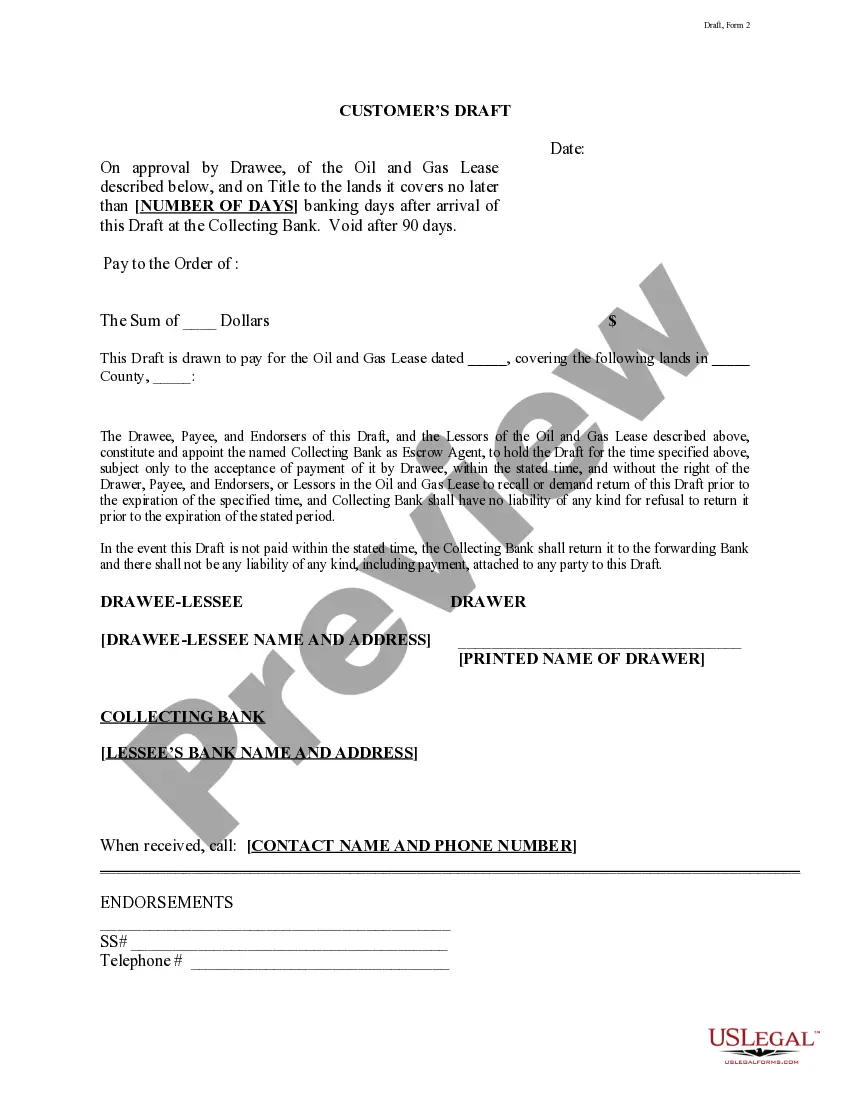

This form is a draft that is drawn to pay for an Oil and Gas Lease. The Drawee, Payee, and Endorsers of this Draft, and the Lessor(s) of the Oil and Gas Lease, constitute and appoint a Collecting Bank as Escrow Agent, to hold this Draft for the number of days specified.

Austin Texas Customer's Draft is a financial instrument that is specifically used for the purpose of transferring funds. It is issued by a customer of a financial institution, typically a bank, to authorize the institution to pay a certain amount of money to a specified recipient. The draft serves as a written order from the customer to the financial institution, instructing them to pay the designated amount to the recipient. There are different types of Austin Texas Customer's Drafts, such as demand drafts and time drafts. A demand draft, also known as a sight draft, is payable on demand, meaning that it must be paid immediately upon presentation to the financial institution. This type of draft is commonly used for making immediate payments, and it ensures that the funds are available upfront. On the other hand, a time draft, also referred to as a date draft, has a specified date in the future when the payment becomes due. It allows the recipient of the draft to receive the funds at a later date, providing some flexibility in terms of timing. These drafts are often utilized in various commercial transactions where payment terms are agreed upon in advance. Austin Texas Customer's Drafts are typically used for a variety of purposes, including bill payments, transfer of funds between accounts, payment for goods or services, and loans. They provide a secure and traceable method of transferring funds, ensuring that the payment is made accurately to the intended recipient. Overall, Austin Texas Customer's Draft is a financial tool that facilitates the transfer of funds from a customer to a designated recipient through written instructions issued to a financial institution.