McAllen Texas Tax Affidavit Designation Other Property as Homestead Property is a legal process that allows homeowners to designate additional properties as their homestead in order to receive certain tax exemptions or benefits. This designation is applicable to properties located within McAllen, Texas, specifically. Homestead exemption provides property owners with a reduction in property taxes by exempting a portion of the property's assessed value from taxation. However, the primary residence is usually the only property eligible for this exemption. The McAllen Texas Tax Affidavit Designation Other Property as Homestead Property allows homeowners to extend this exemption to other qualifying properties they own. By designating additional properties as homestead, homeowners can save money on property taxes and protect their investment. It is important to note that not all properties are eligible for this designation. The property must meet certain criteria set by the state of Texas in order to qualify: 1. The homeowner must own and occupy the primary residence as of January 1st of the tax year. 2. The additional property being designated as homestead should not be generating rental income or used for business purposes. 3. The homeowner must file a McAllen Texas Tax Affidavit Designation Other Property as Homestead Property with the appropriate tax office, providing proof of ownership and residency. Benefits of this designation include a reduction in property taxes on the additional designated property, protection from creditor claims, and the ability to pass down the property to family members without losing the homestead exemption. It is important to consult with a tax professional or the local tax office to understand the specific requirements and process for designating other properties as homestead within McAllen, Texas. Each property may have its own unique considerations, so it is advisable to seek professional guidance. In conclusion, McAllen Texas Tax Affidavit Designation Other Property as Homestead Property allows homeowners in McAllen to extend the homestead exemption to additional qualifying properties they own, resulting in potential tax savings and other benefits.

McAllen Texas Tax Affidavit Designation Other Property as Homestead Property

Description

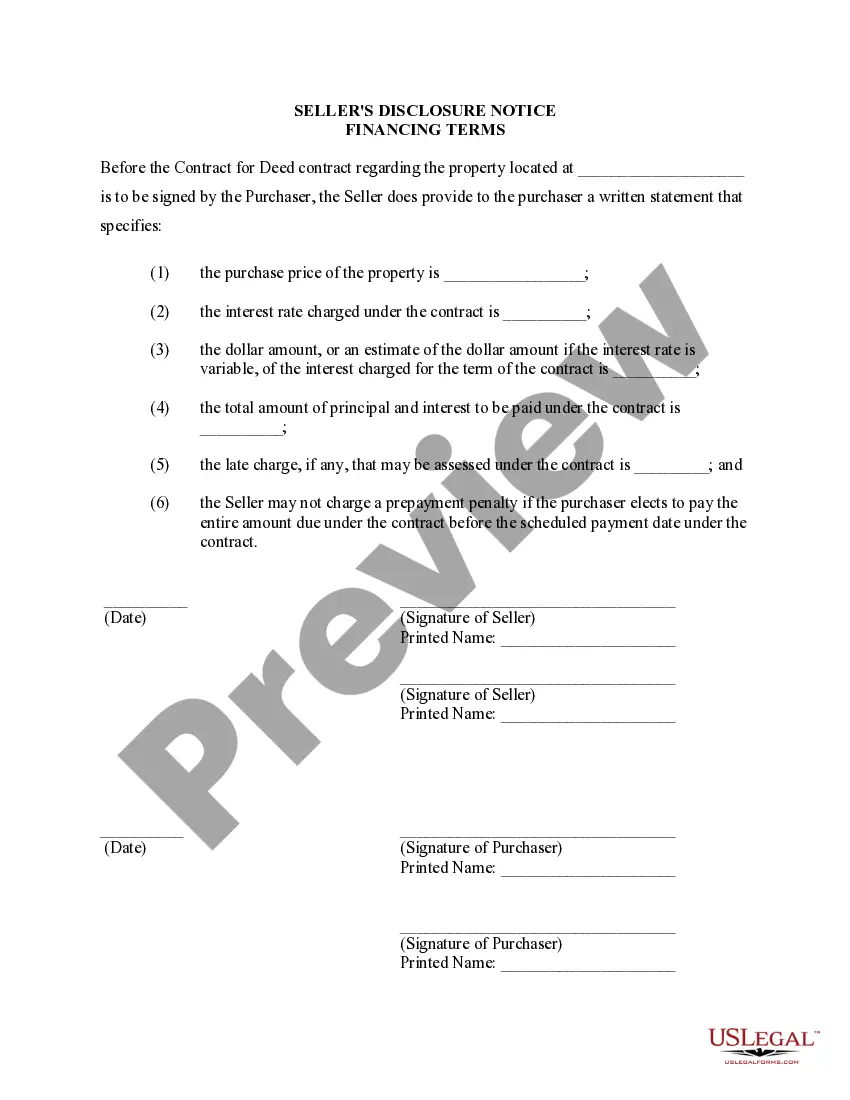

How to fill out McAllen Texas Tax Affidavit Designation Other Property As Homestead Property?

