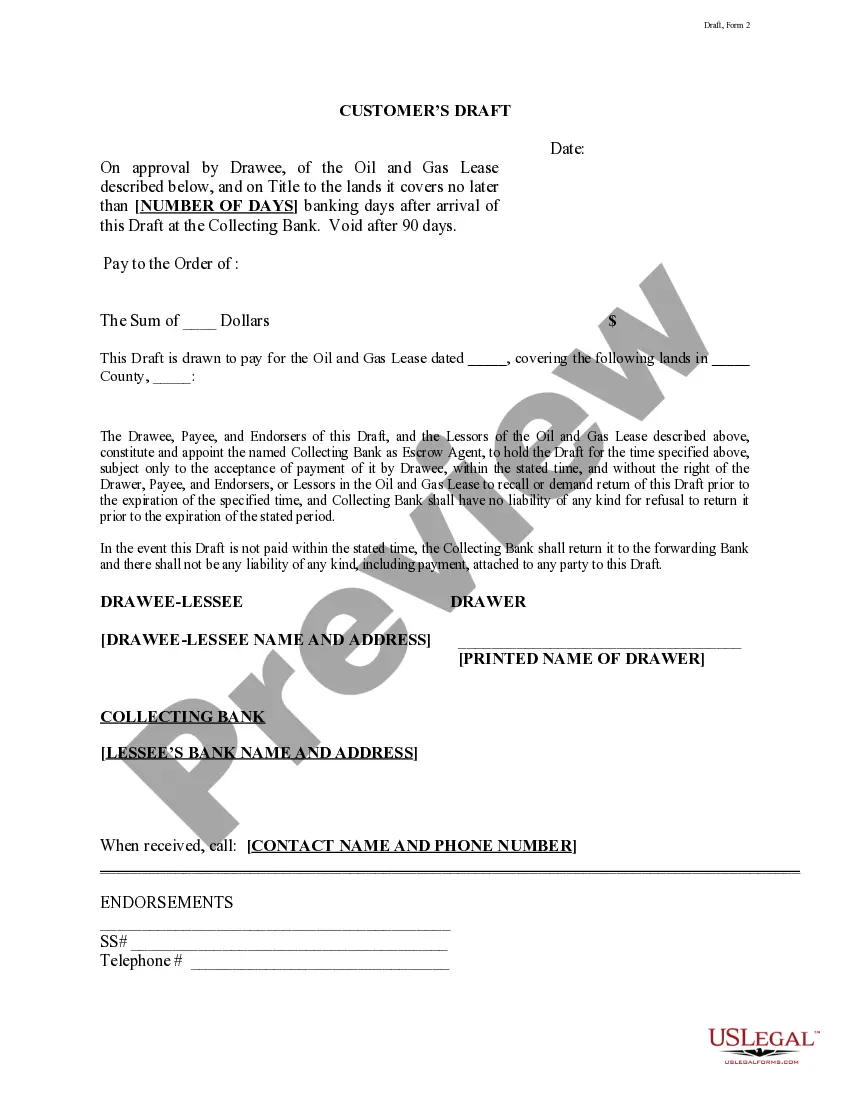

This form is a draft that is drawn to pay for an Oil and Gas Lease. The Drawee, Payee, and Endorsers of this Draft, and the Lessor(s) of the Oil and Gas Lease, constitute and appoint a Collecting Bank as Escrow Agent, to hold this Draft for the number of days specified.

Houston Texas Customer's Draft is a type of financial instrument that allows customers in Houston, Texas to issue payments to individuals or businesses. It is essentially a written order from the customer instructing their bank to pay a specific amount of money to a designated recipient. This draft is commonly used for various purposes, such as making payments for goods, services, or bills. Customers in Houston, Texas can issue different types of drafts depending on their specific needs. Some common types include cashier's drafts, certified drafts, and demand drafts. A cashier's draft is a draft issued by the customer's bank on their behalf, using funds from the customer's account. It is considered a secure form of payment since the funds are guaranteed by the bank. This type of draft is often used for larger transactions or when the recipient requires a guaranteed form of payment. A certified draft is another type of customer's draft that assures the recipient that the funds are available in the customer's bank account. The customer's bank verifies the availability of funds and certifies the draft accordingly. This type of draft provides a level of assurance to the recipient that the payment will not bounce due to insufficient funds. Demand drafts, also known as sight drafts, are customer's drafts that are payable on demand. They allow the recipient to collect the payment immediately upon presentation of the draft to the customer's bank. This type of draft is commonly used in situations where immediate payment is required or when the parties are located in different locations. Houston Texas Customer's Drafts are an important financial tool that enables individuals and businesses in Houston, Texas to make secure and convenient payments. By issuing drafts, customers can ensure that their payments are properly authorized and delivered to the intended recipients, thereby facilitating smooth financial transactions.Houston Texas Customer's Draft is a type of financial instrument that allows customers in Houston, Texas to issue payments to individuals or businesses. It is essentially a written order from the customer instructing their bank to pay a specific amount of money to a designated recipient. This draft is commonly used for various purposes, such as making payments for goods, services, or bills. Customers in Houston, Texas can issue different types of drafts depending on their specific needs. Some common types include cashier's drafts, certified drafts, and demand drafts. A cashier's draft is a draft issued by the customer's bank on their behalf, using funds from the customer's account. It is considered a secure form of payment since the funds are guaranteed by the bank. This type of draft is often used for larger transactions or when the recipient requires a guaranteed form of payment. A certified draft is another type of customer's draft that assures the recipient that the funds are available in the customer's bank account. The customer's bank verifies the availability of funds and certifies the draft accordingly. This type of draft provides a level of assurance to the recipient that the payment will not bounce due to insufficient funds. Demand drafts, also known as sight drafts, are customer's drafts that are payable on demand. They allow the recipient to collect the payment immediately upon presentation of the draft to the customer's bank. This type of draft is commonly used in situations where immediate payment is required or when the parties are located in different locations. Houston Texas Customer's Drafts are an important financial tool that enables individuals and businesses in Houston, Texas to make secure and convenient payments. By issuing drafts, customers can ensure that their payments are properly authorized and delivered to the intended recipients, thereby facilitating smooth financial transactions.