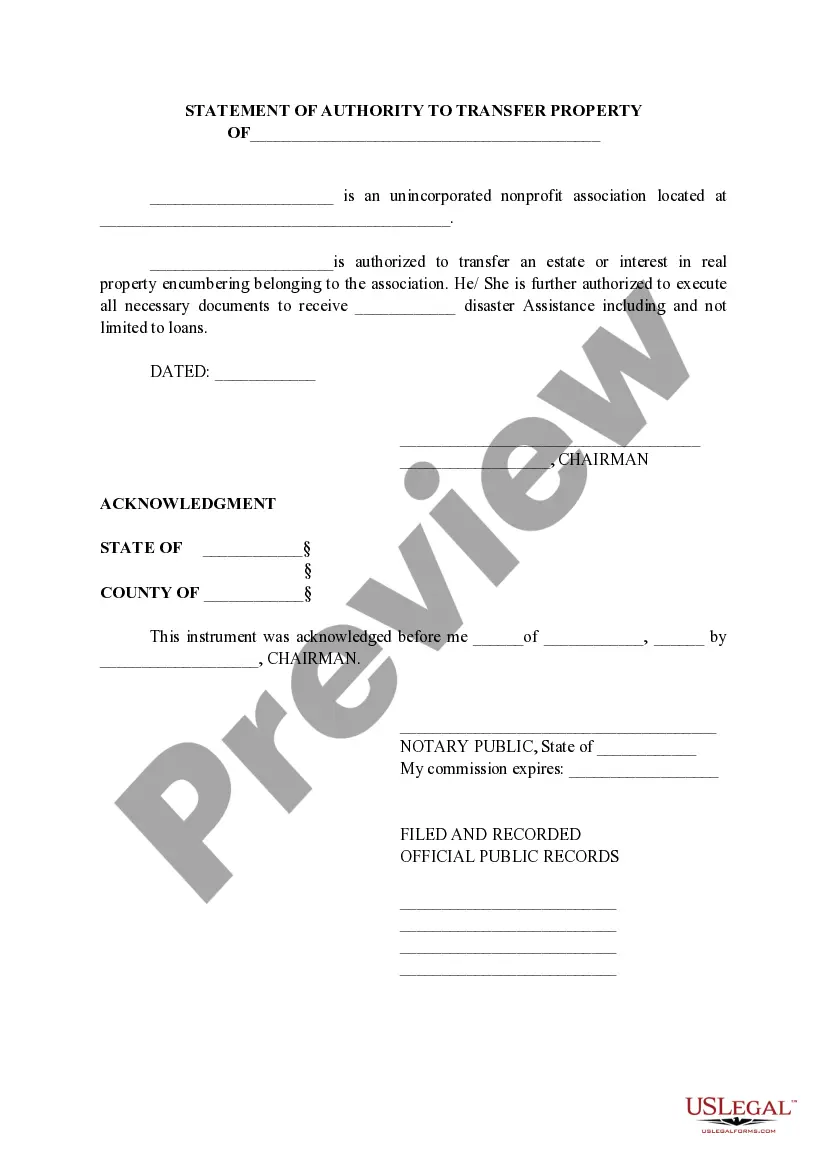

The Tarrant Texas Statement of Authority to Transfer Property is a legal document that grants individuals or entities the power to transfer ownership or sell property in Tarrant County, Texas. This significant document outlines the specific rights and responsibilities of the authorized party in relation to the property transfer process. It serves as proof of the authority bestowed upon the designated individual or entity, ensuring a smooth and legally compliant transfer of ownership. The Tarrant Texas Statement of Authority to Transfer Property is a vital component in real estate transactions, serving as a formal declaration of the transferor's intention to grant the authority to the transferee. This document confirms the existence of a lawful agreement between the parties involved and provides clarity on the permitted actions and limitations during the transfer process. There may be different types of Tarrant Texas Statement of Authority to Transfer Property, depending on the nature of the transfer or the specific requirements governing the property in question. Some common variations of this document include: 1. General Authority to Transfer Property: This type of statement provides broad authorization to transfer property, covering all necessary actions required for a legal transfer. 2. Limited Authority to Transfer Property: This statement grants authority for specific purposes or within specific limitations, such as transferring a portion of the property or transferring ownership on behalf of a particular party. 3. Authority to Transfer Property in Trust: This type of statement pertains to property transfers made in the context of a trust. It outlines the trustee's authority to act on behalf of a beneficiary or beneficiaries and ensures the proper transfer of property ownership within the trust. 4. Authority to Transfer Property in a Business Transaction: This statement is commonly used when transferring property as part of a business transaction, such as a merger or acquisition. It establishes the authority of the involved parties to carry out the necessary property transfer actions related to the transaction. The Tarrant Texas Statement of Authority to Transfer Property is a crucial legal document that provides a clear framework for property transfers in Tarrant County, Texas. It ensures that all parties involved have a comprehensive understanding of the authorized actions, rights, and responsibilities throughout the transfer process.

The Tarrant Texas Statement of Authority to Transfer Property is a legal document that grants individuals or entities the power to transfer ownership or sell property in Tarrant County, Texas. This significant document outlines the specific rights and responsibilities of the authorized party in relation to the property transfer process. It serves as proof of the authority bestowed upon the designated individual or entity, ensuring a smooth and legally compliant transfer of ownership. The Tarrant Texas Statement of Authority to Transfer Property is a vital component in real estate transactions, serving as a formal declaration of the transferor's intention to grant the authority to the transferee. This document confirms the existence of a lawful agreement between the parties involved and provides clarity on the permitted actions and limitations during the transfer process. There may be different types of Tarrant Texas Statement of Authority to Transfer Property, depending on the nature of the transfer or the specific requirements governing the property in question. Some common variations of this document include: 1. General Authority to Transfer Property: This type of statement provides broad authorization to transfer property, covering all necessary actions required for a legal transfer. 2. Limited Authority to Transfer Property: This statement grants authority for specific purposes or within specific limitations, such as transferring a portion of the property or transferring ownership on behalf of a particular party. 3. Authority to Transfer Property in Trust: This type of statement pertains to property transfers made in the context of a trust. It outlines the trustee's authority to act on behalf of a beneficiary or beneficiaries and ensures the proper transfer of property ownership within the trust. 4. Authority to Transfer Property in a Business Transaction: This statement is commonly used when transferring property as part of a business transaction, such as a merger or acquisition. It establishes the authority of the involved parties to carry out the necessary property transfer actions related to the transaction. The Tarrant Texas Statement of Authority to Transfer Property is a crucial legal document that provides a clear framework for property transfers in Tarrant County, Texas. It ensures that all parties involved have a comprehensive understanding of the authorized actions, rights, and responsibilities throughout the transfer process.