A Mesquite Texas Non-Homestead Affidavit and Designation of Homestead are legal documents used to determine the status of a property for taxation purposes. These declarations play a crucial role in defining whether a property is eligible for certain tax exemptions or benefits. Let's delve into the intricacies of these documents and explore their various types. The Non-Homestead Affidavit is a declaration commonly filed by property owners to certify that a specific property they own is not their primary residence. When a property is deemed non-homestead, it typically does not qualify for exemptions and benefits attributed to homestead properties, such as a reduced property tax rate. The Non-Homestead Affidavit is essential for ensuring accurate taxation based on the property's designation. On the other hand, the Designation of Homestead is a document that homeowners submit to establish their primary residence as a homestead. By declaring a property as a homestead, homeowners become eligible for several tax advantages and protections, including a reduction in property taxes and protection against some creditors. This designation offers homeowners financial benefits and safeguards their primary residence. In Mesquite, Texas, there are additional types of Non-Homestead Affidavit and Designation of Homestead forms, depending on the specific circumstance: 1. Non-Homestead Affidavit for Rental Property: Specifically designed for property owners who rent out their homes or properties, this form indicates that the property is not the owner's primary residence. It enables accurate taxation and ensures that landlords receive fair treatment by not receiving homestead benefits on their rental property. 2. Non-Homestead Affidavit for Secondary Residences: This type of affidavit is used when someone owns multiple properties but designates one as their primary residence for the purpose of receiving homestead exemptions. This document clarifies that the other properties are considered secondary residences, ensuring that they do not benefit from homestead exemptions. 3. Designation of Homestead with Contiguous Property: This form is used when homeowners have multiple contiguous properties under their ownership, and they wish to designate all properties as a homestead. By submitting this combined form, the property owners can streamline the process and enjoy homestead benefits for all adjacent properties. This Mesquite Texas Non-Homestead Affidavit and Designation of Homestead forms aid in accurately assessing property taxes and conferring important benefits to homeowners. It is vital for property owners in Mesquite, Texas, to understand and complete these forms correctly, as they can impact taxation liabilities and provide much-needed financial relief.

Mesquite Texas Non- Homestead Affidavit and Designation of Homestead

Category:

State:

Texas

City:

Mesquite

Control #:

TX-LR042T

Format:

Word;

Rich Text

Instant download

Description

This affidavit is used to notify a change in location of legal Homestead Property.

A Mesquite Texas Non-Homestead Affidavit and Designation of Homestead are legal documents used to determine the status of a property for taxation purposes. These declarations play a crucial role in defining whether a property is eligible for certain tax exemptions or benefits. Let's delve into the intricacies of these documents and explore their various types. The Non-Homestead Affidavit is a declaration commonly filed by property owners to certify that a specific property they own is not their primary residence. When a property is deemed non-homestead, it typically does not qualify for exemptions and benefits attributed to homestead properties, such as a reduced property tax rate. The Non-Homestead Affidavit is essential for ensuring accurate taxation based on the property's designation. On the other hand, the Designation of Homestead is a document that homeowners submit to establish their primary residence as a homestead. By declaring a property as a homestead, homeowners become eligible for several tax advantages and protections, including a reduction in property taxes and protection against some creditors. This designation offers homeowners financial benefits and safeguards their primary residence. In Mesquite, Texas, there are additional types of Non-Homestead Affidavit and Designation of Homestead forms, depending on the specific circumstance: 1. Non-Homestead Affidavit for Rental Property: Specifically designed for property owners who rent out their homes or properties, this form indicates that the property is not the owner's primary residence. It enables accurate taxation and ensures that landlords receive fair treatment by not receiving homestead benefits on their rental property. 2. Non-Homestead Affidavit for Secondary Residences: This type of affidavit is used when someone owns multiple properties but designates one as their primary residence for the purpose of receiving homestead exemptions. This document clarifies that the other properties are considered secondary residences, ensuring that they do not benefit from homestead exemptions. 3. Designation of Homestead with Contiguous Property: This form is used when homeowners have multiple contiguous properties under their ownership, and they wish to designate all properties as a homestead. By submitting this combined form, the property owners can streamline the process and enjoy homestead benefits for all adjacent properties. This Mesquite Texas Non-Homestead Affidavit and Designation of Homestead forms aid in accurately assessing property taxes and conferring important benefits to homeowners. It is vital for property owners in Mesquite, Texas, to understand and complete these forms correctly, as they can impact taxation liabilities and provide much-needed financial relief.

