Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property is an important aspect of tax filing in the region. This designation allows homeowners to claim their properties as homesteads for tax purposes, providing certain benefits and exemptions. Let's explore this topic in detail and understand the different types of designations available: What is a Tax Affidavit Designation Other Property as Homestead Property? In Sugar Land, Texas, a Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners to declare a property as their primary residence for tax considerations, even if it is not their primary homestead. This designation offers various tax advantages such as deductions, exemptions, and lowered property tax rates, similar to those provided to primary homestead properties. Benefits of Tax Affidavit Designation Other Property as Homestead Property: 1. Property Tax Exemptions: By designating a property as a homestead, eligible homeowners can receive exemptions that reduce their property tax liability. These exemptions can include school district taxes, county taxes, and even state taxes. 2. Lowered Tax Rates: Homestead designations often ensure a decreased tax rate on the property, resulting in significant savings for the homeowner. 3. Protection Against Creditor Claims: Designating a property as a homestead offers a level of protection against creditor claims, providing vital security to homeowners during financial crises. Types of Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property: 1. Primary Homestead Property: This is the most common designation where a property serves as the owner's primary residence, and they receive the maximum exemptions and benefits available. 2. Seasonal/Vacation Property: This type of designation is applicable when the property isn't the primary residence but is used as a seasonal or vacation home for the homeowner. It allows for certain exemptions and benefits, but they may vary from those provided to primary homestead properties. 3. Rental Property: In some cases, property owners who occasionally rent out a property they own also have the option to designate it as a homestead property, albeit with potential limitations on exemptions. However, specific guidelines and restrictions might apply, so consulting with a tax professional is crucial. 4. Elderly/Disabled Homestead: Sugar Land, Texas provides additional exemptions and benefits to elderly or disabled homeowners who designate a property as a homestead. These individuals can enjoy increased deductions, lowered taxes, and enhanced protection. 5. Second/Additional Home: If a property owner possesses multiple properties and one of them serves as their primary homestead, they can designate other properties as homestead properties too. However, the benefits and exemptions might differ from those available to primary homestead properties. In conclusion, Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property enables property owners to leverage tax advantages for properties that are not their primary residences. Whether it's a seasonal home, rental property, or an additional dwelling, understanding the various types of designations and the associated benefits is crucial for homeowners in this region. It is advisable to consult with a qualified tax professional or the local tax authority for precise guidelines and eligibility criteria pertaining to Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property.

Sugar Land Texas Tax Affidavit Designation Other Property as Homestead Property

Category:

State:

Texas

City:

Sugar Land

Control #:

TX-LR052T

Format:

Word;

