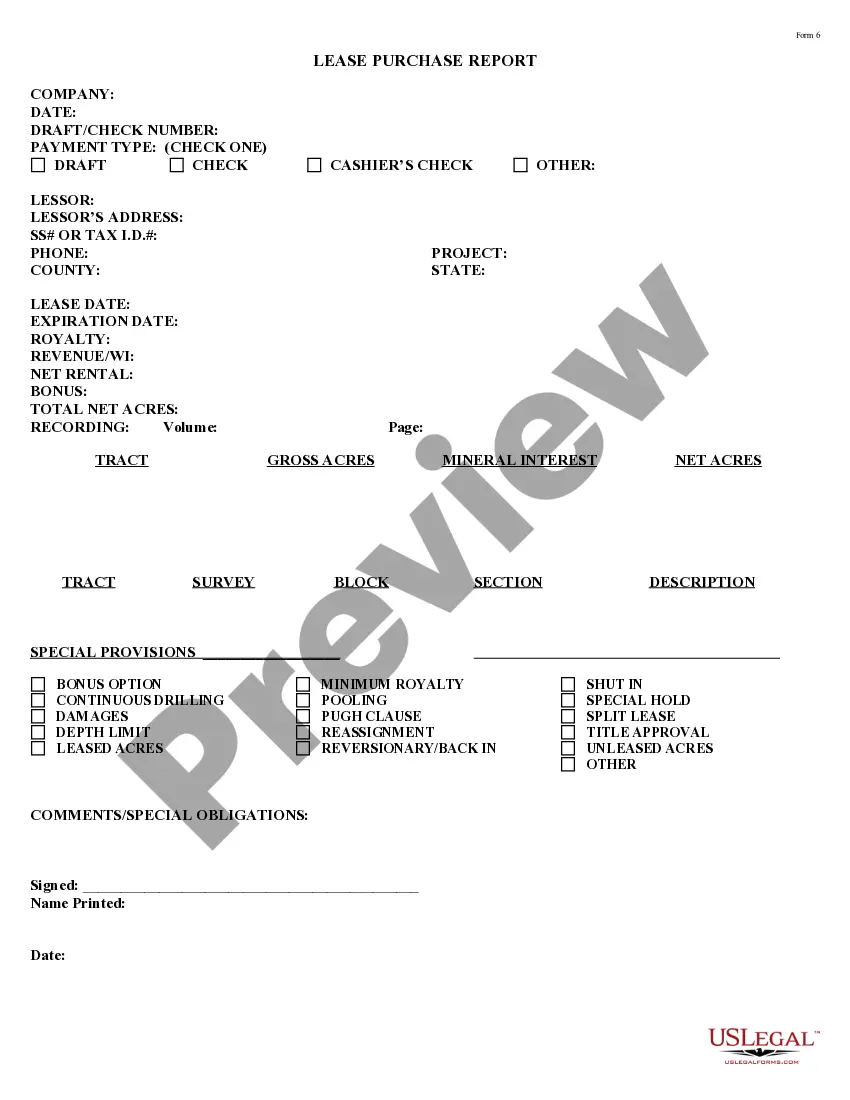

This oil, gas, and minerals document is a report form documenting information of sellers and purchasers that enter into a legally binding obligation to sell and purchase real property at the expiration of or during a lease term. In a lease purchase agreement, a party agrees to purchase a particular piece of real property within a certain timeframe, usually at a price determined beforehand.

The Harris Texas Lease Purchase Report Form 6 is a vital document used in the real estate industry specifically in the state of Texas. This report form is designed to facilitate the lease purchase agreement between a tenant and a landlord, providing a legal framework and capturing important information related to the transaction. The Harris Texas Lease Purchase Report Form 6 serves as a comprehensive record that outlines the terms and conditions of the lease purchase agreement. It encompasses key details such as the property information, lease start and end dates, monthly rental amount, security deposit, and any additional fees or charges. The form also includes provisions for both the tenant and the landlord to agree upon, such as maintenance responsibilities, utilities, and potential penalties for late rent or damages. Named after the county in which it is primarily used, the Harris Texas Lease Purchase Report Form 6 ensures compliance with relevant state laws and regulations, offering protection for both parties involved in the lease purchase agreement. This standardized form streamlines the lease process, reducing potential disputes and conflicts by clearly documenting the agreed-upon terms from the outset. While there may not be different types of the Harris Texas Lease Purchase Report Form 6 per se, it is important to note that variations or amendments to the form may exist based on specific circumstances or unique lease agreements. It is critical for landlords and tenants to carefully review and customize the form to accurately reflect their individual agreement and requirements. In conclusion, the Harris Texas Lease Purchase Report Form 6 is an essential document for landlords and tenants in Texas who are engaging in a lease purchase agreement. By capturing the key elements of the transaction, it ensures clarity, protection, and a legally binding record for both parties.The Harris Texas Lease Purchase Report Form 6 is a vital document used in the real estate industry specifically in the state of Texas. This report form is designed to facilitate the lease purchase agreement between a tenant and a landlord, providing a legal framework and capturing important information related to the transaction. The Harris Texas Lease Purchase Report Form 6 serves as a comprehensive record that outlines the terms and conditions of the lease purchase agreement. It encompasses key details such as the property information, lease start and end dates, monthly rental amount, security deposit, and any additional fees or charges. The form also includes provisions for both the tenant and the landlord to agree upon, such as maintenance responsibilities, utilities, and potential penalties for late rent or damages. Named after the county in which it is primarily used, the Harris Texas Lease Purchase Report Form 6 ensures compliance with relevant state laws and regulations, offering protection for both parties involved in the lease purchase agreement. This standardized form streamlines the lease process, reducing potential disputes and conflicts by clearly documenting the agreed-upon terms from the outset. While there may not be different types of the Harris Texas Lease Purchase Report Form 6 per se, it is important to note that variations or amendments to the form may exist based on specific circumstances or unique lease agreements. It is critical for landlords and tenants to carefully review and customize the form to accurately reflect their individual agreement and requirements. In conclusion, the Harris Texas Lease Purchase Report Form 6 is an essential document for landlords and tenants in Texas who are engaging in a lease purchase agreement. By capturing the key elements of the transaction, it ensures clarity, protection, and a legally binding record for both parties.