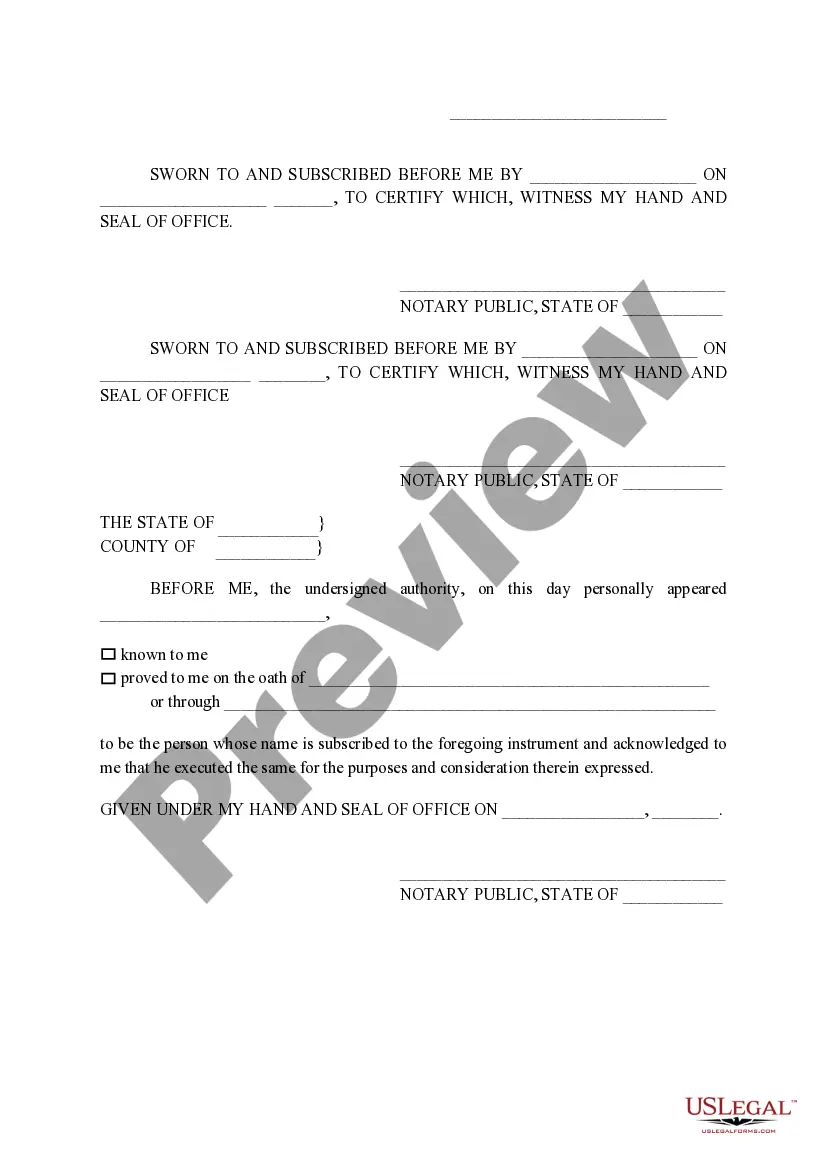

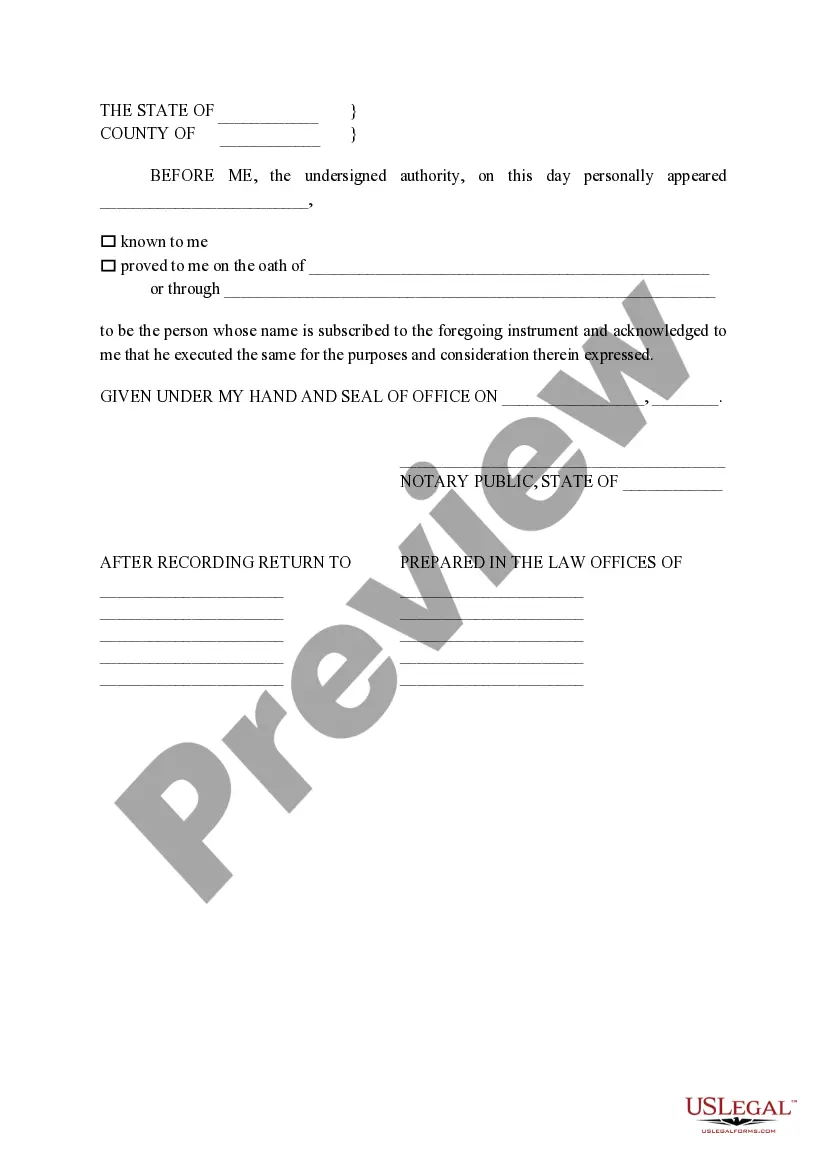

Free preview

How to fill out Mesquite Texas Non- Homestead Affidavit And Designation Of Homestead?

If you’ve already utilized our service before, log in to your account and download the Mesquite Texas Non- Homestead Affidavit and Designation of Homestead on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Mesquite Texas Non- Homestead Affidavit and Designation of Homestead. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!