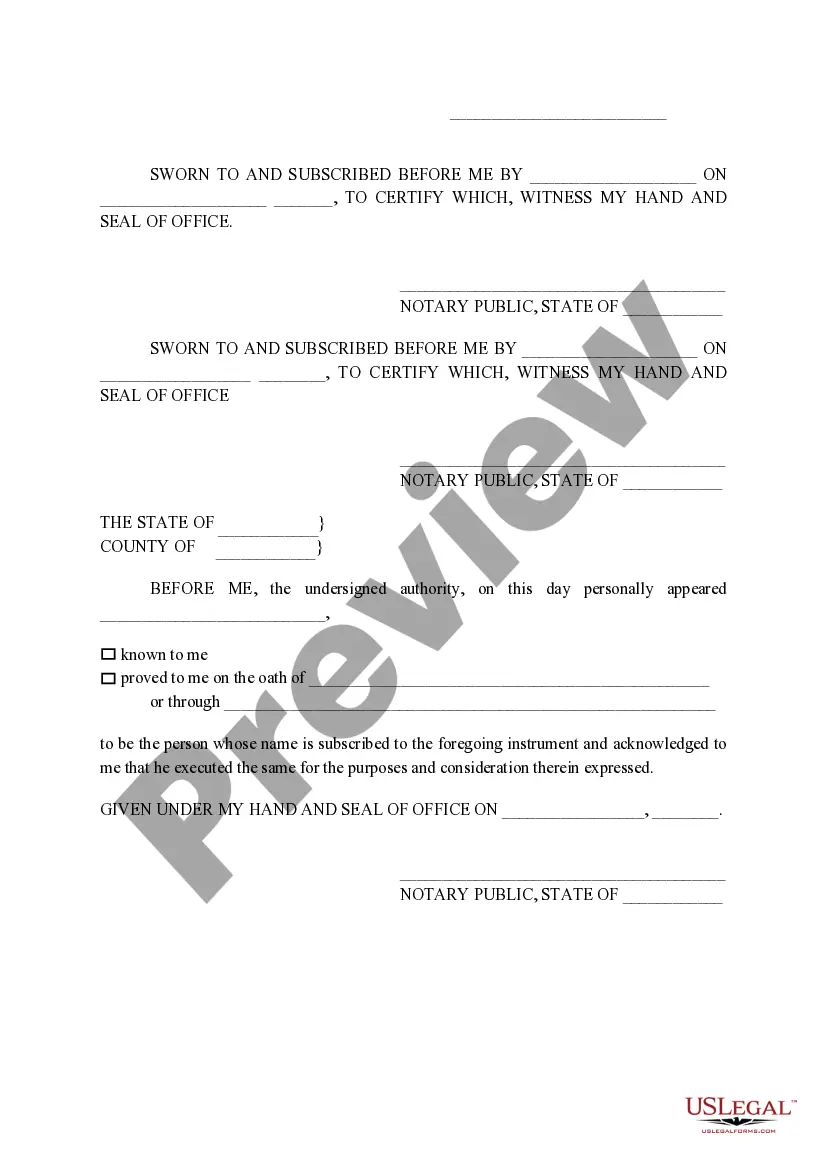

The McKinney Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and taxation in McKinney, Texas. These documents are utilized to establish and determine the status of a property as a homestead or non-homestead for tax purposes. Understanding the intricacies of these affidavits is crucial for property owners in McKinney to ensure accurate tax assessment and potentially save on property taxes. In McKinney, Texas, there are two main types of affidavits relevant to property owners: the Non-Homestead Affidavit and the Designation of Homestead. Let's delve into each document to gain a comprehensive understanding. 1. Non-Homestead Affidavit: The Non-Homestead Affidavit is a legal declaration required when a property is not being claimed as a person's primary residence or homestead. Property owners who use their property for business purposes, rent it out, or reside elsewhere while making no other claims to it as their homestead must file this affidavit to establish their property's non-homestead status. This affidavit helps in determining the property's tax assessment as non-homestead properties are often subject to higher tax rates compared to homestead properties. 2. Designation of Homestead: The Designation of Homestead form is crucial for property owners in McKinney, Texas, who wish to claim their property as their primary residence or homestead. By filing this affidavit, property owners can enjoy certain benefits and protections provided to homestead properties, such as tax exemptions and reduced tax rates. The homestead designation safeguards the property from certain legal actions, prevents forced sale due to debts and creditors, and entitles the property owner to various tax exemptions, resulting in potential cost savings. It is important to note that these affidavits need to be filed with the relevant county appraisal district in McKinney, Texas. Property owners should familiarize themselves with the guidelines provided by the district to ensure accurate completion and submission of the forms. Failing to properly execute the affidavits or missing the submission deadline can lead to incorrect tax assessments or the loss of potential benefits associated with homestead designation. Overall, the McKinney Texas Non-Homestead Affidavit and Designation of Homestead play a significant role in determining the tax status and benefits associated with property ownership in McKinney, Texas. Property owners should consult legal professionals or the appropriate county appraisal district to obtain the necessary forms, understand the requirements, and obtain guidance on properly completing these affidavits to ensure compliance with the local laws and regulations.

McKinney Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out McKinney Texas Non- Homestead Affidavit And Designation Of Homestead?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to draft this sort of paperwork from scratch, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you need the McKinney Texas Non- Homestead Affidavit and Designation of Homestead or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the McKinney Texas Non- Homestead Affidavit and Designation of Homestead quickly employing our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to obtaining the McKinney Texas Non- Homestead Affidavit and Designation of Homestead:

- Be sure the form you have chosen is specific to your location considering that the rules of one state or area do not work for another state or area.

- Preview the document and read a short outline (if provided) of cases the paper can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment method and proceed to download the McKinney Texas Non- Homestead Affidavit and Designation of Homestead once the payment is completed.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.