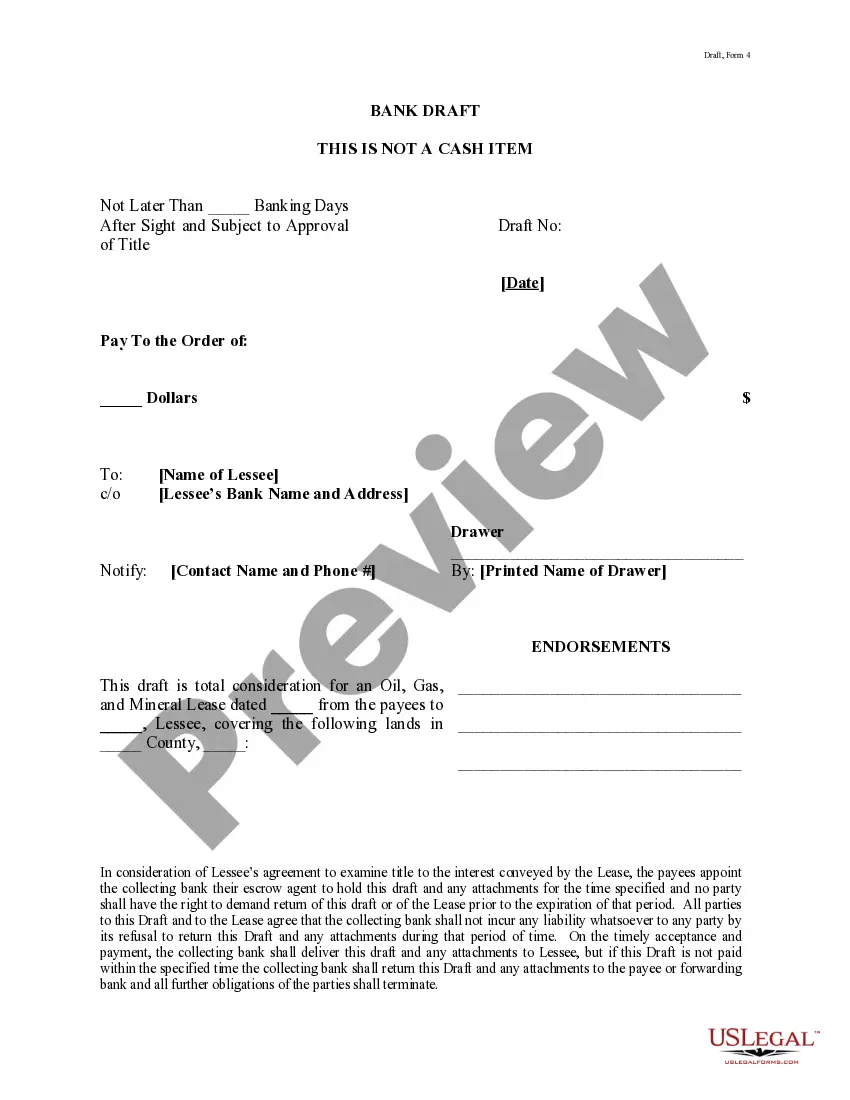

Abilene Texas Bank Draft is a financial instrument used for making payments and transferring funds securely within the Abilene, Texas banking system. It provides a convenient way for individuals and businesses to move money between accounts, both within the same bank and between different banks. A bank draft is essentially a guaranteed form of payment issued by a bank on behalf of a customer. The bank acts as an intermediary, ensuring that the funds are transferred from the payer's account to the recipient's account in a reliable and traceable manner. The bank draft is considered more secure than personal checks since it is backed by the bank's guarantee of payment. In Abilene, Texas, there are various types of bank drafts available to cater to different needs and preferences. Some of these include: 1. Personal Bank Draft: This type of bank draft is commonly used by individuals to make payments or transfer funds between their personal accounts or to individuals. It provides a secure method to make large payments without the need for carrying cash or relying on less secure payment methods. 2. Business Bank Draft: Aimed specifically at businesses, this type of bank draft allows companies to make payments to suppliers, vendors, and employees. It enables businesses to streamline their payment processes and keep a record of transactions for accounting purposes. 3. Certified Bank Draft: This type of bank draft involves the bank certifying that the funds required to cover the draft are available in the payer's account. It provides an added level of assurance to the recipient that the payment will be honored by the bank. 4. International Bank Draft: For individuals or businesses engaged in international trade or transactions, an international bank draft is available. It allows cross-border payments, ensuring that funds are transferred securely and conform to international banking regulations. Regardless of the type, Abilene Texas Bank Drafts offer a reliable and convenient method for transferring funds within the Abilene banking system. It minimizes the risk of fraudulent transactions and provides a traceable record of payment, making it an essential tool for individuals and businesses alike.

Abilene Texas Bank Draft

Description

How to fill out Abilene Texas Bank Draft?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Abilene Texas Bank Draft or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Abilene Texas Bank Draft complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Abilene Texas Bank Draft would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!