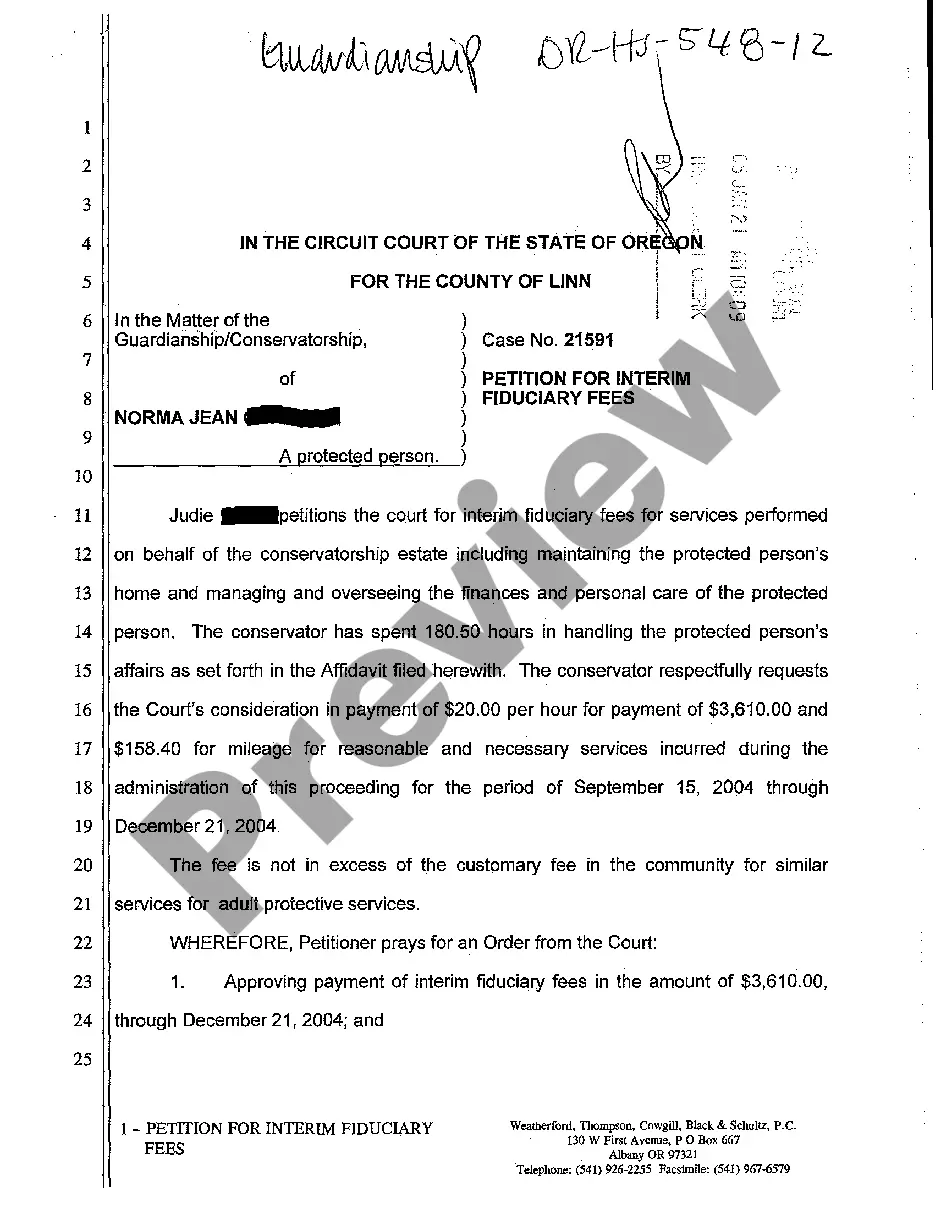

Tarrant Texas Tax Lien Contract is a legal agreement that arises when a property owner fails to pay their property taxes. In Tarrant County, Texas, the government imposes a tax lien on the property as a means to recover the unpaid taxes. This tax lien can be sold to investors through a tax lien auction, where the highest bidder purchases the lien. The Tarrant Texas Tax Lien Contract outlines the terms and conditions of the purchase of the tax lien. It specifies the amount of the lien, the interest rate, and the redemption period during which the property owner can repay the debt. The contract also details the potential consequences for the property owner if they fail to redeem the lien, such as foreclosure and the transfer of property ownership to the lien holder. There are two main types of Tarrant Texas Tax Lien Contracts: redeemable tax liens and non-redeemable tax liens. In a redeemable tax lien contract, the property owner has a specific period, typically six months to two years, to redeem the tax lien by paying the outstanding debt, plus any interest and fees. The property owner may also have the option to enter into an installment plan to repay the debt. On the other hand, a non-redeemable tax lien contract means that the property