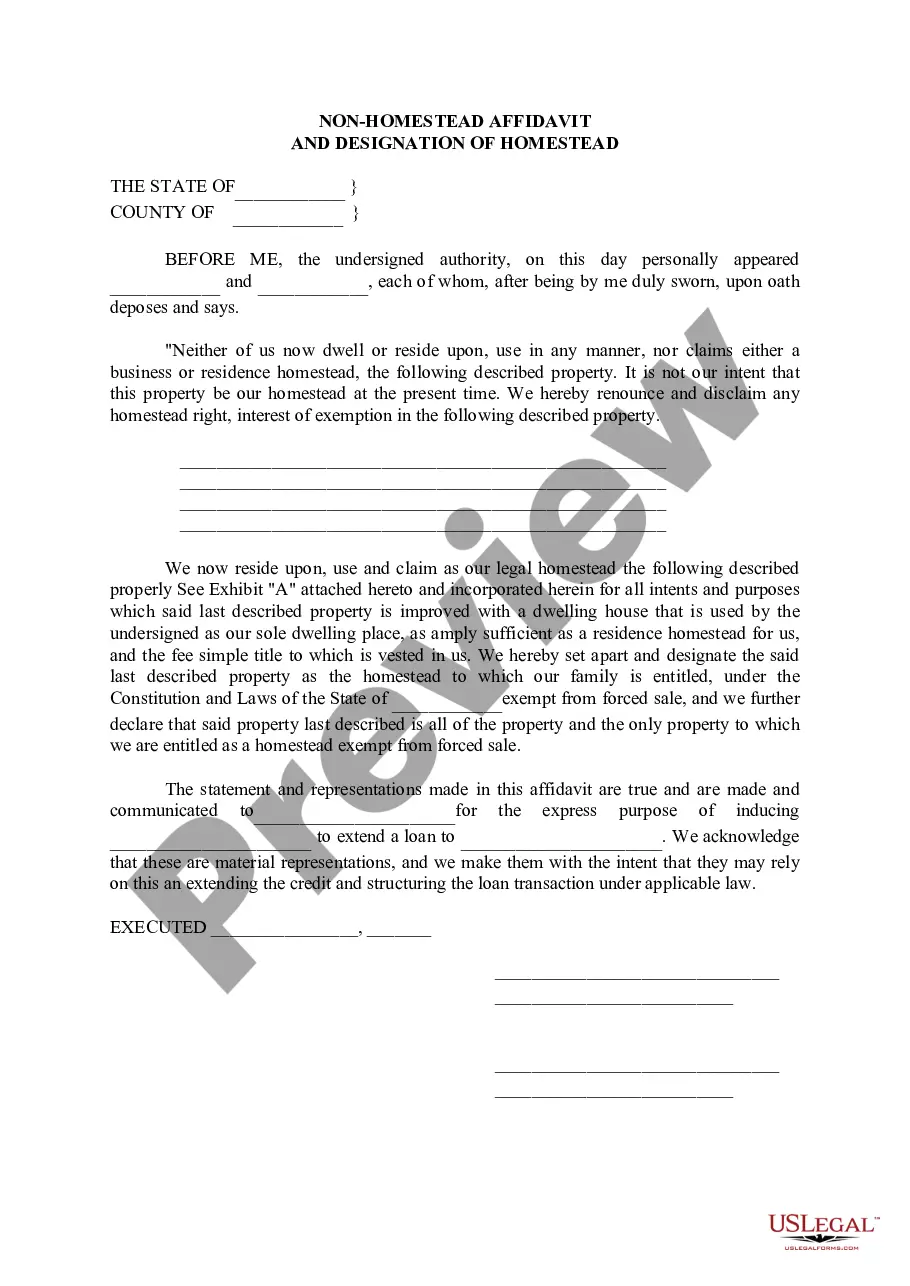

The McAllen Texas Non-Homestead Affidavit and Designation of Homestead are legal documents used to establish and protect a homeowner's homestead status in McAllen, Texas. These documents serve distinct purposes but are both essential in safeguarding property rights and assessing property taxes accurately. The Non-Homestead Affidavit is typically used when a property does not qualify for homestead exemption. It must be filed by property owners to declare that their property does not meet the requirements for a homestead exemption. By submitting this affidavit, property owners acknowledge that their property falls under the non-homestead category, ensuring that accurate taxes are assessed. This document may include information such as the property's address, the owner's name, and an acknowledgment of understanding the non-homestead status. On the other hand, the Designation of Homestead form is used when a property meets specific criteria that qualify it for a homestead exemption. Homestead status provides important legal protections, such as limiting property tax increases and protection from certain creditors. The Designation of Homestead form is filed to officially declare a property as a homestead and claim the appropriate exemptions. This document typically requires information such as the property's address, owner's name, date of occupancy, and the owner's intent to use the property as a primary residence. In addition to the general Non-Homestead Affidavit and Designation of Homestead forms, there may be various subtypes depending on the specific circumstances or requirements. 1. McAllen Texas Non-Homestead Affidavit for Investment Properties: This subtype is used when the property in question is solely used for investment purposes and does not qualify for a homestead exemption due to not being the owner's primary residence. 2. McAllen Texas Non-Homestead Affidavit for Rental Properties: This subtype comes into play when the property is being leased or rented out to tenants and does not qualify for a homestead exemption since it is not the owner's primary residence. 3. McAllen Texas Non-Homestead Affidavit for Commercial Properties: This specific variation is used for commercial properties, such as office buildings or retail spaces, which are not eligible for a homestead exemption under McAllen's regulations. It is important to note that the specific variations of the Non-Homestead Affidavit and Designation of Homestead forms might vary depending on local regulations and guidelines. Property owners should consult with legal professionals or visit the official McAllen city website to ensure they are using the correct forms for their specific situation.

