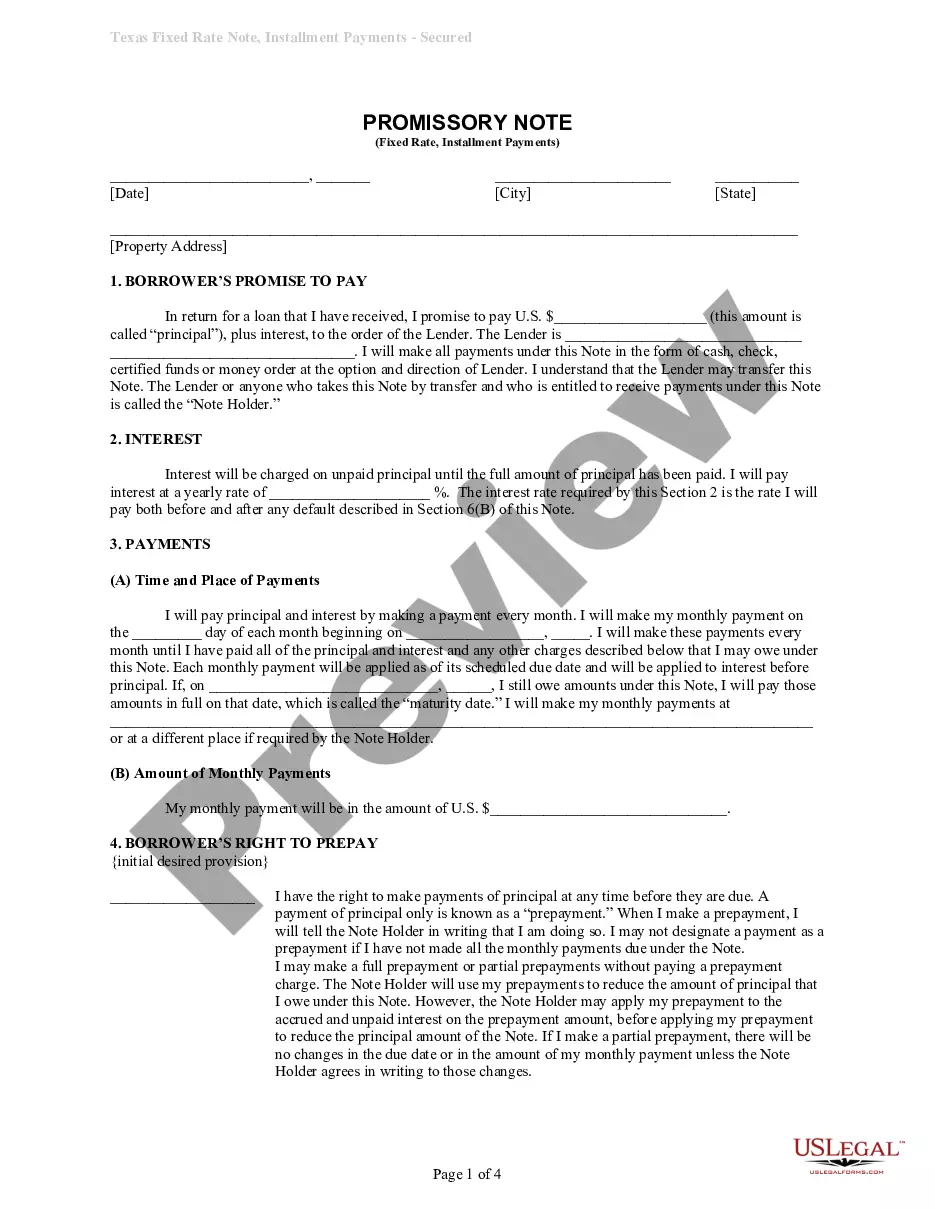

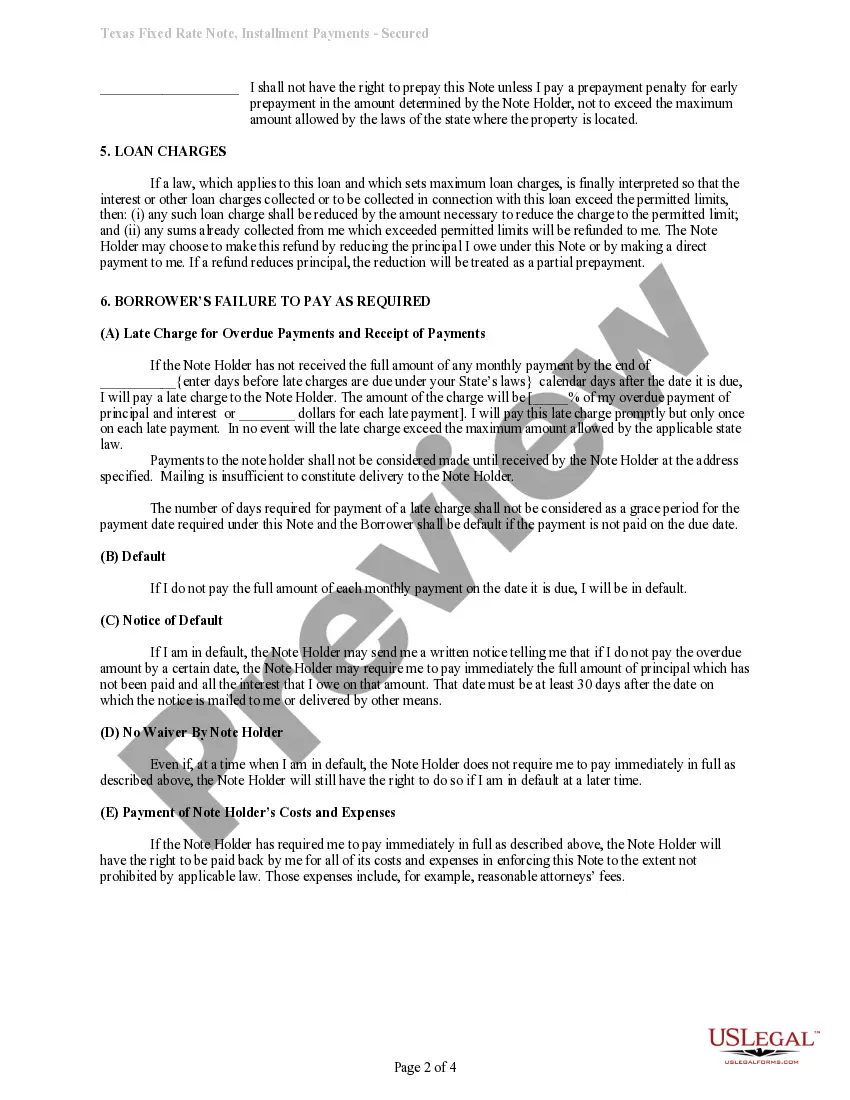

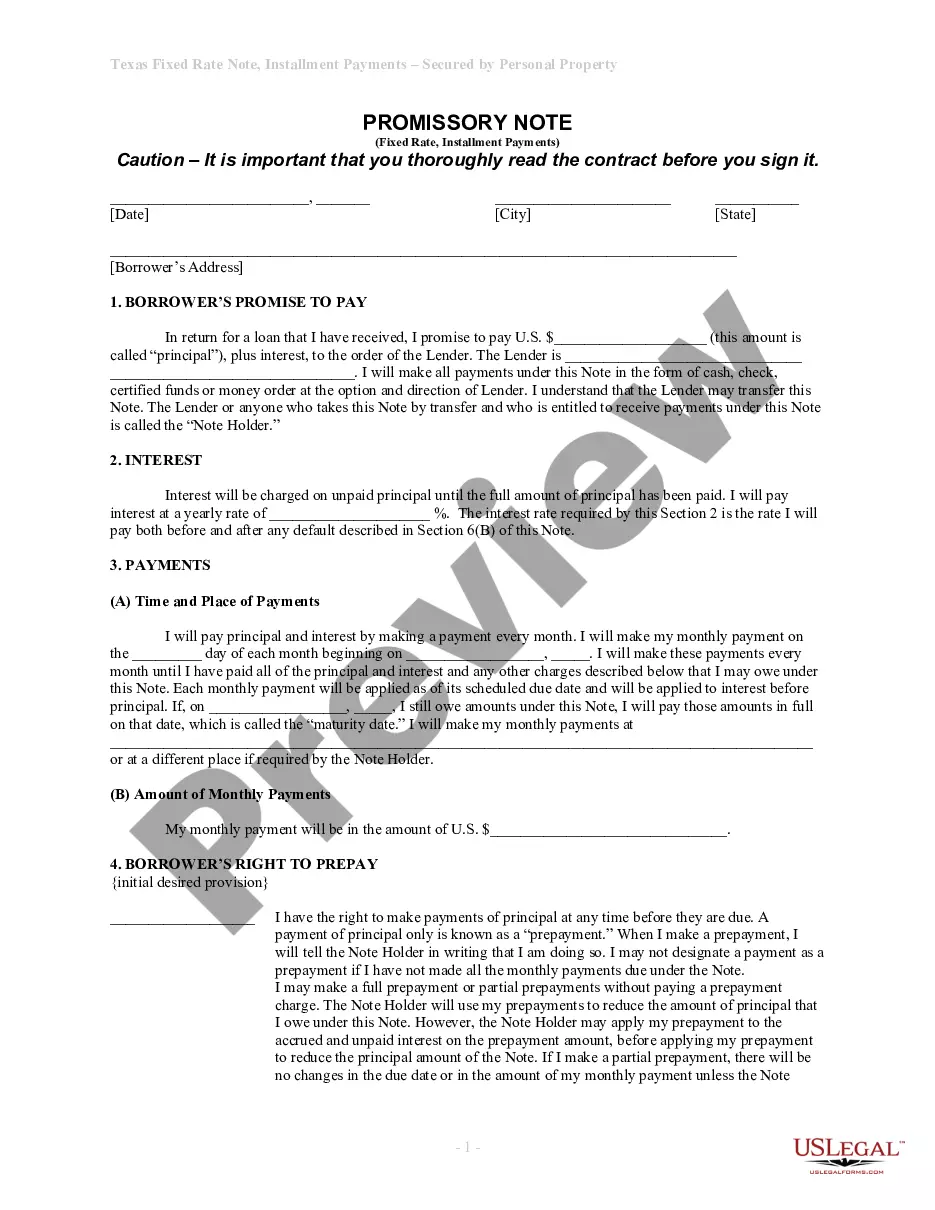

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are in search of a legitimate document, it’s incredibly challenging to discover a superior location than the US Legal Forms site – likely the most comprehensive collections on the internet.

Here you can locate a vast array of document samples for commercial and personal use categorized by types and regions, or keywords.

Using our sophisticated search feature, locating the most current Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3.

Obtain the document. Specify the format and download it to your device.

Make modifications. Complete, alter, print, and sign the obtained Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to Log In to your account and hit the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions provided below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature to view its content. If it doesn’t satisfy your requirements, employ the Search option at the top of the screen to find the suitable document.

- Verify your selection. Click on the Buy now button. Subsequently, choose the desired pricing plan and enter information to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the registration procedure.

Form popularity

FAQ

Promissory notes are indeed legally binding in Texas, provided they comply with state laws. The document must clearly outline the repayment terms, the parties involved, and any applicable interest rates. Utilizing resources like US Legal Forms can help you create a reliable Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate that meets all legal requirements, safeguarding your investment.

