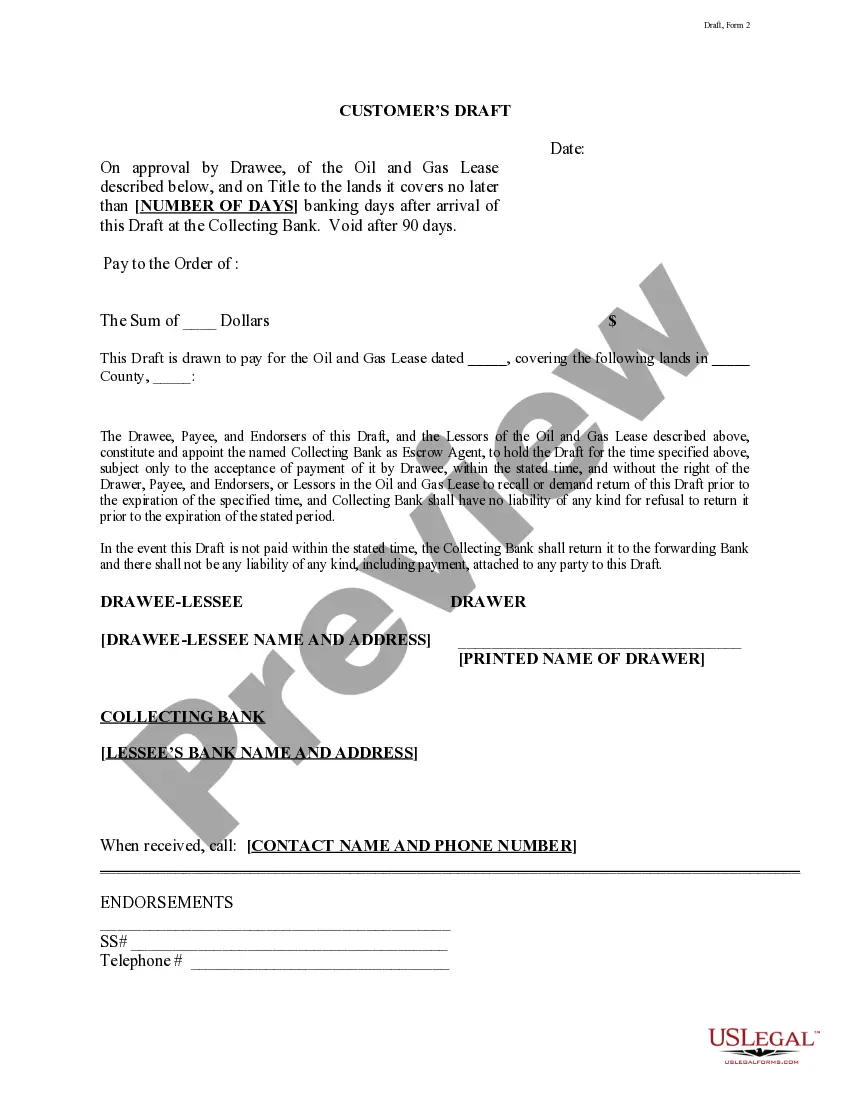

This form is a draft that is drawn to pay for an Oil and Gas Lease. The Drawee, Payee, and Endorsers of this Draft, and the Lessor(s) of the Oil and Gas Lease, constitute and appoint a Collecting Bank as Escrow Agent, to hold this Draft for the number of days specified.

The Harris Texas Customer's Draft is a vital document that plays a significant role in the business world. It is an essential tool used in financial transactions and serves as a legal instrument for making payments. The Harris Texas Customer's Draft serves as a written order from a customer to a bank, typically drawn on a specific account, to pay a specific amount of money to a designated recipient. This payment method is widely utilized in various industries, including trade, commerce, and even personal transactions. There are several types of Harris Texas Customer's Drafts available, each designed to cater to different needs. Some common types include: 1. Regular Harris Texas Customer's Draft: This is the most basic form of a draft, where a customer issues a written order to their bank to transfer a specific amount of money from their account to another party's account. It is widely used for one-time transactions or occasional payments. 2. Standing Harris Texas Customer's Draft: This type of draft is often established for recurring payments, such as monthly bills or subscriptions. The customer authorizes their bank to withdraw a fixed amount of money at regular intervals and pay it to a designated recipient. 3. Banker's Harris Texas Customer's Draft: In this case, the bank itself issues the draft on behalf of the customer. The bank guarantees the payment, taking responsibility for the payment instead of the customer. This type of draft is often utilized when a customer doesn't have the required funds to make a payment, but the bank trusts their creditworthiness. 4. Electronic Harris Texas Customer's Draft: With the advancement of technology, electronic drafts have gained popularity. This type of draft involves sending payment instructions electronically, rather than using traditional paper-based drafts. It offers convenience and efficiency for both customers and banks. The Harris Texas Customer's Draft is a secure payment method as it requires the customer's signature or authorization. It provides protection against unauthorized payments and ensures that funds are transferred securely. Additionally, it serves as a valuable record of the transaction, aiding in financial management and record-keeping. In conclusion, the Harris Texas Customer's Draft is an indispensable financial tool used for various payment transactions. Its different types cater to different needs, providing flexibility and convenience in managing financial obligations. Whether it is a regular, standing, banker's, or electronic draft, this payment method remains an essential part of businesses and individuals alike, ensuring smooth and secure financial transactions.