Collin Texas Change of Depository refers to the process of transferring the location where financial institutions store and deposit their funds in Collin County, Texas. This change is usually implemented to enhance operational efficiency, improve security measures, or comply with specific regulatory requirements. The Collin Texas Change of Depository can include various types, depending on the nature of the institution or purpose of the transfer. Some common types are: 1. Commercial Banks Change of Depository: Commercial banks might opt for a change of depository to better meet their business needs, such as seeking better interest rates, lower fees, or improved services provided by another depository institution within Collin County, Texas. 2. Credit Union Change of Depository: Credit unions, similar to commercial banks, might initiate a change of depository to improve financial performance, find more advantageous terms, or enhance member experience by choosing a different depository located within Collin County, Texas. 3. Government Institution Change of Depository: Government institutions, such as local municipalities, school districts, or public agencies, may undergo a change of depository to comply with specific regulatory or legal requirements. These changes are often made to ensure proper management of public funds and adhere to transparency guidelines. 4. Non-Profit Organization Change of Depository: Non-profit organizations might undergo a change of depository for various reasons, including seeking lower administrative costs, obtaining better investment options, or aligning with the organization's financial strategy. The process of Collin Texas Change of Depository requires careful planning, coordination, and communication between the institution initiating the change and the new depository institution. It typically involves gathering necessary documentation, such as account information, identification documents, and agreements, and establishing new account relationships. When considering a Collin Texas Change of Depository, institutions should evaluate the new depository's financial stability, reputation, range of offered services, fees, customer support, and any potential implications on existing operations. Collin Texas Change of Depository can have a significant impact on an institution's financial management, liquidity, and overall financial health. Therefore, it is crucial for organizations to conduct thorough research, consultation, and due diligence to make the best-informed decision for their specific needs.

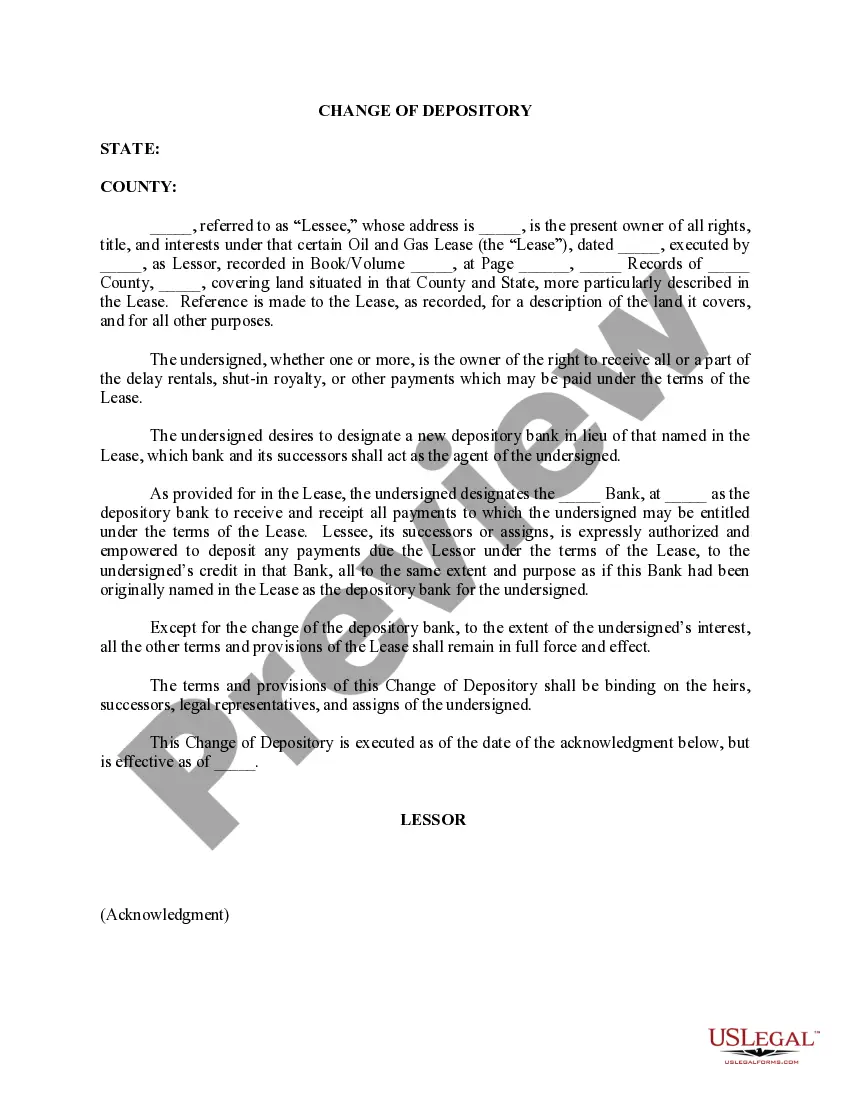

Collin Texas Change of Depository

Description

How to fill out Collin Texas Change Of Depository?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Collin Texas Change of Depository gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Collin Texas Change of Depository takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Collin Texas Change of Depository. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!