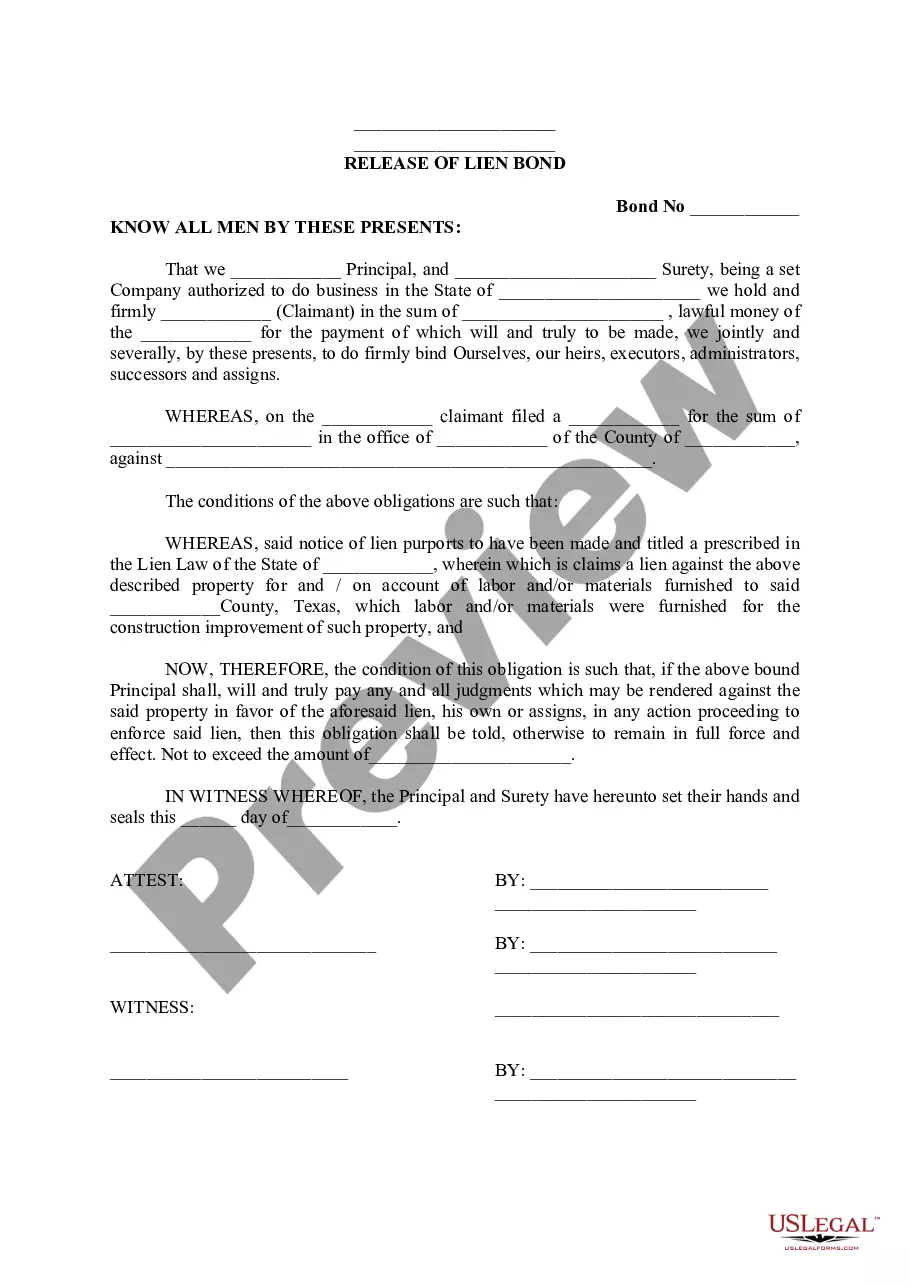

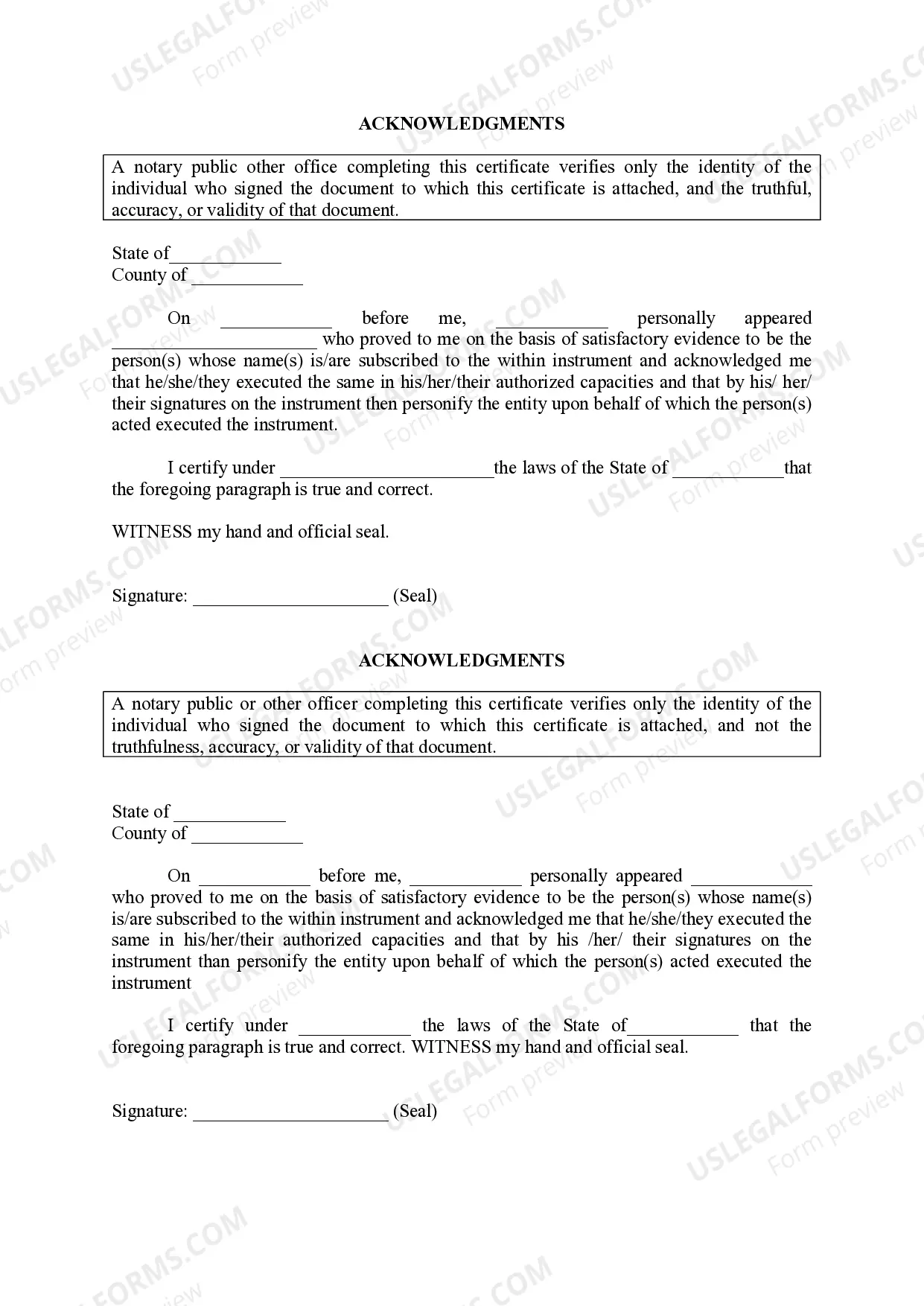

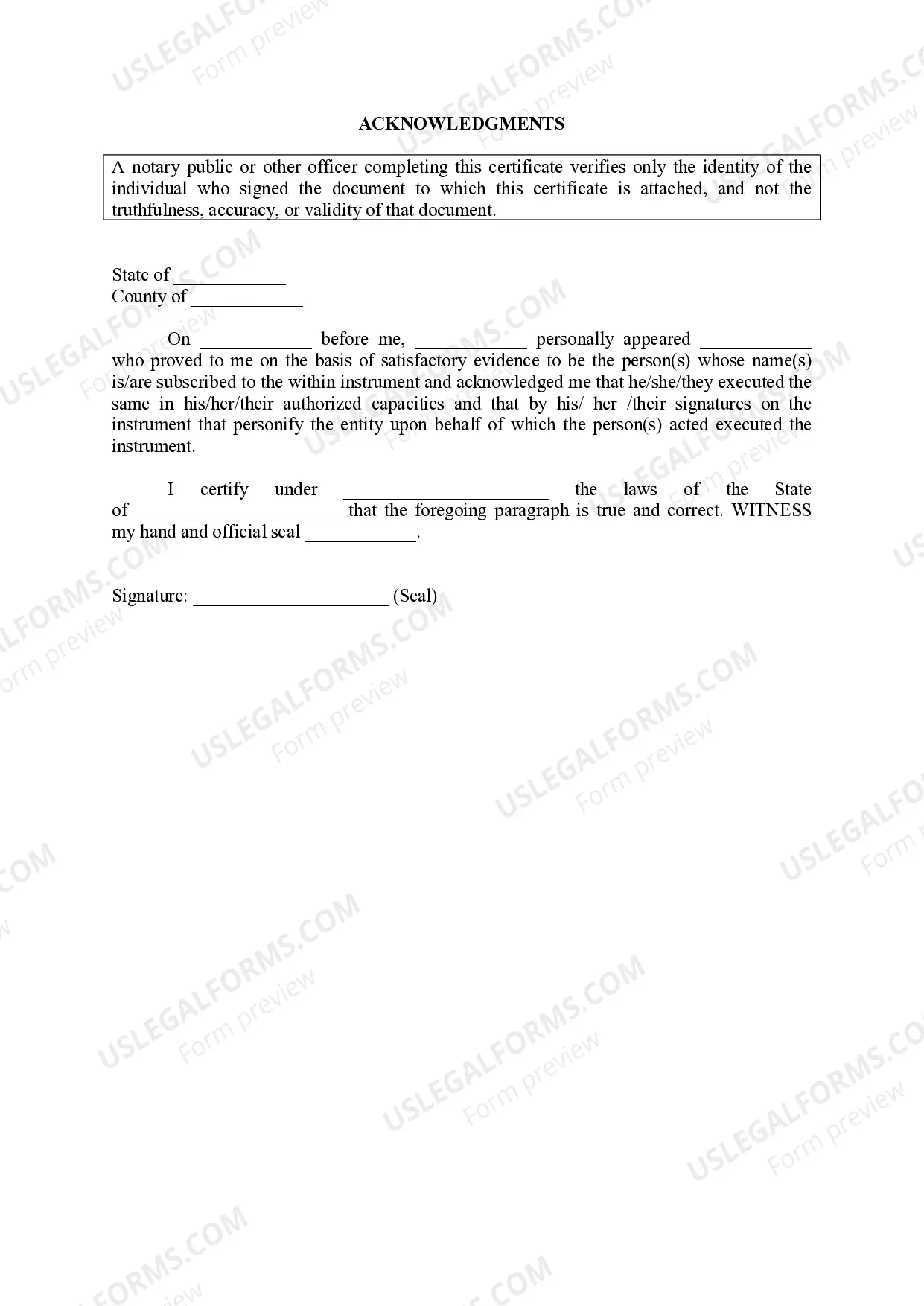

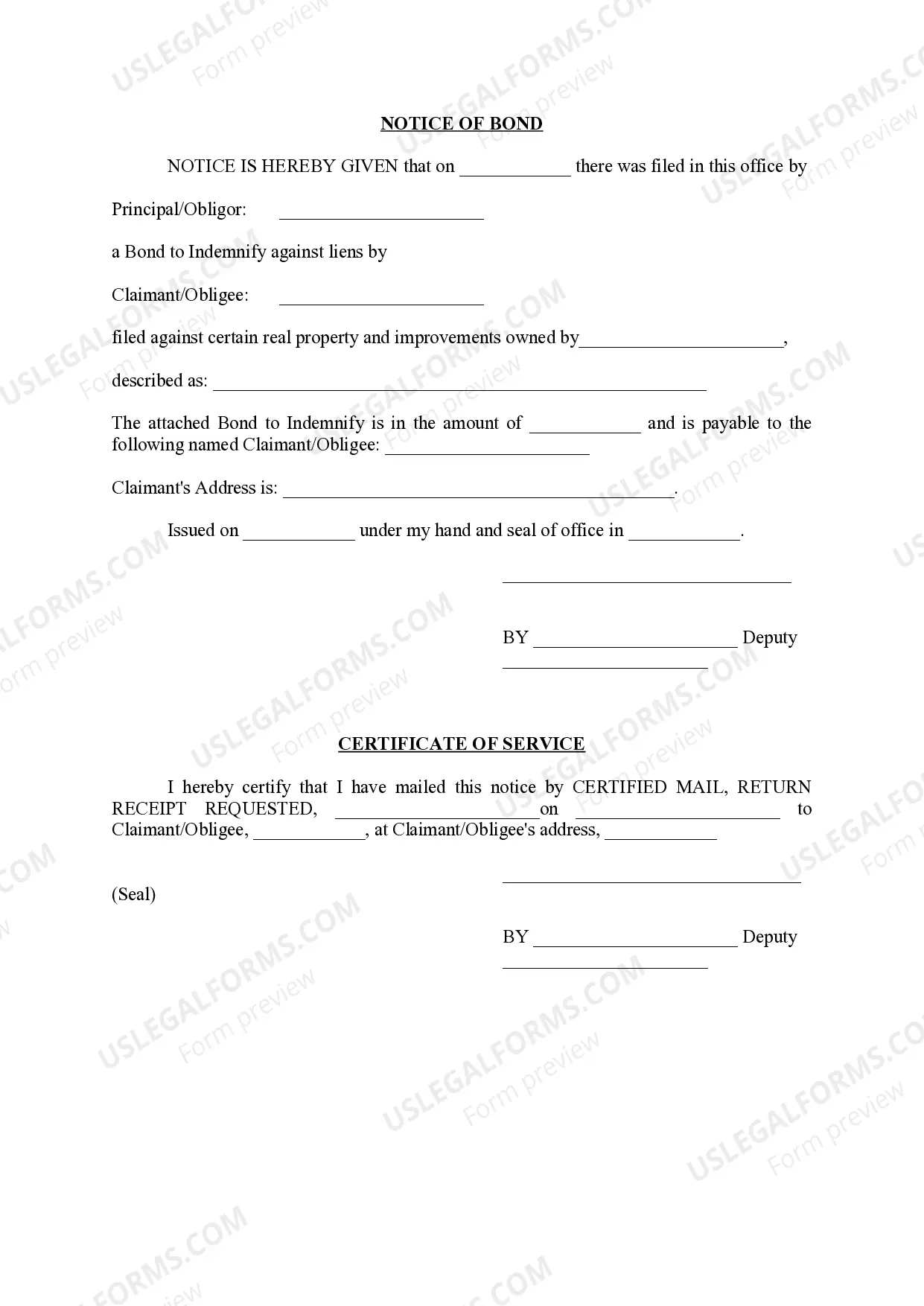

The Harris Texas Release of Lien Bond serves as a crucial legal instrument that ensures the release of a lien on a property in Harris County, Texas. This bond is designed to safeguard the rights and interests of property owners by providing assurance to potential purchasers and lenders that any existing liens on the property have been resolved or will be cleared. Liens are often placed on properties as a means of securing debt payments, typically by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement projects. The Release of Lien Bond acts as a financial guarantee that the lien holder will release the lien and relinquish any claims on the property once the bond is issued. This bond serves as a viable option for property owners who need to sell or refinance their property but are hindered by an outstanding lien. By obtaining a Release of Lien Bond, property owners can effectively proceed with their real estate transactions without the