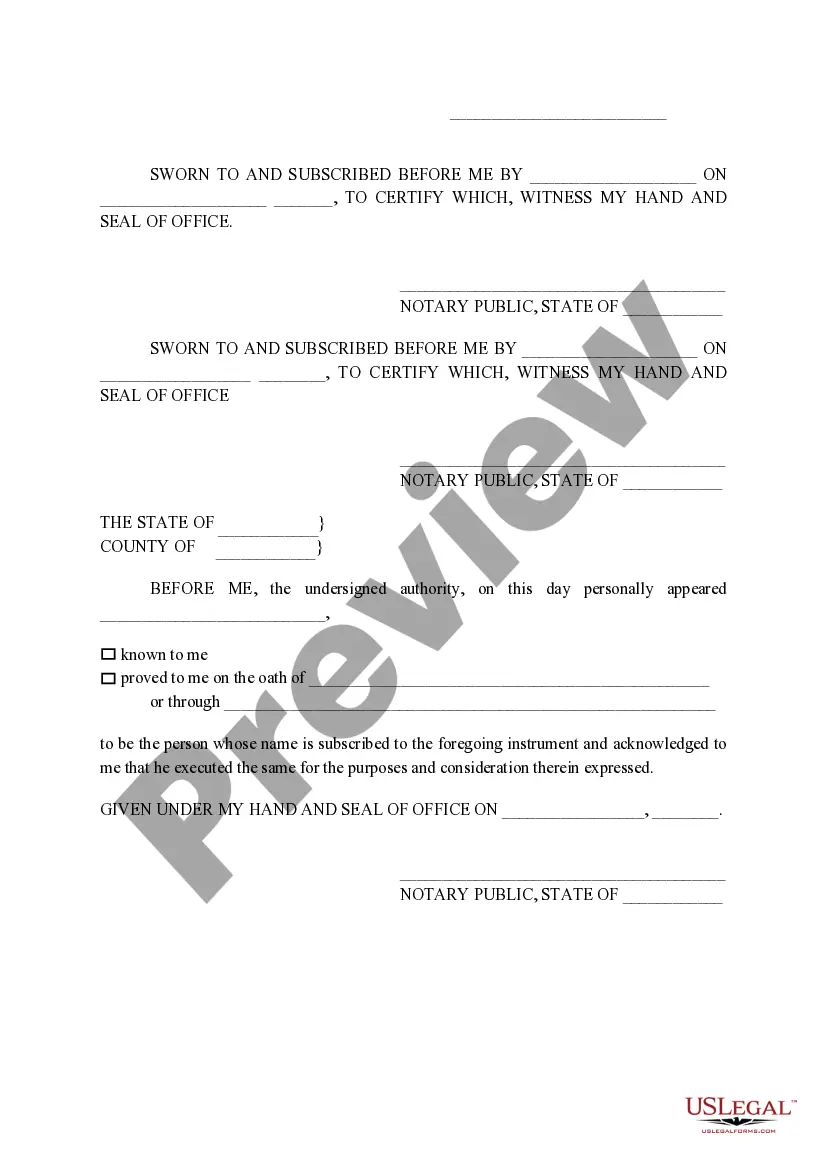

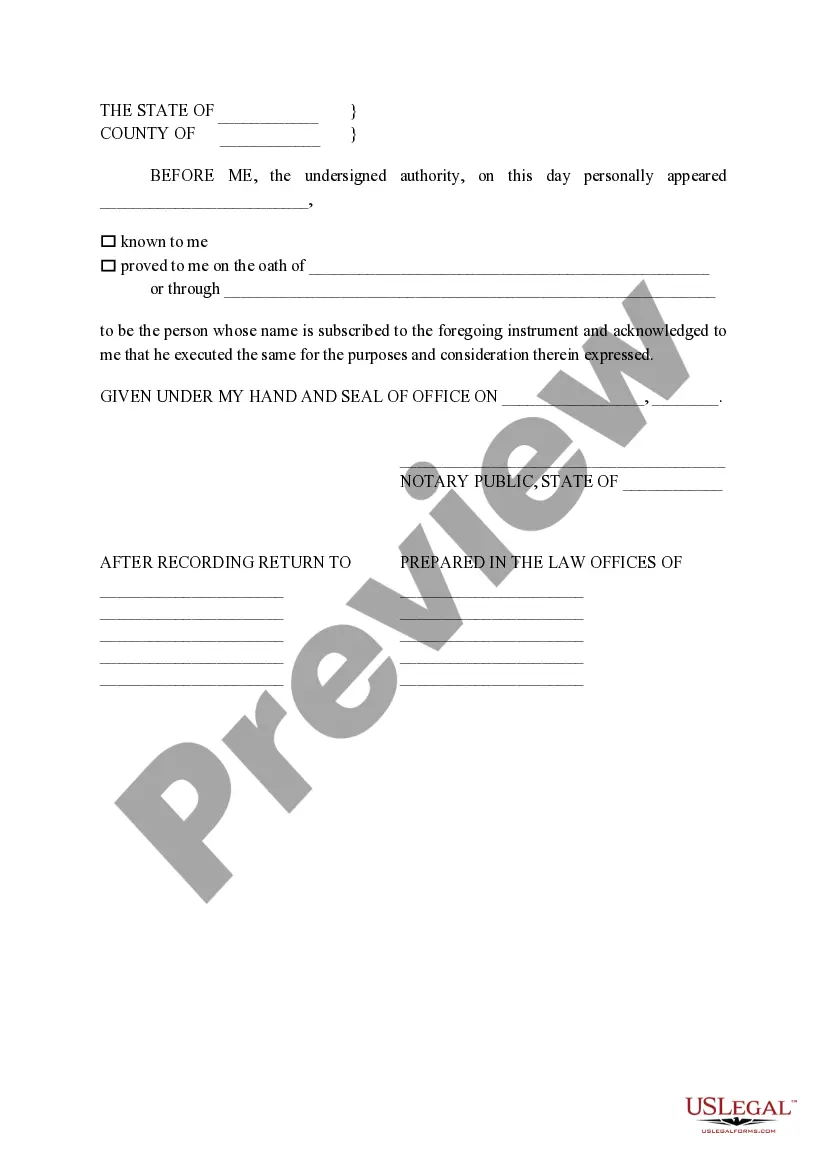

The Harris County, Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that relate to property ownership and taxation in the county. These documents are essential for property owners in order to assert their rights and claim exemptions on their homes or other qualified properties. Here is a detailed explanation of each document: 1. Harris County Non-Homestead Affidavit: The Harris County Non-Homestead Affidavit is a legal document used to declare that a property does not qualify for a homestead exemption. This affidavit is necessary for properties that are not utilized as the owner's primary residence or do not meet the criteria set for a homestead. By filing this affidavit, property owners ensure that their property is taxed accordingly based on its non-homestead status. Related keywords: Harris County, non-homestead property, property taxation, affidavit, primary residence, property owners. 2. Harris County Designation of Homestead: The Harris County Designation of Homestead is a legal document used to claim a homestead exemption on a property. This document is essential for property owners who use their property as their primary residence and want to enjoy the associated tax benefits. By designating a property as a homestead, owners can lower their property taxes and protect their property from certain types of creditors. Related keywords: Harris County, homestead exemption, primary residence, property taxes, tax benefits, designated homestead, property protection. It is important to note that these documents are specific to Harris County in Texas. Other counties or states may have similar documents, but the details and requirements may vary. In Harris County, there may be additional types of non-homestead affidavits and homestead designations based on certain criteria or circumstances. Some possible variations include: 1. Disabled Person's Homestead Exemption: A designation specifically for individuals with disabilities, providing additional tax benefits and protections. 2. Over-65 Homestead Exemption: A designation available for individuals aged 65 or older, offering additional tax exemptions and benefits. 