Yes, a properly structured promissory note can hold up in a court of law in Texas. Courts typically honor the terms specified in the document, provided they are clear and agreed upon by both parties. To enhance your chances of success, it’s wise to use a legally sound template for your Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, which is available through platforms like US Legal Forms.

Several factors can render a promissory note invalid in Texas. If it lacks necessary components such as the principal amount, interest rate, or signatures, it may be considered unenforceable. In addition, if the terms are ambiguous or if it involves illegal consideration, the note may not hold up. For crafting a solid Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, using US Legal Forms can help ensure your document meets all legal standards.

Yes, a promissory note is legally binding in Texas when it meets certain requirements. To ensure its enforceability, it must include essential elements such as clear terms, signatures from both parties, and a specified repayment plan. You can navigate this process smoothly with resources like US Legal Forms, which provides templates and guidance specifically for creating a Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Yes, a promissory note can be secured, meaning it is backed by collateral. This collateral, like residential real estate in Mesquite, Texas, provides the lender with assurance in case the borrower defaults. Using a residential property increases the security of the note, and USLegalForms offers templates to help you create a Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate efficiently.

Writing a simple promissory note involves stating the total amount borrowed, the payback terms, and the date by which repayment will occur. Keep the language straightforward and clear to avoid confusion. Look into USLegalForms for guidance on writing a Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, as they provide easily customizable templates.

Typically, you do not need to file a promissory note with the county clerk's office. Instead, it is essential to keep it in a safe place. For a Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure you maintain a copy with any additional documents related to the property for your records and future reference.

You can obtain a promissory note for your mortgage through various channels including banks, credit unions, or legal document service providers. Platforms like US Legal Forms offer templates and guidance to help you create a valid Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate that meets your needs. This can simplify your mortgage process and ensure compliance with local laws.

The document that secures a promissory note to real property is commonly referred to as a mortgage or a deed of trust. This document establishes the lender's legal claim to the property if the borrower fails to fulfill the terms of the note. In the context of a Mesquite Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it provides peace of mind for lenders and facilitates the financing process for buyers.