complications posed by an unresolved lien. Different types of Harris Texas Release of Lien Bonds may include: 1. Mechanics Lien Release Bond: This bond is commonly utilized in the construction industry when a contractor, subcontractor, or supplier wishes to release a mechanics lien filed against a property. By obtaining this bond, the lien holder assures that they will release the lien upon receiving the agreed-upon payment or entering into an alternative settlement. 2. Property Tax Lien Release Bond: In cases where a property owner has failed to pay their property taxes, the county or municipality may place a tax lien on the property. A Property Tax Lien Release Bond can be acquired to remove the lien by providing a financial guarantee that the outstanding taxes will be paid. 3. Judgment Lien Release Bond: If a property has a judgment lien against it resulting from a court judgment, a property owner can obtain a Judgment Lien Release Bond to release the lien. This bond guarantees payment of the judgment amount and ensures the lien holder is satisfied. Overall, the Harris Texas Release of Lien Bond acts as a crucial tool for property owners seeking to clear liens on their properties, enabling them to successfully sell, refinance, or conduct transactions without the encumbrance of an unresolved lien. By obtaining the appropriate type of bond, property owners can effectively resolve outstanding liens and protect their property rights.

Harris Texas Release of Lien Bond

Category:

State:

Texas

County:

Harris

Control #:

TX-LR046T

Format:

Word;

Rich Text

Instant download

Description

Contractor places Lien on Claimant for labor and/or materials were used for the construction improvement of Claimant's property.

The Harris Texas Release of Lien Bond serves as a crucial legal instrument that ensures the release of a lien on a property in Harris County, Texas. This bond is designed to safeguard the rights and interests of property owners by providing assurance to potential purchasers and lenders that any existing liens on the property have been resolved or will be cleared. Liens are often placed on properties as a means of securing debt payments, typically by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement