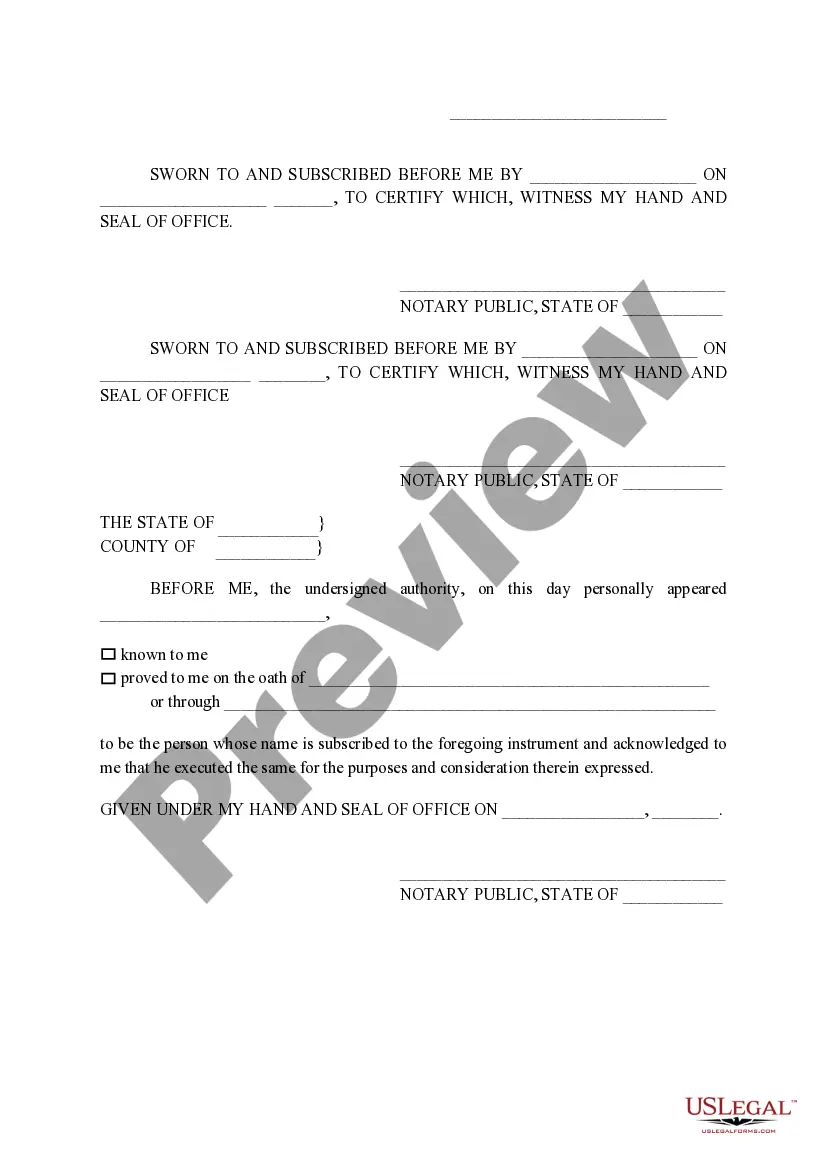

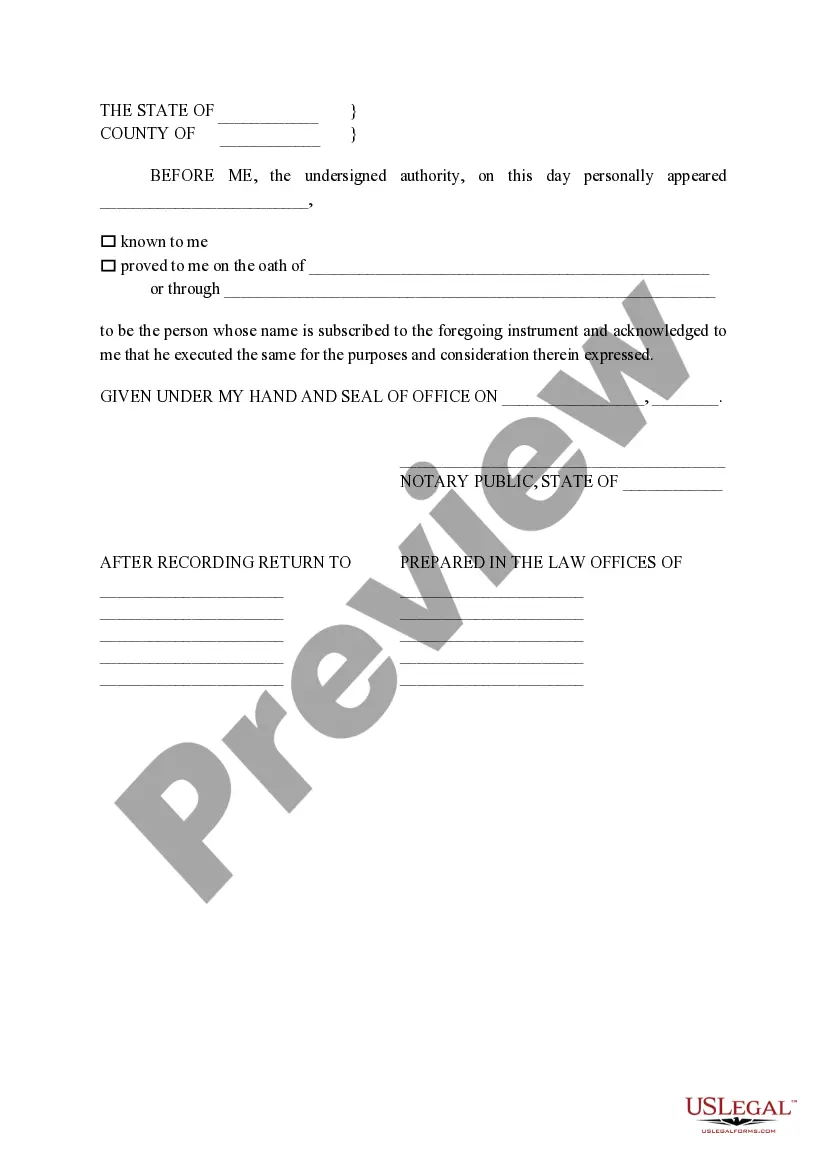

Travis Texas Non-Homestead Affidavit and Designation of Homestead: The Travis Texas Non-Homestead Affidavit and Designation of Homestead are legal documents related to property ownership and taxation in Travis County, Texas. These documents serve different purposes and are crucial for homeowners and investors in the area. Let's dive into each one individually: 1. Travis Texas Non-Homestead Affidavit: The Travis Texas Non-Homestead Affidavit is a legal declaration required for properties that do not qualify for a homestead exemption. A homestead exemption provides tax relief to homeowners by reducing the taxable value of their primary residence. However, properties that are not used as a primary residence, such as rental properties or vacation homes, are not eligible for this exemption. By filing the Non-Homestead Affidavit, property owners confirm that the property is not their primary residence and should not receive any homestead exemption benefits. This affidavit helps ensure accurate property tax assessments by the county and prevents individuals from claiming multiple exemptions on different properties. 2. Designation of Homestead: On the other hand, the Designation of Homestead is a separate document used to claim a homestead exemption on the owner's primary residence. Homeowners in Travis County can apply for this exemption to reduce the taxable value of their residential properties, ultimately lowering their annual property tax bill. The Designation of Homestead requires property owners to verify their eligibility, provide proof of residency, and declare that the property meets the necessary criteria to qualify as a homestead. Common requirements include using the property as the owner's primary residence and being filed by the applicable deadline, typically on or before January 1st of the tax year. This exemption is available to both existing homeowners and those purchasing a new primary residence within Travis County. In summary, while the Travis