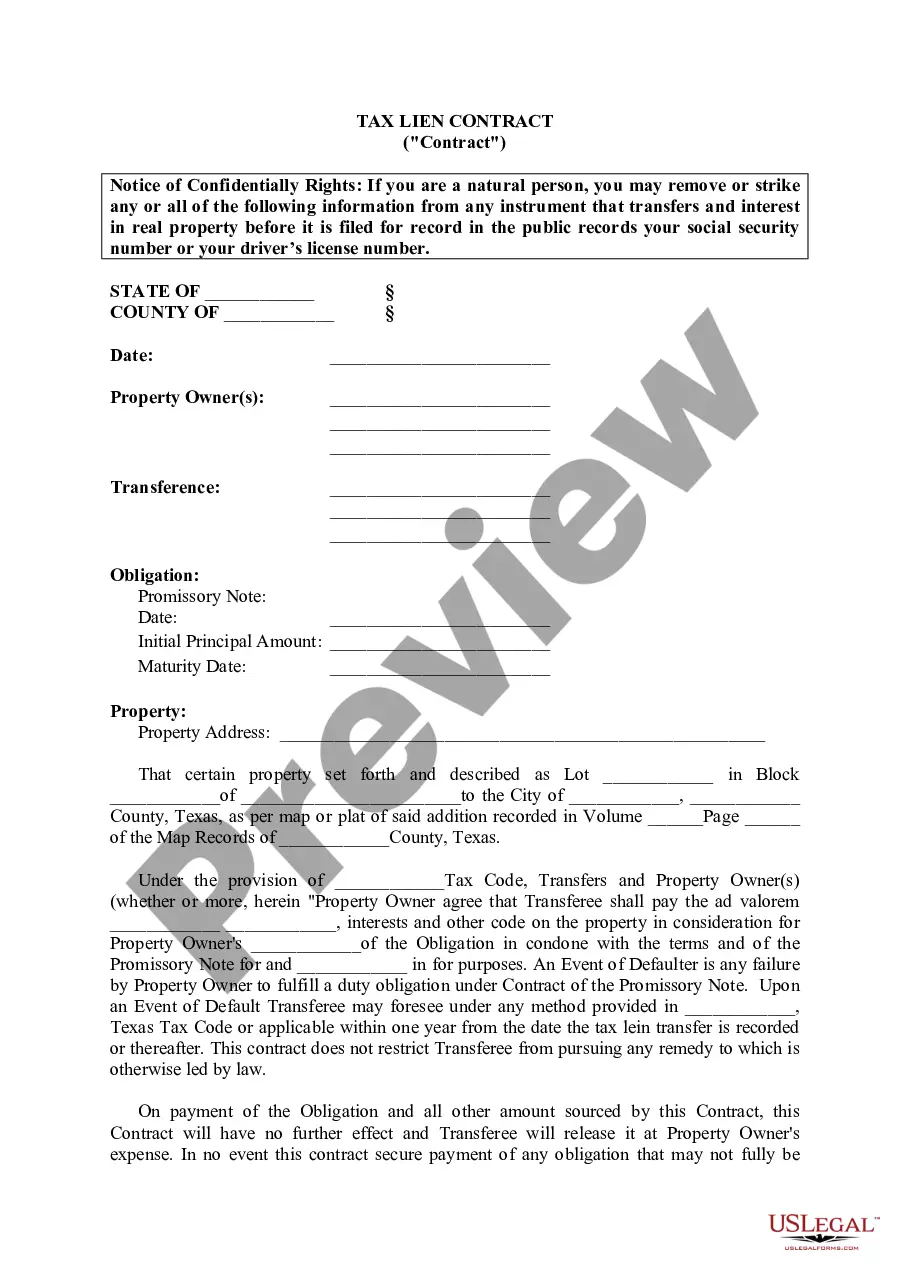

Pearland Texas Tax Lien Contract: A Detailed Description In Pearland, Texas, a tax lien contract is a legal agreement between the property owner and the taxing authority, typically the county, which allows the county to place a lien on the property for unpaid property taxes. This contract provides the county with a means to collect the delinquent taxes and ensures that the property owner meets their tax obligations. When property owners fail to pay their property taxes in Pearland, the taxing authority may initiate the tax lien process. Here's how it generally works: the county will auction off the tax lien to investors who are willing to pay the unpaid taxes on behalf of the property owner. In return, the investor receives a tax lien certificate as proof of their investment. The tax lien certificate, issued to the winning bidder, allows the investor to collect the unpaid property taxes, along with accrued interest, from the property owner. The interest rates on tax lien certificates in Pearland, Texas, can be quite high, making it an attractive investment option for investors seeking fixed returns. There are different types of tax lien contracts in Pearland, Texas, and understanding them is crucial for both property owners and prospective investors. These types may include: 1. Traditional Tax Lien Contracts: Under this type, the taxing authority auctions off the tax lien certificate to the highest bidder. The winning bidder then has the right to collect the delinquent taxes from the property owner. 2. Online Tax Lien Auctions: Some counties in Pearland, Texas, have adopted an online platform for conducting tax lien auctions. This allows investors to bid on tax lien certificates remotely, providing more convenience and accessibility for participants. 3. Redeemable Tax Lien Contracts: In Pearland, Texas, some tax lien contracts offer redemption periods during which the property owner can pay off the delinquent taxes, including any interest or penalties. If the property owner fails to redeem the tax lien certificate within the specified period, the investor can proceed with foreclosure proceedings. 4. Non-Redeemable Tax Lien Contracts: Unlike redeemable tax lien contracts, non-redeemable contracts do not provide a redemption period. If the property owner fails to pay off the delinquent taxes within the prescribed timeline, the tax lien investor can initiate foreclosure proceedings immediately. It is important to note that tax lien contracts in Pearland, Texas, can be complex legal instruments, and property owners should seek professional advice before entering into such agreements. Similarly, potential investors should carefully assess the risks and benefits associated with purchasing tax lien certificates. Overall, Pearland Texas Tax Lien Contracts provide a mechanism for collecting delinquent property taxes, while offering an investment opportunity for those looking for fixed returns. Understanding the different types of tax lien contracts and their implications is crucial for navigating the process successfully.

