Killeen Texas Tax Affidavit Designation Other Property as Homestead Property serves as an essential document for property owners in Killeen to declare and designate their property as a homestead for tax purposes. This affidavit is used to support a property owner's claim for various tax exemptions and reductions available to them as Texas residents. By designating a property as a homestead, owners can benefit from significant tax breaks, such as the Homestead Exemption, which lowers the property's taxable value. This exemption can lead to substantial savings on property taxes. Additionally, it offers protection against certain creditor actions and a limitation on annual property tax increases. The Killeen Texas Tax Affidavit Designation Other Property as Homestead Property is applicable to different types of properties, including residential homes, condos, mobile homes, and even certain rental properties. Property owners must meet certain qualifications to be eligible for homestead designation, such as being a legal resident of Texas and occupying the property as their primary residence. To complete the affidavit, property owners need to provide various details, including the property's address, their name, contact information, social security number, and legal description of the property. They may also need to provide documents showing proof of residency, such as a driver's license or voter registration card. It is important to note that the Killeen Texas Tax Affidavit Designation Other Property as Homestead Property must be filed with the local county appraisal district office or the county tax assessor-collector office. These offices are responsible for evaluating property values, assessing tax liabilities, and administering exemptions. By designating property as a homestead through this affidavit, Killeen residents can take advantage of the numerous benefits and tax savings available to them. It is crucial for property owners to understand the requirements and guidelines associated with homestead designation to ensure they receive all eligible tax exemptions and protections. In conclusion, the Killeen Texas Tax Affidavit Designation Other Property as Homestead Property serves as a vital document for property owners in Killeen to declare and designate their property as a homestead for tax purposes. By completing this affidavit and meeting certain qualifications, property owners can enjoy tax savings, protection against creditors, and limited increases in property taxes. It is crucial for property owners to file the affidavit with the appropriate local offices to take advantage of these benefits.

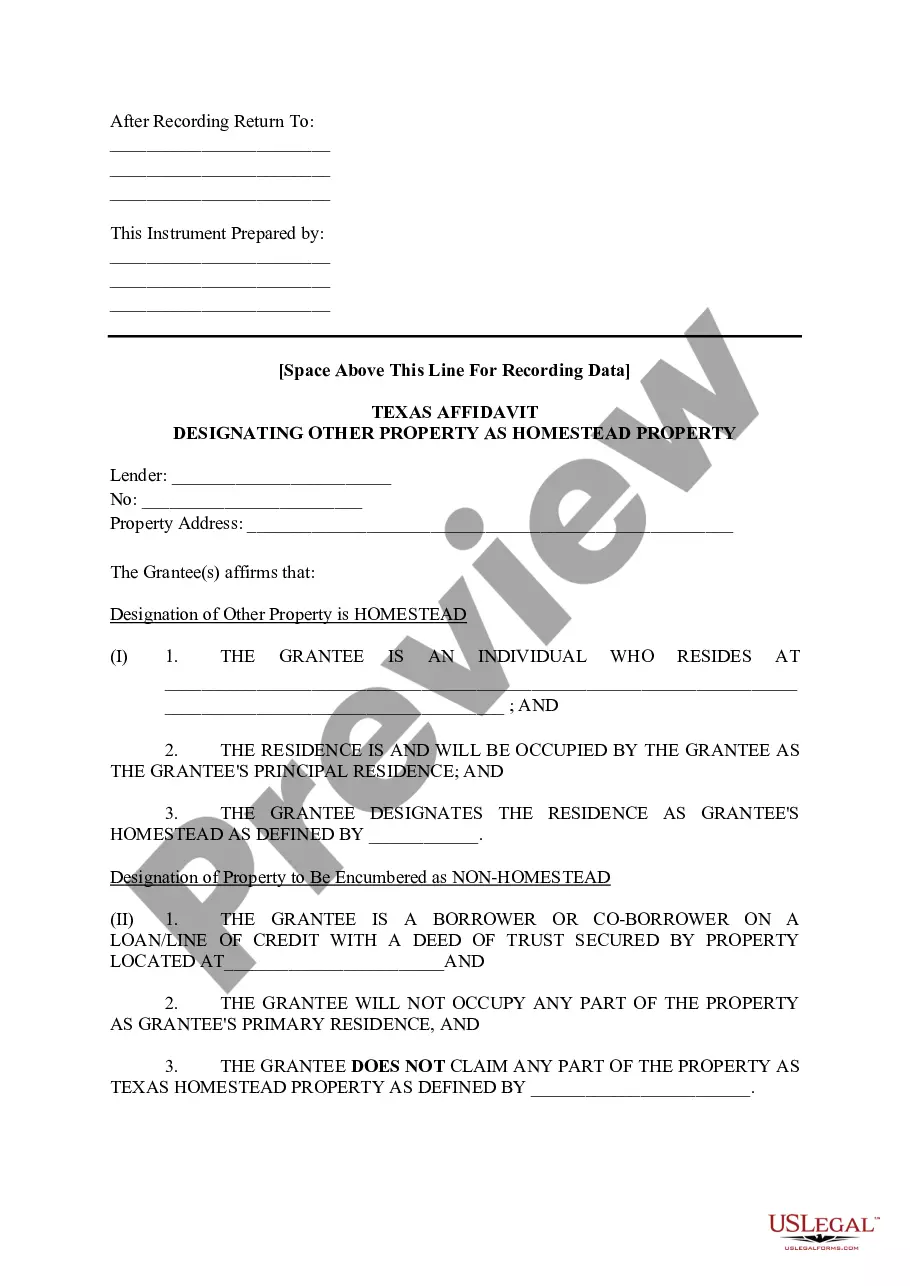

Killeen Texas Tax Affidavit Designation Other Property as Homestead Property

Description

How to fill out Killeen Texas Tax Affidavit Designation Other Property As Homestead Property?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Killeen Texas Tax Affidavit Designation Other Property as Homestead Property gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Killeen Texas Tax Affidavit Designation Other Property as Homestead Property takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Killeen Texas Tax Affidavit Designation Other Property as Homestead Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!