Texas Non-Homestead Affidavit acknowledges that a property does not qualify for a homestead exemption, the Designation of Homestead applies to primary residences that meet specific criteria and allows homeowners to benefit from reduced property taxes. Different Types of Travis Texas Non-Homestead Affidavit and Designation of Homestead: Although there aren't different types of Non-Homestead Affidavit and Designation of Homestead based on their legal function, these documents may vary based on specific situations. Some scenarios where different versions may exist include: 1. Non-Homestead Affidavit for Rental Properties: This version would be applicable when the property is exclusively used for rental purposes and not as the owner's primary residence. 2. Designation of Homestead for New Homeowners: This version is for individuals who have recently purchased a property within Travis County and are applying for the homestead exemption for the first time. 3. Designation of Homestead for Existing Homeowners: This version is for homeowners who have been residing in Travis County and have previously claimed the homestead exemption, but need to renew or amend their existing designation. Ultimately, it is important to consult with legal professionals or the Travis County Appraisal District to ensure accurate completion and submission of the Non-Homestead Affidavit and Designation of Homestead, as requirements and processes may vary over time.

Travis Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Travis Texas Non- Homestead Affidavit And Designation Of Homestead?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal services that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Travis Texas Non- Homestead Affidavit and Designation of Homestead or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Travis Texas Non- Homestead Affidavit and Designation of Homestead adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Travis Texas Non- Homestead Affidavit and Designation of Homestead is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!