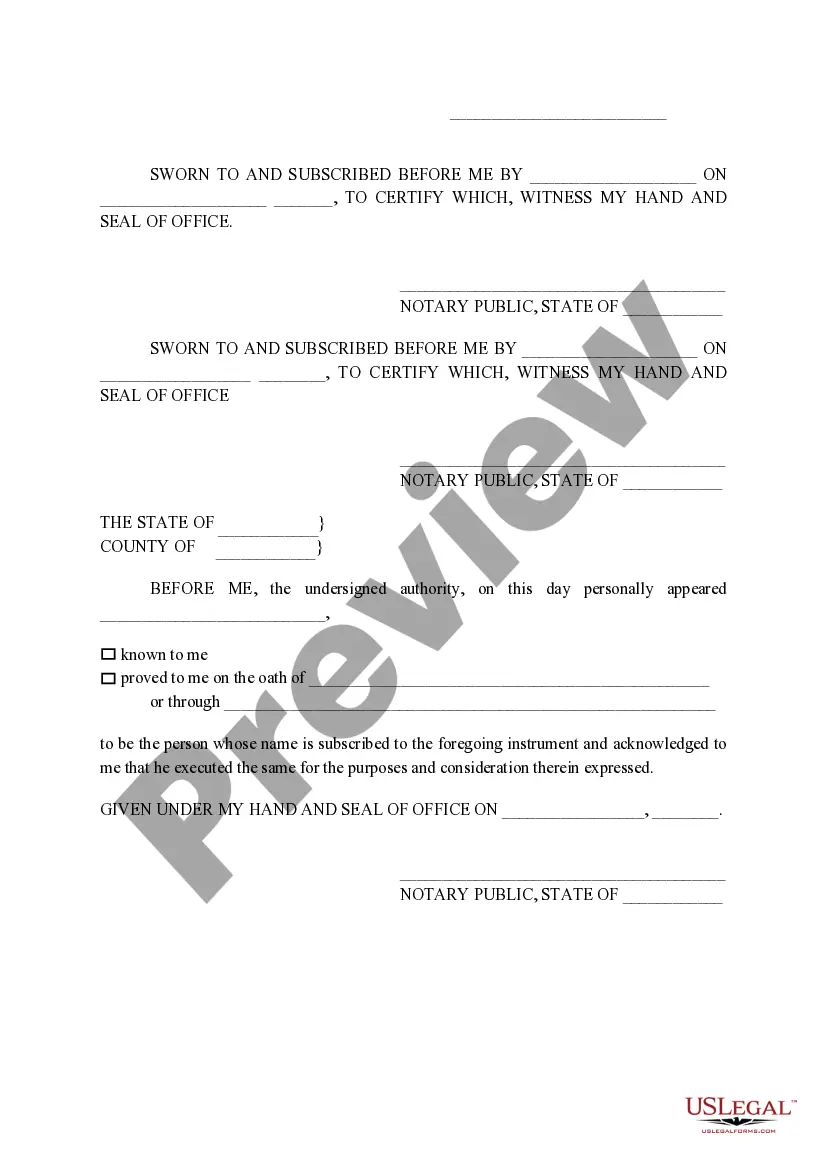

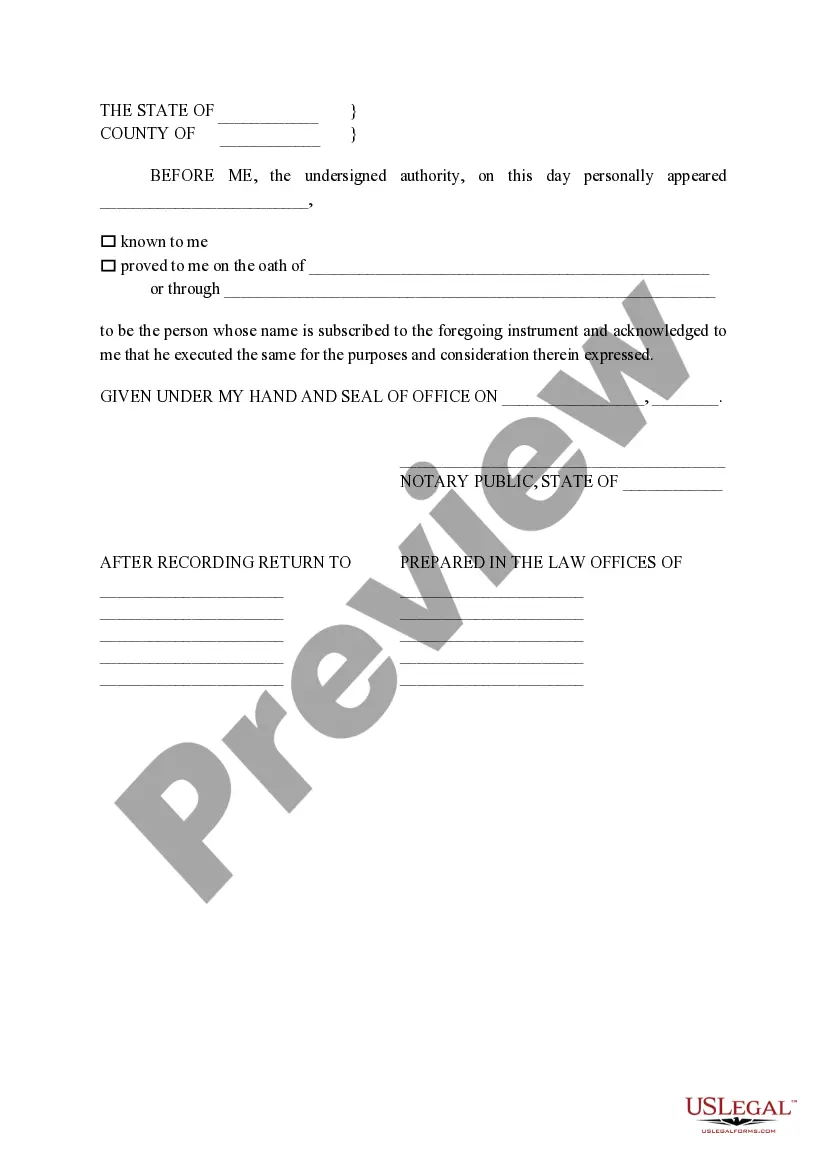

League City, located in the great state of Texas, abides by certain laws and regulations when it comes to Non-Homestead Affidavit and Designation of Homestead. Understanding these terms and their implications is crucial for homeowners within the city. Non-Homestead Affidavit is a legal document that property owners in League City may need to file in order to declare that their property is not designated as their primary residence. In Texas, a homestead is defined as a property that serves as the owner's principal place of residence and is protected from certain creditors' claims. By filing a Non-Homestead Affidavit, property owners effectively confirm that their property does not qualify as a homestead. On the other hand, Designation of Homestead is a legal process through which League City homeowners declare their property as their primary residence and, consequently, receive the benefits and protections associated with homestead designation. These benefits include property tax exemptions, protection from some creditors, and limitations on property value increases for taxation purposes. It's important to note that there are different types of League City Texas Non-Homestead Affidavits and Designation of Homestead, based on the intended purpose and circumstances. Here are some examples: 1. Residential Property Non-Homestead Affidavit: This type of affidavit is typically used when the property is not a principal residence, such as a vacation home or rental property. 2. Business Non-Homestead Affidavit: Property owners who utilize their property predominantly for business purposes, rather than as their primary residence, would file this type of affidavit. 