Waco Texas Tax Lien Contract — Understanding Tax Liens and its Types in Waco, Texas A Waco Texas Tax Lien Contract refers to a legally binding agreement between the local government and property owners who owe outstanding property taxes in Waco, Texas. When property taxes remain unpaid, the county or city government takes necessary action by imposing a tax lien on the delinquent property. This lien allows the government to secure the unpaid tax debt by placing a claim on the property. The tax lien contract serves as a means for the government to recover the unpaid taxes while also providing an opportunity for interested investors to capitalize on these liens for potential financial gain. There are different types of tax lien contracts that exist in Waco, Texas, each with its own specific terms and conditions. Let's delve into them: 1. Traditional Tax Lien Auctions: In this type of tax lien contract, the government holds periodic auctions where interested bidders can purchase tax liens on delinquent properties. These auctions typically take place annually or semi-annually and involve competitive bidding among investors. The highest bidder wins the tax lien, which grants them the right to collect the delinquent tax amount from the property owner. 2. Online Tax Lien Sales: With the advancement of technology, many counties and cities in Texas, including Waco, have transitioned to online platforms to conduct tax lien sales. This allows interested investors to participate in auctions remotely, providing greater accessibility and convenience. Online tax lien sales often operate similarly to traditional auctions, where bidders compete virtually to acquire tax liens on properties with unpaid taxes. 3. Redeemed Tax Liens: A redeemed tax lien contract comes into play when the property owner settles their outstanding tax debt. After a property owner fulfills their tax obligations, the tax lien is considered "redeemed," and the investor who holds that lien is reimbursed with the principal amount, along with any accrued interest or penalties as per the terms of the contract. 4. Foreclosed Tax Liens: When property owners fail to redeem the tax liens on their properties within the specified timeframe, the investor holding the lien may proceed with foreclosure proceedings. Foreclosed tax liens result in the investor gaining ownership of the delinquent property. The investor can then take possession of the property or sell it to recover the investment along with any additional costs incurred during the foreclosure process. Understanding the intricacies of Waco Texas Tax Lien Contracts is crucial for both property owners and potential investors. Property owners can ensure timely payment of property taxes to avoid tax liens, while investors can explore these contracts as a potential investment avenue. However, it is important for both parties to familiarize themselves with the specific terms and conditions outlined in the contract and seek professional advice when necessary. So, whether you are a property owner or an investor, it is essential to comprehend the different types of tax lien contracts prevailing in Waco, Texas, and navigate the associated processes accordingly to fulfill your respective obligations and objectives.

