The Waco Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and taxation in Waco, Texas. These documents are crucial for homeowners and property owners in the city. The Waco Texas Non-Homestead Affidavit is filed by individuals or entities claiming property that does not qualify as their primary residence for tax purposes. It is necessary to declare properties as non-homestead to ensure accurate property tax assessments. This affidavit is used to specify the non-homestead property, its location, and the reasons why it does not qualify for a homestead exemption. On the other hand, the Designation of Homestead is aimed at declaring a property as a homestead, which may entitle the property owner to certain protections, exemptions, and benefits under Texas law. By designating a property as a homestead, homeowners can potentially avail of property tax reductions, creditor protections, and other advantages. This designation is particularly important for those who reside in Waco as it impacts their property tax rates and liability. There are no different types of Waco Texas Non-Homestead Affidavit and Designation of Homestead, as they are standard documents used in property ownership and taxation matters in the city. However, it is crucial to note that these affidavits and designations can vary in format and content, depending on the specific requirements set by the local authorities. To complete these documents accurately, property owners in Waco should consult with a legal professional or the local tax assessor's office. They can provide guidance on the specific information needed and ensure compliance with all relevant laws and regulations. In conclusion, the Waco Texas Non-Homestead Affidavit and Designation of Homestead are important legal documents that property owners in Waco, Texas, must understand and complete accordingly. These documents play a crucial role in property taxation and protection, ensuring accurate assessments and potential benefits to eligible homeowners.

Waco Texas Non- Homestead Affidavit and Designation of Homestead

Category:

State:

Texas

City:

Waco

Control #:

TX-LR042T

Format:

Word;

Rich Text

Instant download

Description

This affidavit is used to notify a change in location of legal Homestead Property.

The Waco Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that pertain to property ownership and taxation in Waco, Texas. These documents are crucial for homeowners and property owners in the city. The Waco Texas Non-Homestead Affidavit is filed by individuals or entities claiming property that does not qualify as their primary residence for tax purposes. It is necessary to declare properties as non-homestead to ensure accurate property tax assessments. This affidavit is used to specify the non-homestead property, its location, and the reasons why it does not qualify for a homestead exemption. On the other hand, the Designation of Homestead is aimed at declaring a property as a homestead, which may entitle the property owner to certain protections, exemptions, and benefits under Texas law. By designating a property as a homestead, homeowners can potentially avail of property tax reductions, creditor protections, and other advantages. This designation is particularly important for those who reside in Waco as it impacts their property tax rates and liability. There are no different types of Waco Texas Non-Homestead Affidavit and Designation of Homestead, as they are standard documents used in property ownership and taxation matters in the city. However, it is crucial to note that these affidavits and designations can vary in format and content, depending on the specific requirements set by the local authorities. To complete these documents accurately, property owners in Waco should consult with a legal professional or the local tax assessor's office. They can provide guidance on the specific information needed and ensure compliance with all relevant laws and regulations. In conclusion, the Waco Texas Non-Homestead Affidavit and Designation of Homestead are important legal documents that property owners in Waco, Texas, must understand and complete accordingly. These documents play a crucial role in property taxation and protection, ensuring accurate assessments and potential benefits to eligible homeowners.

