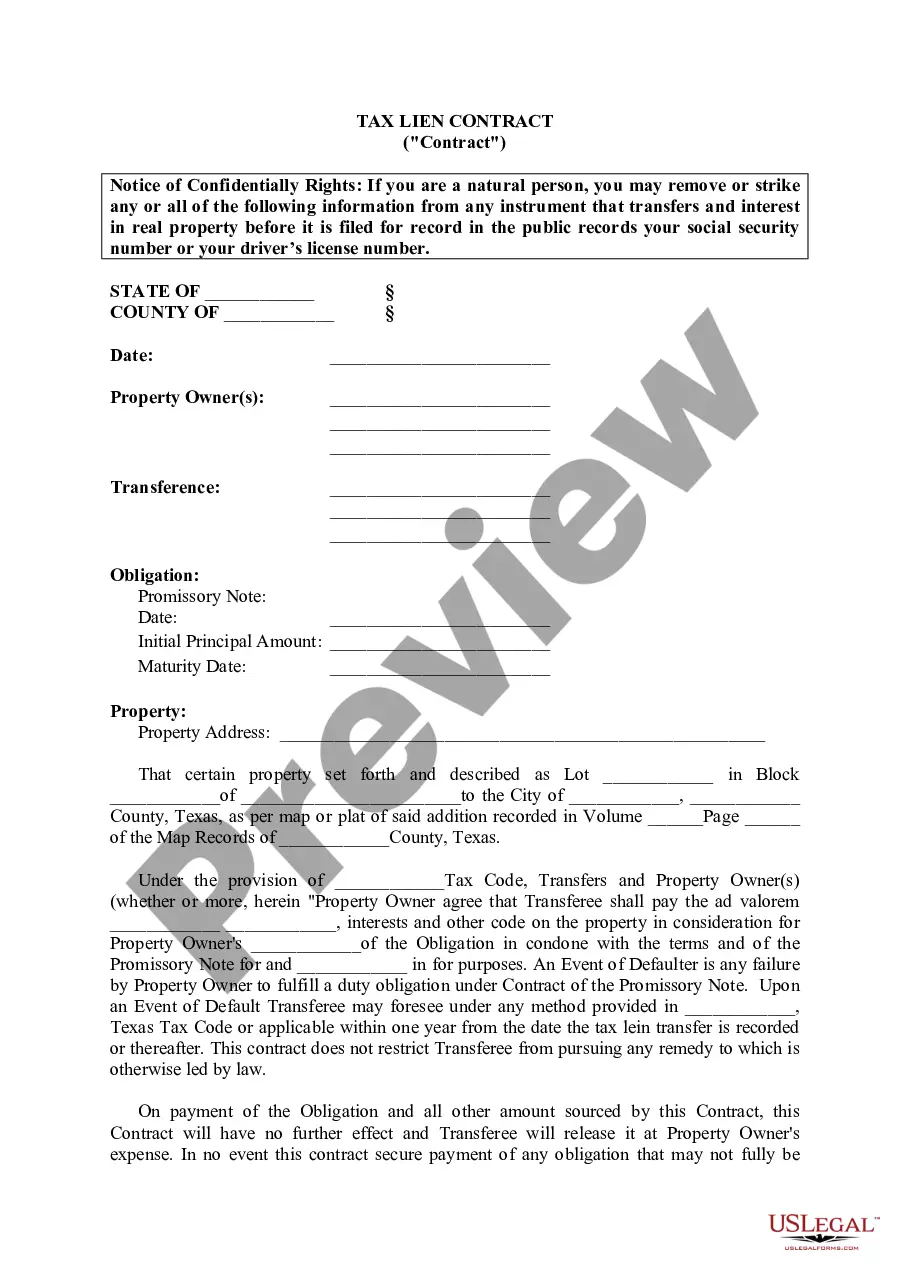

San Antonio Texas Tax Lien Contract

Description

How to fill out Texas Tax Lien Contract?

We consistently aim to minimize or prevent legal harm when navigating intricate legal or financial issues.

To achieve this, we seek legal remedies that are generally quite costly.

However, not all legal issues are equally complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the San Antonio Texas Tax Lien Contract or any other form effortlessly and securely.

