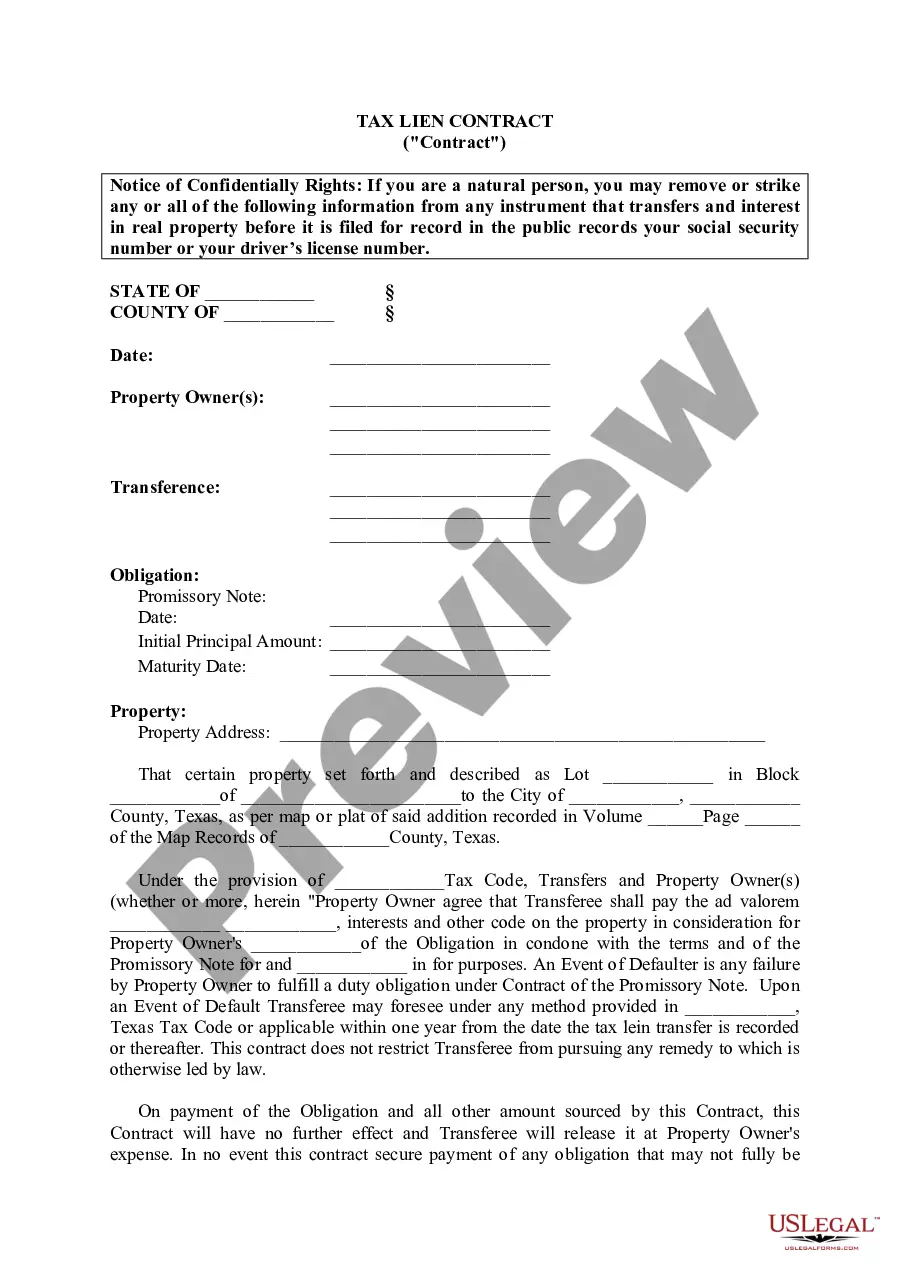

Round Rock, Texas Tax Lien Contracts: A Comprehensive Overview Round Rock, Texas Tax Lien Contracts are legal agreements that are formed between the Round Rock local government and property owners who have unpaid property taxes. These contracts allow the local government to place a lien on the property as collateral until the outstanding tax amount is repaid by the property owner. This lien ensures that the government receives the tax payments it is owed while providing an opportunity for the property owner to remedy their tax delinquency. These tax lien contracts are an effective way for local governments to recover unpaid property taxes without resorting to extreme measures such as property seizure. The Round Rock Tax Lien Contract gives the government the right to place a lien on the property, which serves as a legal claim against the property until the tax debt is satisfied. One of the primary benefits of Round Rock Tax Lien Contracts is that they offer fairness and flexibility to both parties involved. Property owners are given ample time to repay their overdue taxes and redeem their property, while the local government can recover their revenue promptly. This system benefits property owners who may be experiencing financial hardships, as it provides them with an opportunity to get back on track without losing their property. It also allows the local government to collect the tax revenues they need to fund essential services for the community. While there may not be different types of Round Rock Tax Lien Contracts, the process typically involves a few key steps. First, the property owner will receive a notice of delinquency regarding their unpaid property taxes. If the taxes remain unpaid after the prescribed period, the local government may proceed to place a tax lien on the property. The lien will serve as a legal claim against the property, establishing the government's right to collect the outstanding taxes. Once the tax lien is in place, the property owner has a specific redemption period, during which they can repay the debt. The redemption period typically ranges from a few months to several years, depending on the specific circumstances and local rules. If the property owner fails to redeem the property within the redemption period, the local government may initiate foreclosure proceedings, leading to the sale of the property at a public auction. In summary, Round Rock, Texas Tax Lien Contracts are legal agreements established between the local government and property owners to address unpaid property taxes. These contracts provide a fair and flexible system that helps property owners resolve their tax delinquency while allowing the government to collect the taxes it is owed. While there may not be different types of Round Rock Tax Lien Contracts, the process typically involves notice of delinquency, tax lien placement, redemption period, and potential foreclosure if the debt remains unpaid.