Take advantage of the US Legal Forms and gain instant access to any document you need.

Our efficient platform with a vast assortment of templates simplifies the process of locating and acquiring nearly any sample document you seek.

You can save, fill out, and validate the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property in just a few minutes instead of spending hours online trying to find the correct template.

Utilizing our catalog is an excellent method to enhance the security of your form submissions.

Additionally, you can locate all previously saved documents in the My documents section.

If you haven’t created an account yet, follow the instructions below.

- Our skilled attorneys frequently review all records to ensure that the forms are applicable to a specific state and adhere to the latest laws and regulations.

- How can you obtain the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property.

- If you have a subscription, simply Log In to your account. The Download button will show up on all templates you browse.

Form popularity

FAQ

Yes, having a homestead in Texas does lower property taxes as it grants the homeowner valuable exemptions. This reduction decreases the assessed value of the property, leading to lower tax amounts owed annually. By filing the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property, you can unlock these tax benefits efficiently. A lower property tax burden allows homeowners to allocate funds to other essential areas of their lives, enhancing overall financial stability.

The property ID for a homestead exemption is typically found on your county's appraisal district website, which details your property's unique identification number. This ID is vital when applying for exemptions like the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property, as it links your application to your specific property. Ensuring you have the correct property ID streamlines the exemption process and enhances your chances of receiving the exemption. Always check with your local appraisal district for accurate information.

A property becomes a homestead in Texas when it serves as the owner's primary residence and meets specific criteria set by state law. The owner must occupy the home, establishing it as their everyday living space. Filing the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property further solidifies this status and provides essential protections. It is also crucial to note that only one homestead designation is allowed per household at any given time.

In Texas, a homestead is typically a single-family home, a manufactured home, or a condominium that serves as the primary residence of the owner. To qualify, the property must be used for residential purposes, and the homeowner must occupy it. When you submit the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property, you confirm such qualifications. This process not only helps protect your home but also opens the door to valuable tax benefits.

Under the Texas Property Code, the designation of homestead protects your home from forced sale and creditors, except in specific cases like unpaid taxes. This designation also allows homeowners to enjoy tax exemptions when they file the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property. The law defines a homestead as a residence occupied by its owner, which can include a portion of the land surrounding the home. Understanding these regulations can empower homeowners to safeguard their investment.

Seniors in Texas can qualify for property tax exemptions at the age of 65 or older, which can significantly lower their property tax liabilities. This exemption applies once you file the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property. However, it's crucial to understand that they will not be entirely exempt from paying property taxes; the exemptions simply lessen the overall amount owed. By filing for these exemptions, seniors can enjoy financial relief.

In Texas, a homestead exemption can significantly reduce your property taxes. The exemption may save you hundreds of dollars annually, depending on your property's assessed value. When you file the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property, you make sure to take advantage of these savings. Knowing the specific amount you can save helps you budget better for your annual expenses.

The new law for homestead exemption in Texas expands the eligibility criteria and streamlines the application process for homeowners. It aims to reduce paperwork and enhance accessibility for claiming exemptions. Homeowners interested in designating properties using the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property will find this law particularly beneficial for leveraging their property’s value.

To designate a homestead in Texas, you typically need to file a homestead exemption application with your local appraisal district. This process often requires relevant documents, such as proof of identity and property ownership. By correctly completing this procedure, including the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property, you can maximize the benefits associated with homesteading.

Yes, homestead properties fall under the exemptions outlined in Texas Property Code, providing significant protection against creditors and tax benefits. These exemptions are designed to help maintain stability for homeowners. Understanding the specifics of the McAllen Texas Tax Affidavit Designation Other Property as Homestead Property allows Texans to make informed decisions regarding their property status.