3. Designation of Homestead for Elderly/Disabled Individuals: League City provides additional protections for elderly or disabled individuals, allowing them to designate their primary residence as a homestead with certain exemptions and limitations. 4. Designation of Homestead with Spousal Right of Survivorship: Couples can file this type of affidavit to ensure that if one spouse passes away, the surviving spouse retains rights to the homestead property, protecting their rights and preventing the property from being sold or seized involuntarily. 5. Designation of Homestead for Tax Exemption: Homeowners looking to take advantage of the property tax exemptions available for homestead properties would file this affidavit to officially designate their property as their primary residence. Understanding the differences between these various affidavits and designations is crucial for League City homeowners to ensure they are in compliance with legal requirements and take full advantage of the benefits, protections, and exemptions that homestead designation offers. It is recommended to seek legal advice or consult local authorities to ensure the correct filing procedure and requirements are met.

League City Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out League City Texas Non- Homestead Affidavit And Designation Of Homestead?

Do you need a reliable and affordable legal forms provider to get the League City Texas Non- Homestead Affidavit and Designation of Homestead? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the League City Texas Non- Homestead Affidavit and Designation of Homestead conforms to the regulations of your state and local area.

- Read the form’s description (if available) to find out who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the League City Texas Non- Homestead Affidavit and Designation of Homestead in any available format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online once and for all.