Round Rock Texas Tax Lien Contract

Description

How to fill out Round Rock Texas Tax Lien Contract?

Finding validated templates tailored to your regional laws can be challenging unless you access the US Legal Forms library.

This online resource boasts over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All forms are appropriately sorted by area of use and jurisdictional categories, making the search for the Round Rock Texas Tax Lien Contract as simple and straightforward as one-two-three.

Complete your purchase by inputting your credit card information or utilizing your PayPal account to pay for the subscription.

- Review the Preview mode and document description.

- Ensure you’ve chosen the right one that aligns with your needs and adheres to your local jurisdiction criteria.

- Seek another template if necessary.

- If you identify any discrepancies, utilize the Search tab above to find the accurate one. If it meets your criteria, proceed to the next phase.

- Acquire the document.

Form popularity

FAQ

If the lien is not satisfied within a reasonable amount of time, the lienholder has the right to foreclose on the property. The period in which this occurs can range from 60 days to more than 120 days. It all depends on the taxing authority and local market conditions.

Let's get into more detail on how to buy tax lien properties in Texas. When they do the auction in Texas, they auction a deed. It's a redeemable deed. That means the property owner can come back at any time and redeem that deed, which means they're going to get their property back.

TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

A tax lien automatically attaches to property on Jan. 1 each year to secure payment of all taxes. This tax lien gives the courts the power to foreclose on the lien and seize the property, even if its ownership has changed. The property then will be auctioned and the proceeds used to pay the taxes.

You can sell a property with a tax lien, but technically the lien should be satisfied before the sale closes. You can negotiate with the buyer to take over the lien, but most don't want to do that. Instead, take steps to relieve your tax burden through a payment plan, Offer in Compromise, or personal loan.

Sec. 113.105. TAX LIEN; PERIOD OF VALIDITY. (a) The state tax lien on personal property and real estate continues until the taxes secured by the lien are paid.

Like other states, a delinquent tax amount in Texas, including interest and penalties, becomes a lien on the property. The lien attaches to the property on January 1 of the tax year, awaiting assessment and billing of taxes later in the calendar year. (Tex. Tax Code § 32.01.)

TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

Texas doesn't sell tax liens, but it does sell tax-delinquent properties at auction, with a redemption period during which the previous homeowner will have to pay a 25 to 50 percent penalty to recoup the home.