McKinney, Texas is a vibrant city located in Collin County, known for its thriving economy and unparalleled quality of life. One of the important aspects of living in McKinney is understanding the nature of tax liens and the contracts associated with them. McKinney Texas Tax Lien Contracts are legal agreements established between the government and property owners to address unpaid taxes. These contracts help ensure the collection of outstanding property tax debts while protecting the rights of property owners. In McKinney, there are primarily two types of tax lien contracts: tax lien sales and tax lien certificates. 1. Tax Lien Sales: When property owners fail to pay their property taxes, the local government may conduct tax lien sales to recover the outstanding debts. These sales involve auctioning off the tax liens to interested buyers. The highest bidder essentially purchases the lien, which represents the right to collect the unpaid property taxes. The property owner, however, still has a specified period (redemption period) to pay off the taxes, plus any interest and fees, to avoid potential foreclosure or loss of their property. 2. Tax Lien Certificates: Another form of tax lien contract in McKinney is tax lien certificates. In this case, instead of conducting auctions, the government issues certificates to investors. These certificates represent the right to collect the unpaid property taxes along with accrued interest. Investors are then entitled to receive the delinquent tax amount along with any additional interest once the property owner fulfills their payment obligation within the redemption period. Therefore, investors have the potential to earn interest on the tax debt owed by property owners. Both tax lien sales and tax lien certificates offer opportunities for investors to earn a return on their investment by collecting the outstanding property taxes. However, it's essential to note that these contracts are legally binding and must be thoroughly understood before engaging in any tax lien investment in McKinney, Texas. Understanding the intricacies of McKinney Texas Tax Lien Contracts is vital for property owners and investors alike. It's important to consult with legal and financial professionals who specialize in tax lien investments to ensure compliance with regulations and make informed decisions. By being aware of the different types of tax lien contracts available, property owners can navigate the complexities of unpaid property taxes, while investors can explore potential investment opportunities in the McKinney, Texas area.

McKinney Texas Tax Lien Contract

Category:

State:

Texas

City:

McKinney

Control #:

TX-LR051T

Format:

Word;

