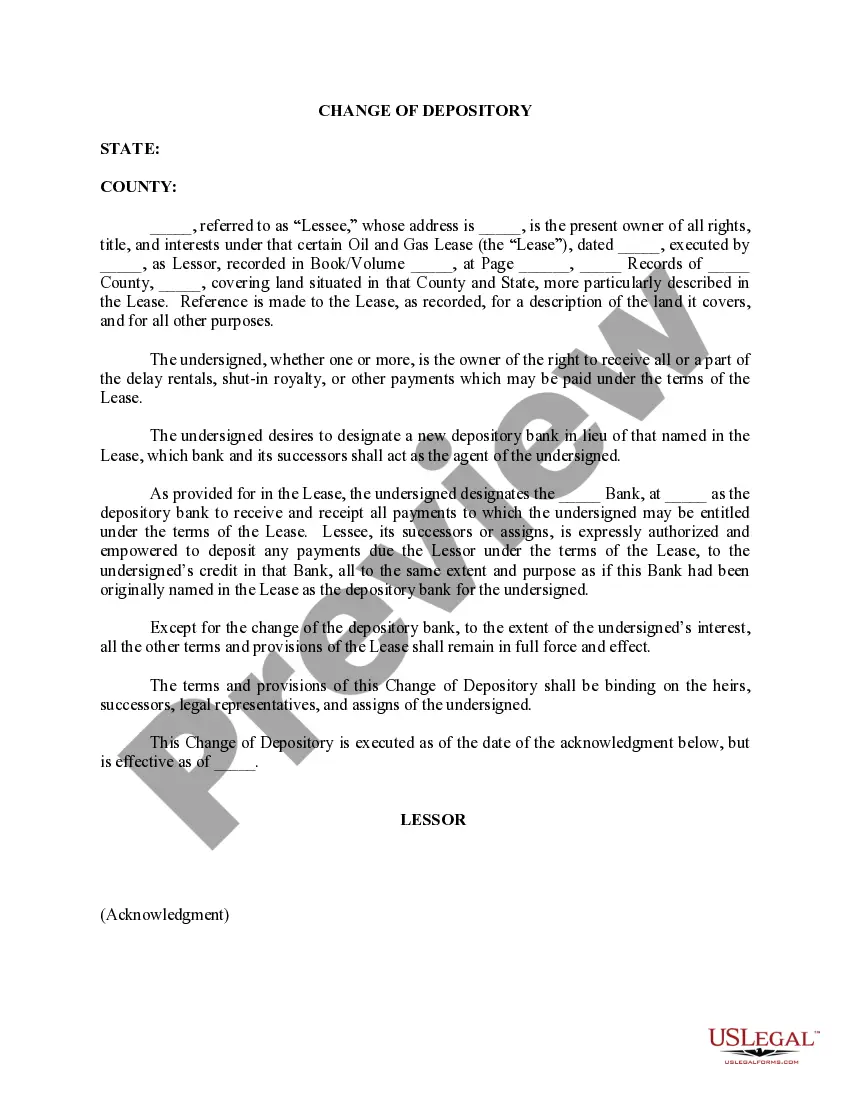

Amarillo Texas Change of Depository is a financial process that involves transferring funds or assets from one depository institution to another within the Amarillo, Texas region. It typically refers to a shifting of accounts, investments, or financial holdings from one bank or credit union to another. This type of change is often initiated by individuals or businesses seeking to take advantage of better interest rates, improved services, or simply to consolidate their financial arrangements. Amarillo Texas Change of Depository can be done for personal checking or savings accounts, as well as for business accounts or investment portfolios. There are several types of Amarillo Texas Change of Depository one can opt for, including: 1. Personal Account Transfer: This involves moving an individual's personal checking or savings accounts from one bank or credit union in Amarillo to another. It may be driven by factors such as better interest rates, lower fees, or improved customer service. 2. Business Account Transfer: Similar to personal account transfers, businesses can also conduct Amarillo Texas Change of Depository for their checking, savings, or merchant accounts. This may be motivated by the desire to streamline the banking relationships, capitalize on business-specific offerings, or seek better deals on financial services. 3. Investment Account Transfer: Individuals or businesses with investment portfolios can transfer their holdings from one financial institution to another using Amarillo Texas Change of Depository. This can include stocks, bonds, mutual funds, retirement accounts, or other investment instruments. The transfer may be influenced by factors such as more favorable investment options or access to specialized financial advisers. 4. Credit Card Balance Transfers: Although not strictly a depository service, Amarillo Texas Change of Depository can also extend to credit cards. Individuals or businesses can transfer their outstanding credit card balances from one issuer to another, usually attracted by lower interest rates, promotional offers, or rewards programs. In conclusion, Amarillo Texas Change of Depository is a strategic move to transfer funds, accounts, or assets between depository institutions in the Amarillo, Texas area. It encompasses personal and business accounts, investment portfolios, and occasionally credit card balances. By conducting this change, individuals or businesses seek to optimize their financial arrangements and take advantage of more beneficial terms, rates, and services offered by other depository institutions.

Amarillo Texas Change of Depository

Description

How to fill out Amarillo Texas Change Of Depository?

Benefit from the US Legal Forms and obtain instant access to any form sample you require. Our useful website with a large number of document templates makes it easy to find and get virtually any document sample you require. It is possible to save, complete, and sign the Amarillo Texas Change of Depository in just a few minutes instead of browsing the web for hours trying to find a proper template.

Utilizing our collection is a great strategy to raise the safety of your document submissions. Our experienced attorneys on a regular basis check all the records to make certain that the forms are relevant for a particular state and compliant with new laws and polices.

How do you get the Amarillo Texas Change of Depository? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Find the form you require. Make sure that it is the template you were hoping to find: verify its name and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to get the Amarillo Texas Change of Depository and modify and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the Amarillo Texas Change of Depository.

Feel free to take advantage of our service and make your document experience as efficient as possible!