projects. The Release of Lien Bond acts as a financial guarantee that the lien holder will release the lien and relinquish any claims on the property once the bond is issued. This bond serves as a viable option for property owners who need to sell or refinance their property but are hindered by an outstanding lien. By obtaining a Release of Lien Bond, property owners can effectively proceed with their real estate transactions without the complications posed by an unresolved lien. Different types of Harris Texas Release of Lien Bonds may include: 1. Mechanics Lien Release Bond: This bond is commonly utilized in the construction industry when a contractor, subcontractor, or supplier wishes to release a mechanics lien filed against a property. By obtaining this bond, the lien holder assures that they will release the lien upon receiving the agreed-upon payment or entering into an alternative settlement. 2. Property Tax Lien Release Bond: In cases where a property owner has failed to pay their property taxes, the county or municipality may place a tax lien on the property. A Property Tax Lien Release Bond can be acquired to remove the lien by providing a financial guarantee that the outstanding taxes will be paid. 3. Judgment Lien Release Bond: If a property has a judgment lien against it resulting from a court judgment, a property owner can obtain a Judgment Lien Release Bond to release the lien. This bond guarantees payment of the judgment amount and ensures the lien holder is satisfied. Overall, the Harris Texas Release of Lien Bond acts as a crucial tool for property owners seeking to clear liens on their properties, enabling them to successfully sell, refinance, or conduct transactions without the encumbrance of an unresolved lien. By obtaining the appropriate type of bond, property owners can effectively resolve outstanding liens and protect their property rights.

Free preview

How to fill out Harris Texas Release Of Lien Bond?

If you’ve already used our service before, log in to your account and save the Harris Texas Release of Lien Bond on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Harris Texas Release of Lien Bond. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!