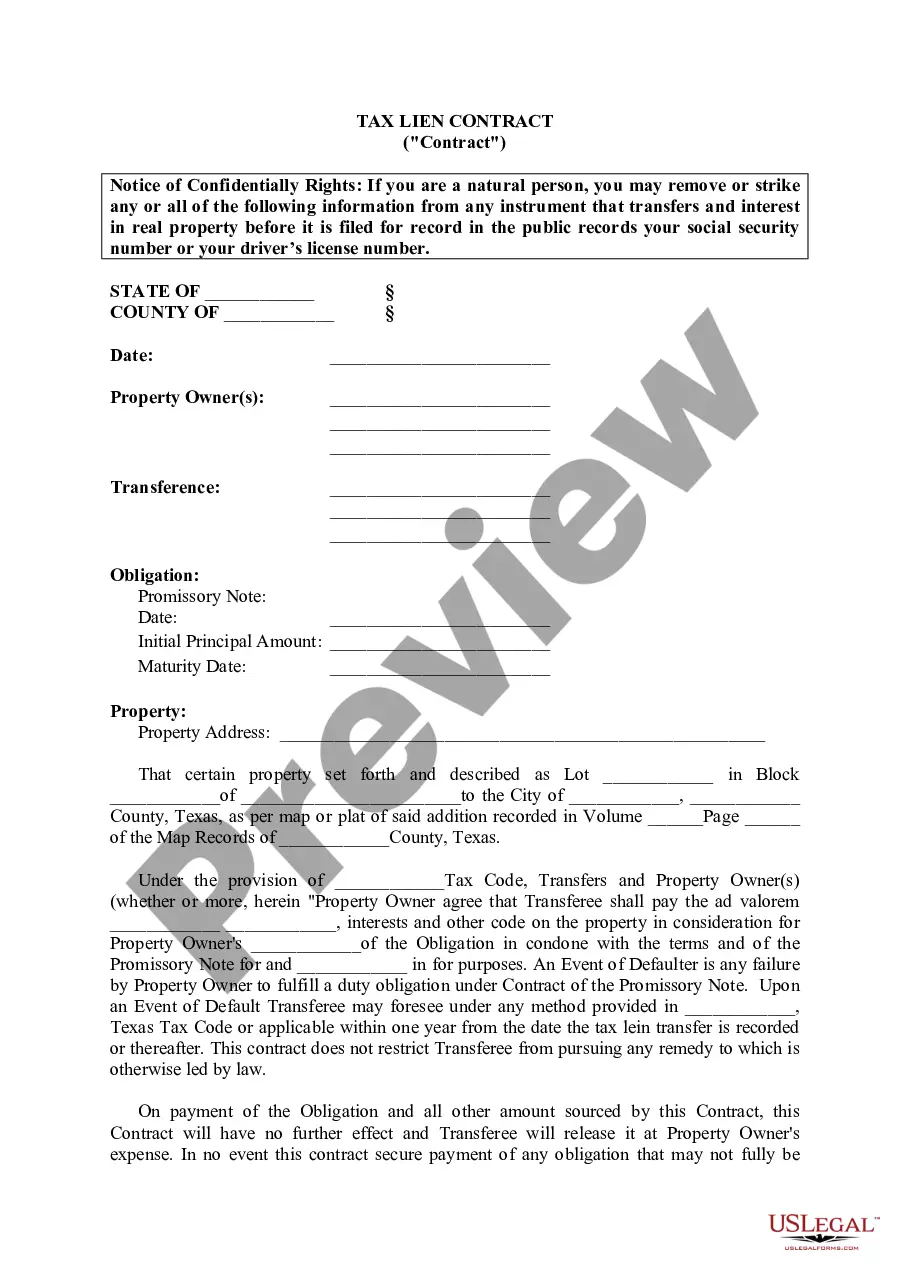

Waco Texas Tax Lien Contract

Category:

State:

Texas

City:

Waco

Control #:

TX-LR051T

Format:

Word;

Rich Text

Instant download

Description

This Lien document state Property Owner agrees that Transferee shall pay Ad valorem taxes, interests and other codes within terms of Promissory Note.

Waco Texas Tax Lien Contract — Understanding Tax Liens and its Types in Waco, Texas A Waco Texas Tax Lien Contract refers to a legally binding agreement between the local government and property owners who owe outstanding property taxes in Waco, Texas. When property taxes remain unpaid, the county or city government takes necessary action by imposing a tax lien on the delinquent property. This lien allows the government to secure the unpaid tax debt by placing a claim on the property. The tax lien contract serves as a means for the government to recover the unpaid taxes while also providing an opportunity for interested investors to capitalize on these liens for potential financial gain. There are different types of tax lien contracts that exist in Waco, Texas, each with its own specific terms and conditions. Let's delve into them: 1. Traditional Tax Lien Auctions: In this type of tax lien contract, the government holds periodic auctions where interested bidders can purchase tax liens on delinquent properties. These auctions typically take place annually or semi-annually and involve competitive bidding among investors. The highest bidder wins the tax lien, which grants them the right to collect the delinquent tax amount from the property owner. 2. Online Tax Lien Sales: With the advancement of technology, many counties and cities in Texas, including Waco, have transitioned to online platforms to conduct tax lien sales. This allows interested investors to participate in auctions remotely, providing greater accessibility and convenience. Online tax lien sales often operate similarly to traditional auctions, where bidders compete virtually to acquire tax liens on properties with unpaid taxes. 3. Redeemed Tax Liens: A redeemed tax lien contract comes into play when the property owner settles their outstanding tax debt. After a property owner fulfills their tax obligations, the tax lien is considered "redeemed," and the investor who holds that lien is reimbursed with the principal amount, along with any accrued interest or penalties as per the terms of the contract. 4. Foreclosed Tax Liens: When property owners fail to redeem the tax liens on their properties within the specified timeframe, the investor holding the lien may proceed with foreclosure proceedings. Foreclosed tax liens result in the investor gaining ownership of the delinquent property. The investor can then take possession of the property or sell it to recover the investment along with any additional costs incurred during the foreclosure process. Understanding the intricacies of Waco Texas Tax Lien Contracts is crucial for both property owners and potential investors. Property owners can ensure timely payment of property taxes to avoid tax liens, while investors can explore these contracts as a potential investment avenue. However, it is important for both parties to familiarize themselves with the specific terms and conditions outlined in the contract and seek professional advice when necessary. So, whether you are a property owner or an investor, it is essential to comprehend the different types of tax lien contracts prevailing in Waco, Texas, and navigate the associated processes accordingly to fulfill your respective obligations and objectives.

Free preview

How to fill out Waco Texas Tax Lien Contract?

If you’ve already used our service before, log in to your account and save the Waco Texas Tax Lien Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Waco Texas Tax Lien Contract. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!