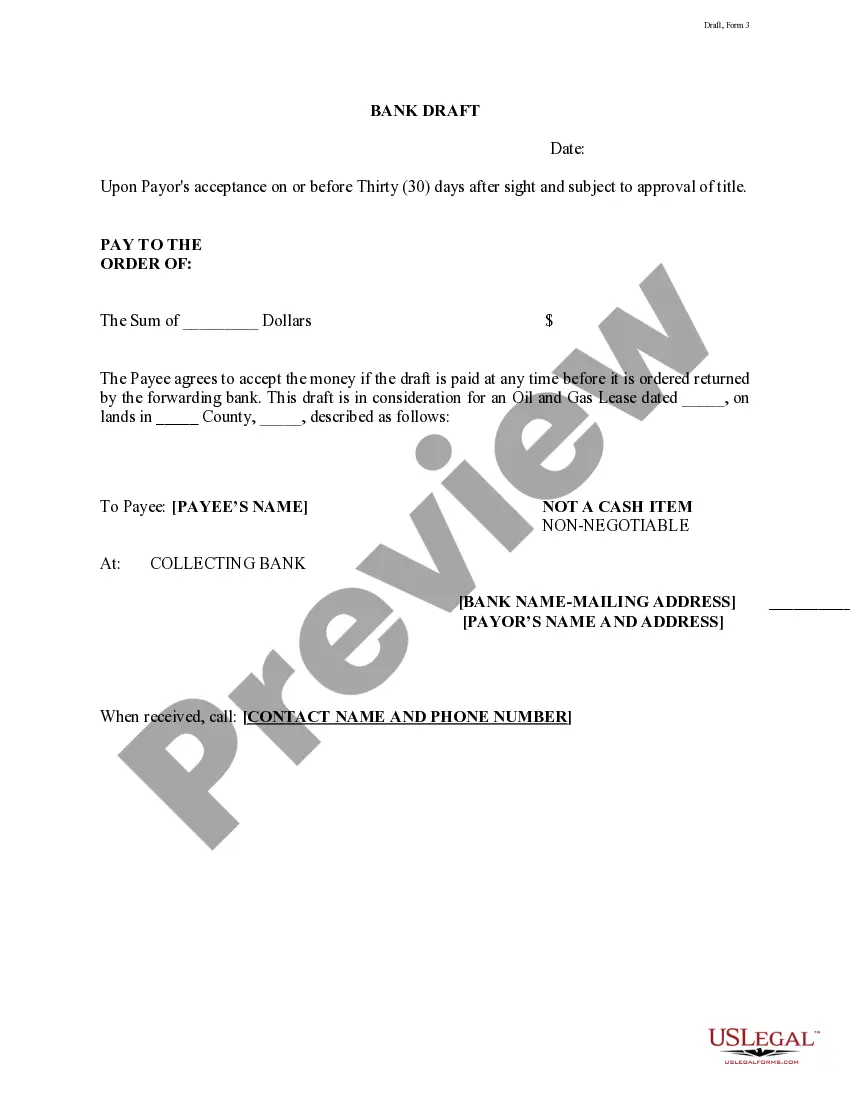

The Amarillo Texas Bank Draft is a financial instrument commonly used in the region for secure and convenient money transfers. This method enables individuals, businesses, and organizations to make payments within Amarillo, Texas, and beyond. Here is a detailed description of the Amarillo Texas Bank Draft and its various types: 1. Definition: An Amarillo Texas Bank Draft refers to a check-like instrument that authorizes Amarillo-based banks to transfer funds from one bank account to another. It serves as a legal and traceable payment method widely accepted by both individuals and businesses. 2. Procedure: To obtain an Amarillo Texas Bank Draft, customers must visit their bank in person or access online banking services. They will need to provide the recipient's name, account number, the receiving bank's routing number, and the desired transfer amount. The bank will then issue a bank draft to facilitate the transfer. 3. Amarillo Texas Bank Drafts for Individuals: This type of bank draft allows individuals to make safe and efficient payments to a particular person or organization. Common instances include rental payments, personal loans, tuition fees, and purchasing goods from businesses that prefer bank drafts over other payment methods. 4. Amarillo Texas Bank Drafts for Businesses: This category of bank draft caters to the needs of businesses operating in Amarillo, Texas. It allows them to make payments to suppliers, service providers, contractors, and employees. The bank draft offers a secure and auditable transaction record for financial management and tracking purposes. 5. Interbank Drafts: Interbank drafts are specifically designed for individuals or businesses wanting to transfer funds to accounts outside of Amarillo, Texas. These drafts ensure the swift movement of funds between banks, both within Texas and across state lines, making them useful for interstate commerce or personal financial transactions. 6. Benefits: The Amarillo Texas Bank Draft offers several advantages to customers. Firstly, it eliminates the risk associated with carrying large sums of cash. Secondly, it provides a convenient method for making payments without the need for physical presence. Thirdly, it offers a secure and transparent way of transferring funds, reducing the risk of fraud. Lastly, it provides a clear paper trail for both the payer and the payee. 7. Security Measures: Amarillo Texas Bank Drafts incorporate various security features to ensure authenticity and prevent fraudulent activities. These may include watermarks, specific paper textures, holograms, unique serial numbers, and signature verification requirements. In conclusion, the Amarillo Texas Bank Draft is a reliable and widely accepted payment method facilitating transactions within and beyond Amarillo, Texas. With different types of drafts tailored for individuals, businesses, and interbank transfers, this financial instrument provides convenience, security, and a reliable record of transactions.

Amarillo Texas Bank Draft

Description

How to fill out Amarillo Texas Bank Draft?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person without any law education to create this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you need the Amarillo Texas Bank Draft or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Amarillo Texas Bank Draft in minutes using our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before downloading the Amarillo Texas Bank Draft:

- Ensure the form you have found is specific to your location since the rules of one state or area do not work for another state or area.

- Preview the form and read a brief outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start again and search for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Amarillo Texas Bank Draft as soon as the payment is completed.

You’re all set! Now you can proceed to print out the form or complete it online. In case you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.