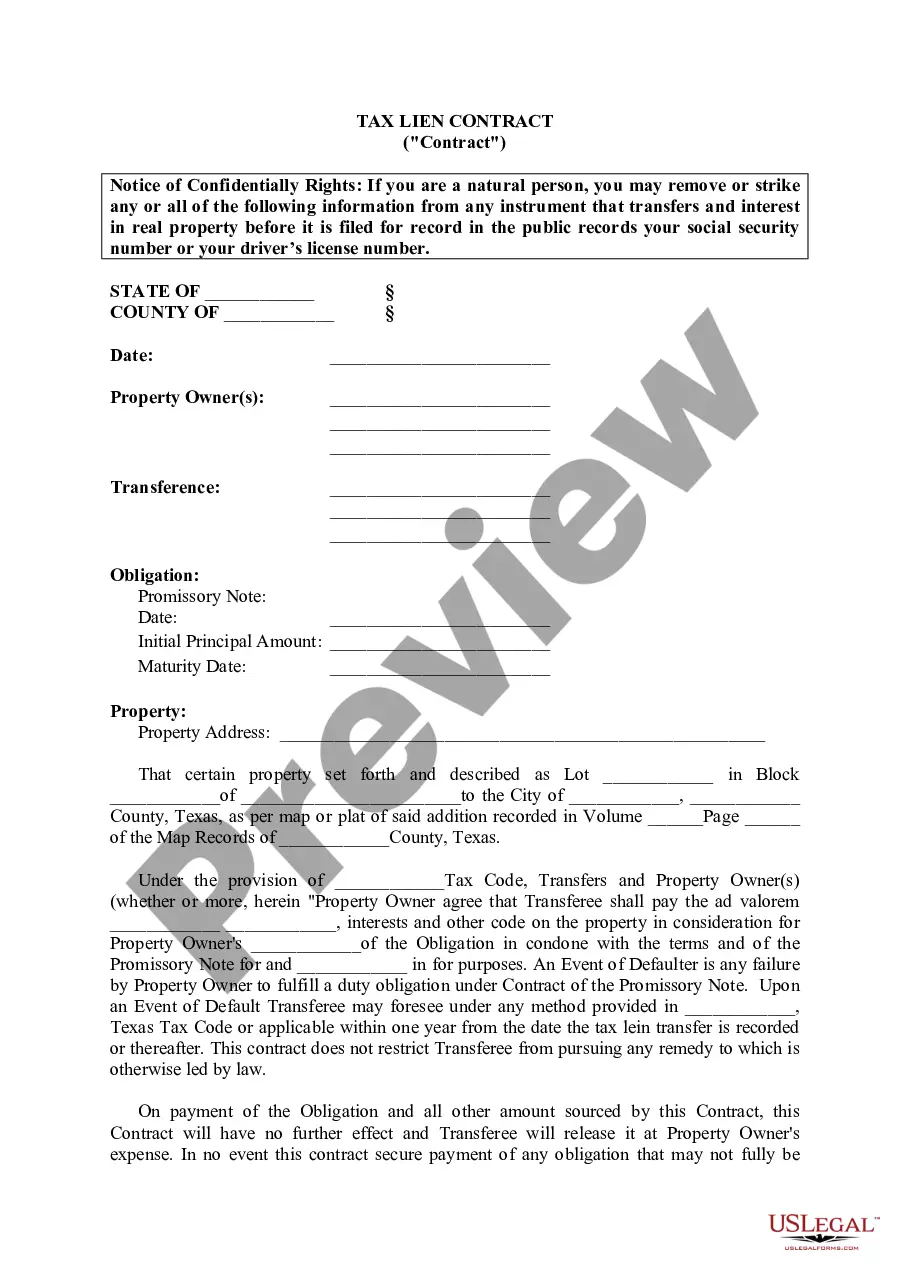

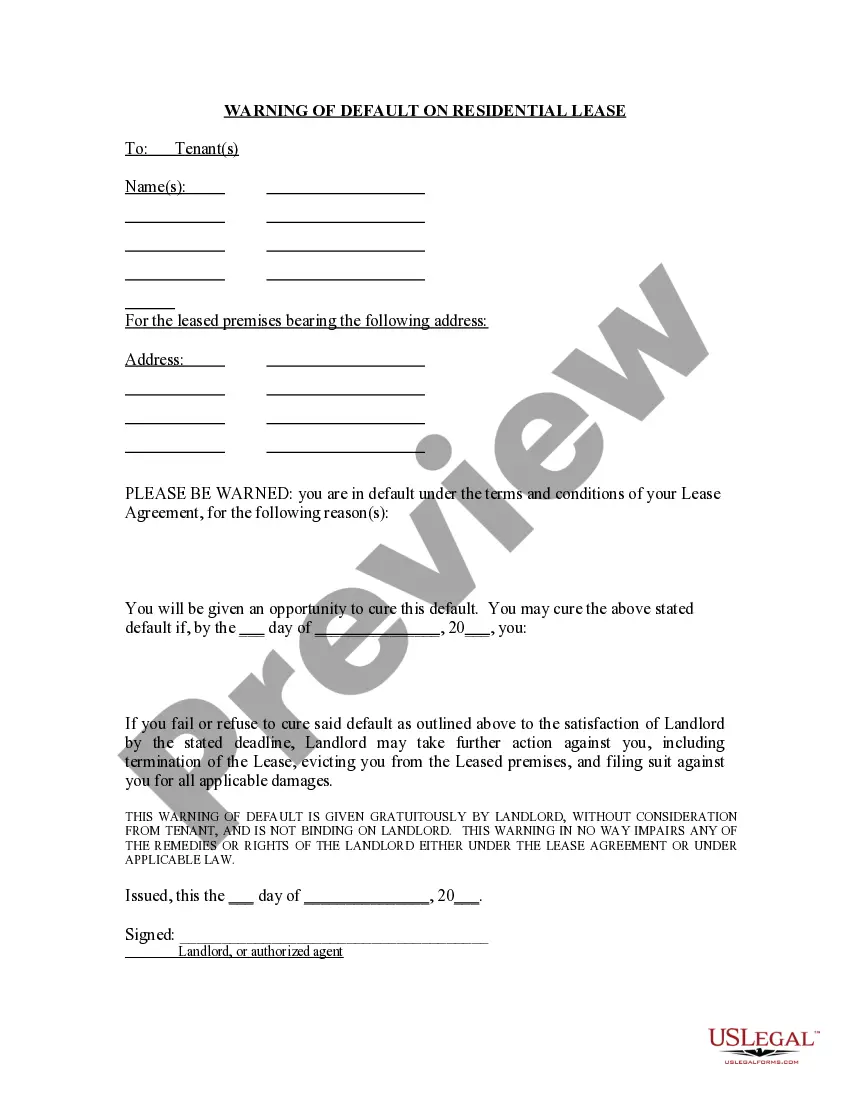

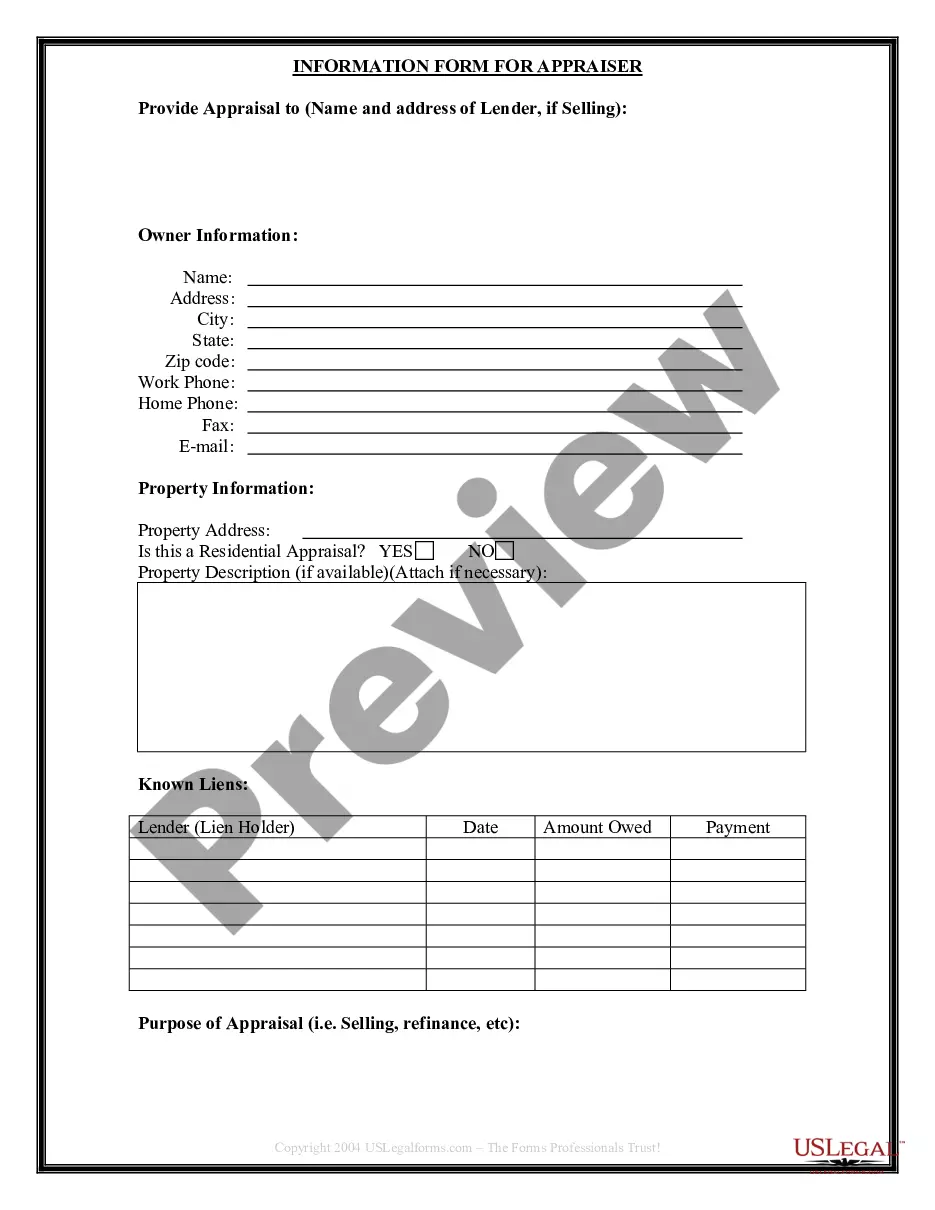

Lewisville, Texas Tax Lien Contract: Understanding Your Tax Obligations In Lewisville, Texas, tax lien contracts play a crucial role in ensuring the efficient collection of property taxes. These contracts are legal agreements between the local government and property owners who have become delinquent in paying their property taxes. By using tax lien contracts, the city can recover the owed taxes while still allowing property owners an opportunity to fulfill their obligations. A tax lien contract is initiated when a property owner fails to pay their property taxes within a specific timeframe. In this situation, the tax collector's office will issue a tax lien on the property. This lien serves as a legal claim on the property, enabling the government to collect the overdue taxes in the future. The tax lien contract outlines the terms and conditions for repayment of the delinquent taxes. It typically includes details such as the amount owed, any applicable interest rates, repayment schedules, and the consequences of non-compliance. The property owner must sign this contract, acknowledging their debt and agreeing to adhere to the repayment terms. There are