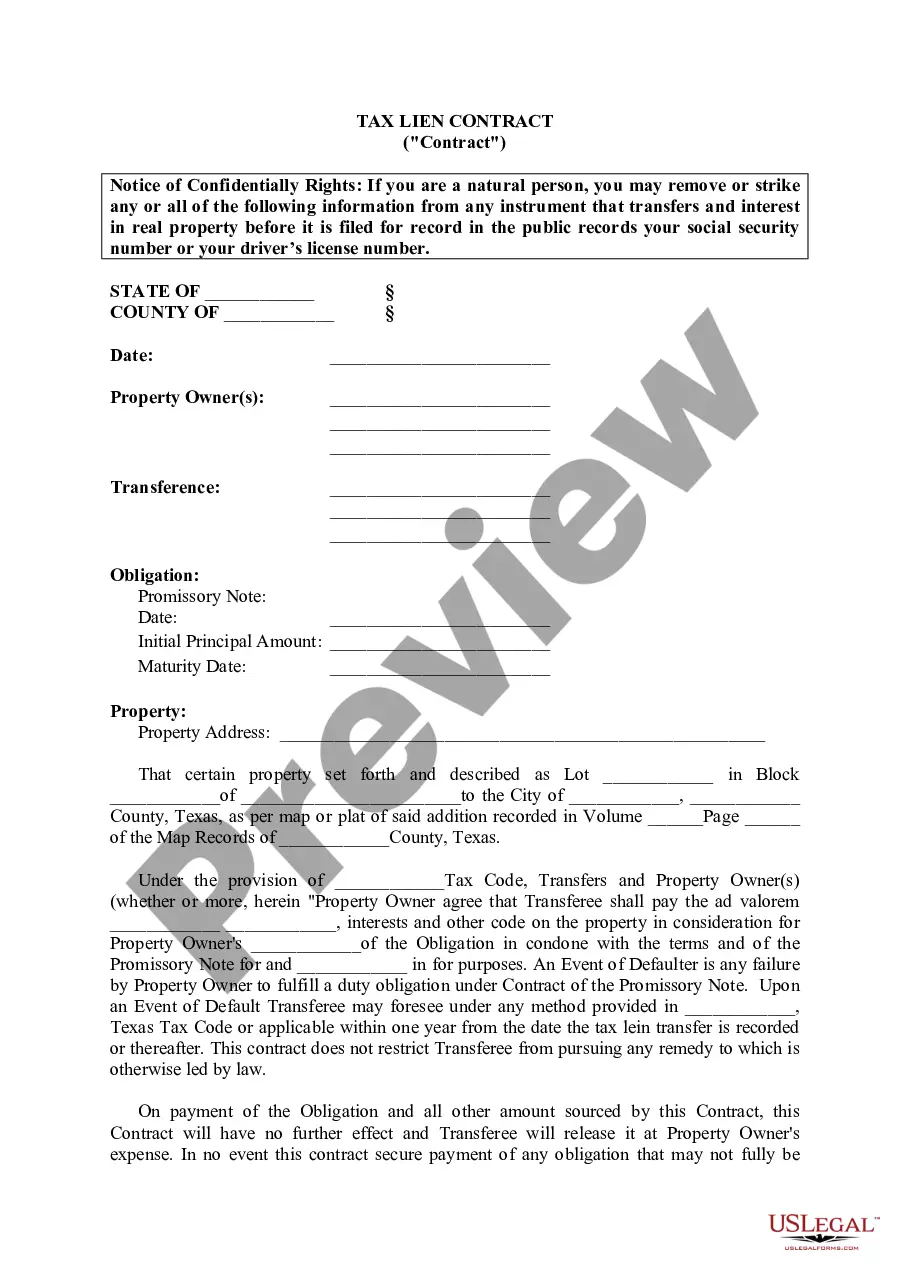

Odessa Texas Tax Lien Contract: A Detailed Description and Types In Odessa, Texas, the tax lien contract refers to a legal agreement entered into by the City of Odessa and property owners who have delinquent property taxes. This contract allows the city to sell tax liens on the properties with unpaid taxes to investors, who then have the opportunity to earn interest on the tax debt. The tax lien contract in Odessa is a mechanism used by the city to collect outstanding property taxes from delinquent property owners. When a property owner fails to pay property taxes, the city places a lien or claim against the property to secure the debt. This lien gives the city the legal right to sell the tax lien to a third party, such as an investor or a tax lien certificate holder. The tax lien contract serves as an agreement between the city and the tax lien certificate holder. It outlines the terms and conditions of the investment, along with the rate of interest that will be earned on the tax debt. The contract specifies the duration of the investment, redemption period, and other relevant details. There are different types of tax lien contracts in Odessa, Texas, based on the nature of the investment and the parties involved. Some common types include: 1. Individual Tax Lien Contract: In this type of contract, an individual investor purchases a tax lien certificate on a specific property with delinquent taxes. The investor holds the lien and has the opportunity to earn interest on the outstanding tax amount. 2. Institutional Tax Lien Contract: In contrast, an institutional investor, such as a bank or a financial institution, may purchase multiple tax liens from the city. These larger-scale investments allow institutions to diversify their portfolios and potentially earn higher returns. 3. Redeemable Tax Lien Contract: A redeemable tax lien contract provides the property owner with a certain redemption period during which they can repay the delinquent taxes plus interest to regain full ownership of the property. If the property owner fails to redeem the lien within the specified timeframe, the tax lien certificate holder may take further legal action to foreclose the property. 4. Non-Redeemable Tax Lien Contract: In a non-redeemable tax lien contract, the property owner does not have the option to redeem the lien by paying the delinquent taxes. Instead, the tax lien certificate holder maintains the legal claim on the property until the debt is repaid, either through foreclosure or sale. It is important for property owners in Odessa, Texas, to be aware of the tax lien contract and its implications. Failure to address property tax delinquency promptly can result in the sale of the tax lien and potential loss of property ownership. Understanding the different types of tax lien contracts can help property owners make informed decisions and take appropriate action to resolve their tax obligations.

Odessa Texas Tax Lien Contract

Description

How to fill out Odessa Texas Tax Lien Contract?

Are you looking for a trustworthy and affordable legal forms supplier to get the Odessa Texas Tax Lien Contract? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and area.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Odessa Texas Tax Lien Contract conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Odessa Texas Tax Lien Contract in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online once and for all.