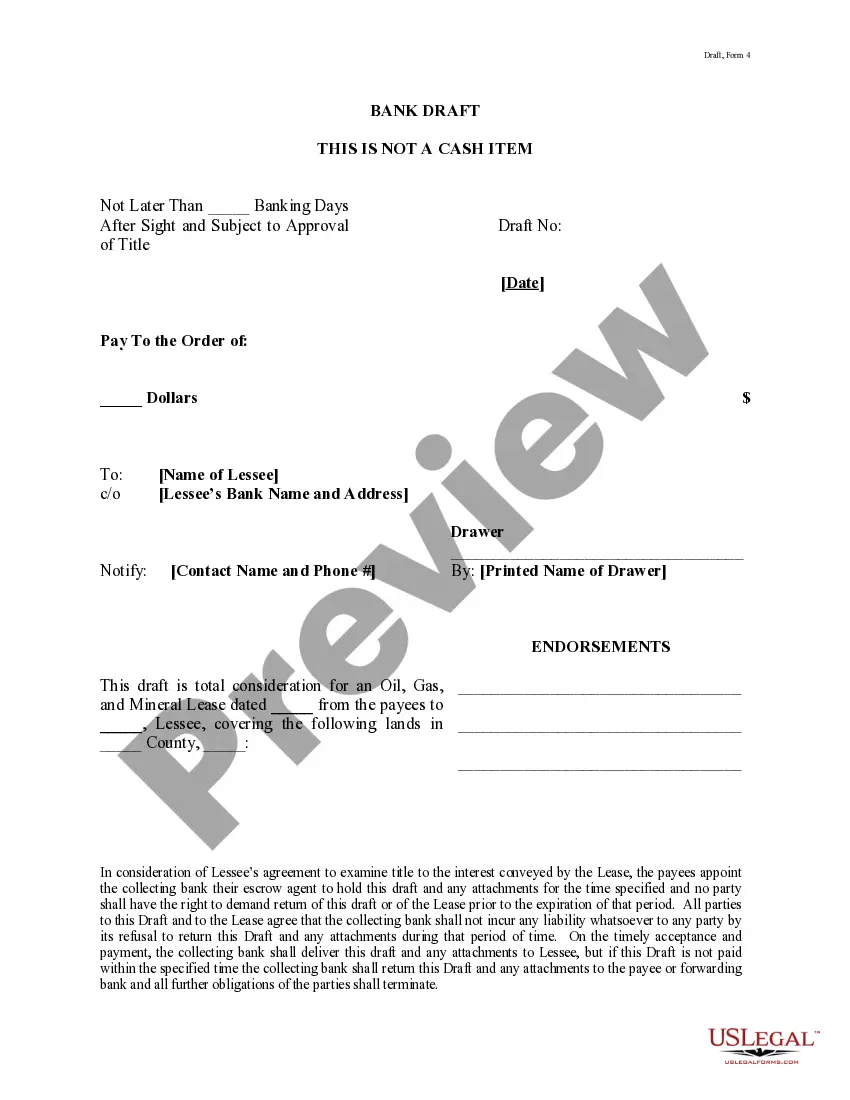

The Brownsville Texas Bank Draft is a financial instrument that allows individuals or businesses in Brownsville, Texas, to make secure and convenient payments. It serves as an alternative to traditional checks and is commonly used for various purposes, such as paying bills, rent, or making purchases. A Brownsville Texas Bank Draft is typically issued by a local bank or credit union and works similarly to a check. It contains essential information like the payer's account details, the payee's name, the amount to be paid, and the date of payment. The payer authorizes the bank to withdraw funds from their account and transfer them to the payee's account. One distinguishing feature of the Brownsville Texas Bank Draft is its enhanced security measures. Banks utilize advanced technology and verification processes to ensure the validity of the draft, protecting both the payer and the payee from fraudulent activities. There are different types of Brownsville Texas Bank Drafts available to cater to the diverse needs of individuals and businesses: 1. Personal Bank Draft: This type of draft is commonly used by individuals to make personal payments such as rent, utility bills, or loan repayments. It provides a convenient and secure way to transfer funds without the need for physical cash. 2. Business Bank Draft: Specifically designed for businesses, this type of draft enables seamless financial transactions between different organizations. It is often used for vendor payments, employee salaries, or other business-related expenses. 3. Cashier's Bank Draft: This is a type of bank draft issued by the bank itself. It guarantees payment as the funds are directly debited from the payer's account and credited to the payee. Cashier's bank drafts are often used for large transactions or significant purchases, as they provide an additional level of security. In conclusion, the Brownsville Texas Bank Draft is a reliable and secure payment instrument widely used in Brownsville, Texas. It offers individuals and businesses a convenient way to transfer funds, making it a popular alternative to traditional checks. With various types available, individuals can choose the draft that suits their specific needs, whether it's for personal, business, or higher-value transactions.

Brownsville Texas Bank Draft

Description

How to fill out Brownsville Texas Bank Draft?

Are you looking for a reliable and inexpensive legal forms provider to get the Brownsville Texas Bank Draft? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Brownsville Texas Bank Draft conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Brownsville Texas Bank Draft in any provided file format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal paperwork online for good.