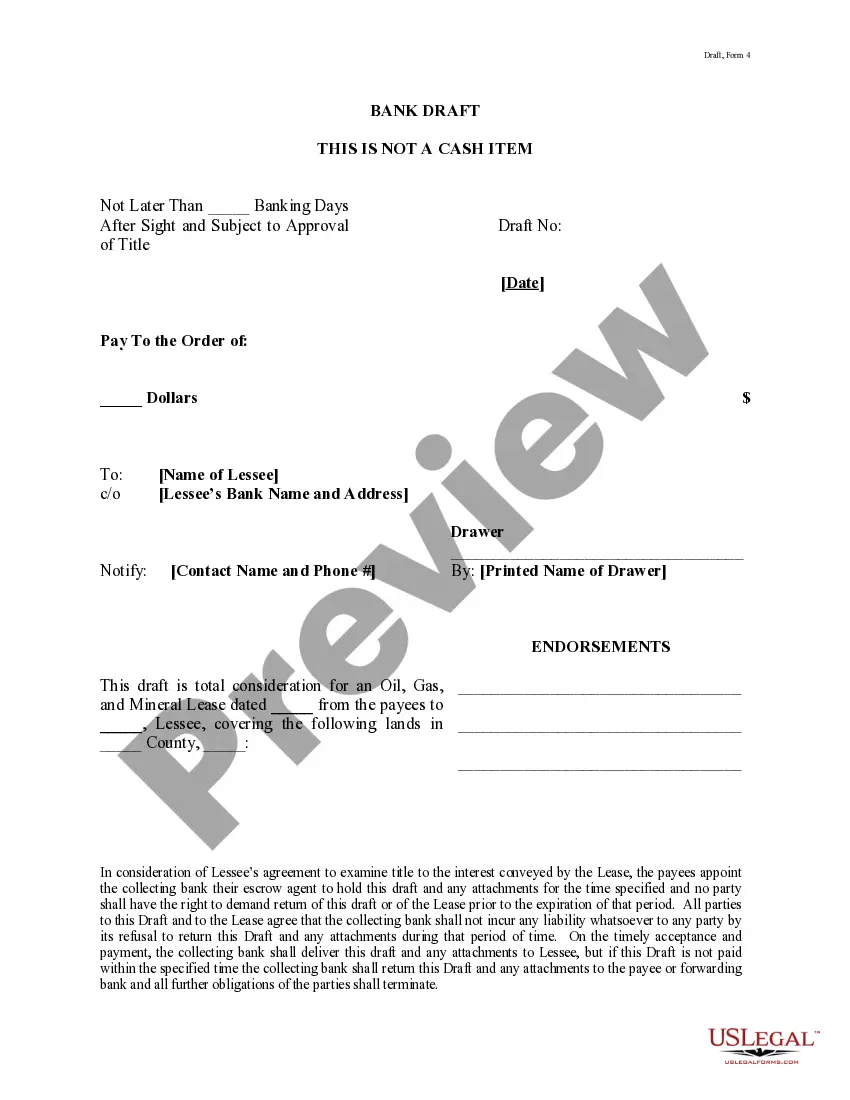

A McAllen Texas Bank Draft, also known as a cashier's check or a bank draft, is a secure payment method issued by a bank to facilitate large or guaranteed transactions. It acts as a promise to pay the recipient a specific amount of money, making it a reliable and preferred method to personal checks or cash. McAllen Texas Bank Drafts are typically utilized for significant financial transactions, such as real estate purchases, vehicle acquisitions, or other high-value payments. They offer a more secure alternative to personal checks, as the bank guarantees the funds and eliminates the risk of insufficient funds or bounced checks. Several types of McAllen Texas Bank Drafts are commonly available to suit different requirements: 1. Standard Bank Draft: This is the most common type of McAllen Texas Bank Draft, allowing individuals or businesses to make secure payments. The draft typically requires the payer to have sufficient funds deposited in their bank account or purchase the draft in cash. 2. International Bank Draft: This type of McAllen Texas Bank Draft enables individuals to make secure payments internationally. It guarantees that the specified amount will be paid to the recipient in the foreign currency specified. 3. Official Bank Draft: This type of McAllen Texas Bank Draft is often required for specific purposes, such as issuing refunds, making governmental payments, or disbursing funds for legal matters. It ensures the validity and credibility of the payment, making it widely accepted. 4. Demand Draft: A demand draft acts as an order to pay money to the designated recipient upon demand. It is an effective method for making immediate payments for services rendered or goods received. To obtain a McAllen Texas Bank Draft, individuals or businesses must visit a local bank branch and provide the required funds. The bank will then issue the draft, detailing the name of the payee, the designated amount, and any necessary instructions or limitations. Overall, McAllen Texas Bank Drafts provide a secure and convenient means of making significant or guaranteed payments without the risks associated with personal checks or cash transactions. They are widely accepted and preferred for their reliability and the assurance they bring to both payers and recipients.

McAllen Texas Bank Draft

Description

How to fill out McAllen Texas Bank Draft?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the McAllen Texas Bank Draft becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the McAllen Texas Bank Draft takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the McAllen Texas Bank Draft. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!