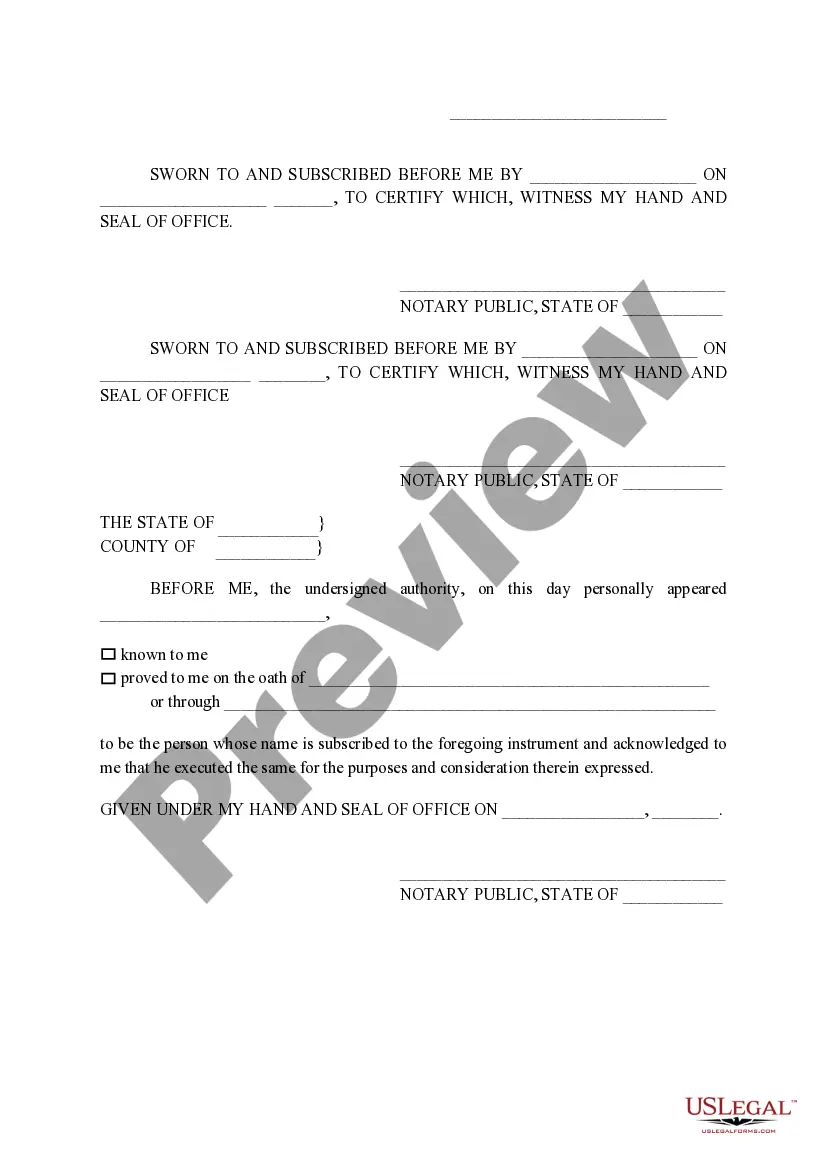

Round Rock Texas Non-Homestead Affidavit and Designation of Homestead is a legal document that holds significance in property ownership and taxation. It serves to protect homeowners' rights, determine property tax rates, and establish the primary residence in Round Rock, Texas. This affidavit is crucial for property owners who wish to claim homestead exemptions or clarify non-homestead properties. Non-Homestead Affidavit: The Non-Homestead Affidavit is filed by property owners who do not reside in the property as their primary residence or do not meet the specific homestead requirements. This affidavit helps in classifying the property as non-homestead and determining the appropriate taxation rates. Designation of Homestead: The Designation of Homestead allows property owners to claim their primary residence as a homestead. This designation comes with several benefits, including property tax exemptions, protection from certain creditors, and a cap on annual property tax increases. By filing the Designation of Homestead, homeowners can establish their property as their primary residence, ensuring the rights and privileges associated with being a homestead property owner. It is important to note that there may be variations or additional types of affidavits and designations related to non-homestead properties in Round Rock, Texas, depending on specific circumstances or legal requirements. For instance, there could be affidavits related to rental properties, second homes, or properties held by businesses. It is advisable to consult with legal experts or the appropriate local authorities for detailed information regarding these specific types of affidavits. By understanding and properly filing the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead, property owners can protect their rights, determine accurate property tax rates, and take advantage of the various benefits associated with homestead exemptions.

Designation Of Homestead Affidavit

Description

How to fill out Round Rock Texas Non- Homestead Affidavit And Designation Of Homestead?

If you are searching for a relevant form, it’s impossible to choose a more convenient service than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find thousands of form samples for business and individual purposes by types and regions, or key phrases. Using our advanced search function, getting the most recent Round Rock Texas Non- Homestead Affidavit and Designation of Homestead is as easy as 1-2-3. In addition, the relevance of each file is confirmed by a team of skilled attorneys that regularly check the templates on our website and update them according to the most recent state and county requirements.

If you already know about our system and have an account, all you need to get the Round Rock Texas Non- Homestead Affidavit and Designation of Homestead is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you want. Read its explanation and make use of the Preview option to check its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to get the proper record.

- Affirm your selection. Select the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to finish the registration procedure.

- Get the template. Select the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Round Rock Texas Non- Homestead Affidavit and Designation of Homestead.

Every template you add to your user profile has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to have an extra version for enhancing or printing, feel free to come back and export it again whenever you want.

Make use of the US Legal Forms extensive collection to gain access to the Round Rock Texas Non- Homestead Affidavit and Designation of Homestead you were seeking and thousands of other professional and state-specific templates in one place!