Pearland Texas Tax Lien Contract

Description

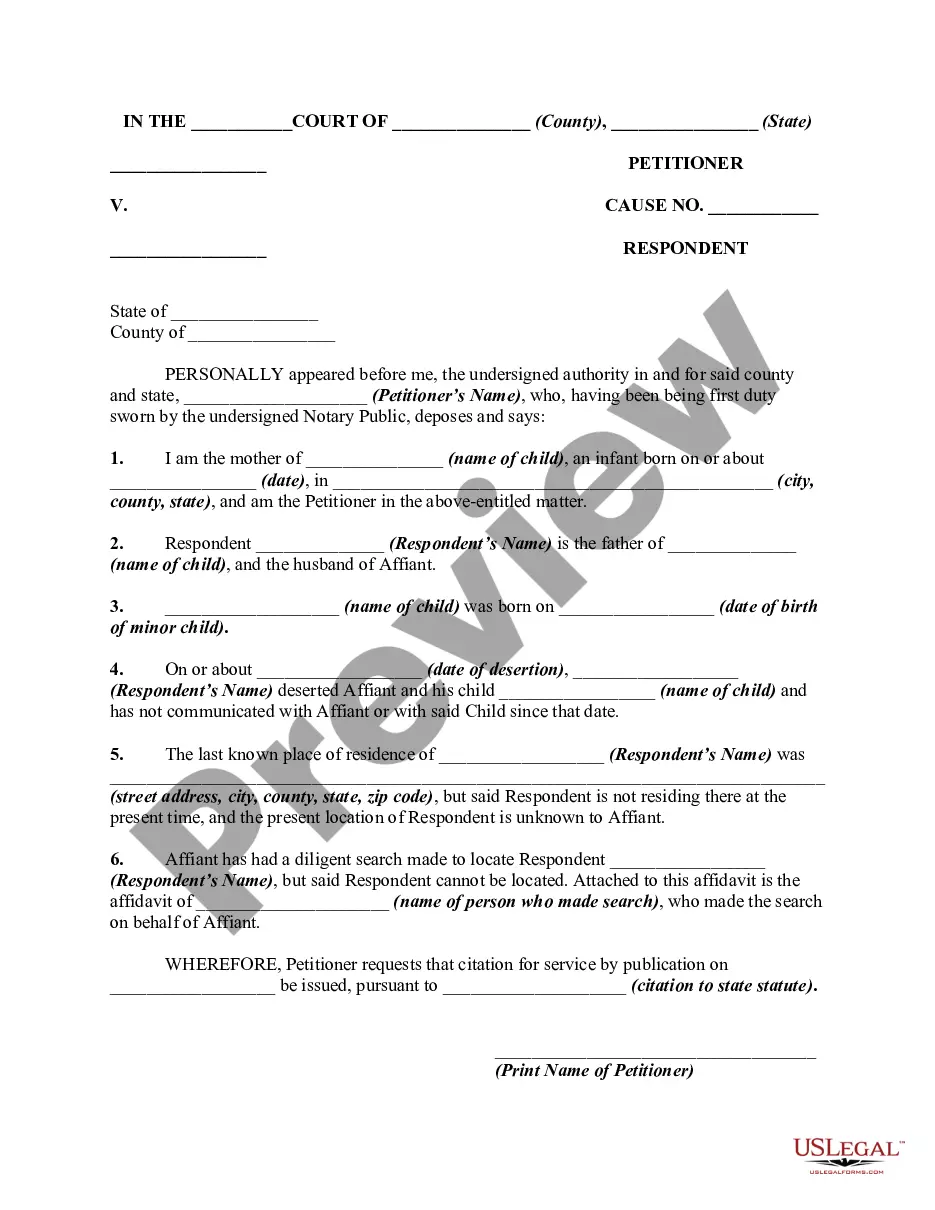

How to fill out Pearland Texas Tax Lien Contract?

