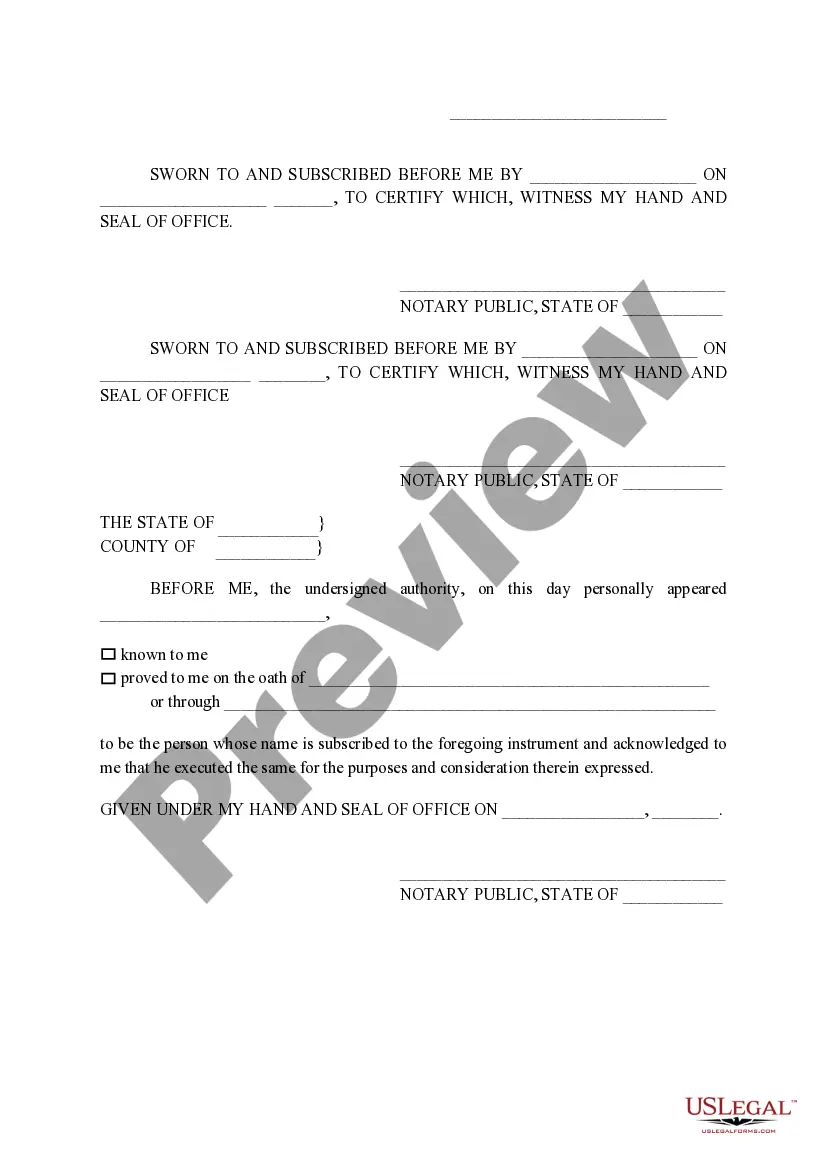

The Tarrant Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and exemptions within Tarrant County, Texas. These documents are significant for individuals seeking to declare their property as a homestead, which offers various tax benefits and protections. The Non-Homestead Affidavit is specifically used to declare that a property is not being utilized as a primary residence or homestead. It is typically filed to exempt the property from certain restrictions or regulations that may apply to homestead properties, such as limitations on creditor actions or property taxes. On the other hand, the Designation of Homestead document is utilized when property owners wish to establish their property as a homestead, making it eligible for numerous advantages. By designating a property as a homestead, owners can benefit from tax exemptions, protection from forced sales due to creditor debts, and potential reductions in property taxes. Within the Tarrant County area, there aren't generally different types of Non-Homestead Affidavit or Designation of Homestead documents. However, it is important to note that these documents can vary in content or wording based on the specific requirements and regulations of the county or state where they are being filed. Keywords: Tarrant Texas, Non-Homestead Affidavit, Designation of Homestead, property ownership, exemptions, homestead declaration, tax benefits, property protections, primary residence, creditor actions, property taxes, tax exemptions, forced sales, Tarrant County.

Tarrant Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Tarrant Texas Non- Homestead Affidavit And Designation Of Homestead?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Tarrant Texas Non- Homestead Affidavit and Designation of Homestead or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Tarrant Texas Non- Homestead Affidavit and Designation of Homestead complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Tarrant Texas Non- Homestead Affidavit and Designation of Homestead is suitable for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!