A Fort Worth Texas Bank Draft is a financial instrument issued by a bank located in Fort Worth, Texas. It is a written order directing the bank to pay a specific amount of money from a customer's account to a designated payee. Bank drafts are often used as a secure method of payment, especially for large transactions or when the recipient does not accept personal checks. Fort Worth Texas Bank Drafts come in various types, including: 1. Personal Bank Draft: This type of bank draft is issued to individuals for personal transactions, such as paying rent, making large purchases, or conducting business transactions. 2. Cashier's Bank Draft: A cashier's bank draft is guaranteed by the issuing bank. It is commonly used for high-value transactions where immediate funds are required. The issuing bank deducts the amount from the customer's account and holds it in its own account until the draft is presented for payment. 3. Certified Bank Draft: A certified bank draft is an assurance from the bank that the funds are available in the customer's account. The bank verifies the customer's account balance and places a hold on the specified amount. The draft is then marked as certified, indicating that the funds are set aside for payment. 4. Demand Bank Draft: Also known as an open bank draft, this type of draft is payable on-demand. It allows the payee to request payment from the issuing bank at any time. Demand drafts are often used for bills, utility payments, or in situations where immediate payment is required. Fort Worth Texas Bank Drafts provide a secure and convenient method for transferring funds from one account to another. They are widely accepted and trusted within the local community. However, it is important to note that bank drafts typically involve fees, and the payee may need to present proper identification at the bank to receive the funds.

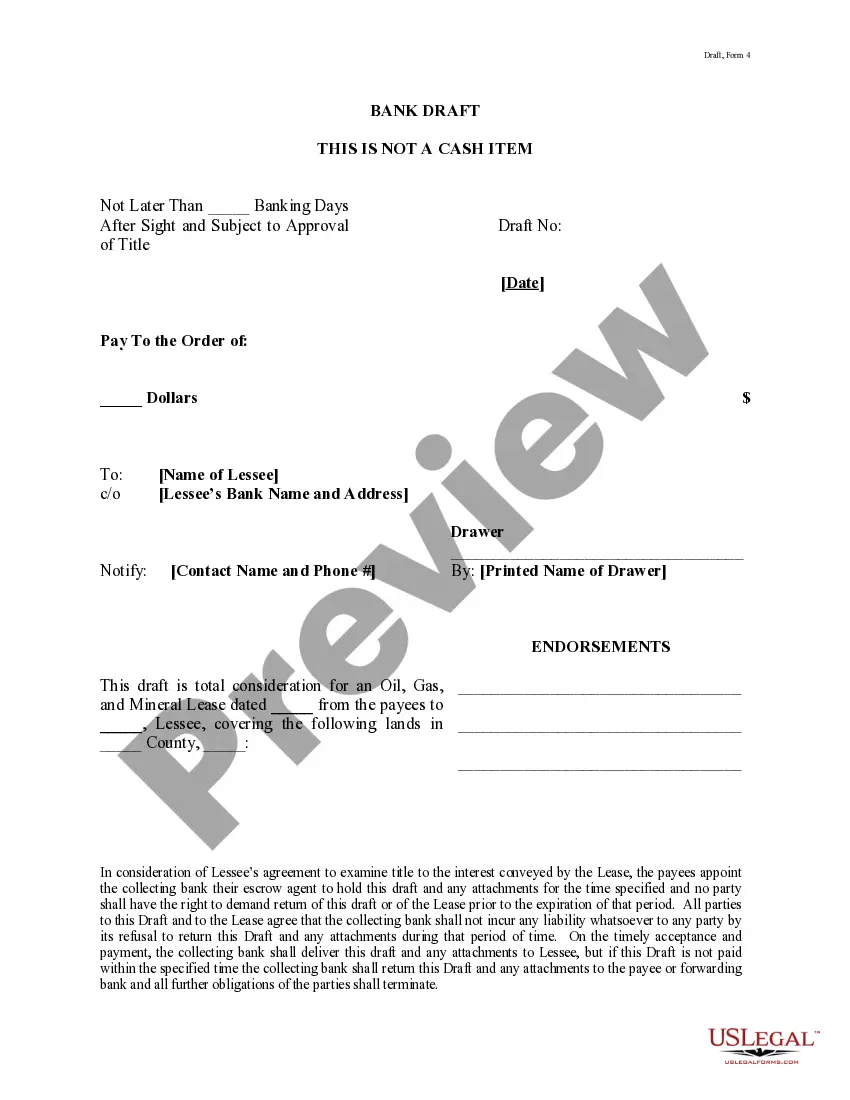

Fort Worth Texas Bank Draft

Description

How to fill out Fort Worth Texas Bank Draft?

Do you require a reliable and affordable legal forms provider to obtain the Fort Worth Texas Bank Draft? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a suite of documents to facilitate your separation or divorce through the court system, we have you supported.

Our platform offers more than 85,000 current legal document templates for individual and business purposes. All templates we provide are not generic and are tailored to meet the regulations of specific states and regions.

To acquire the form, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates anytime from the My documents section.

Now you can establish your account. Then select the subscription plan and continue to payment. After completing the payment, download the Fort Worth Texas Bank Draft in any available format. You can revisit the website at any time and redownload the form at no additional cost.

Locating current legal documents has never been simpler. Experience US Legal Forms today, and eliminate the hassle of spending hours researching legal documents online once and for all.

- Are you unfamiliar with our website? No problem.

- You can create an account in a few minutes, but ensure to do the following beforehand.

- Confirm if the Fort Worth Texas Bank Draft adheres to your state and local regulations.

- Review the form’s details (if available) to understand who and what the form is designated for.

- Restart your search if the form is inappropriate for your legal circumstances.

Form popularity

More info

We are here to help — Contact a member today! Bank of America Branch. 3009 N. Lamar Blvd TX 78258 U.S. and Canada.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.