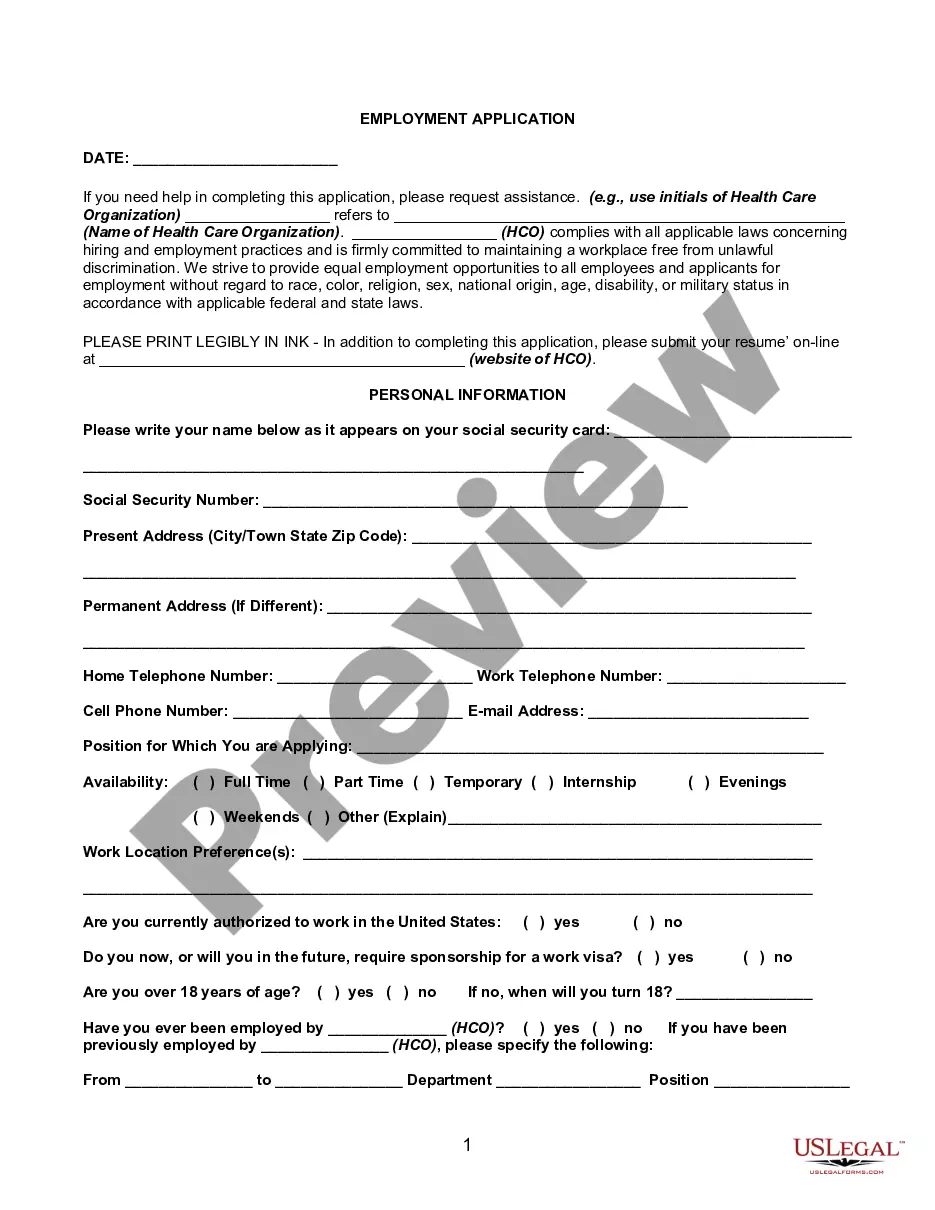

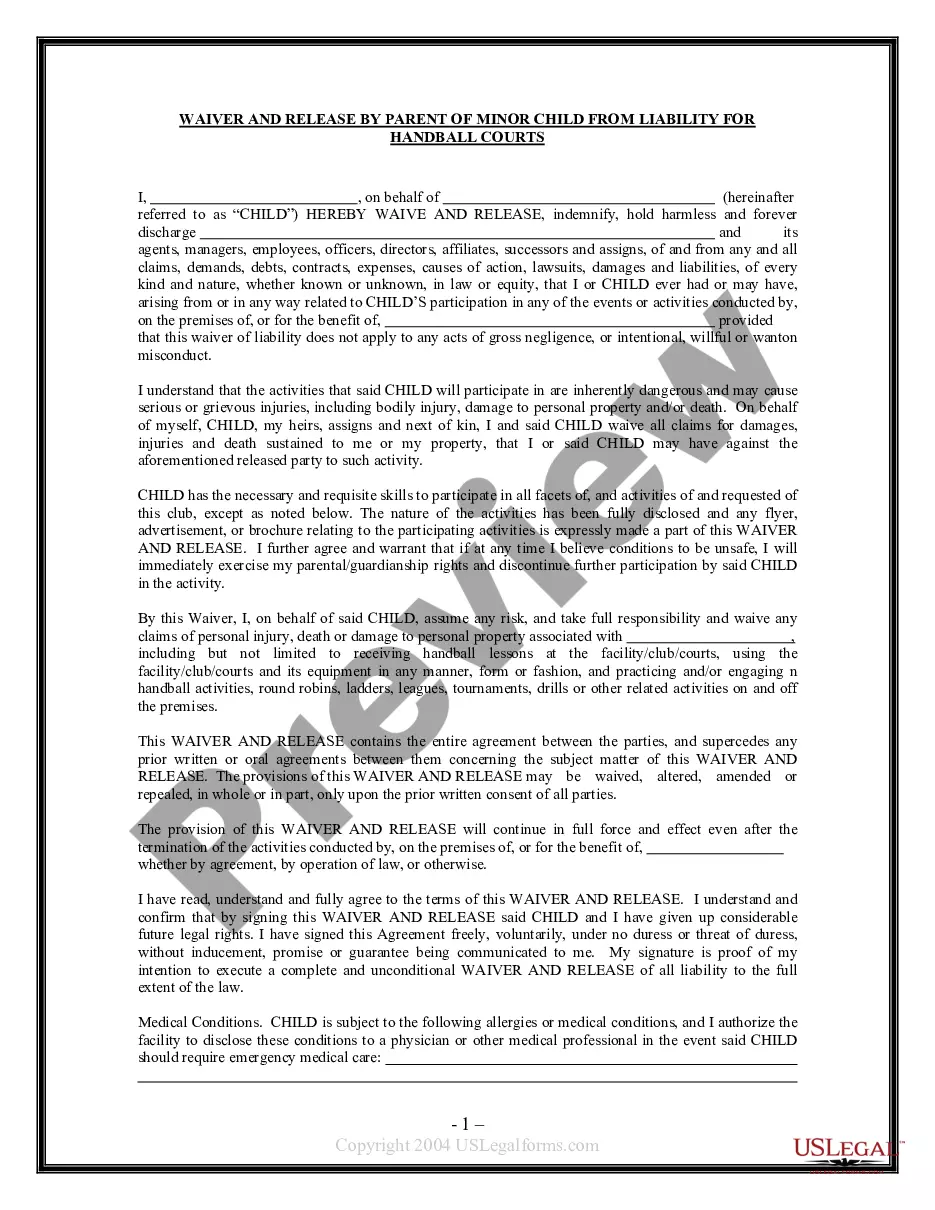

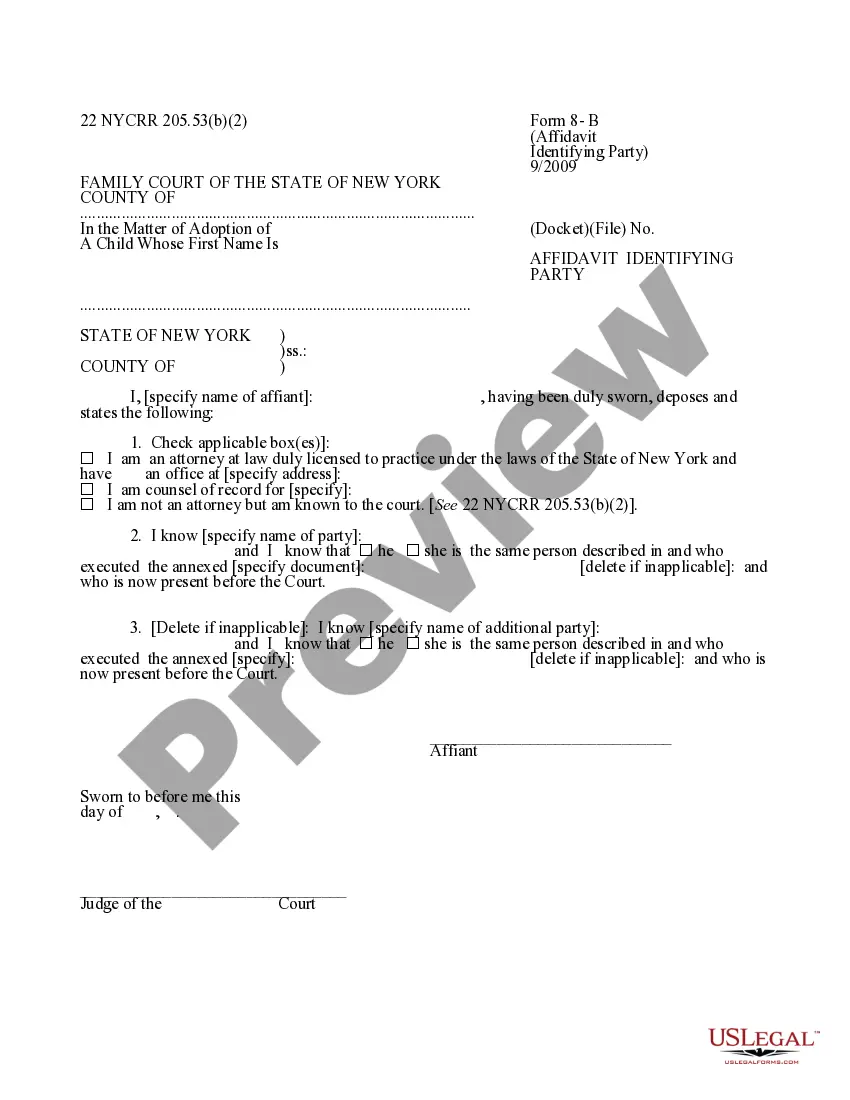

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for legal solutions that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Pearland Texas Tax Lien Contract or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Pearland Texas Tax Lien Contract adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Pearland Texas Tax Lien Contract is proper for you, you can pick the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

