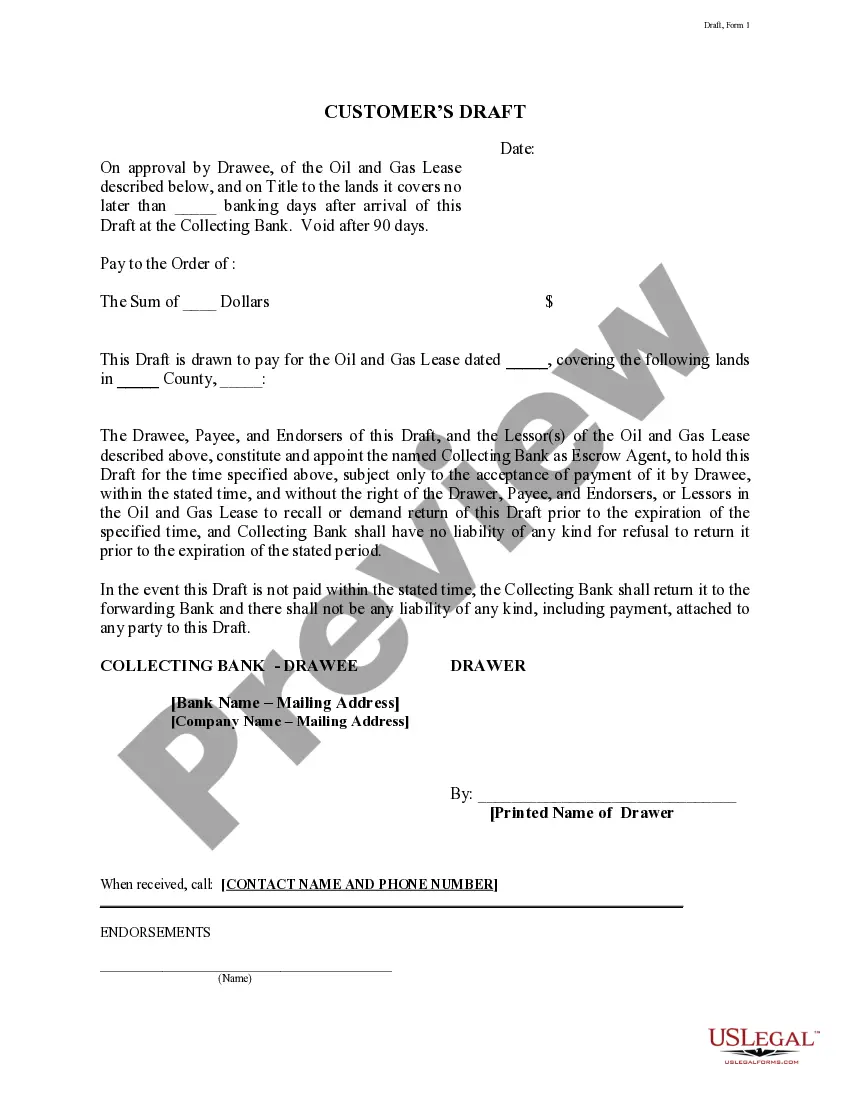

This form is a draft that is drawn to pay for an Oil and Gas Lease. The Drawee, Payee, and Endorsers of this Draft, and the Lessor(s) of the Oil and Gas Lease, constitute and appoint a Collecting Bank as Escrow Agent, to hold this Draft until the date specified.

Austin Texas Customer's Draft refers to a payment instrument issued by customers in Austin, Texas, to authorize the transfer of funds from their bank accounts to a designated recipient or payee. This form of payment is primarily used in local transactions, particularly for individuals or businesses within the Austin area. A customer's draft typically consists of a written document that includes specific details such as the name of the payer (customer), the amount to be paid, the recipient's name, and any additional instructions or references. This document serves as a formal authorization for the payer's bank to debit the specified amount from the customer's account and credit it to the payee's account. The types of Austin Texas Customer's Draft may vary based on the nature of the transaction or the parties involved. These variations can include: 1. Personal Customer's Draft: This type is commonly used when an individual wishes to make a payment to another individual or a local business, such as paying rent, utility bills, or purchasing goods or services. 2. Business Customer's Draft: Primarily used for commercial transactions, this type of draft enables businesses to make payments to their suppliers, vendors, contractors, or other business partners within the Austin area. It offers a convenient form of payment that allows companies to maintain records and monitor their financial transactions. 3. Certified Customer's Draft: A certified draft is a type of customer's draft that has been authorized and guaranteed by the payer's bank. The bank certifies the availability of funds in the customer's account and places a stamp or mark on the document to validate its authenticity. This type of draft provides added security and ensures that the payment will be honored. 4. Electronic Customer's Draft: With the advent of online and digital banking, customers in Austin, Texas, may opt for electronic drafts, also known as e-drafts. This type of payment instrument allows customers to initiate transactions electronically, without the need for physical paper documents. The customer may access their online banking platform, specify the payment details, and authorize the transfer of funds to the designated recipient. In summary, Austin Texas Customer's Draft is a written payment instrument used by individuals and businesses in Austin, Texas, to authorize the transfer of funds from their bank accounts to a specified recipient or payee. Different types of drafts are available, including personal, business, certified, and electronic drafts, each catering to specific transactional needs and offering varied levels of security and convenience.Austin Texas Customer's Draft refers to a payment instrument issued by customers in Austin, Texas, to authorize the transfer of funds from their bank accounts to a designated recipient or payee. This form of payment is primarily used in local transactions, particularly for individuals or businesses within the Austin area. A customer's draft typically consists of a written document that includes specific details such as the name of the payer (customer), the amount to be paid, the recipient's name, and any additional instructions or references. This document serves as a formal authorization for the payer's bank to debit the specified amount from the customer's account and credit it to the payee's account. The types of Austin Texas Customer's Draft may vary based on the nature of the transaction or the parties involved. These variations can include: 1. Personal Customer's Draft: This type is commonly used when an individual wishes to make a payment to another individual or a local business, such as paying rent, utility bills, or purchasing goods or services. 2. Business Customer's Draft: Primarily used for commercial transactions, this type of draft enables businesses to make payments to their suppliers, vendors, contractors, or other business partners within the Austin area. It offers a convenient form of payment that allows companies to maintain records and monitor their financial transactions. 3. Certified Customer's Draft: A certified draft is a type of customer's draft that has been authorized and guaranteed by the payer's bank. The bank certifies the availability of funds in the customer's account and places a stamp or mark on the document to validate its authenticity. This type of draft provides added security and ensures that the payment will be honored. 4. Electronic Customer's Draft: With the advent of online and digital banking, customers in Austin, Texas, may opt for electronic drafts, also known as e-drafts. This type of payment instrument allows customers to initiate transactions electronically, without the need for physical paper documents. The customer may access their online banking platform, specify the payment details, and authorize the transfer of funds to the designated recipient. In summary, Austin Texas Customer's Draft is a written payment instrument used by individuals and businesses in Austin, Texas, to authorize the transfer of funds from their bank accounts to a specified recipient or payee. Different types of drafts are available, including personal, business, certified, and electronic drafts, each catering to specific transactional needs and offering varied levels of security and convenience.