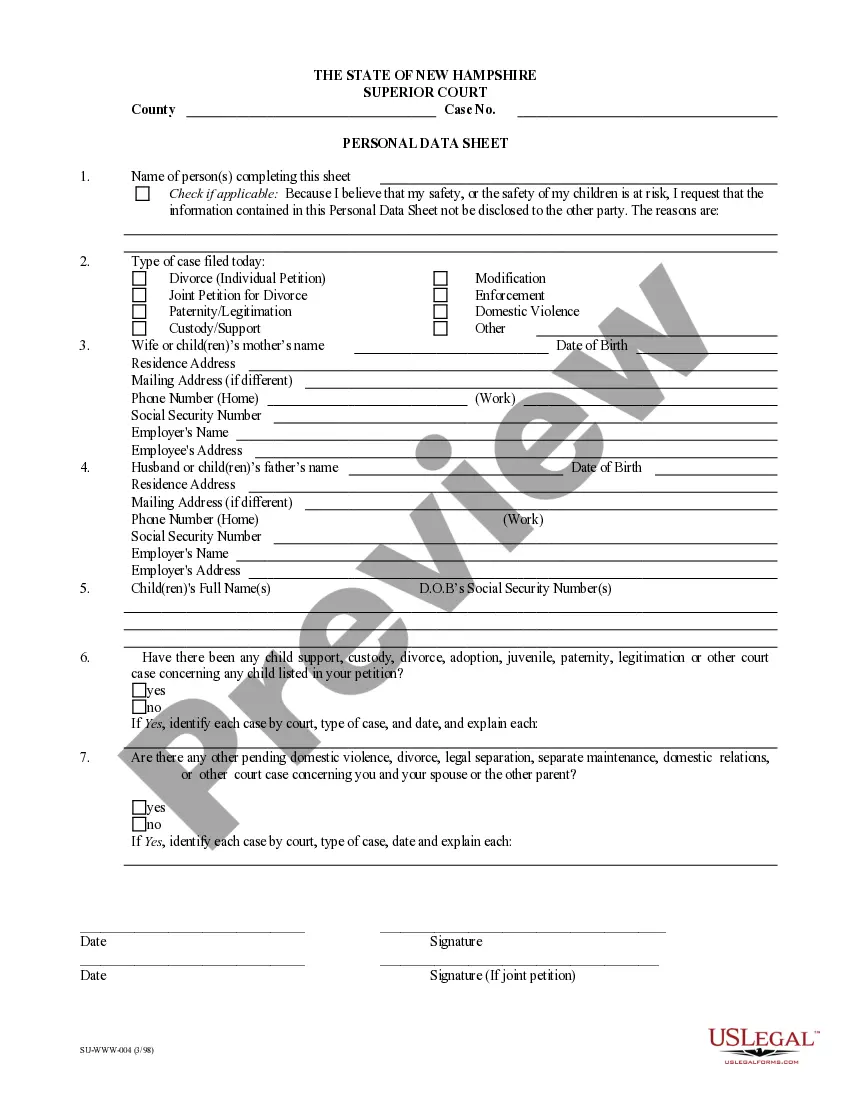

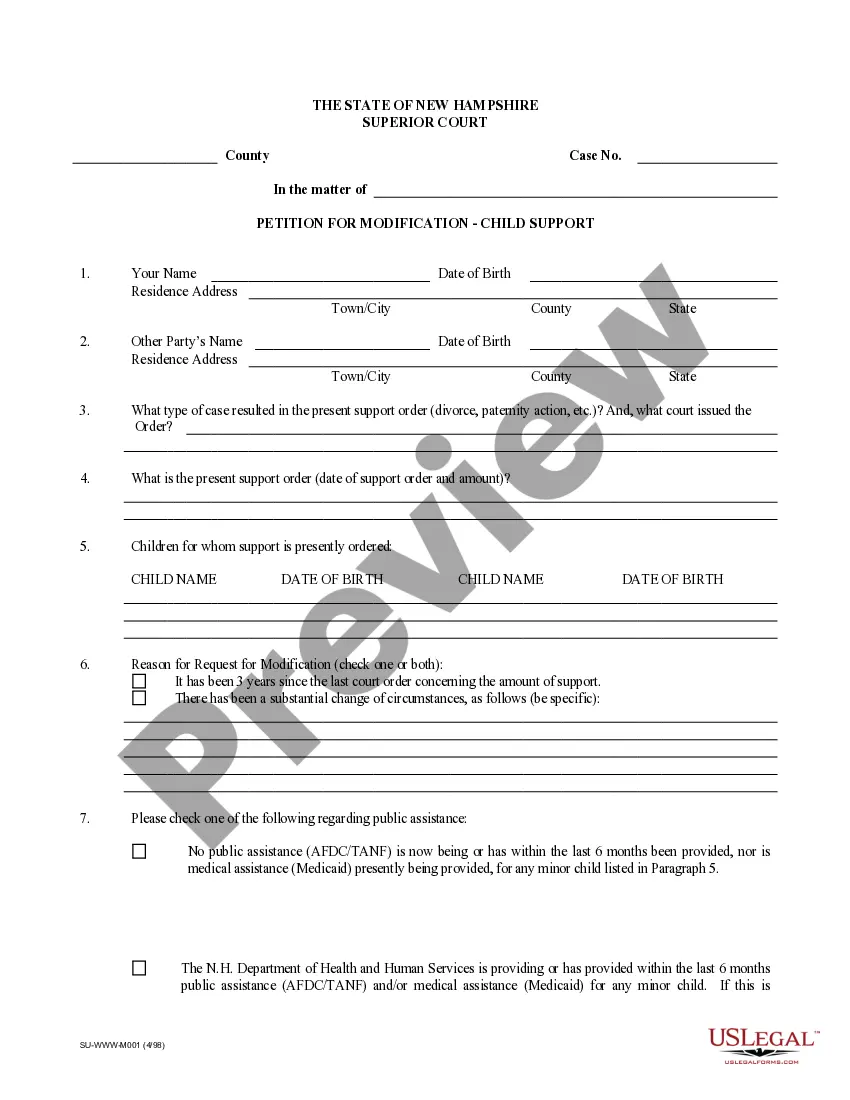

Corpus Christi, Texas residents seeking to protect their property rights and enjoy certain tax benefits can benefit from understanding the Non-Homestead Affidavit and Designation of Homestead processes. These legal documents play a crucial role in delineating whether a property qualifies for homestead exemption or falls under non-homestead classification. Familiarizing oneself with these concepts can help homeowners make informed decisions about their property and potentially save on property taxes. The Non-Homestead Affidavit is a legal document filed by property owners, declaring that their property does not qualify for the homestead exemption according to Texas law. It confirms that the property is not used as the owner's primary residence and thus cannot benefit from homestead-related tax exemptions and protections. This affidavit may be necessary when an owner purchases an additional property, owns rental properties, or is temporarily residing outside the primary residence. Conversely, the Designation of Homestead document is crucial for homeowners seeking to claim homestead exemption. It establishes their primary residence as a homestead and grants them various property tax benefits and protections. By filing this document, owners can potentially lower their property tax burden and safeguard their home from certain creditors. It is important to note that while the terms "Non-Homestead Affidavit" and "Designation of Homestead" are widely used, there may not be different types specific to Corpus Christi, Texas. However, the processes and requirements may vary slightly between cities and counties within the state. To file a Non-Homestead Affidavit or a Designation of Homestead in Corpus Christi, Texas, homeowners must adhere to specific guidelines and meet eligibility criteria. It is advisable to consult with an experienced real estate attorney or reach out to the Nueces County Appraisal District for precise instructions and assistance throughout the process. Understanding the intricacies of the Corpus Christi, Texas Non-Homestead Affidavit and Designation of Homestead can empower property owners to navigate legal requirements smoothly, protect their property rights, and optimize their tax obligations. Stay knowledgeable about these procedures to make informed decisions regarding your property and potential tax benefits.

