Are you interested in learning about Beaumont Texas Tax Lien Contracts? Look no further! In this detailed description, we will explore the ins and outs of Beaumont Texas Tax Lien Contracts, discussing their definition, purpose, and different types. So, let's dive right in! A Beaumont Texas Tax Lien Contract refers to a legal agreement between the government entity and a taxpayer (often a property owner) who has unpaid property taxes. In order to recover these unpaid taxes, the government issues tax liens on the property. These liens serve as a claim against the property, allowing the government to collect the owed taxes. A Tax Lien Contract acts as a tool to formalize the repayment process between the taxpayer and the government. The primary purpose of a Beaumont Texas Tax Lien Contract is to establish a mutually beneficial agreement that allows the taxpayer to clear their outstanding tax debt while providing the government with a method to recover the owed funds. These contracts often include details such as the amount owed, repayment terms, interest rates, and other applicable fees. Several types of Beaumont Texas Tax Lien Contracts may exist based on different circumstances and arrangements. Let's explore a few types: 1. Installment Agreement Tax Lien Contract: This type of contract allows taxpayers to repay their tax debts in monthly installments. The agreement typically includes a fixed payment schedule, which spans over a specific period, making it easier for the taxpayer to manage their obligations. 2. Lump Sum Payment Tax Lien Contract: Some taxpayers prefer to settle their unpaid taxes with a single payment rather than stretching it over time. A lump sum payment tax lien contract enables them to pay the overdue amount in full, eliminating any further interest or penalties. 3. Offer in Compromise Tax Lien Contract: In specific circumstances where taxpayers are unable to repay their entire tax debt due to financial hardship, an offer in compromise tax lien contract may be an option. This contract allows the taxpayer to negotiate a reduced payment amount, sometimes significantly lower than the original debt, to satisfy the tax lien. 4. Redemption Tax Lien Contract: When a property owner becomes delinquent on property taxes, a redemption tax lien contract comes into play. This contract provides an opportunity for the taxpayer to pay off the delinquent taxes, interest, penalties, and associated costs within a specified redemption period to regain full ownership of the property. Understanding the different types of Beaumont Texas Tax Lien Contracts helps taxpayers select the most suitable option depending on their financial situation and capabilities. In conclusion, Beaumont Texas Tax Lien Contracts serve as crucial instruments in resolving unpaid property tax issues between the government and taxpayers. By establishing repayment terms, these contracts enable taxpayers to clear their outstanding obligations while providing the government with a path towards recovering the owed funds. By familiarizing yourself with the different types of contracts available, you can better navigate the tax lien process and find the most suitable resolution for your situation in Beaumont, Texas.

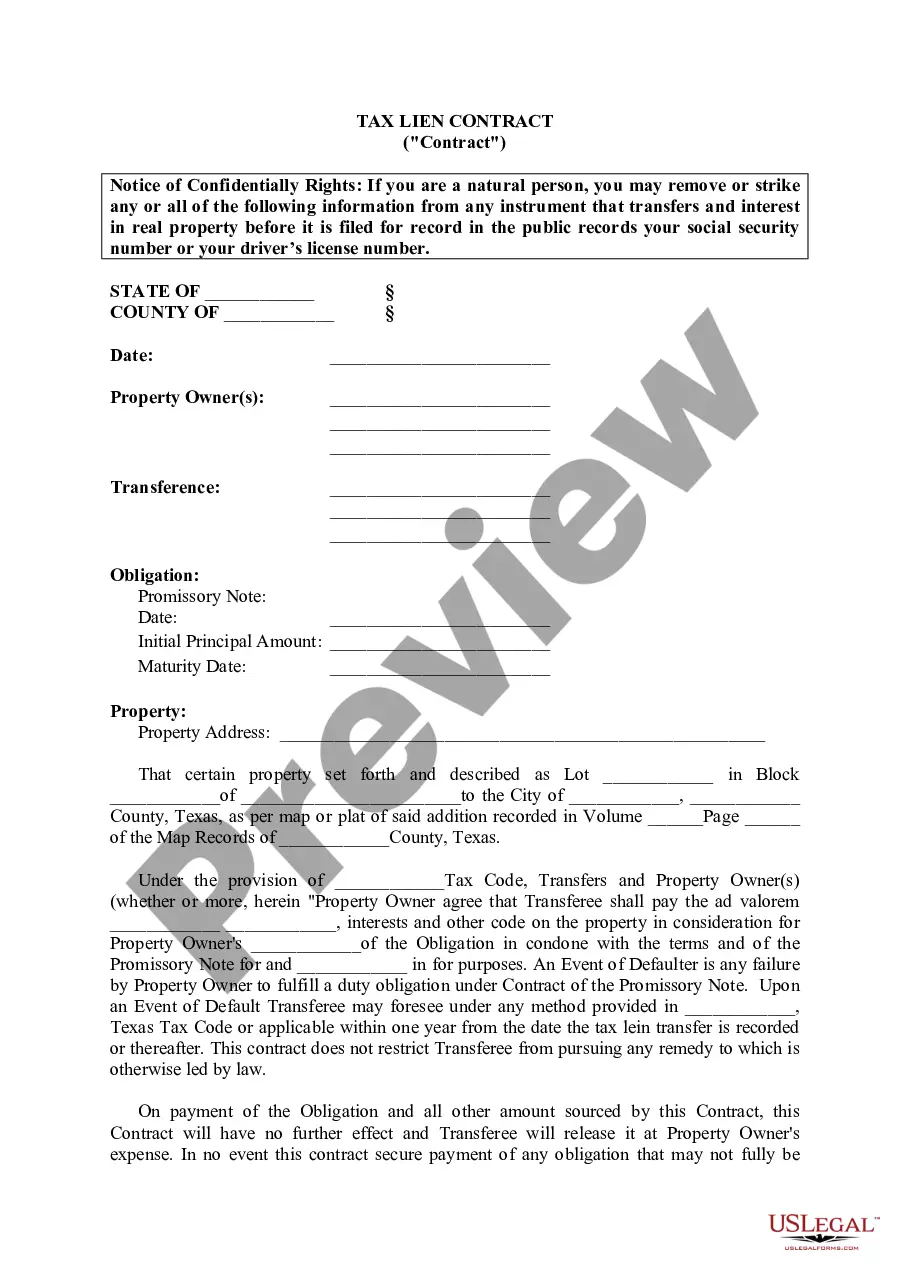

Beaumont Texas Tax Lien Contract

Description

How to fill out Beaumont Texas Tax Lien Contract?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Beaumont Texas Tax Lien Contract becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Beaumont Texas Tax Lien Contract takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Beaumont Texas Tax Lien Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!