Mesquite Texas Tax Lien Contract refers to the legal agreement entered into by the City of Mesquite, Texas, and a property owner who has defaulted on their property taxes. When property owners fail to pay their property taxes, the city may place a tax lien on their property, allowing them to collect the outstanding taxes through a tax lien auction. The Mesquite Texas Tax Lien Contract outlines the terms and conditions under which the property owner can redeem their property and settle their tax debt. It provides a framework for the city to recover unpaid property taxes and ensures that property owners have an opportunity to regain ownership of their property by paying off the outstanding tax amount, including any penalties and interest accrued. The Mesquite Texas Tax Lien Contract includes details such as the property description, the amount of delinquent taxes owed, the redemption period during which the property owner can repay the tax debt, and the penalties and interest that apply. It also specifies the procedures for redeeming the property, such as making payment to the appropriate city office and obtaining a release of the tax lien. In Mesquite, Texas, there are two primary types of tax lien contracts that property owners may encounter: 1. Residential Tax Lien Contracts: These contracts pertain to residential properties and outline the specific terms and conditions for the redemption of tax liens on houses, apartments, and other residential buildings. Property owners facing tax liens on their residential properties must adhere to the guidelines outlined in the Residential Tax Lien Contract. 2. Commercial Tax Lien Contracts: Commercial properties, including retail spaces, office buildings, and industrial facilities, are subject to their own contract known as the Commercial Tax Lien Contract. This agreement provides property owners with the necessary information to redeem their tax liens and regain ownership. Both the Residential Tax Lien Contract and Commercial Tax Lien Contract in Mesquite, Texas, play crucial roles in ensuring that property owners fulfill their tax obligations while providing avenues for redemption. Understanding the terms and conditions outlined in these contracts is vital for property owners in order to resolve their tax liens and maintain their property ownership rights.

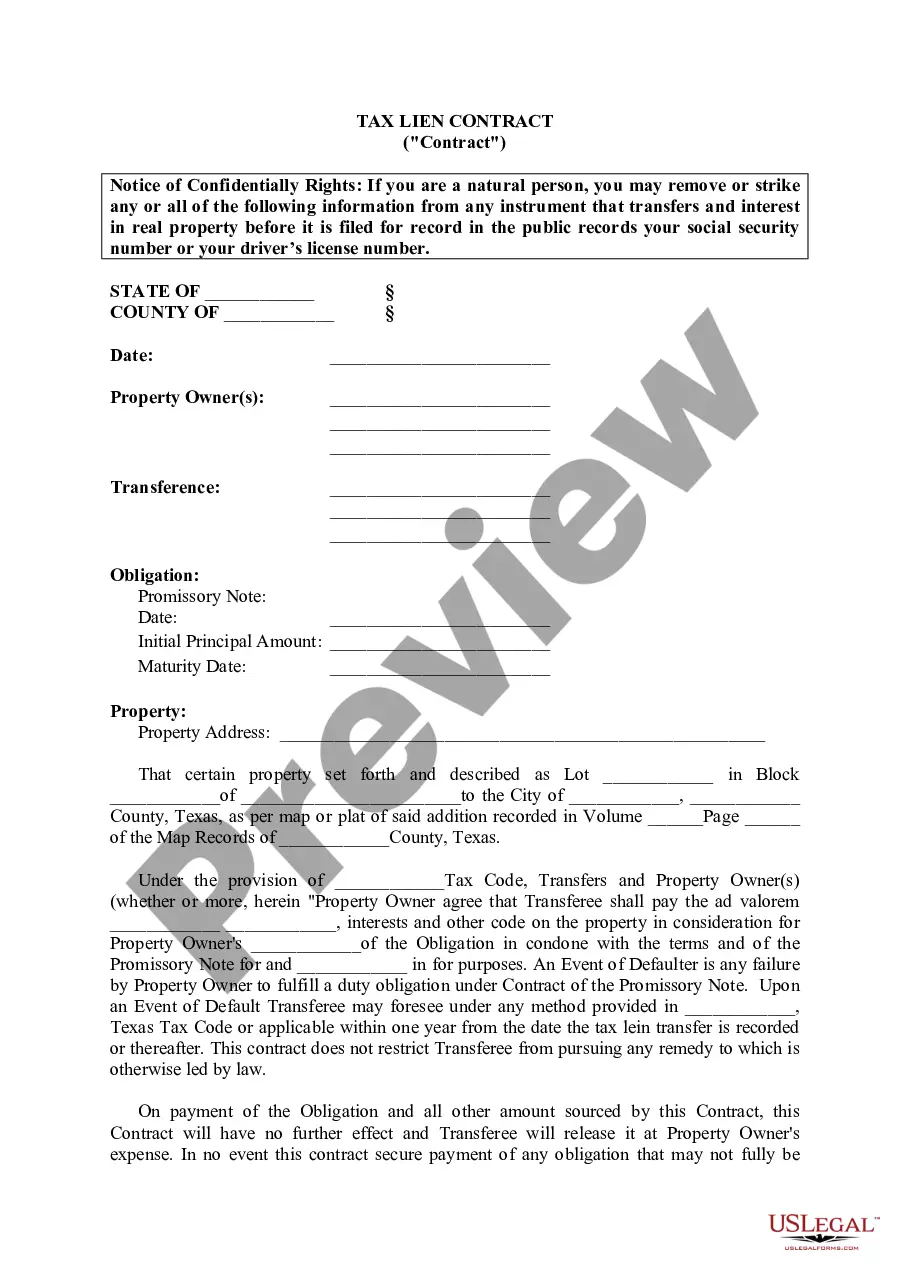

Mesquite Texas Tax Lien Contract

Description

How to fill out Mesquite Texas Tax Lien Contract?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Mesquite Texas Tax Lien Contract gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Mesquite Texas Tax Lien Contract takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Mesquite Texas Tax Lien Contract. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!