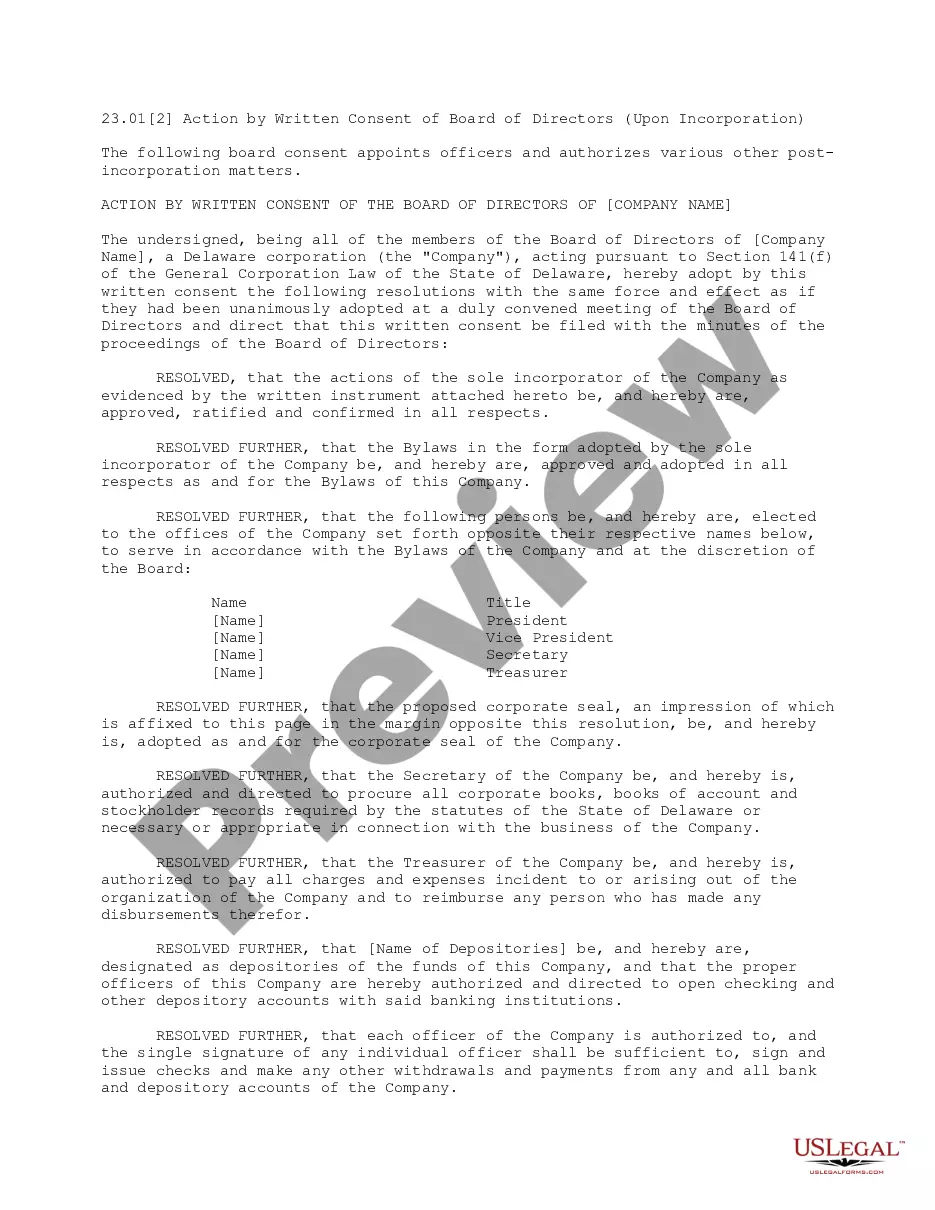

Travis Texas Tax Lien Contract is a legal agreement that outlines the terms and conditions for the sale and purchase of tax liens in Travis County, Texas. When property owners fail to pay their property taxes, a tax lien is placed on their property, allowing the county government to auction off the lien to investors. The Travis Texas Tax Lien Contract is used to formalize this transaction between the county and the winning bidder. The contract contains essential details such as the property information, including the legal description and parcel number, the amount of unpaid taxes, and the date of the tax sale auction. It also specifies the terms of payment for the tax lien, including the winning bid amount and any additional fees or penalties involved. There are different types of tax lien contracts that can be found in Travis County, Texas. Some common variations include: 1. Traditional Tax Lien Contracts: These contracts follow the standard procedures for tax lien sales. The winning bidder pays the outstanding taxes on the property and in return, receives a lien against the property. The property owner then has a specific redemption period to repay the investor, including additional interest and penalties. If the owner fails to redeem the property within the given time frame, the investor can initiate foreclosure proceedings. 2. Assignment of Tax Lien Contracts: In some cases, the original lien holder may choose to sell their right to collect on the tax lien to another investor. This type of contract is known as an assignment of tax lien contract. The new investor steps into the shoes of the original lien holder and assumes all rights and obligations associated with the lien. 3. Bundle Tax Lien Contracts: Sometimes, multiple tax liens from different properties may be bundled together and sold as a package. Investors can then purchase a bundle of tax liens through a single contract. This type of contract allows investors to diversify their investment portfolio by acquiring a variety of tax liens. It's important to note that Travis Texas Tax Lien Contracts are legally binding agreements and should be carefully reviewed and understood by both parties involved. Consulting with a knowledgeable attorney or financial advisor can help ensure a smooth transaction and mitigate any potential risks or pitfalls.