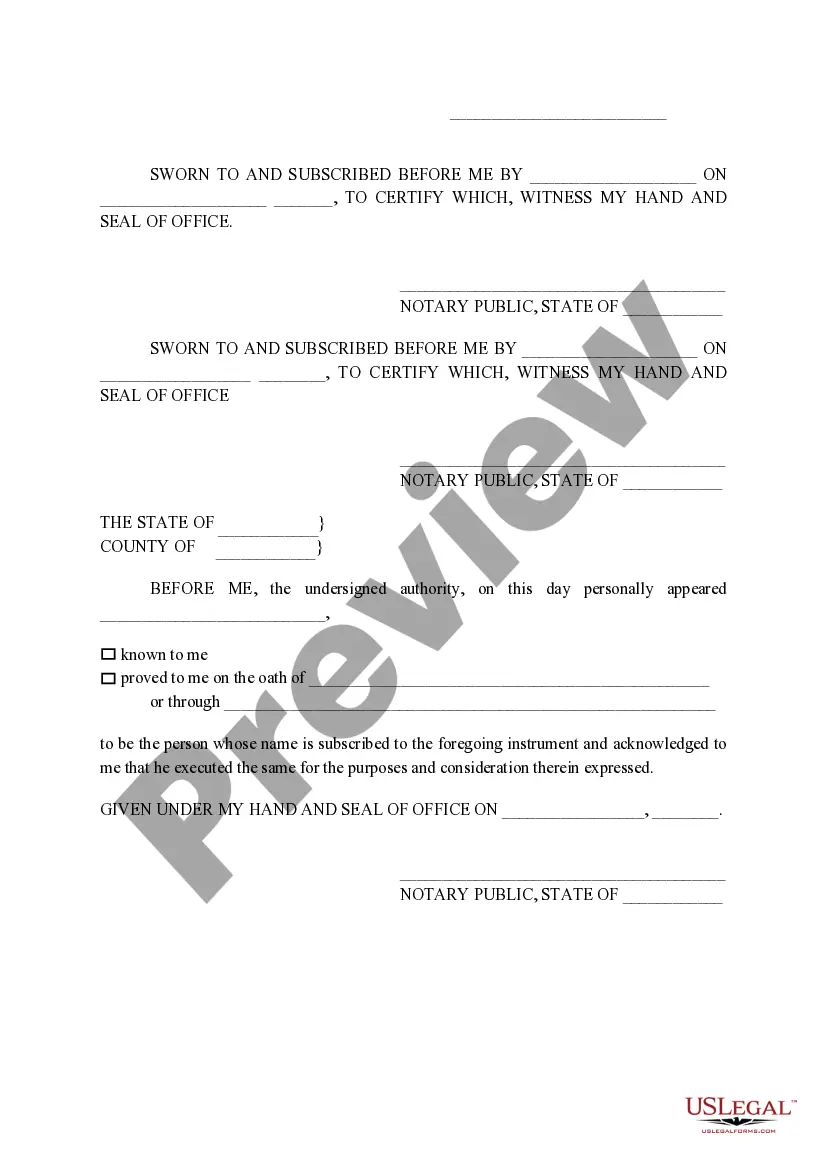

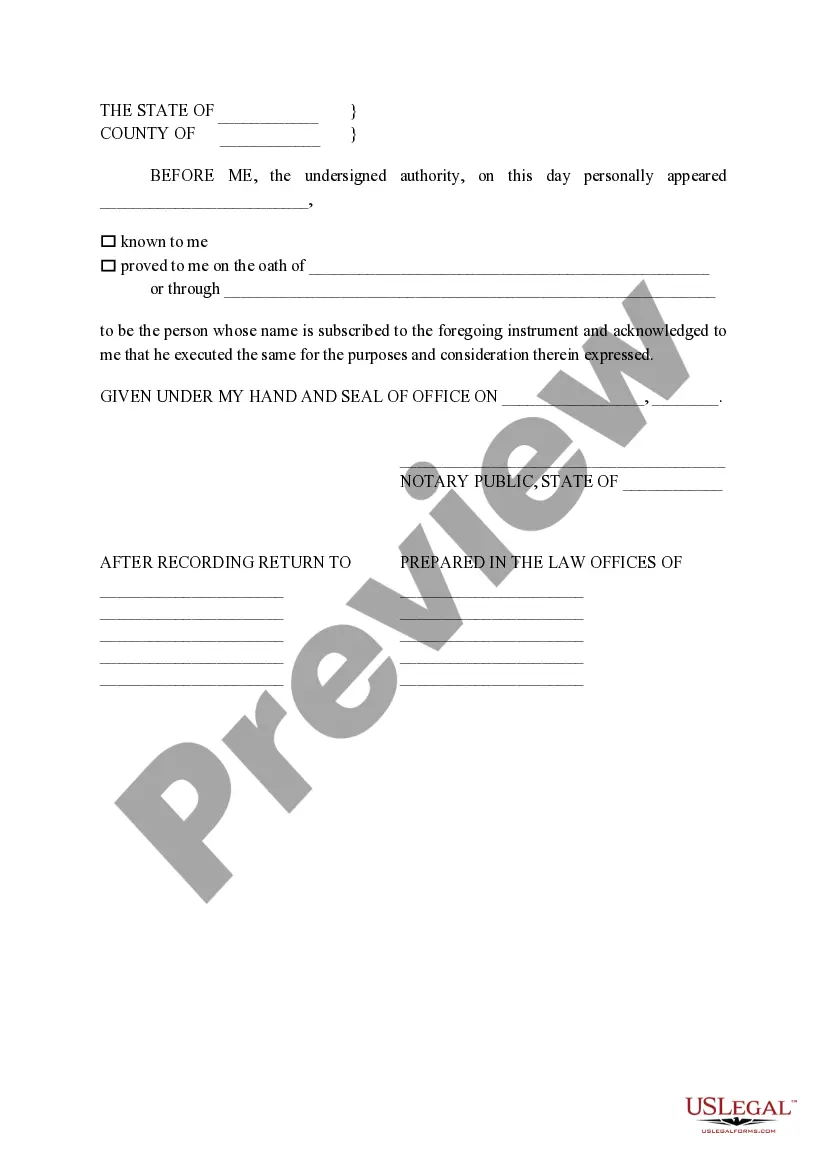

Free preview

How to fill out Waco Texas Non- Homestead Affidavit And Designation Of Homestead?

If you’ve already used our service before, log in to your account and save the Waco Texas Non- Homestead Affidavit and Designation of Homestead on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Waco Texas Non- Homestead Affidavit and Designation of Homestead. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!