Corpus Christi Texas Non- Homestead Affidavit and Designation of Homestead

Description

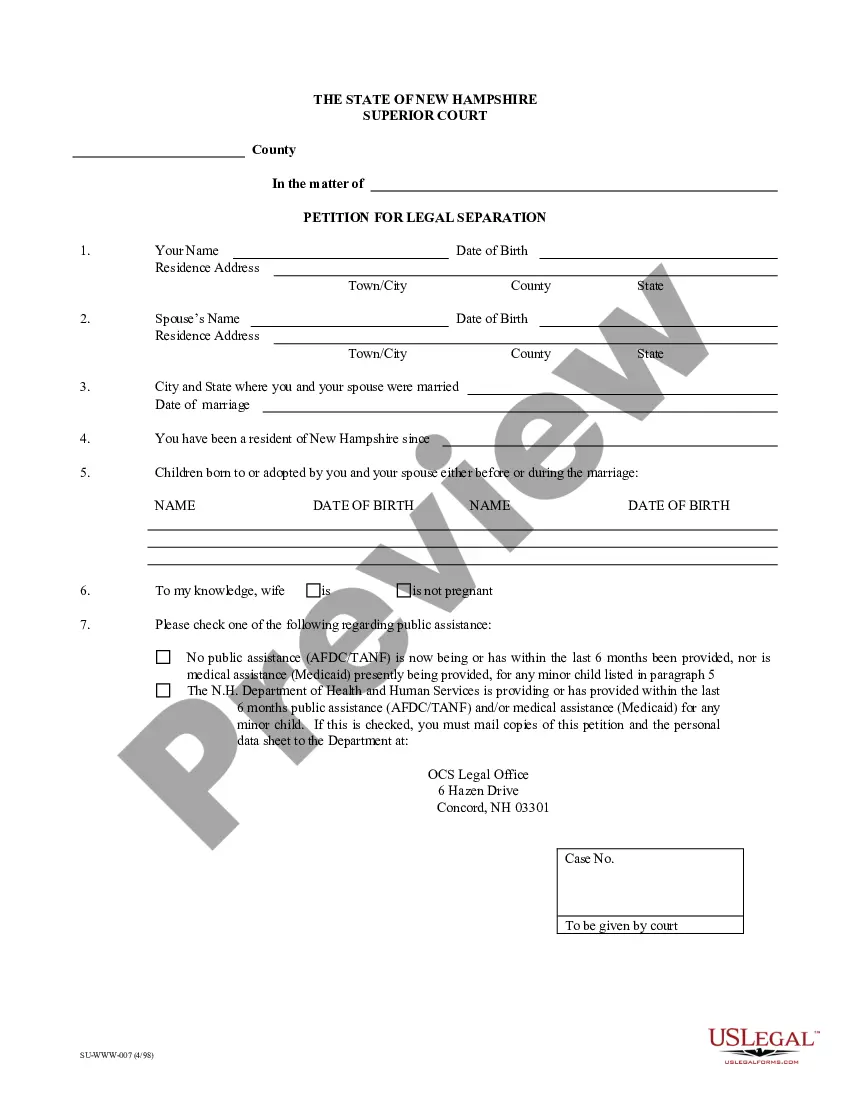

How to fill out Corpus Christi Texas Non- Homestead Affidavit And Designation Of Homestead?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no legal education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Corpus Christi Texas Non- Homestead Affidavit and Designation of Homestead or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Corpus Christi Texas Non- Homestead Affidavit and Designation of Homestead in minutes employing our reliable platform. If you are already an existing customer, you can go on and log in to your account to get the appropriate form.

However, if you are new to our library, ensure that you follow these steps before downloading the Corpus Christi Texas Non- Homestead Affidavit and Designation of Homestead:

- Ensure the form you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Review the form and read a brief outline (if provided) of cases the document can be used for.

- If the one you selected doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment method and proceed to download the Corpus Christi Texas Non- Homestead Affidavit and Designation of Homestead as soon as the payment is through.

You’re good to go! Now you can go on and print the form or fill it out online. Should you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.