McAllen Texas Non- Homestead Affidavit and Designation of Homestead

Description

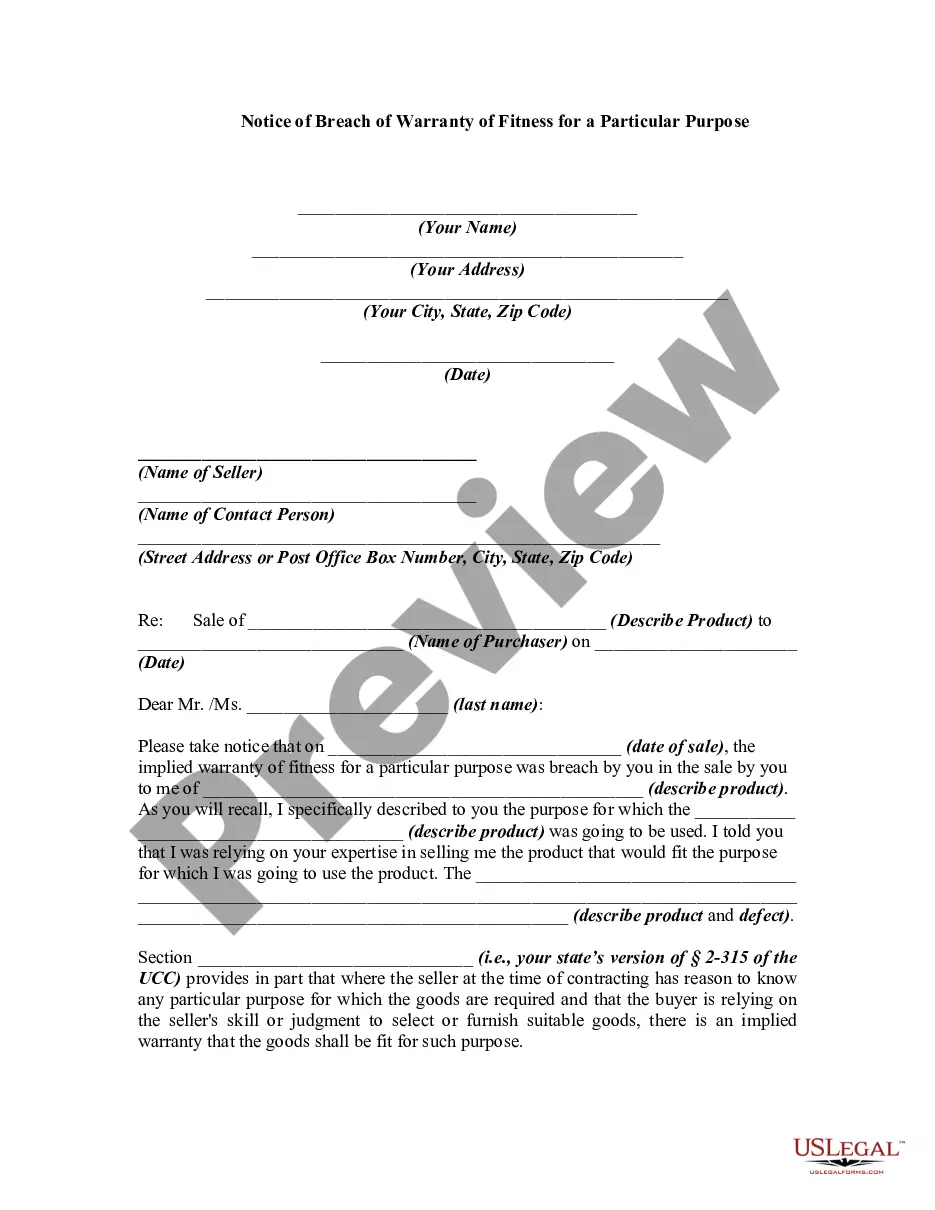

How to fill out McAllen Texas Non- Homestead Affidavit And Designation Of Homestead?