3. Surviving Spouse Homestead Exemption: A designation for surviving spouses of qualified property owners, allowing them to continue benefiting from the homestead exemption. 4. Additional Non-Homestead Affidavits: Variations of non-homestead affidavits may exist to address specific situations, such as properties used for rental purposes or properties subject to certain restrictions. It is important for property owners to consult with legal professionals or tax authorities in Harris County, Texas, to ensure they complete the correct documents and receive the appropriate exemptions and benefits based on their specific circumstances.

Designation Of Homestead Request Form

Description

How to fill out Harris Texas Non- Homestead Affidavit And Designation Of Homestead?

Make use of the US Legal Forms and obtain instant access to any form template you require. Our useful platform with thousands of documents allows you to find and get almost any document sample you require. You are able to download, fill, and certify the Harris Texas Non- Homestead Affidavit and Designation of Homestead in just a couple of minutes instead of surfing the Net for several hours seeking the right template.

Utilizing our collection is a superb strategy to improve the safety of your record filing. Our experienced lawyers regularly check all the documents to make certain that the forms are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Harris Texas Non- Homestead Affidavit and Designation of Homestead? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Find the form you require. Ensure that it is the template you were looking for: check its name and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the Harris Texas Non- Homestead Affidavit and Designation of Homestead and edit and fill, or sign it for your needs.

US Legal Forms is among the most considerable and reliable form libraries on the internet. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Harris Texas Non- Homestead Affidavit and Designation of Homestead.

Feel free to benefit from our service and make your document experience as straightforward as possible!