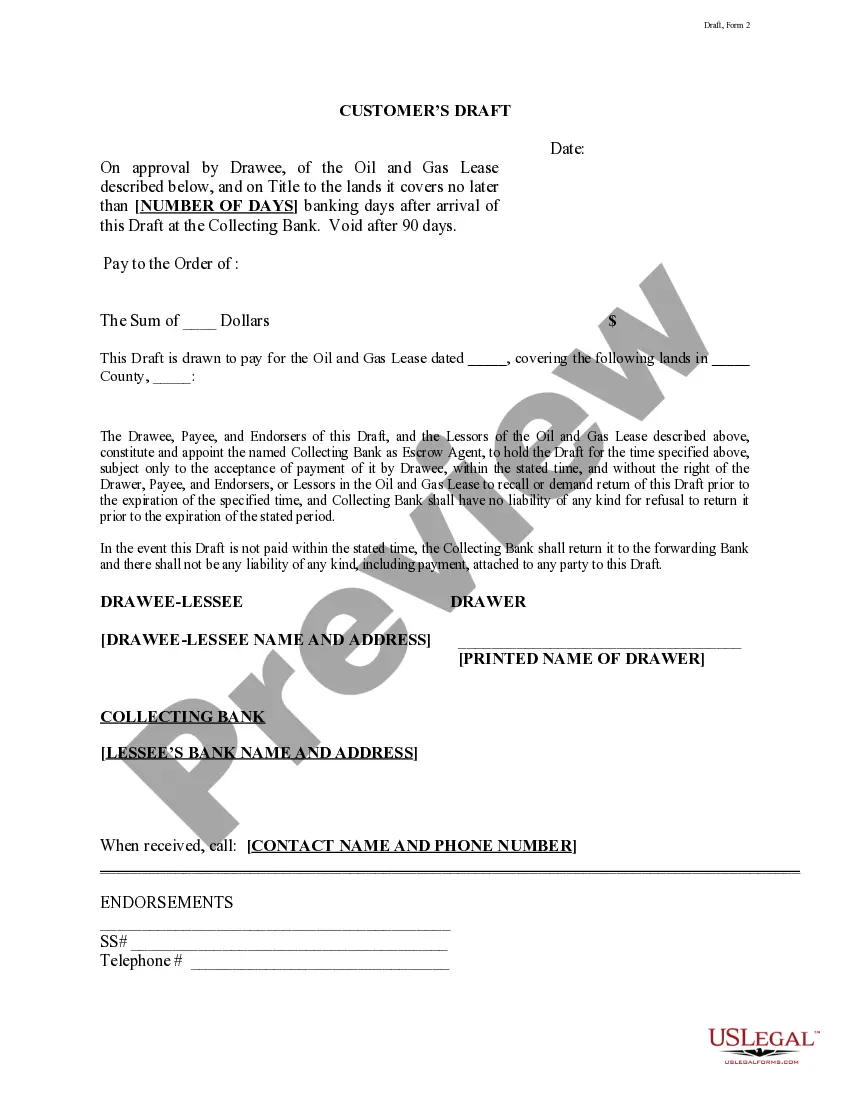

This form is a draft that is drawn to pay for an Oil and Gas Lease. The Drawee, Payee, and Endorsers of this Draft, and the Lessor(s) of the Oil and Gas Lease, constitute and appoint a Collecting Bank as Escrow Agent, to hold this Draft for the number of days specified.

Fort Worth Texas Customer's Draft is a financial instrument used by customers in the Fort Worth, Texas area to make payment transactions to businesses or individuals. It is essentially a type of check that has been pre-approved by the customer's bank. The draft can be created by an account holder at any bank, and it represents an order to the bank to pay a certain amount of money to the designated recipient. A Fort Worth Texas Customer's Draft is similar to a regular check, but it carries a higher level of assurance for the recipient. When issuing the draft, the customer's bank verifies that the funds are available in the customer's account and sets them aside for the payment. This step helps to minimize the risk of non-sufficient funds (NSF) and ensures that the recipient will receive the amount specified on the draft. There are different types of Fort Worth Texas Customer's Drafts available, depending on the specific requirements of the customer. These may include: 1. Personal Draft: This type of draft is issued by an individual for personal payments, such as rent, utility bills, or online purchases. It is commonly used for recurring payments or one-time transactions. 2. Business Draft: Businesses utilize this type of draft to process various financial transactions, such as payroll, vendor payments, or loan disbursements. It operates similarly to a personal draft but is specific to commercial purposes. 3. Cashier's Draft: Also known as a bank draft, this type of Fort Worth Texas Customer's Draft is issued by the customer's bank directly. It guarantees the payment as the funds are drawn from the bank's account, not the customer's account. Cashier's drafts are often used for larger transactions, such as real estate purchases or high-value services. 4. Certified Draft: A certified draft goes through an additional verification step compared to regular drafts. The bank certifies that the customer's signature and available funds are valid. It assures the recipient that the draft is genuine and that payment will be made. Fort Worth Texas Customer's Drafts are widely accepted by businesses and individuals in the local region as a secure and convenient form of payment. They provide a level of assurance in financial transactions and help to ensure that payments are honored promptly.Fort Worth Texas Customer's Draft is a financial instrument used by customers in the Fort Worth, Texas area to make payment transactions to businesses or individuals. It is essentially a type of check that has been pre-approved by the customer's bank. The draft can be created by an account holder at any bank, and it represents an order to the bank to pay a certain amount of money to the designated recipient. A Fort Worth Texas Customer's Draft is similar to a regular check, but it carries a higher level of assurance for the recipient. When issuing the draft, the customer's bank verifies that the funds are available in the customer's account and sets them aside for the payment. This step helps to minimize the risk of non-sufficient funds (NSF) and ensures that the recipient will receive the amount specified on the draft. There are different types of Fort Worth Texas Customer's Drafts available, depending on the specific requirements of the customer. These may include: 1. Personal Draft: This type of draft is issued by an individual for personal payments, such as rent, utility bills, or online purchases. It is commonly used for recurring payments or one-time transactions. 2. Business Draft: Businesses utilize this type of draft to process various financial transactions, such as payroll, vendor payments, or loan disbursements. It operates similarly to a personal draft but is specific to commercial purposes. 3. Cashier's Draft: Also known as a bank draft, this type of Fort Worth Texas Customer's Draft is issued by the customer's bank directly. It guarantees the payment as the funds are drawn from the bank's account, not the customer's account. Cashier's drafts are often used for larger transactions, such as real estate purchases or high-value services. 4. Certified Draft: A certified draft goes through an additional verification step compared to regular drafts. The bank certifies that the customer's signature and available funds are valid. It assures the recipient that the draft is genuine and that payment will be made. Fort Worth Texas Customer's Drafts are widely accepted by businesses and individuals in the local region as a secure and convenient form of payment. They provide a level of assurance in financial transactions and help to ensure that payments are honored promptly.