owner does not have the opportunity to redeem the lien. Once the lien is sold, the property owner loses all rights to the property, and the lien holder can initiate foreclosure proceedings to take ownership. It is important to note that purchasing a Tarrant Texas Tax Lien Contract can be a potentially lucrative investment opportunity for buyers. As an investor, you can earn interest on the liens purchased or potentially acquire ownership of the property if the lien is not redeemed. However, it is essential to thoroughly research the property and assess the potential risks associated with the investment before participating in a tax lien auction. In summary, a Tarrant Texas Tax Lien Contract is a legal agreement that allows investors to purchase tax liens on properties with unpaid property taxes. The contract outlines the terms, interest rates, and redemption period for the property owner to repay the debt. Different types of Tarrant Texas Tax Lien Contracts include redeemable tax liens, where the property owner has a specified time to redeem the lien, and non-redeemable tax liens, where the property owner loses all rights to the property.

Tarrant County Tax Deed Sales

Description

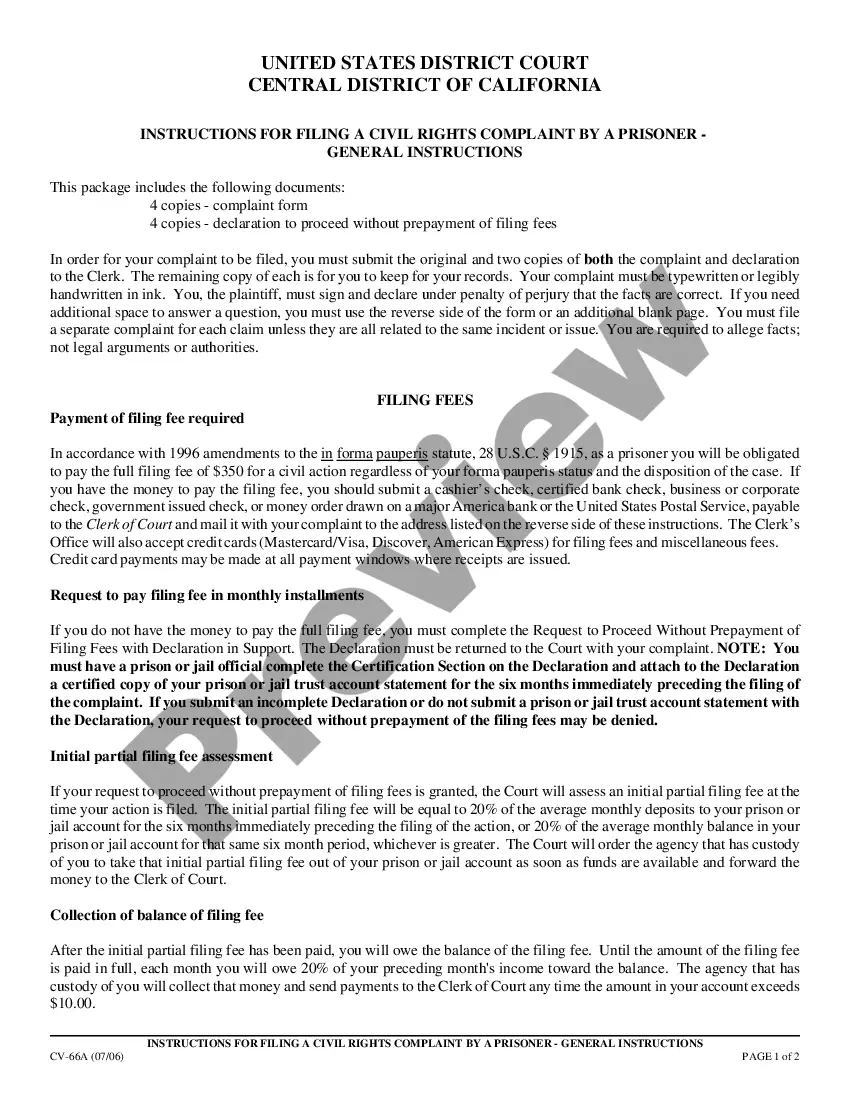

How to fill out Tarrant Texas Tax Lien Contract?