several types of tax lien contracts in Lewisville, Texas, each serving a different purpose. These include: 1. General Tax Lien Contracts: These contracts are initiated when property owners fail to pay their annual property taxes. The government files a lien against the property, and the contract is set up to facilitate the repayment of the outstanding amount. 2. Special Assessment Liens: Special assessment liens are imposed when property owners fail to pay for specific services or improvements provided by the city. These can include expenses like street repairs, infrastructure maintenance, or the installation of utilities. 3. Property Improvement Lien Contracts: When property owners undertake certain improvements such as renovations or expansions, they may be subject to property improvement liens if they fail to pay for these improvements. These liens secure the payment to contractors or suppliers involved in the improvement project. It is important for property owners in Lewisville, Texas to abide by their tax obligations and pay their property taxes promptly. Failure to do so may result in tax lien contracts being initiated, which could have severe consequences. These consequences may include penalties, interest charges, or even the potential loss of ownership if the tax lien remains unpaid. If you find yourself facing a tax lien contract in Lewisville, Texas, it is advisable to seek professional assistance. Tax lawyers or property tax consultants can provide valuable guidance and help negotiate favorable terms for repayment. In conclusion, Lewisville, Texas tax lien contracts are legal agreements established to collect delinquent property taxes. They serve as a means for the city to recover owed taxes while allowing property owners an opportunity to fulfill their financial obligations. Different types of tax lien contracts include general tax liens, special assessment liens, and property improvement lien contracts. It is crucial for property owners to remain proactive in meeting their tax responsibilities to avoid the potential repercussions of tax liens.

Lewisville Texas Tax Lien Contract

Description

How to fill out Lewisville Texas Tax Lien Contract?

Do you need a reliable and inexpensive legal forms provider to buy the Lewisville Texas Tax Lien Contract? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Lewisville Texas Tax Lien Contract conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Lewisville Texas Tax Lien Contract in any provided format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal papers online once and for all.