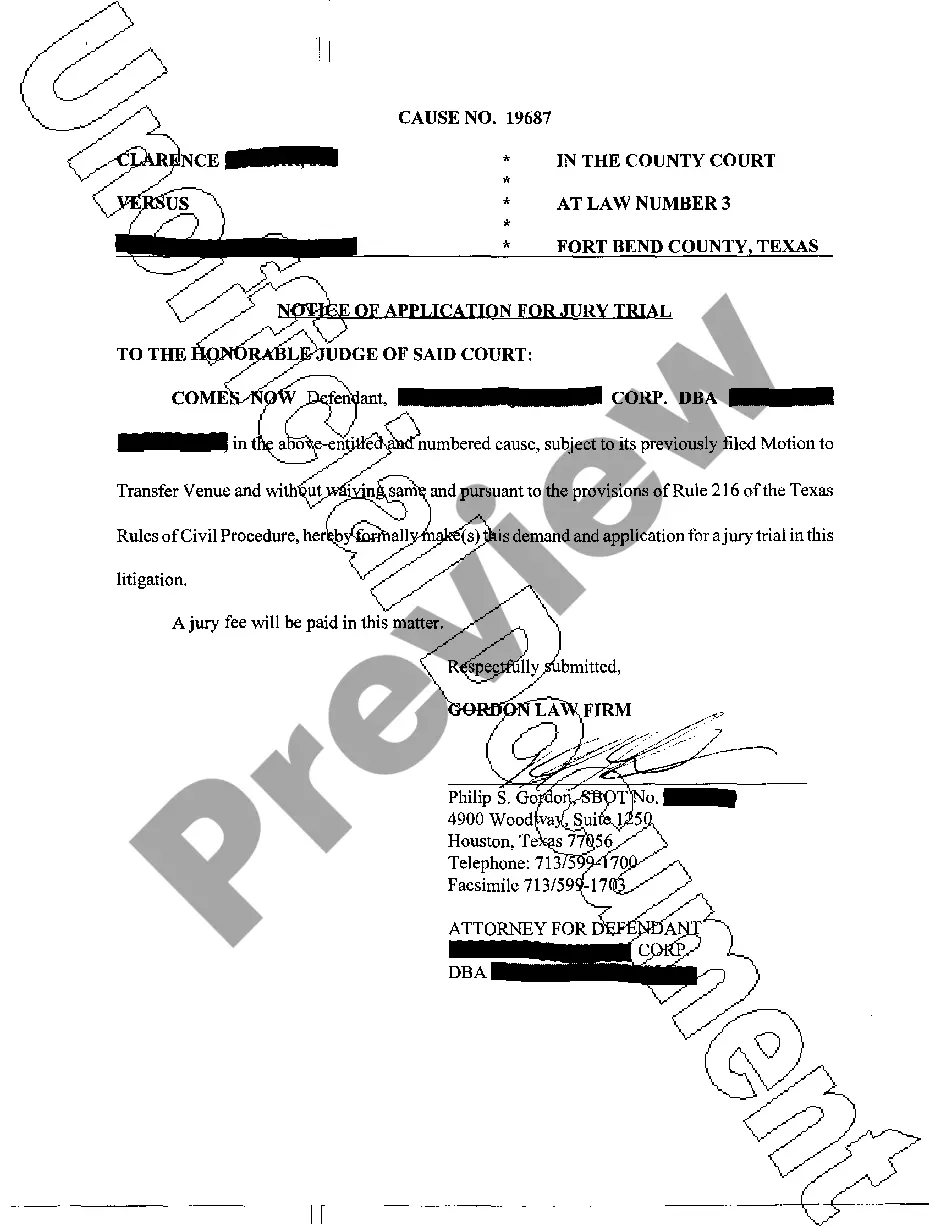

The primary difference lies in how properties are sold due to delinquent taxes. In tax deed states, the property is sold outright to recover unpaid taxes. In contrast, tax lien states, like Texas, sell a lien against the property first, allowing the owner time to repay the tax debt before any sale. Thus, understanding the Pearland Texas Tax Lien Contract process is crucial for potential investors.

To buy a tax lien property in Texas, you typically start by researching available liens in your area, like Pearland. Once you identify a property, you can attend an auction or apply for a Pearland Texas Tax Lien Contract through a licensed service. Each auction will provide you with the details of the property, and you'll need to be prepared to bid on the lien to secure ownership.

Texas is primarily a lien state, which means that when property taxes remain unpaid, the government can place a lien on the property. This lien gives the government the right to collect the owed taxes, and it can lead to the sale of a tax lien certificate. In Pearland, Texas, this process often involves participating in auctions where you can acquire these tax liens through a Pearland Texas Tax Lien Contract.

Whether to buy tax liens or tax deeds depends on your investment strategy. Tax liens, like the Pearland Texas Tax Lien Contract, offer the chance to earn interest on delinquent taxes without the immediate responsibility of property ownership. On the other hand, buying tax deeds can lead to property ownership after a set period. Carefully assess your goals before deciding which option fits your investment plan.

In Texas, a tax lien generally lasts for about two years. During this period, property owners can redeem their property by paying the owed taxes plus interest. If you hold a Pearland Texas Tax Lien Contract, your investment is protected until the property is redeemed or goes to foreclosure after the redemption period expires.