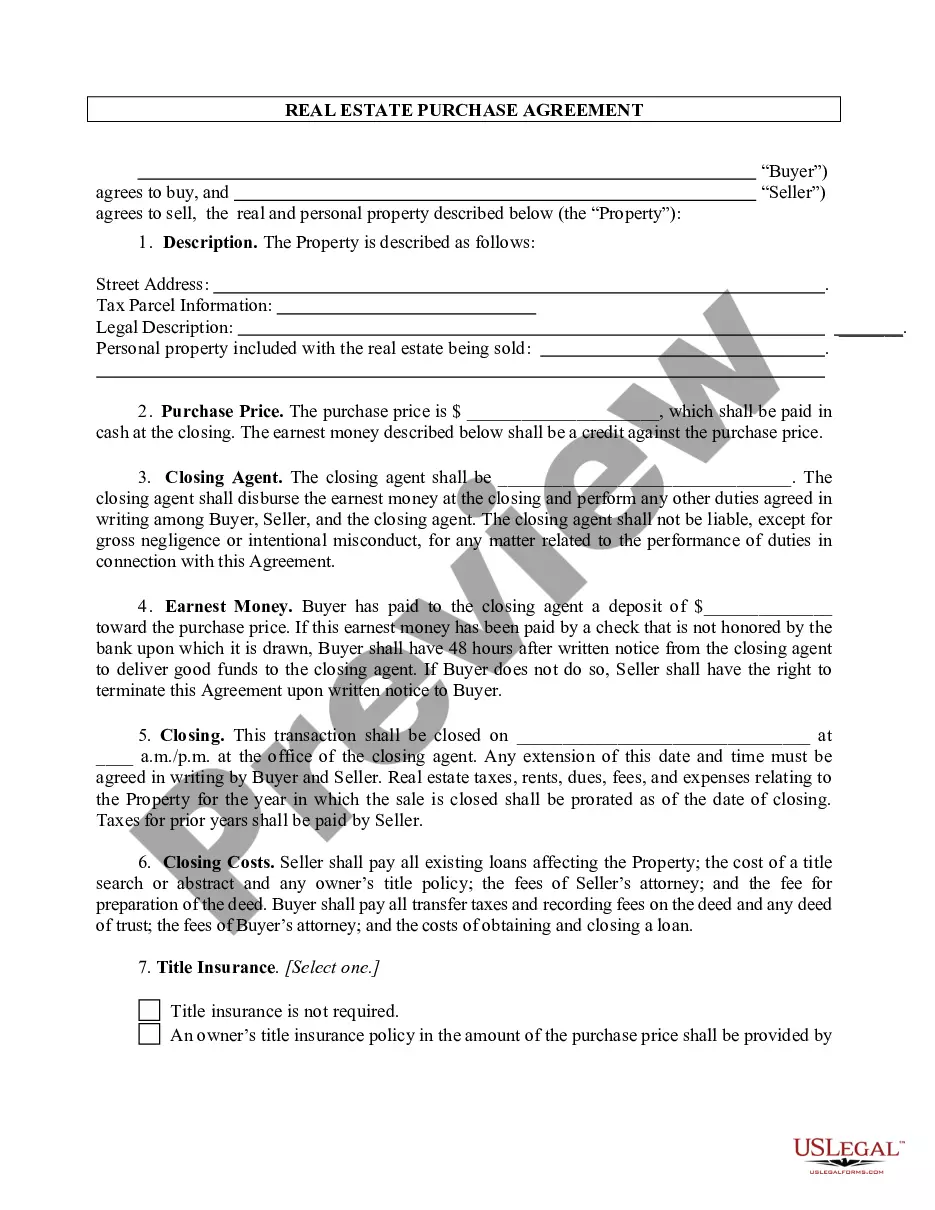

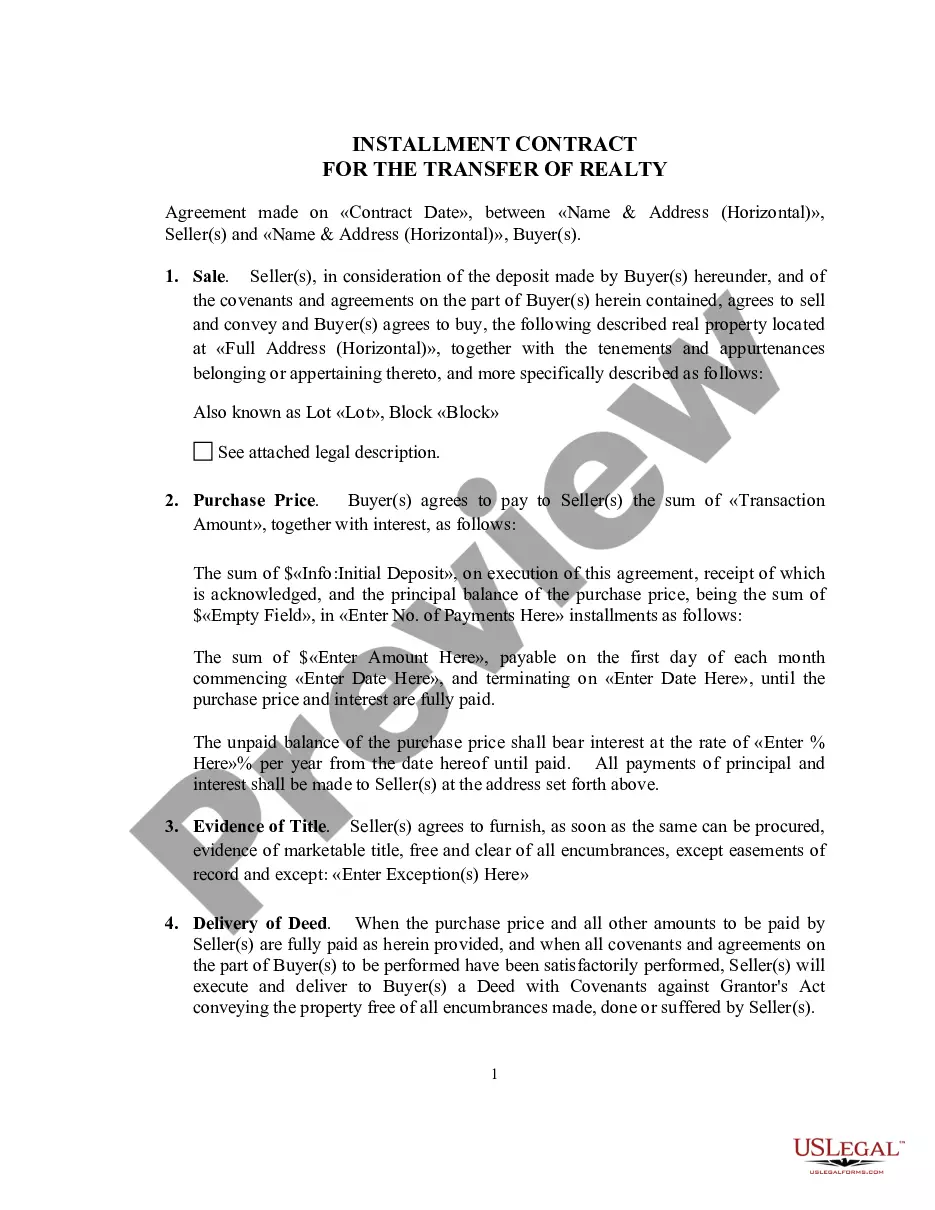

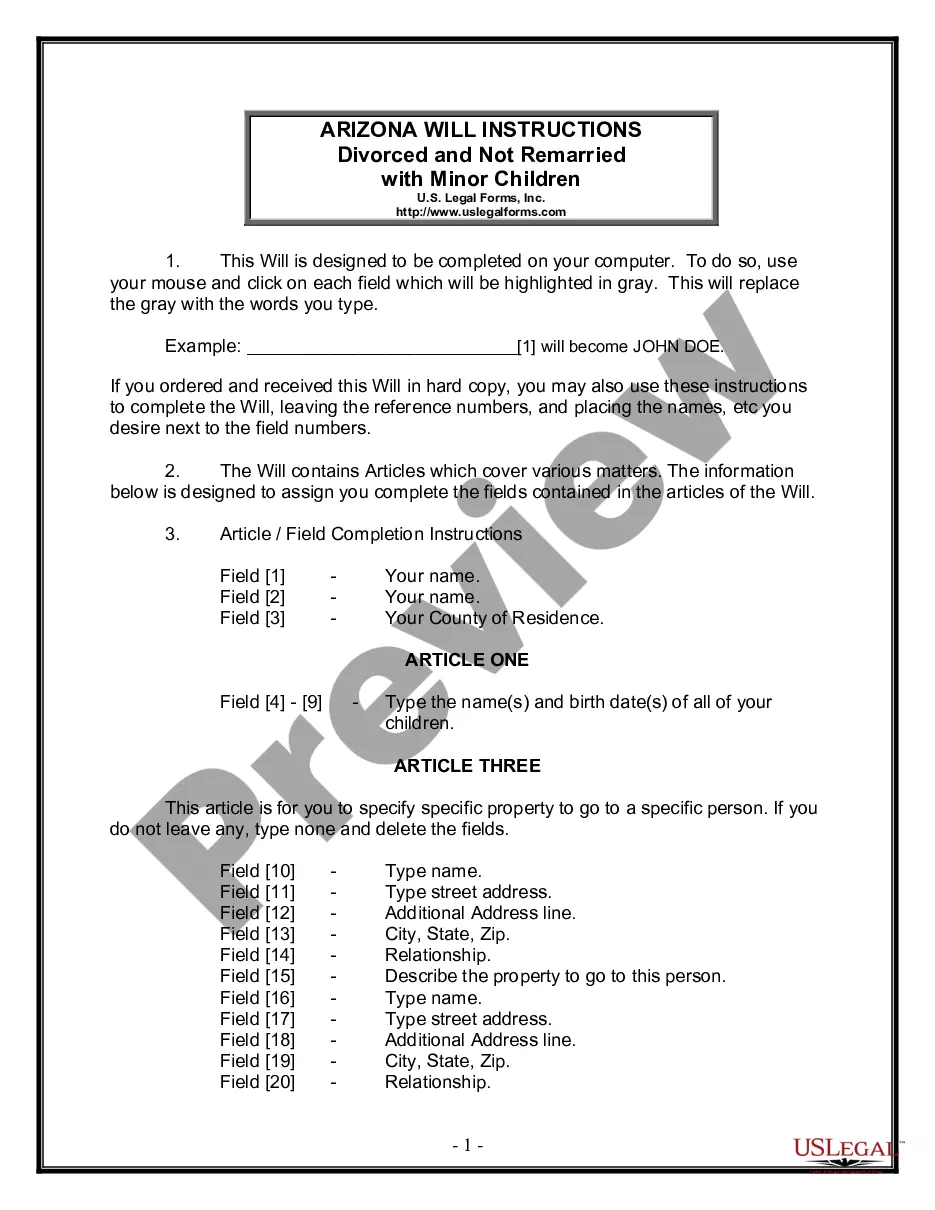

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to manage your issues without employing legal representation.

- We offer access to legal form templates that are not always publicly available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

(a) All taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien on all of the person's property that is subject to execution. (b) The lien for taxes attaches to all of the property of a person liable for the taxes. Acts 1981, 67th Leg., p.