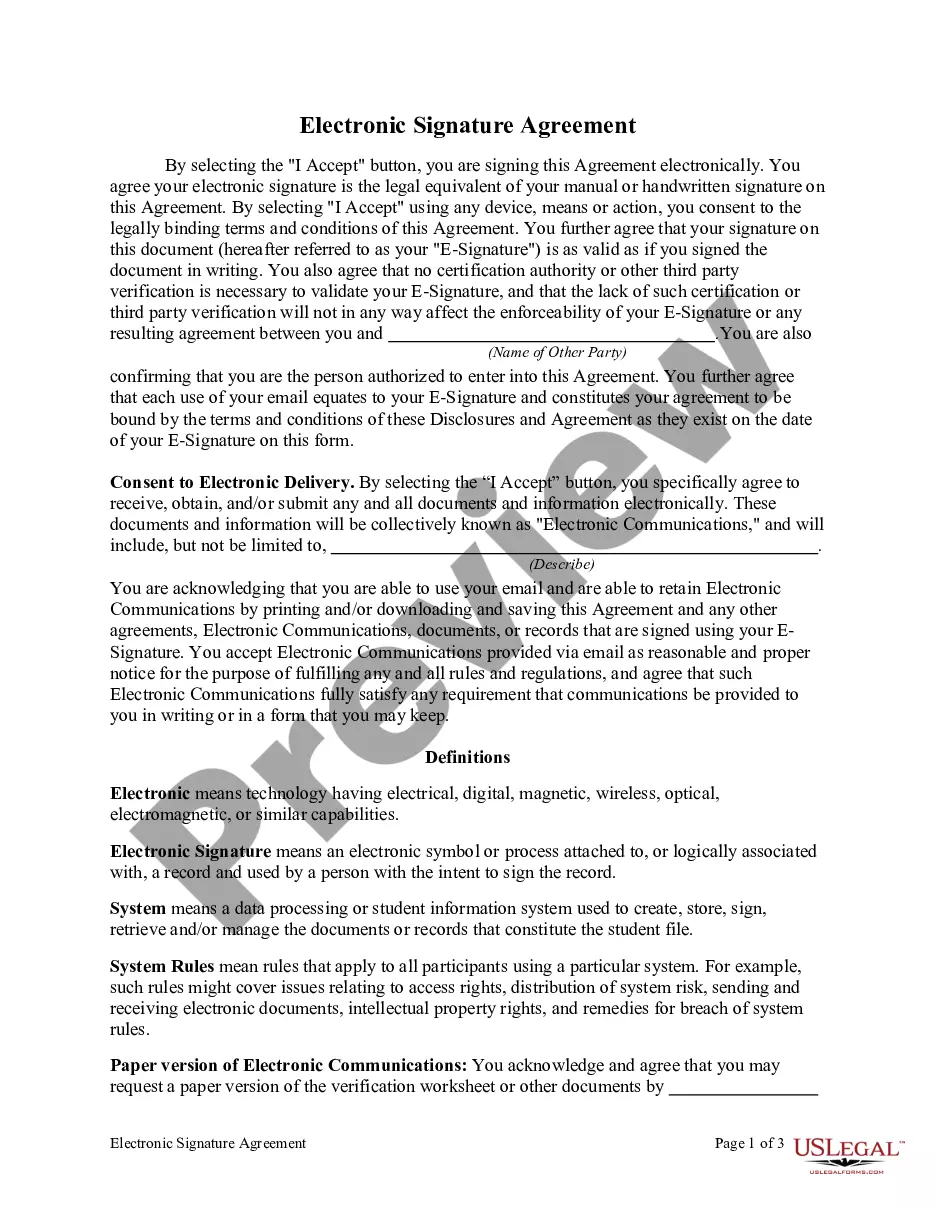

Make use of the US Legal Forms and have instant access to any form template you need. Our helpful website with thousands of documents makes it easy to find and get almost any document sample you need. You can export, complete, and sign the McAllen Texas Non- Homestead Affidavit and Designation of Homestead in just a matter of minutes instead of surfing the Net for hours searching for an appropriate template.

Using our collection is a wonderful way to raise the safety of your document submissions. Our professional attorneys on a regular basis review all the records to ensure that the forms are relevant for a particular region and compliant with new laws and polices.

How can you get the McAllen Texas Non- Homestead Affidavit and Designation of Homestead? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Find the template you need. Ensure that it is the template you were hoping to find: examine its name and description, and use the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the file. Choose the format to obtain the McAllen Texas Non- Homestead Affidavit and Designation of Homestead and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable template libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the McAllen Texas Non- Homestead Affidavit and Designation of Homestead.

Feel free to take advantage of our service and make your document experience as efficient as possible!