Travis Texas Tax Lien Contract

Description

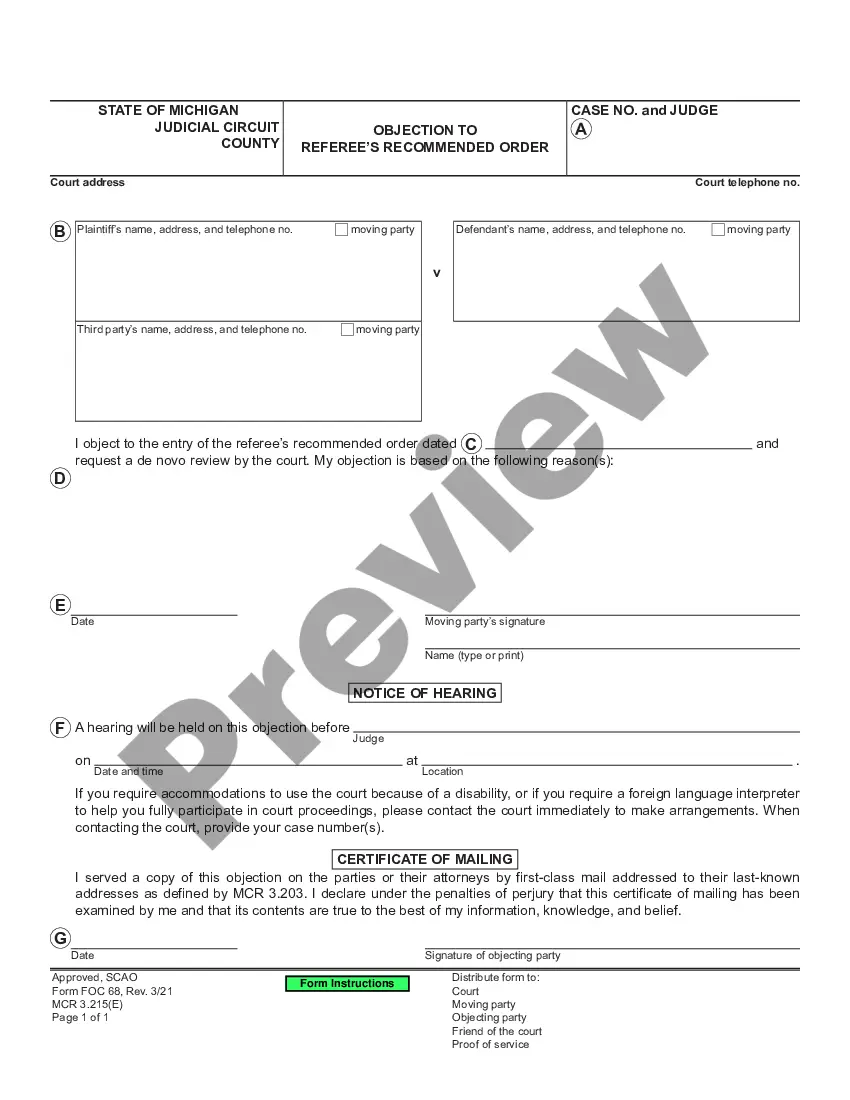

How to fill out Travis Texas Tax Lien Contract?

If you’ve already used our service before, log in to your account and save the Travis Texas Tax Lien Contract on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Travis Texas Tax Lien Contract. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

Texas Property Taxes Any unpaid property tax becomes a lien against the property. If the taxes are not paid by February 1 of the following year for which the tax is imposed, they are considered delinquent.

Does Paying Property Tax Give Ownership In Texas? No. Simply paying property taxes for a piece of real estate is not enough to establish ownership under Texas law. Rather, the property belongs to whoever has ?clear title,? regardless of who pays the taxes.

Like other states, a delinquent tax amount in Texas, including interest and penalties, becomes a lien on the property. The lien attaches to the property on January 1 of the tax year, awaiting assessment and billing of taxes later in the calendar year. (Tex. Tax Code § 32.01.)

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.

We're going to talk about redeemable tax deeds, because Texas does not sell tax liens. They sell tax deeds, which means a tax defaulted property, and they sell what they call a redeemable tax deed, which simply means that when you buy the deed to that property, it's redeemable.

The process is very simple: Ask your county treasurer for the tax delinquent list. Determine the cost ? could be free, or up to $500. Mail a check to the treasurer's office with a letter of instruction. Receive the list in the method you choose (email, mail, CD-ROM, etc.)

We're going to talk about redeemable tax deeds, because Texas does not sell tax liens. They sell tax deeds, which means a tax defaulted property, and they sell what they call a redeemable tax deed, which simply means that when you buy the deed to that property, it's redeemable.

Sec. 113.105. TAX LIEN; PERIOD OF VALIDITY. (a) The state tax lien on personal property and real estate continues until the taxes secured by the lien are paid.

TAX LIENS AND PERSONAL LIABILITY. Sec. 32.01. TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.