Rich Text

Instant download

Description

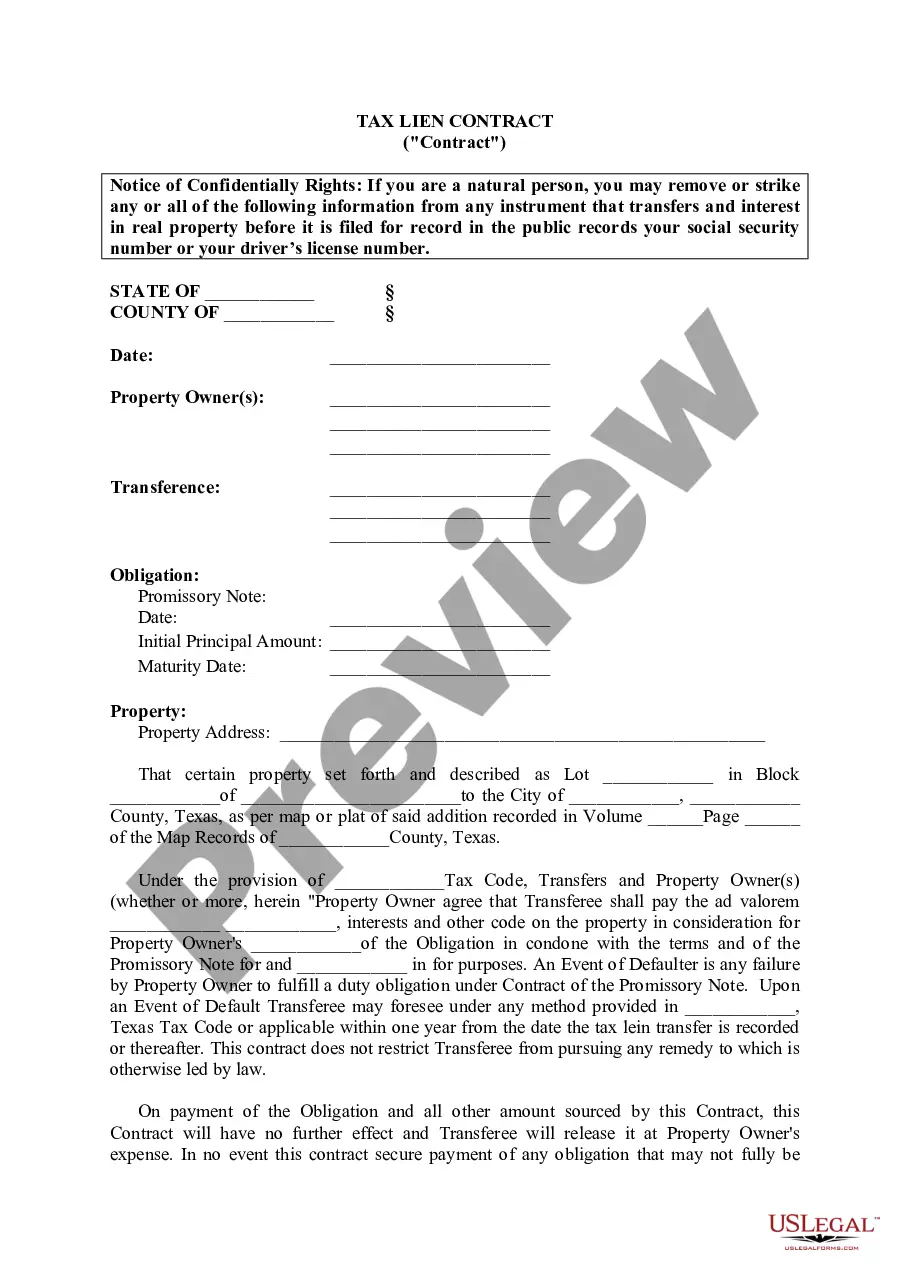

This Lien document state Property Owner agrees that Transferee shall pay Ad valorem taxes, interests and other codes within terms of Promissory Note.

McKinney, Texas is a vibrant city located in Collin County, known for its thriving economy and unparalleled quality of life. One of the important aspects of living in McKinney is understanding the nature of tax liens and the contracts associated with them. McKinney Texas Tax Lien Contracts are legal agreements established between the government and property owners to address unpaid taxes. These contracts help ensure the collection of outstanding property tax debts while protecting the rights of property owners. In McKinney, there are primarily two types of tax lien contracts: tax lien sales and tax lien certificates. 1. Tax Lien Sales: When property owners fail to pay their property taxes, the local government may conduct tax lien sales to recover the outstanding debts. These sales involve auctioning off the tax liens to interested buyers. The highest bidder essentially purchases the lien, which represents the right to collect the unpaid property taxes. The property owner, however, still has a specified period (redemption period) to pay off the taxes, plus any interest and fees, to avoid potential foreclosure or loss of their property. 2. Tax Lien Certificates: Another form of tax lien contract in McKinney is tax lien certificates. In this case, instead of conducting auctions, the government issues certificates to investors. These certificates represent the right to collect the unpaid property taxes along with accrued interest. Investors are then entitled to receive the delinquent tax amount along with any additional interest once the property owner fulfills their payment obligation within the redemption period. Therefore, investors have the potential to earn interest on the tax debt owed by property owners. Both tax lien sales and tax lien certificates offer opportunities for investors to earn a return on their investment by collecting the outstanding property taxes. However, it's essential to note that these contracts are legally binding and must be thoroughly understood before engaging in any tax lien investment in McKinney, Texas. Understanding the intricacies of McKinney Texas Tax Lien Contracts is vital for property owners and investors alike. It's important to consult with legal and financial professionals who specialize in tax lien investments to ensure compliance with regulations and make informed decisions. By being aware of the different types of tax lien contracts available, property owners can navigate the complexities of unpaid property taxes, while investors can explore potential investment opportunities in the McKinney, Texas area.

Free preview

How to fill out McKinney Texas Tax Lien Contract?

If you’ve already utilized our service before, log in to your account and save the McKinney Texas Tax Lien Contract on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your McKinney Texas Tax Lien Contract. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!