Tax lien investing can be quite profitable, particularly in areas like Pearland, Texas. Investors earn interest on the unpaid taxes, which can range from 8% to 25% annually, depending on the state. With the right research and strategy, including leveraging a Pearland Texas Tax Lien Contract, you can achieve significant returns on your investment.

The best state to invest in tax liens often depends on your financial goals. Texas is frequently highlighted for its robust tax lien market, including Pearland, where investors can find solid opportunities. Factors such as interest rates, redemption periods, and local regulations can greatly affect profitability, so be sure to compare states before making a decision.

To participate in a Texas tax lien sale, you must register with your local county tax office. They usually publish notices before the sale which include property details and lien amounts. After securing a Pearland Texas Tax Lien Contract, you’ll bid during the auction. Be sure to have your finances in order to make compelling bids and increase your chances of securing a lien.

To navigate around a tax lien, you should first understand the implications of a Pearland Texas Tax Lien Contract. Consider negotiating a payment plan with the tax authorities, as this may facilitate the removal of the lien. Investigate options like filing an appeal or obtaining a release through payment or settlement. Consulting with a legal professional experienced in tax matters can also provide guidance tailored to your situation.

To buy a house that owes back taxes in Texas, you can participate in a tax lien sale or a tax foreclosure auction. It is essential to conduct thorough research on the property and any existing liens before placing a bid. You should also familiarize yourself with the Pearland Texas Tax Lien Contract, as it outlines the legal framework surrounding these transactions. This knowledge will enhance your investment strategy.