If you are searching for a relevant form template, it’s extremely hard to choose a better place than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can get a huge number of templates for business and individual purposes by categories and regions, or keywords. With our high-quality search feature, getting the latest Tarrant Texas Tax Lien Contract is as easy as 1-2-3. In addition, the relevance of each record is verified by a group of skilled lawyers that regularly check the templates on our website and update them according to the newest state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Tarrant Texas Tax Lien Contract is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have found the form you want. Look at its description and utilize the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to discover the appropriate file.

- Affirm your decision. Select the Buy now option. Next, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and download it on your device.

- Make changes. Fill out, modify, print, and sign the obtained Tarrant Texas Tax Lien Contract.

Each template you add to your account does not have an expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to have an extra duplicate for modifying or printing, you may return and save it again at any moment.

Make use of the US Legal Forms professional catalogue to get access to the Tarrant Texas Tax Lien Contract you were seeking and a huge number of other professional and state-specific templates in a single place!

Form popularity

FAQ

TAX LIENS AND PERSONAL LIABILITY. Sec. 32.01. TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

For information about this process contact the Tax Assessor-Collector's Office at 817-884-1186. The amount of time required to obtain the statement will be approximately two weeks, from request to issuance.

In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

We're going to talk about redeemable tax deeds, because Texas does not sell tax liens. They sell tax deeds, which means a tax defaulted property, and they sell what they call a redeemable tax deed, which simply means that when you buy the deed to that property, it's redeemable.

The tax office does not sell tax liens. Texas law allows the public to purchase properties from the county at a monthly tax foreclosure sale. The states sells the deed to the property. Note: The state does not sell tax lien certificates where a buyer becomes the lienholder for the back taxes.

You can sell a property with a tax lien, but technically the lien should be satisfied before the sale closes. You can negotiate with the buyer to take over the lien, but most don't want to do that. Instead, take steps to relieve your tax burden through a payment plan, Offer in Compromise, or personal loan.

Like other states, a delinquent tax amount in Texas, including interest and penalties, becomes a lien on the property. The lien attaches to the property on January 1 of the tax year, awaiting assessment and billing of taxes later in the calendar year. (Tex. Tax Code § 32.01.)

5 WAYS TO GET AROUND A FEDERAL TAX LIEN Pay In Full. The simplest?but often hardest?strategy is to pay your tax debt in full.Subordinate the Lien. Each security interest in an asset has its own spot in line.Discharge the Lien.Direct Debit Installment Agreements.Challenge the Lien.

A tax lien automatically attaches to property on Jan. 1 each year to secure payment of all taxes. This tax lien gives the courts the power to foreclose on the lien and seize the property, even if its ownership has changed. The property then will be auctioned and the proceeds used to pay the taxes.

Sec. 113.105. TAX LIEN; PERIOD OF VALIDITY. (a) The state tax lien on personal property and real estate continues until the taxes secured by the lien are paid.

More info

The person listed on the form assumes all responsibility of any delinquent child support payments. Texas Department of Revenue. , Box 1035 Dallas, TX 75231, fax Texas Comptroller Credit System This form will generate credit for a state agency within two months after you provide any information requested on the form. It is a standard credit report with all required information. It will not be reported. Information submitted to this program must be complete, correct, and timely. Do not submit duplicate information on a new application or on your monthly credit report. The information you provide will be used solely for the purpose for which it is received. The Comptroller will not use the information on this or any other credit report for any other purpose or in connection with any investigation. In the event the information submitted to this program becomes incomplete or inaccurate, it may be deemed incomplete or inaccurate.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.