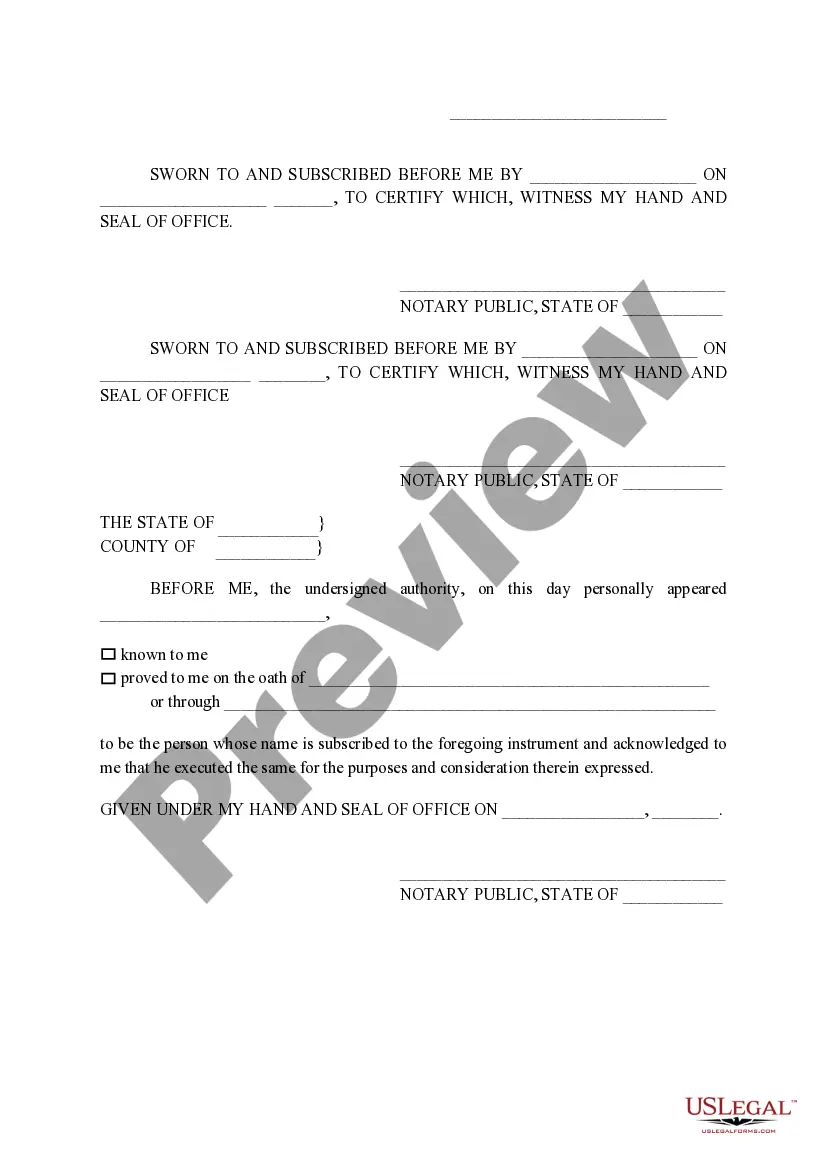

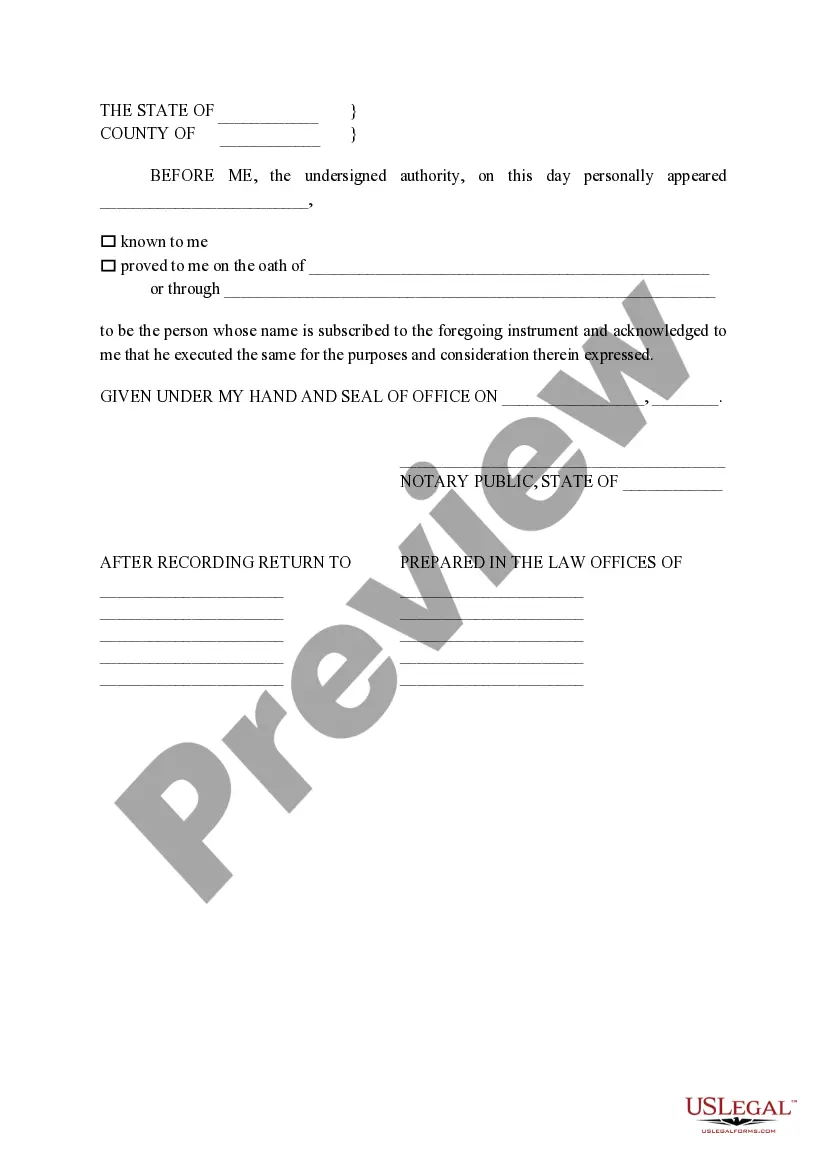

The Pasadena Texas Non-Homestead Affidavit and Designation of Homestead are important legal documents that play a crucial role in property ownership and taxation in Pasadena, Texas. These documents are designed to protect homeowners and determine the applicable homestead exemptions and tax rates. The Non-Homestead Affidavit is typically used when the property in question is not the homeowner's primary residence or homestead. By filing this affidavit, the property owner declares that the property is not their homestead and acknowledges that it may be subject to non-homestead tax rates and regulations. On the other hand, the Designation of Homestead is used when the property is the homeowner's primary residence or homestead. By filing this designation, the property owner establishes their property as their homestead and becomes eligible for various homestead exemptions and protections provided by the state of Texas. These documents are essential for property owners in Pasadena to ensure accurate taxation and protection of their properties. Property owners should consult with a knowledgeable attorney or tax professional to understand the specific requirements and implications of filing these affidavits and designations. It is worth noting that there may be variations or additional types of non-homestead affidavits and designations specific to Pasadena, Texas. These could include affidavits and designations for certain property types, such as commercial or rental properties, or for specific situations, such as inherited or jointly owned properties. It is vital for property owners to research and consult with local authorities or legal professionals familiar with Pasadena's specific regulations and requirements to ensure compliance with the applicable laws. To summarize, the Pasadena Non-Homestead Affidavit and Designation of Homestead are vital legal documents that property owners must file to protect their property and determine the appropriate tax rates and exemptions. While these are the general aspects of these documents, property owners should be aware that there may be additional variations or types based on specific circumstances or property types.

Pasadena Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Pasadena Texas Non- Homestead Affidavit And Designation Of Homestead?

If you are looking for a valid form, it’s impossible to find a more convenient place than the US Legal Forms site – one of the most considerable libraries on the web. Here you can find a large number of form samples for business and personal purposes by categories and states, or key phrases. Using our advanced search option, discovering the most up-to-date Pasadena Texas Non- Homestead Affidavit and Designation of Homestead is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a group of expert lawyers that regularly review the templates on our platform and revise them based on the most recent state and county demands.

If you already know about our system and have a registered account, all you need to get the Pasadena Texas Non- Homestead Affidavit and Designation of Homestead is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the form you require. Look at its information and use the Preview feature to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the needed file.

- Affirm your choice. Click the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Pasadena Texas Non- Homestead Affidavit and Designation of Homestead.

Every template you add to your account has no expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to receive an extra copy for editing or creating a hard copy, feel free to come back and export it again at any time.

Make use of the US Legal Forms extensive library to gain access to the Pasadena Texas Non- Homestead Affidavit and Designation of Homestead you were looking for and a large number of other professional and state-specific samples on a single website!