Title: Understanding League City Texas Tax Lien Contracts and Their Types Introduction: A League City Texas tax lien contract refers to a legal agreement between the City and property owners that allows the City to recover unpaid property taxes by placing a lien on the property. Tax liens are crucial in facilitating the collection of delinquent taxes while ensuring that the City's revenue stream remains uninterrupted. In this article, we will explore the ins and outs of League City Texas tax lien contracts, including their types and relevance in property tax enforcement. 1. League City Texas Tax Lien Contract Definition: A League City Texas tax lien contract is an agreement that grants the City the authority to place a lien on a property when property taxes go unpaid. This allows the City to recover the owed taxes by auctioning off the tax lien to interested investors. The property owner is then responsible for repaying the investor within a specified redemption period, after which failure to do so may result in the foreclosure and sale of the property. 2. Types of League City Texas Tax Lien Contracts: a) Traditional Tax Lien Contracts: Under this type of contract, the City places a lien on the property and auctions it to investors. The investor, upon winning the auction, pays the delinquent taxes on behalf of the property owner. In return, the investor receives a tax lien certificate, which entitles them to collect the unpaid taxes plus interest from the property owner during the redemption period. b) Assignment Tax Lien Contracts: In this variation, the City assigns the tax liens directly to investors, eliminating the need for an auction process. The investor assumes the City's rights and responsibilities to collect the owed taxes and earn interest. This type provides a more streamlined process for investors and generates immediate revenue for the City. c) Hybrid Tax Lien Contracts: This type combines elements of both traditional and assignment tax lien contracts. The City assigns a portion of the tax liens to investors while auctioning off the remaining ones. It offers a balanced approach, providing investors the opportunity to purchase assigned liens while maintaining the competitive nature of traditional auctions. Relevance in Property Tax Enforcement: League City Texas tax lien contracts play a vital role in enforcing property tax payments. By utilizing tax liens, the City can incentivize property owners to fulfill their tax obligations promptly. The contracts ensure a consistent revenue flow for the City, which can be used for public services, infrastructure improvements, and community development projects. Additionally, tax lien contracts attract investors seeking a secure investment opportunity. Investors can earn substantial returns through the interest charged on tax liens. Moreover, the contracts promote economic growth by encouraging property owners to promptly settle their tax liabilities, thus bolstering the stability of the local economy. Conclusion: League City Texas tax lien contracts are instrumental in maintaining a consistent revenue stream for the City while ensuring property owners meet their tax obligations. By offering different types of tax lien contracts, the City provides flexibility and choice to both investors and property owners. These contracts contribute to the economic well-being of League City, making it a thriving community with improved public infrastructure and services.

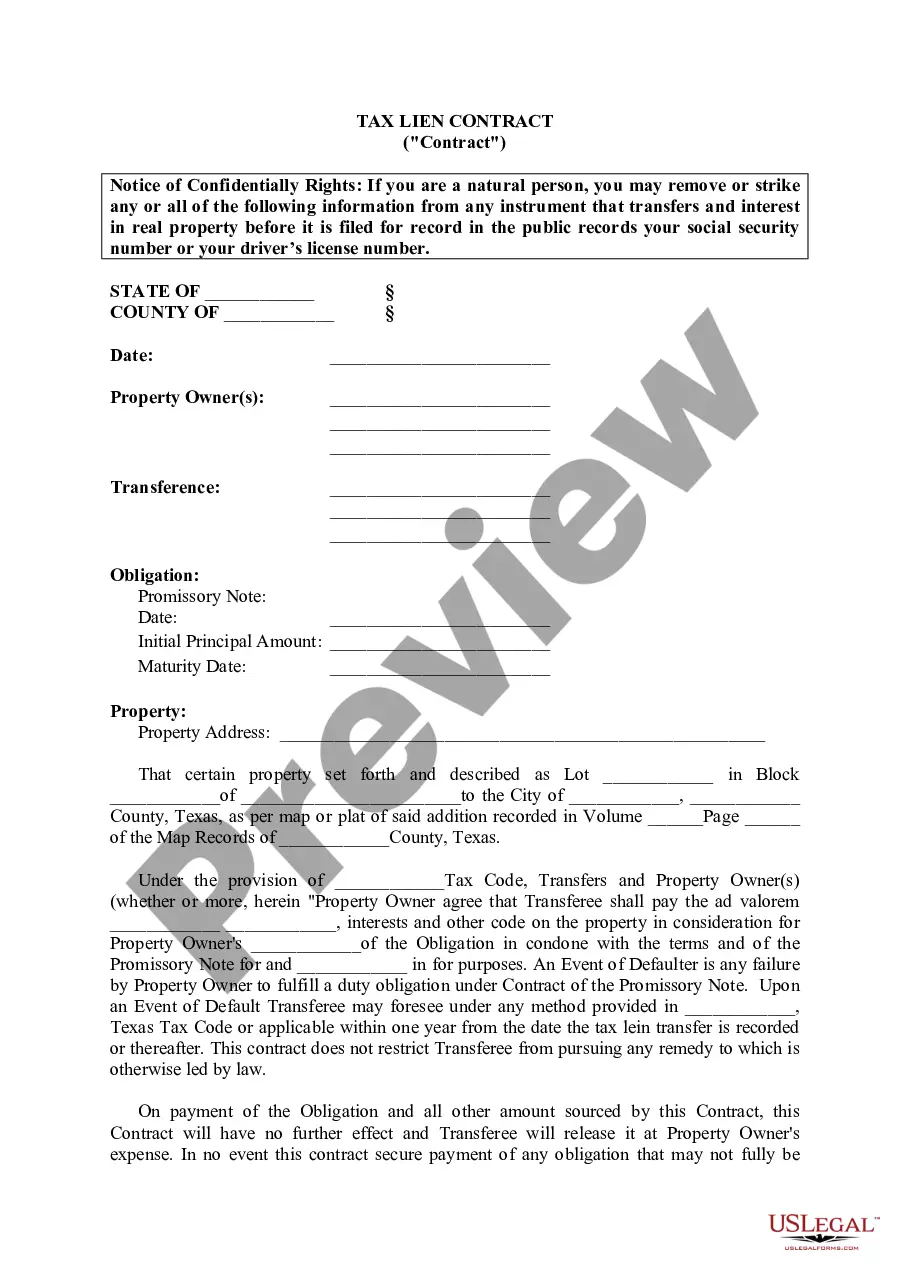

League City Texas Tax Lien Contract

Description

How to fill out League City Texas Tax Lien Contract?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal background to draft such papers from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the League City Texas Tax Lien Contract or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the League City Texas Tax Lien Contract in minutes employing our trusted platform. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are unfamiliar with our library, make sure to follow these steps prior to obtaining the League City Texas Tax Lien Contract:

- Ensure the form you have found is good for your location because the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if available) of scenarios the paper can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the League City Texas Tax Lien Contract once the payment is through.

You’re good to go! Now you can go on and print out the document or complete it online. In case you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.