Rich Text

Instant download

Description

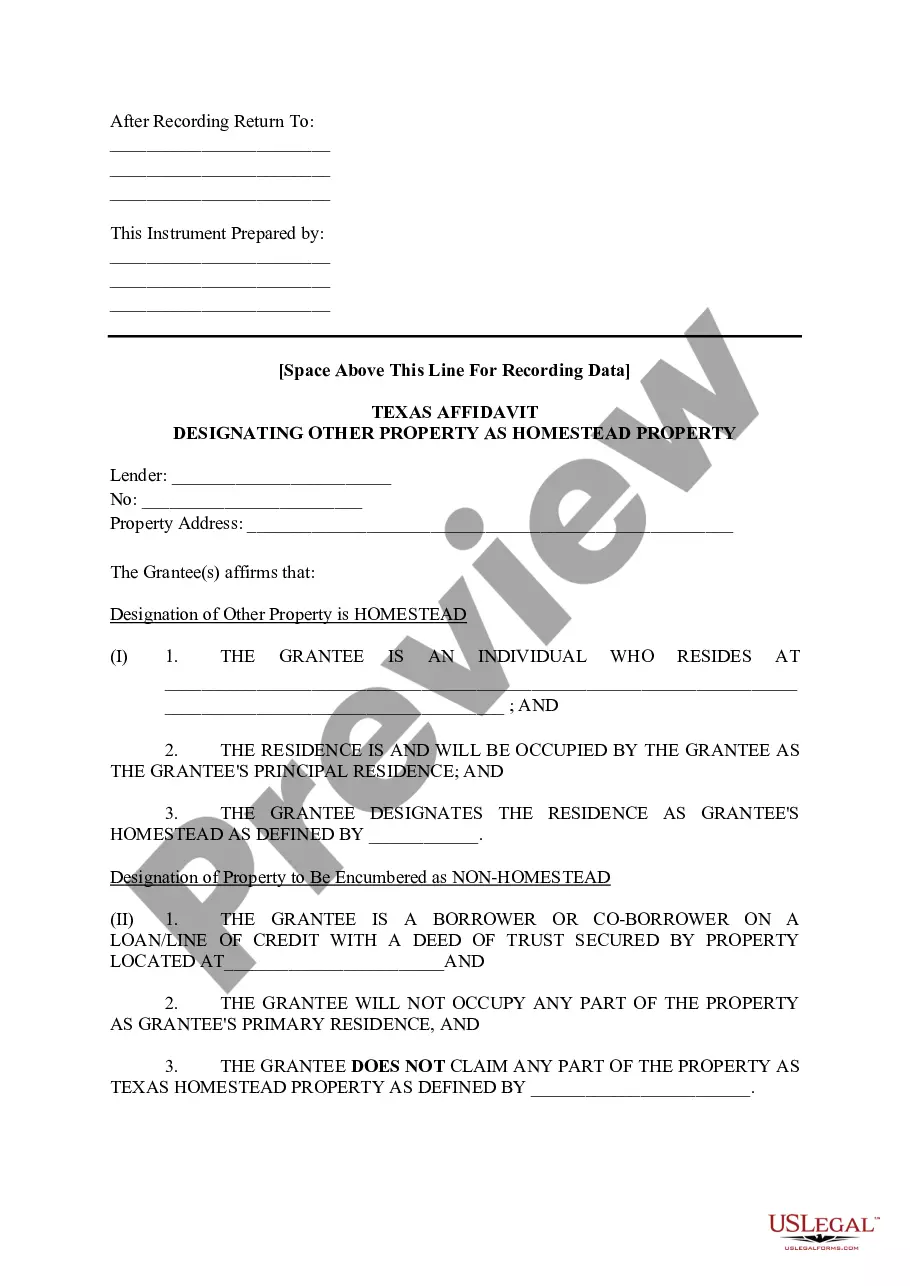

This affidavit is used to designate another property as legal Homestead Property as defined by Texas Law and list the location of non-homestead property.

Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property is an important aspect of tax filing in the region. This designation allows homeowners to claim their properties as homesteads for tax purposes, providing certain benefits and exemptions. Let's explore this topic in detail and understand the different types of designations available: What is a Tax Affidavit Designation Other Property as Homestead Property? In Sugar Land, Texas, a Tax Affidavit Designation Other Property as Homestead Property is a legal document that allows property owners to declare a property as their primary residence for tax considerations, even if it is not their primary homestead. This designation offers various tax advantages such as deductions, exemptions, and lowered property tax rates, similar to those provided to primary homestead properties. Benefits of Tax Affidavit Designation Other Property as Homestead Property: 1. Property Tax Exemptions: By designating a property as a homestead, eligible homeowners can receive exemptions that reduce their property tax liability. These exemptions can include school district taxes, county taxes, and even state taxes. 2. Lowered Tax Rates: Homestead designations often ensure a decreased tax rate on the property, resulting in significant savings for the homeowner. 3. Protection Against Creditor Claims: Designating a property as a homestead offers a level of protection against creditor claims, providing vital security to homeowners during financial crises. Types of Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property: 1. Primary Homestead Property: This is the most common designation where a property serves as the owner's primary residence, and they receive the maximum exemptions and benefits available. 2. Seasonal/Vacation Property: This type of designation is applicable when the property isn't the primary residence but is used as a seasonal or vacation home for the homeowner. It allows for certain exemptions and benefits, but they may vary from those provided to primary homestead properties. 3. Rental Property: In some cases, property owners who occasionally rent out a property they own also have the option to designate it as a homestead property, albeit with potential limitations on exemptions. However, specific guidelines and restrictions might apply, so consulting with a tax professional is crucial. 4. Elderly/Disabled Homestead: Sugar Land, Texas provides additional exemptions and benefits to elderly or disabled homeowners who designate a property as a homestead. These individuals can enjoy increased deductions, lowered taxes, and enhanced protection. 5. Second/Additional Home: If a property owner possesses multiple properties and one of them serves as their primary homestead, they can designate other properties as homestead properties too. However, the benefits and exemptions might differ from those available to primary homestead properties. In conclusion, Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property enables property owners to leverage tax advantages for properties that are not their primary residences. Whether it's a seasonal home, rental property, or an additional dwelling, understanding the various types of designations and the associated benefits is crucial for homeowners in this region. It is advisable to consult with a qualified tax professional or the local tax authority for precise guidelines and eligibility criteria pertaining to Sugar Land, Texas Tax Affidavit Designation Other Property as Homestead Property.

Free preview

How to fill out Sugar Land Texas Tax Affidavit Designation Other Property As Homestead Property?

If you’ve already utilized our service before, log in to your account and save the Sugar Land Texas Tax Affidavit Designation Other Property as Homestead Property on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Sugar Land Texas Tax Affidavit Designation Other Property as Homestead Property. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!