PROPERTY CODE §52.006(B): STATE OF TEXAS JUDGMENT LIEN EXPIRES 20 YEARS AFTER FILING IN THE COUNTY CLERK'S OFFICE. EXISTING STATE OF TEXAS JUDGMENT LIEN: CREATES NEW JUDGMENT LIEN FOR ANOTHER 20 YEARS HAVING PRIORITY BACK TO FILING-DATE OF PRIOR JUDGMENT LIEN.

Texas doesn't sell tax liens, but it does sell tax-delinquent properties at auction, with a redemption period during which the previous homeowner will have to pay a 25 to 50 percent penalty to recoup the home.

To register to bid on a tax foreclosure, contact Linebarger, Goggan, Blair and Sampson LLP Attorneys at Law by phone at 210-225-6763 or visit to register. Both the mortgage and tax foreclosures are cash auctions. Therefore, only cash or certified funds may be tendered at the time of sale.

The unpaid taxes are auctioned off at a tax lien sale. The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

Like other states, a delinquent tax amount in Texas, including interest and penalties, becomes a lien on the property. The lien attaches to the property on January 1 of the tax year, awaiting assessment and billing of taxes later in the calendar year. (Tex. Tax Code § 32.01.)

Sec. 32.01. TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

TAX LIENS AND PERSONAL LIABILITY. Sec. 32.01. TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.