This detailed sample Abstract of Judgment complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

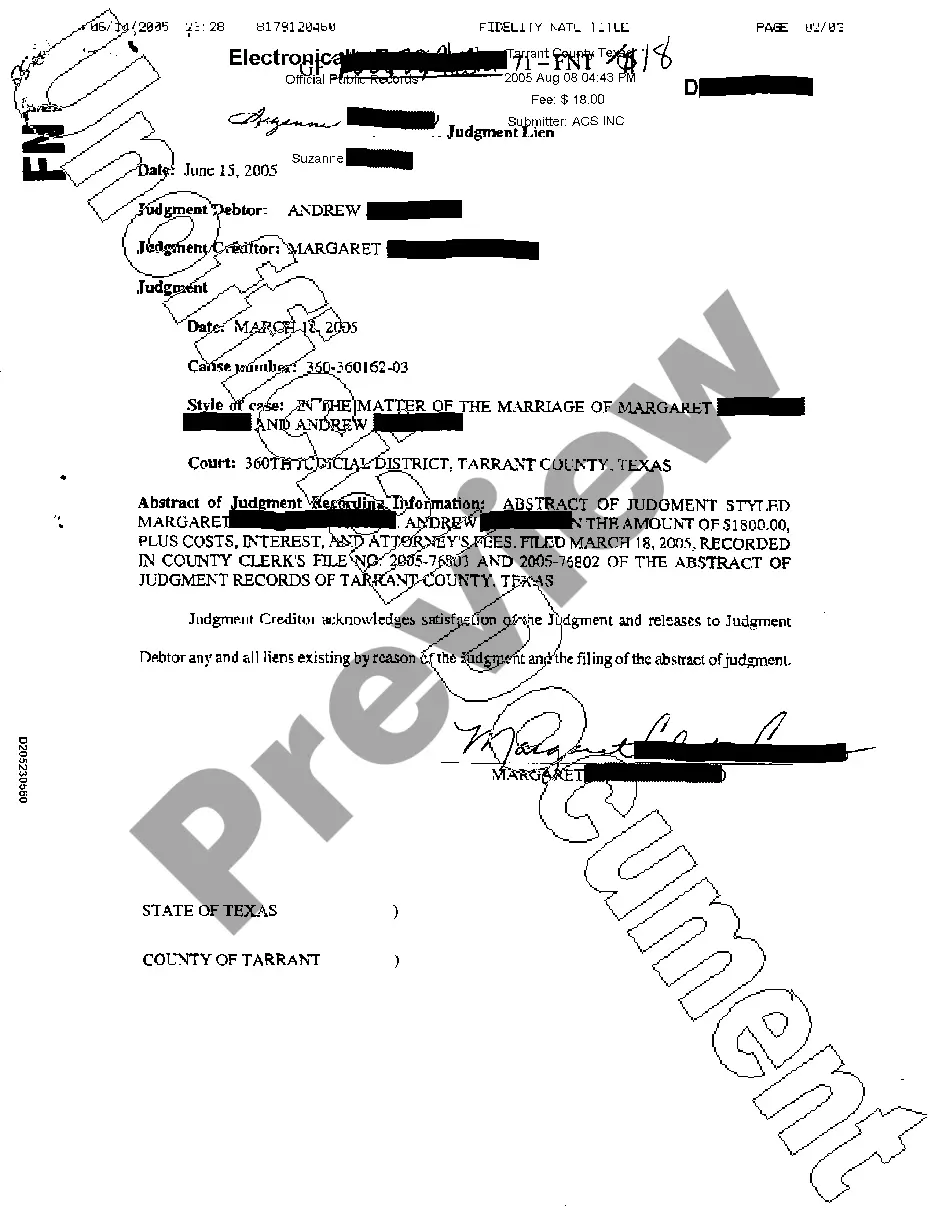

The Houston Texas Abstract of Judgment is a legal document that serves as a formal record of a court's judgment in a civil case. It is commonly used to enforce and collect debts owed by a party that has failed to satisfy their court-awarded obligation. This abstract acts as a lien on any property owned by the judgment debtor in the county where it is filed, ensuring that the debt is satisfied. When an abstract of judgment is filed in Houston, it creates a public record that alerts potential creditors and interested parties about the debtor's outstanding debt. The abstract includes essential details such as the names of the parties involved in the case, the court where the judgment was issued, the amount owed, and the date of the judgment. By filing the abstract, the judgment creditor aims to secure their rights to collect the debt owed to them if the debtor possesses any real estate or personal property in that specific county. In Houston, there are different types of abstracts of judgment that can be filed, depending on the situation and the nature of the debt. Some common types include: 1. Regular Abstract of Judgment: This is the standard form of abstract that is filed to create a lien on the debtor's property in the county where it is recorded. It is generally used for general creditor-debtor situations. 2. Child Support Abstract of Judgment: This type of abstract is filed when the judgment arises from unpaid child support obligations. It allows the custodial parent or the child support agency to enforce the judgment and potentially intercept the debtor's income or seize their property. 3. IRS (Internal Revenue Service) Abstract of Judgment: If the judgment is related to unpaid federal taxes, the IRS has the authority to file an abstract of judgment, creating a priority lien against the debtor's property in the county. This ensures that the debt owed to the IRS is prioritized over other debts. The Houston Texas Abstract of Judgment is a crucial tool for creditors who seek to protect their interests and collect a court-awarded debt. By creating a public record and securing a lien on the debtor's property, the abstract increases the likelihood of debt satisfaction. However, it is important to consult legal professionals or local authorities to fully understand the specific requirements and regulations surrounding abstracts of judgment in Houston.The Houston Texas Abstract of Judgment is a legal document that serves as a formal record of a court's judgment in a civil case. It is commonly used to enforce and collect debts owed by a party that has failed to satisfy their court-awarded obligation. This abstract acts as a lien on any property owned by the judgment debtor in the county where it is filed, ensuring that the debt is satisfied. When an abstract of judgment is filed in Houston, it creates a public record that alerts potential creditors and interested parties about the debtor's outstanding debt. The abstract includes essential details such as the names of the parties involved in the case, the court where the judgment was issued, the amount owed, and the date of the judgment. By filing the abstract, the judgment creditor aims to secure their rights to collect the debt owed to them if the debtor possesses any real estate or personal property in that specific county. In Houston, there are different types of abstracts of judgment that can be filed, depending on the situation and the nature of the debt. Some common types include: 1. Regular Abstract of Judgment: This is the standard form of abstract that is filed to create a lien on the debtor's property in the county where it is recorded. It is generally used for general creditor-debtor situations. 2. Child Support Abstract of Judgment: This type of abstract is filed when the judgment arises from unpaid child support obligations. It allows the custodial parent or the child support agency to enforce the judgment and potentially intercept the debtor's income or seize their property. 3. IRS (Internal Revenue Service) Abstract of Judgment: If the judgment is related to unpaid federal taxes, the IRS has the authority to file an abstract of judgment, creating a priority lien against the debtor's property in the county. This ensures that the debt owed to the IRS is prioritized over other debts. The Houston Texas Abstract of Judgment is a crucial tool for creditors who seek to protect their interests and collect a court-awarded debt. By creating a public record and securing a lien on the debtor's property, the abstract increases the likelihood of debt satisfaction. However, it is important to consult legal professionals or local authorities to fully understand the specific requirements and regulations surrounding abstracts of judgment in Houston.